Sensei’s Morning Forecast: Is XRP About to Go Institutional — Just as Trump Goes All-In on Crypto?

Trump champions U.S. crypto supremacy, China rattles gold markets, Palantir faces an AI reality check, layoffs rise, Reeves hunts revenue, and Ripple’s Swell 2025 could reshape XRP’s future.

👀 Today’s Stories at a Glance

🪙 Trump says U.S. “must be number one in crypto” and hints at deregulating digital assets.

🏮 China ends VAT subsidy on gold, sparking retail selloff and threatening a dip in global demand.

🤖 Palantir earnings tonight will test if AI stock valuations can hold amid stretched fundamentals.

💼 U.S. layoffs hit 950,000 YTD, signaling a shift from growth hiring to cost-cutting across sectors.

💷 UK’s Reeves eyes wealth and property taxes to close £50B gap—risking capital flight and housing hit.

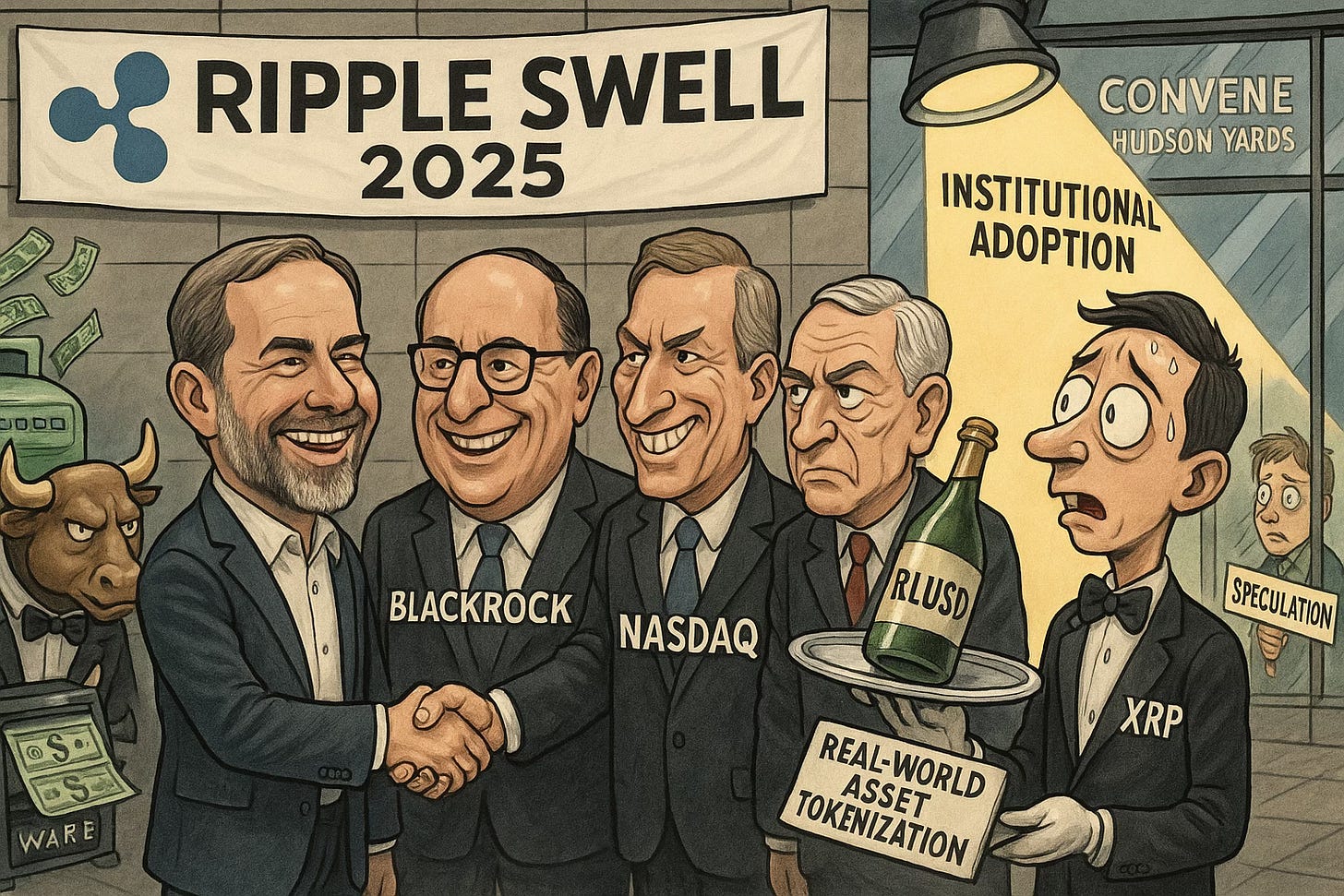

🔍🌀 Ripple’s Swell 2025 begins in New York, with XRP investors watching closely for institutional signals.

🧠 One Big Thing

White House Keynote Signals Regulatory Pivot — Patrick Witt (Executive Director, President’s Council on Digital Assets) is keynoting Swell for the first time in the event’s history. This signals the Trump administration intends to build crypto frameworks, not destroy them. Regulation is shifting from enforcement to enablement.

💰 Money Move of the Day

Patrick Witt’s Swell keynote signals a possible U.S. pivot: from punishing crypto to shaping it. No new laws yet—but tone precedes policy. Smart investors watch the rulebook, not just the scoreboard.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $107,537 (▼ -2.70%)

Ethereum (ETH): $3,711 (▼ -4.97%)

XRP: $2.40 (▼ -4.88%)

Equity Indices (Futures):

S&P 500: 6,866 (▲ +0.45%)

NASDAQ 100: 26,133 (▲ +0.50%)

FTSE 100: 9,731 (▼ -0.12%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.085% (▲ +0.10%)

Oil (WTI): $61.15 (▼ -0.00%)

Gold: $3,998 (▼ -0.10%)

Silver: $48.61 (▼ -0.08%)

🕒 Data as of UK (BST): 10:12 / US (EST): 05:12 / Asia (Tokyo): 19:12

✅ 5 Things to Know Today

🪙 Trump Pushes U.S. Crypto Dominance in 60 Minutes Interview

In his first 60 Minutes appearance in five years, President Donald Trump declared that the United States “must be number one in crypto,” while simultaneously claiming he “didn’t know” Binance founder Changpeng “CZ” Zhao, whom he recently pardoned after Zhao’s 2023 guilty plea to anti-money-laundering violations (CoinDesk, BBC). The president framed digital assets as a strategic national priority, warning that China is “getting very big into Bitcoin and crypto right now” and linking blockchain competitiveness to U.S. technological and security leadership (Reuters). Despite distancing himself from his family’s crypto dealings, Trump said his sons were “running a business” in the space and that he supports the industry’s growth, calling crypto a “huge” market opportunity for the U.S. (Forbes).

The remarks underscore a major policy pivot from Trump’s 2021 view of Bitcoin as “a scam” to full-scale endorsement of U.S. crypto leadership. The interview follows his pardon of Zhao, whose company Binance paid a $4.3 billion settlement in 2023, and amid reports of the Trump family’s 25% stake in World Liberty Financial, a crypto platform valued near $5 billion (Bloomberg). Trump’s statements may signal an administration intent on deregulating digital assets to boost domestic competitiveness. Markets will watch for follow-through on tax, securities, and stablecoin policy—particularly any easing that could accelerate capital inflows into U.S. exchanges or widen institutional adoption.

Sensei’s Insight: Trump’s new pro-crypto posture adds momentum to the U.S. digital-asset narrative—potentially influencing regulatory tone, ETF approvals, and cross-border capital allocation into blockchain markets.

🏮 China Ends Gold Tax Break, Sending Ripples Through Global Bullion Markets

China has scrapped a long-standing value-added tax (VAT) offset for non-investment gold retailers, cutting the deduction rate from 13% to 6% effective November 1. The move, confirmed by the Ministry of Finance, raises costs across China’s $150 billion retail gold industry—the largest in the world—and immediately hit jewelry stocks. Chow Tai Fook plunged 12%, Chow Sang Sang fell 8%, and Laopu Gold dropped 9% as investors priced in weaker retail margins and softer demand (Reuters, Times of India). Spot gold initially slipped 1% in Asian trading but stabilized near $4,000 per ounce as broader market buying offset short-term weakness. The tax change reduces VAT deductions by seven percentage points, a meaningful margin squeeze for an industry operating on 1–3% spreads, and effectively removes a decades-old structural subsidy that had underpinned domestic demand (Business Today).

China’s retail gold market represents roughly 30–35% of global consumption, meaning even a 10% decline in Chinese demand could trim $12–14 billion in annual buying—potentially weighing gold prices 1–3% near term. Analysts expect retailers to either raise consumer prices or reduce volumes, while some shift operations onto the Shanghai Gold Exchange, which remains fully VAT-exempt. UBS notes the change could bifurcate pricing between taxed retail gold and untaxed investment-grade bullion, narrowing China’s retail premium and cooling import flows just as central banks and institutional investors continue to provide strong support at the $4,000 level (Outlook Business, Longbridge).

Sensei’s Insight: A 10–15% dip in Chinese retail demand could trigger a short-term $50–$100 pullback in gold, but global fundamentals—central-bank buying and macro uncertainty—still anchor the long-term uptrend.

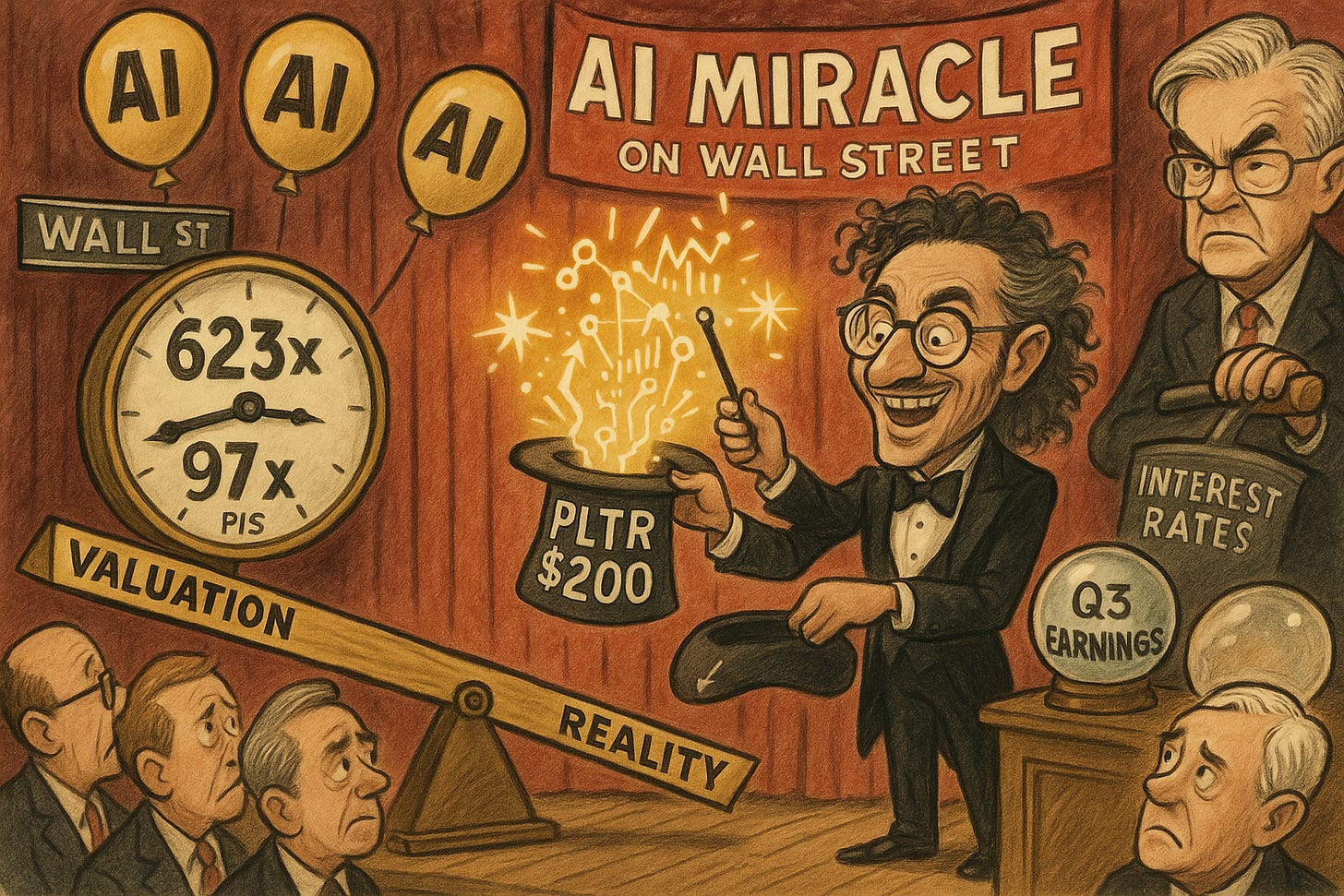

🤖 Palantir’s Earnings Loom as AI Rally Faces Valuation Reality

U.S. equities are poised for another upbeat session as the S&P 500 extends its sixth consecutive monthly gain, up 16% year-to-date, while the Nasdaq climbs 22%. But the focus now shifts to Palantir Technologies (PLTR), which reports Q3 earnings tonight amid growing concern that AI valuations have detached from fundamentals. Palantir stock has surged 165% YTD (and 375% over 12 months) to around $200, leaving its P/E at 623x and P/S near 97x—ratios typically seen only during speculative peaks (Nasdaq, Yahoo Finance). To justify current levels, analysts estimate Palantir would need 50%+ annual earnings growth through 2035, even as 10-year Treasury yields hover around 4.5% (IG). Consensus calls for $1.09B in revenue and $0.17 EPS, with market pricing in perfection after last quarter’s 93% YoY U.S. commercial growth.

The outcome will test whether the AI trade still has legs or is reaching exhaustion. Any earnings miss tonight, weak guidance, or slowdown in commercial momentum could trigger a 10–15% pullback to the $170–$185 range, given Palantir’s extreme multiple and limited margin for error (Finbold). Broader AI sentiment remains strong—77% of S&P 500 firms have beaten EPS expectations this quarter—but valuations are stretched: the S&P 500 forward P/E sits near 23x, above its 10-year average of 18.6x (Reuters). The Fed’s October cut to 3.75–4.00% helped support risk assets, but Chair Jerome Powell’s warning that a December cut is “not guaranteed” has trimmed easing odds to ~68% (MishTalk, Reuters).

Sensei’s Insight: Palantir’s print will be a litmus test for AI valuations—and possibly the next catalyst for rotation if results disappoint. Watch both guidance tone and Fed cut odds; they’ll define the market’s next leg.

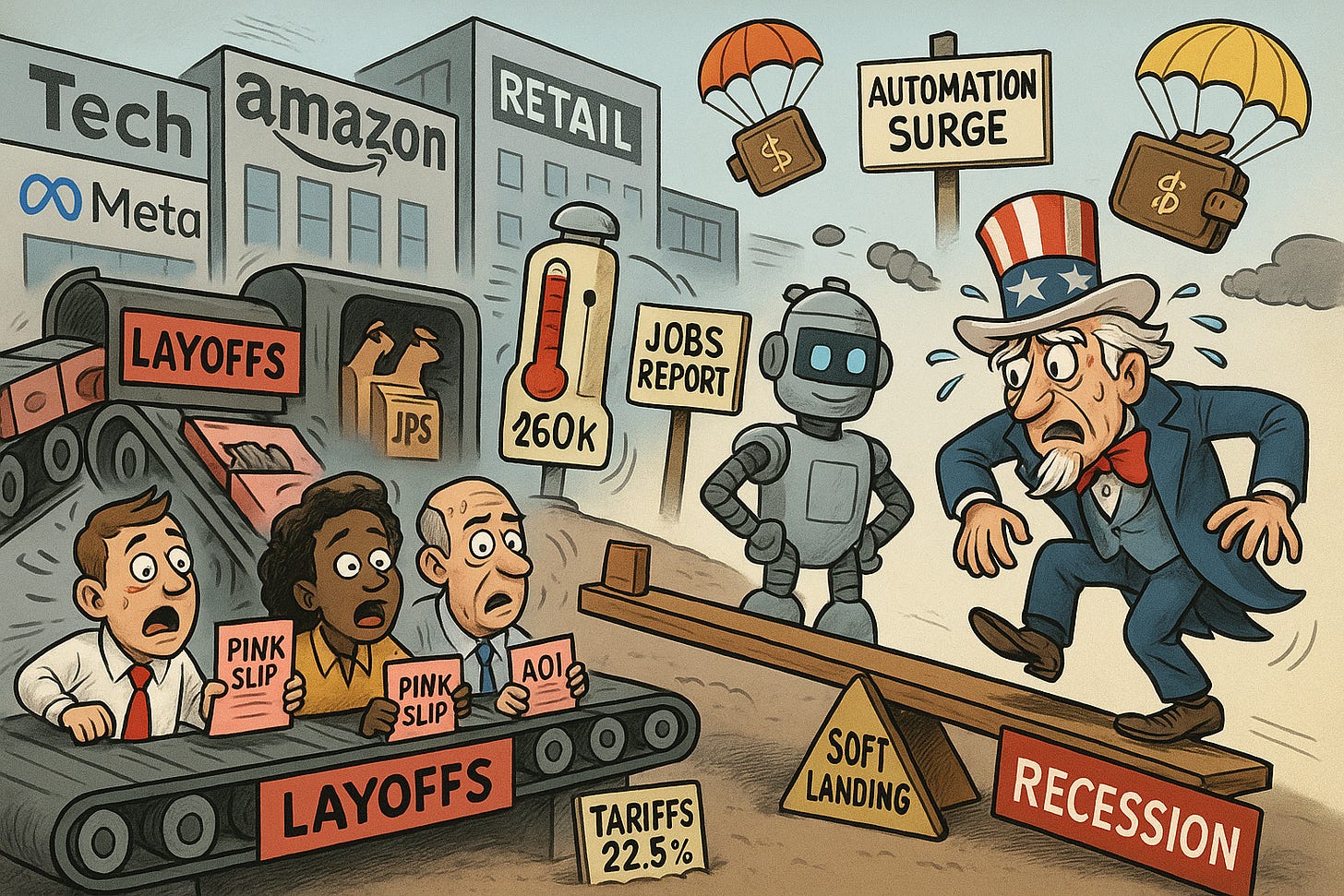

💼 U.S. Layoffs Surge Past 950,000 — Ending the “Low Hire, Low Fire” Era

The U.S. labor market is showing its sharpest stress signals since 2020, with nearly 950,000 job cuts announced through September, according to Challenger, Gray & Christmas—a 27% year-over-year rise that marks the end of the “low hire, low fire” discipline of 2024. October alone brought 172,000 layoffs, a 28% monthly jump and 42% increase over the prior year (CBS News, Economic Times). The cuts are concentrated in technology (128,000), retail (64,000), and government (≈300,000)—industries once seen as labor-stable. UPS alone has eliminated 48,000 roles this year, underscoring the scale of adjustment now underway. While headline unemployment remains near 4.2%, initial jobless claims have started to rise from their 220k–240k range, suggesting a clear turn in the cycle (Reuters).

Three forces explain the shift. AI automation is allowing firms like Amazon and Meta to cut corporate layers and boost productivity; tariff absorption is pushing companies to trim payrolls rather than pass higher costs to consumers, with Trump’s trade regime lifting the effective tariff rate to 22.5%, the highest since 1909; and labor normalization means firms are no longer hoarding staff amid abundant supply. The result: job losses increasingly hit white-collar and mid-salaried workers, threatening consumer spending momentum. Economists estimate tariffs alone could cost 250,000–300,000 jobs and shave up to 0.4% off GDP (Yale Budget Lab, NPR). The Chicago Fed now projects unemployment at 4.35% for October, with economists warning that sustained jobless claims above 260,000 would confirm a genuine labor slowdown (Chicago Fed).

Sensei’s Insight: Layoffs are broadening from tech to retail and logistics—an early signal that cost discipline is replacing growth hiring. If the trend persists, it could cap consumer spending and test the Fed’s “soft landing” narrative into 2026.

💷 Reeves’ Wealth Tax Strategy Faces £50 Billion Gap Test

Chancellor Rachel Reeves is preparing a sweeping fiscal package aimed at plugging a £35–50 billion deficit ahead of the November 26 Budget, with measures targeting high-income earners and property owners at the top of the list. Proposals under review include a 20% exit tax on business assets for wealthy individuals emigrating from the UK and a mansion tax on homes valued above £2 million (Bloomberg, City A.M.). Treasury officials estimate the exit tax could raise around £2 billion annually, while property-based reforms might generate £4 billion through council-tax re-banding. The challenge: the Office for Budget Responsibility’s productivity downgrade—roughly £20 billion in lost revenue—has widened the fiscal gap faster than planned spending cuts can offset. Critics warn Reeves’ approach risks worsening the post-non-dom “wealth exodus,” with 1,800 non-doms already departing in 2024-25—50% above OBR forecasts—and the Henley Migration Report projecting up to 16,500 millionaire exits in 2025 (Independent).

Design and timing are crucial. Announcing an exit levy too early could accelerate relocations before it takes effect—a risk underscored by tax experts such as Dan Neidle, who called advance disclosure “the last thing” Treasury should do. Meanwhile, the mansion-tax design carries trade-offs: a 1% annual levy above £2 million could depress London property values by ~20%, eroding Stamp Duty Land Tax receipts by about £2 billion (Saffery). As Labour balances fiscal credibility with competitiveness, analysts expect Reeves to pair targeted property and capital-gain reforms with extended income-tax threshold freezes rather than broad-based rate hikes. The risk remains that higher-end taxes boost near-term revenue but intensify capital flight—undermining the fiscal gain she seeks.

Sensei’s Insight: Reeves’ budget calculus hinges on precision. A narrow, well-timed wealth-tax rollout could stabilise revenues—but missteps could amplify the exodus and force further tightening in 2026.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: 🌀 Ripple Swell 2025 — A Defining Moment for XRP

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.