Sensei's Morning Forecast: Jackson Hole Looms, Ukraine Peace Stalls, KTA Insight

Trump-Putin summit ends without ceasefire; Fed’s Jackson Hole speech looms; gold drifts; MicroStrategy backs Bitcoin collateral; Musk warns shorts; KTA blockchain emerges with real‑world scalability.

🧠 One Big Thing

Jerome Powell’s speech at Jackson Hole on August 22 could reset market expectations, with traders now pricing in a 25bps rate cut for September amid sticky inflation and a softening labor market.

💰 Money Move of the Day

When central banks speak, markets listen—and often move. For those tracking interest rate-sensitive assets like bonds, tech stocks, or gold, it can be useful to observe how major Fed events shift sentiment, not just prices.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $115,121 (▼ -2.01%)

Ethereum (ETH): $4,279 (▼ -4.38%)

XRP: $2.97 (▼ -3.72%)

Equity Indices (Futures):

S&P 500 (SPX): 6,443 (▼ -0.04%)

NASDAQ 100: 23,782 (▼ -0.09%)

FTSE 100: 9,136 (▼ -0.14%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.293% (▼ -0.67%)

Oil (WTI): $63.11 (▼ -0.26%)

Gold: $3,348 (▲ +0.38%)

🕒 Data as of UK (BST): 12:20 / US (EST): 07:20 / Asia (Tokyo): 20:20

✅ 5 Things to Know Today

🇷🇺 Trump-Putin Summit Yields No Ceasefire as U.S. Focus Shifts to Territorial and Security Deal

U.S. President Donald Trump and Russian President Vladimir Putin held direct talks Friday, August 15, in Anchorage, Alaska, in a high-stakes summit on ending the Ukraine war. While both leaders described the meeting as “productive,” they failed to reach a ceasefire or final peace agreement (Al Jazeera, CNBC, Reuters, CNN). Trump notably softened his prior insistence on a ceasefire as a precondition, instead promoting a phased approach toward a broader settlement focused on territorial and security guarantees—an alignment more favorable to Moscow’s framework. Putin reiterated demands for Ukraine to renounce NATO ambitions and recognize Russian control of Crimea and Donetsk, arguing that lasting peace required addressing what he called the “root causes” of the conflict. Ukrainian President Volodymyr Zelenskyy rejected those terms, holding firm on Kyiv’s refusal to concede territory or abandon NATO aspirations.

In the wake of the summit, Zelenskyy traveled to Washington for urgent meetings with Trump and key European leaders, including European Commission President Ursula von der Leyen, French President Emmanuel Macron, and British Prime Minister Keir Starmer (NPR, DW, NBC News). These leaders jointly affirmed their opposition to any settlement that compromises Ukrainian sovereignty. European officials warned against coercing Kyiv into territorial concessions, emphasizing the need for robust security guarantees akin to NATO’s Article 5. The coordinated effort underscores growing transatlantic resistance to a peace deal on Moscow’s terms (Al Jazeera, ITV).

Sensei’s Insight: Trump’s pivot toward a security-first framework introduces new volatility for European defense and energy markets. Monitor signals from Washington and Brussels—territorial lines and treaty guarantees may soon define asset exposure and geopolitical risk.

📊 Powell’s Jackson Hole Address Takes Center Stage

Federal Reserve Chair Jerome Powell will headline the Jackson Hole Economic Policy Symposium on Friday, August 22, with a 10:00 a.m. ET speech titled “Economic Outlook and Framework Review” (Reuters). The address comes amid rising speculation of a potential 25 basis point rate cut at September’s FOMC meeting. The symposium, often considered the Fed’s most consequential policy gathering of the year, will focus on inflation dynamics, labor market trends, and the central bank’s evolving monetary framework (Yardeni QuickTakes; Wells Fargo). Also under the microscope are FOMC minutes from Wednesday, August 20, which could reveal how policymakers weighed last month’s weak jobs data, persistent inflation, and the economic impact of recent tariffs (Fortune; AInvest).

The FOMC minutes—regarded as the most detailed account of Fed deliberations—will offer insight into internal divisions, dovish or hawkish pivots, and reaction to ongoing price pressures (Equals Money). Powell is also expected to touch on the Fed’s long-term framework review, a recurring policy reassessment evaluating how it pursues its dual mandate of stable prices and maximum employment (Federal Reserve). Market participants will be parsing both events for any signal on future policy flexibility, possible preemptive moves, or sustained tightening as inflation uncertainty lingers (Forbes; CME Group).

Sensei’s Insight: The Fed’s tone this week could either validate or challenge market pricing on rate cuts. Watch for how Powell frames inflation risks versus employment softness—his calibration could define Q4 positioning across bonds, equities, and FX.

🥇 Gold Climbs Ahead of Jackson Hole and Ukraine Talks

Gold prices edged higher on August 18, with spot rates reaching $3,349.01 per troy ounce, marking a 0.38% daily gain. The metal has traded in one of its tightest ranges since March, highlighting market indecision. In the UK, 24K gold remained steady at GBP 79.10 per gram. Investors are closely watching the Jackson Hole Symposium, which will convene over 100 central bankers and finance ministers. Hopes are rising for signals on rate cuts from the U.S. Federal Reserve. Central banks' gold acquisitions hit 166 tons in Q2 2025—40% above historical averages (Gold Bullion Australia, Trading Economics, Times of India).

Simultaneously, geopolitical eyes are on U.S. President Trump and Ukrainian President Zelensky as they engage European leaders in a fresh diplomatic push for peace. The meetings have cooled some safe-haven demand for gold, despite persistent volatility. Mixed macroeconomic indicators and lingering uncertainty over Ukraine continue to influence both commodity and currency markets (Business Times, FCA).

Sensei’s Insight: Markets are positioned on a knife’s edge—central bank tone at Jackson Hole and tangible Ukraine peace progress could either re-ignite gold’s rally or cap it sharply. Watch the macro chessboard.

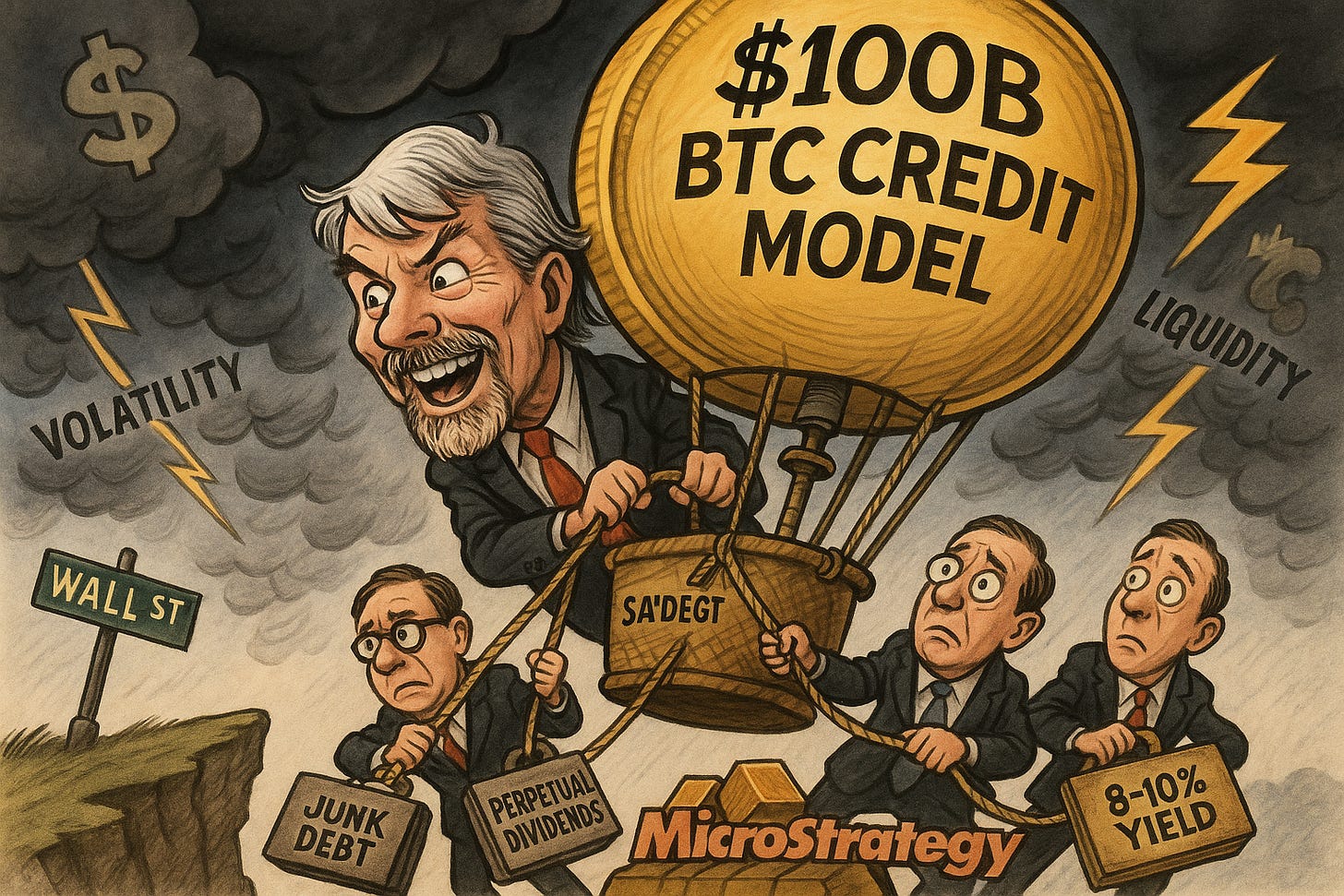

📌 Saylor’s Bitcoin Credit Ambition: From Convertibles to Perpetuals

Michael Saylor is reshaping MicroStrategy’s capital structure with an experimental “BTC Credit Model”—a branded initiative aimed at turning Bitcoin into institutional-grade collateral. Departing from traditional convertible debt, the company has issued roughly $6 billion in 2025 through four financing rounds, including novel perpetual preferred stock instruments, to fund continued Bitcoin accumulation. These offerings offer yields of 8–10% and are positioned to attract institutions seeking crypto exposure without the direct price volatility (Bloomberg, Fortune, AInvest). Saylor has floated a theoretical ceiling of $100 billion in Bitcoin-backed credit—an aspirational target if Bitcoin becomes widely accepted as institutional collateral—not an active credit line.

MicroStrategy’s current holdings stand at approximately 628,000 BTC (worth ~$65 billion), making it the world’s largest corporate Bitcoin holder. While these innovative securities could further normalize Bitcoin as collateral in traditional markets, they come with high risk. Analysts, including those from VanEck and PYMNTS, warn of high-yield spreads (500–1,200 basis points) and potential cash flow strain if Bitcoin fails to appreciate. These concerns highlight the fragility of using a volatile asset to underpin perpetual obligations. Still, as crypto-backed lending gains traction across finance, Saylor’s approach could either lead Bitcoin into mainstream credit—or serve as a case study in the risks of overleveraging digital assets.

Sensei’s Insight: Saylor’s playbook is bold: trade convertibles for perpetuals, and position Bitcoin as institutional collateral. But ambition doesn’t equal execution—this isn’t $100B raised; it’s $100B imagined.

🔻 Musk Renews Threats to Tesla Short Sellers Amid Insider Sell-Offs

Tesla CEO Elon Musk reignited his campaign against short sellers, warning in a recent X post that those betting against Tesla “will be obliterated” if the company achieves autonomy at scale. Short interest in Tesla currently stands at 2.56% of the float, equivalent to 71.99 million shares valued at over $24 billion (MarketBeat). While some outlets estimate large institutional positions—naming MUFG Securities EMEA, Jane Street Group, and Citadel Advisors—these figures are based on third-party analytics and should be considered approximations, not confirmed disclosures (ZeroHedge, Electric Vehicles). The warnings coincide with reports that Tesla SVP Tom Zhu has reduced his holdings by roughly 82%, from 81,000 shares to under 15,000—based on limited-scope media reporting and not yet corroborated via SEC filings. Insiders have collectively sold shares estimated around $702 million over the past two years, though this figure is journalistic and not drawn from audited filings (The Finance 360, CoinCentral).

Tesla shares closed at $330.56 on August 15, down 1.50% for the day and trailing the S&P 500 in 2025 with an 18.15% year-to-date loss versus the index’s 9.66% gain. However, the stock is still up 54.37% over the past year, outperforming the S&P’s 16.35% return (Yahoo Finance, Bloomberg). Tesla currently operates limited robotaxi services with safety drivers in California and Texas, though full autonomy has not been achieved and remains under regulatory scrutiny (Electrek).

Sensei’s Insight: Tesla’s short interest remains dollar-heavy despite its modest float percentage, while Musk’s aggressive rhetoric and Zhu’s reported divestment heighten investor sensitivity to the company’s autonomy narrative. Institutional short exposure claims warrant caution without confirmed filings.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: KEETA (KTA) Deep Dive: What Retail Investors Should Know

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.