Sensei's Morning Forecast: Markets Eye Trump Tax Bill, Altcoin ETF Boom

Trump’s $3.3T budget faces Senate deadlock; ISA cuts loom; ECB hits inflation target; Robinhood rallies on tokenization; altcoin ETF approvals near with 95% odds.

🧠 One Big Thing

$3.3 trillion—the size of President Trump’s “One Big Beautiful Bill” now grinding through a 19+ hour Senate vote-a-rama. If passed, it would become the largest single spending and tax reform package in U.S. history, reshaping the federal budget and triggering ripple effects across healthcare, defense, and entitlement sectors.

💰 Money Move of the Day

Some savers are rushing to max out their £20k Cash ISA before Chancellor Reeves' July 15 speech—just in case the cut is immediate. While the total ISA limit may not change, locking in the full cash allowance now offers flexibility to transfer or rebalance later, especially with Stocks & Shares ISAs expected to remain untouched.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $106,589 (▼ -0.54%)

Ethereum (ETH): $2,457 (▼ -1.15%)

XRP: $2.20 (▼ -1.62%)

Equity Indices (Futures):

S&P 500 (SPX): 6,193 (▼ -0.04%)

NASDAQ 100: 22,835 (▼ -0.26%)

FTSE 100: 8,731 (▼ -0.42%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.187% (▼ -1.06%)

Oil (WTI): $66.48 (▲ +0.89%)

Gold: $3,349 (▲ +1.40%)

🕒 Data as of UK (BST): 12:09 / US (EST): 07:09 / Asia (Tokyo): 20:09

✅ 5 Things to Know Today

🏛️ Senate Vote-a-Rama Drags On as Trump’s $3.3 Trillion ‘Big, Beautiful Bill’ Faces Razor-Thin Margin

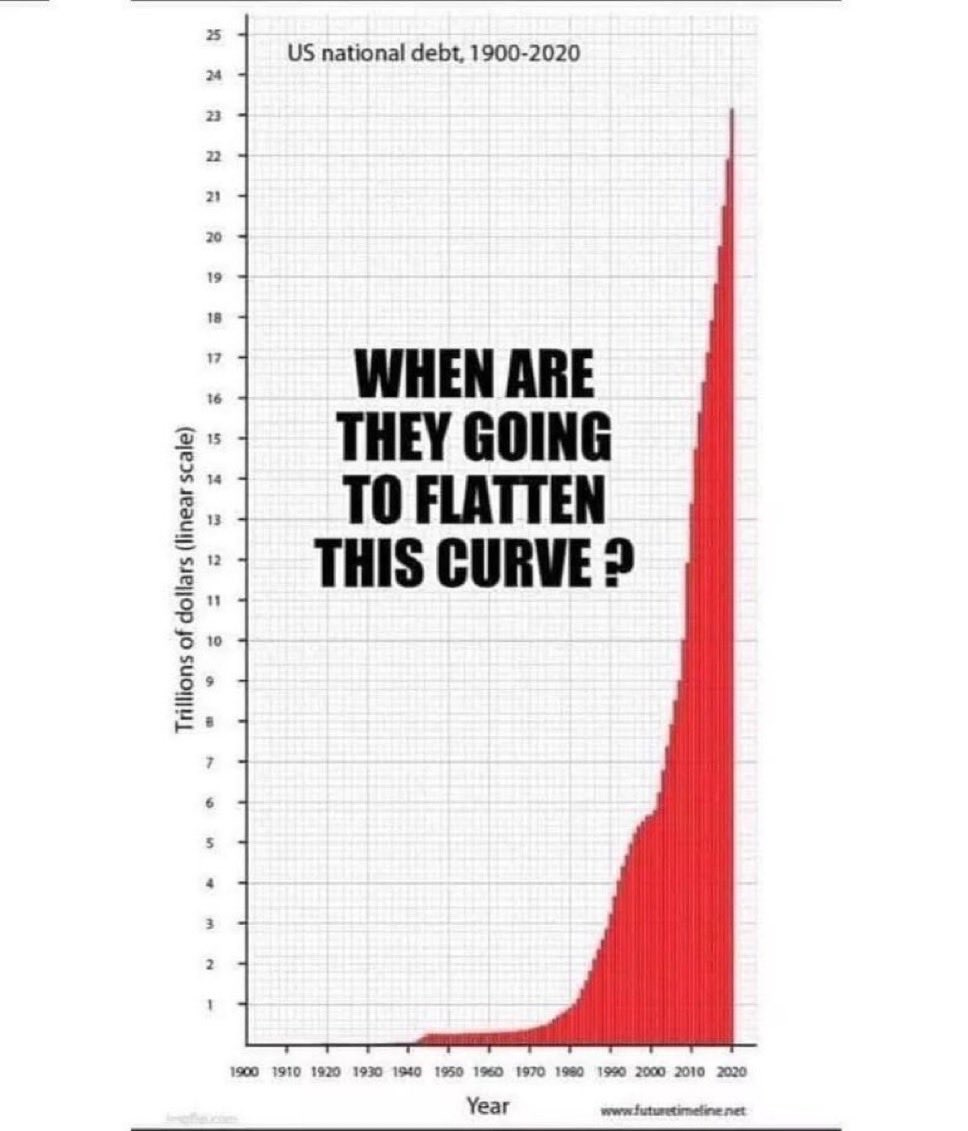

The U.S. Senate remains entrenched in a grueling “vote-a-rama,” extending beyond 19 hours, as lawmakers attempt to finalize President Donald Trump’s $3.3 trillion “One Big Beautiful Bill Act” ahead of the self-imposed July 4 deadline. The 940-page bill proposes sweeping tax cuts, boosts to defense and border security funding, and significant rollbacks in Medicaid and food stamp programs. Enabled by the budget reconciliation process, the bill bypasses the 60-vote filibuster threshold, but Republicans—with only a slim majority—can afford just three defections. Over the weekend, the Senate narrowly advanced the bill 51-49, with GOP Senators Rand Paul and Thom Tillis joining all Democrats in opposition. The Congressional Budget Office projects the bill would add $3.3 trillion to the national debt—$800 billion more than the House-passed version—pushing the total U.S. debt to $36.2 trillion (Reuters, BBC, ABC News).

The amendment marathon has seen both parties flood the floor with changes, including Democrats’ procedural maneuver to force a full reading of the bill and highlight projected Medicaid and safety-net coverage losses. One key failed GOP amendment sought to eliminate wind and solar tax credits, exposing internal party rifts and the bill’s intricacies. If passed, the Senate version would return to the House—where it passed by just one vote—for reconciliation, potentially setting up a decisive vote as early as Wednesday (ABC News, Reuters, Al Jazeera). The bill’s scope carries major market implications—aggressive tax cuts, surging government borrowing, and sharp entitlement reductions promise to reshape fiscal policy. Defense, energy, and border security sectors are poised to benefit, while healthcare and social service providers brace for potential losses. The narrow margins and intraparty discord elevate the risk of gridlock and potential market volatility should the legislation falter or intensify debt ceiling pressures (Al Jazeera, BBC).

An image Elon Musk reposted:

Sensei’s Insight: In fiscal warfare, every comma counts. With $3.3 trillion on the table and political unity fraying, even a single defection could redraw the map of America’s economic future.

💸 Reeves to Slash Cash ISA Allowance in Push for More Investment

UK Chancellor Rachel Reeves is preparing to announce a major cut to the annual tax-free Cash ISA allowance, currently set at £20,000, during her Mansion House speech on July 15. While the total ISA limit will remain the same, the cash portion is expected to be significantly reduced for the first time since 2017–18, with insiders suggesting a new cap between £4,000 and £5,000. The initiative is part of a broader government effort to steer savings from cash into investments—particularly UK equities—to bolster domestic capital markets (Independent, Telegraph, GB News).

Cash ISAs are the UK’s most popular savings vehicle, with 7.8 million holders in the 2022–23 tax year, compared to 3.8 million for stocks and shares ISAs. In April 2025 alone, £14bn was deposited into cash ISAs—marking a record surge, likely driven by anticipation of the cut. The proposed reform has sparked division within the financial industry: while some investment platforms welcome the shift to stimulate equity participation, others—including building societies and consumer groups—warn it could penalize risk-averse savers and may not significantly alter long-term saving behavior (City A.M., LBC, FT).

Sensei’s Insight: This policy pivot reveals more than just a preference for equities over cash—it’s a calculated gamble to inject life into the UK’s capital markets. But in doing so, it may alienate the very savers who’ve long depended on tax-free interest. As the Mansion House speech looms, investors and cautious savers alike should prepare for a new era of savings strategy.

🎯 ECB Hits Target: Eurozone Inflation Returns to 2% in June

Eurozone inflation rose to 2.0% year-over-year in June, aligning with both the European Central Bank's (ECB) target and market expectations, according to preliminary data from Eurostat (FXStreet). This marks a slight increase from May’s 1.9%, primarily driven by services inflation accelerating to 3.3% from 3.2%. Core inflation remained stable at 2.3%, while energy prices stayed in deflation at -2.7%, improving from -3.6% the previous month. Monthly headline inflation posted 0.3%, up from zero growth in May.

This data precedes the ECB’s next policy meeting on July 24, where officials are expected to hold rates steady following a 25 basis point cut in June that brought the deposit rate to 2.0% (Equals Money, ECB). President Christine Lagarde reaffirmed a data-dependent, meeting-by-meeting stance, emphasizing that rates will remain "sufficiently restrictive" to maintain inflation stability. The ECB forecasts inflation at 2.0% in 2025, dipping to 1.6% in 2026, then returning to target in 2027. Despite chief economist Philip Lane’s comment that the tightening cycle is “done” (CNBC), markets only assign a 45% chance to another rate cut this month (Morningstar).

Sensei’s Insight: Hitting the 2% mark is a symbolic and strategic milestone, but the persistence of services inflation at 3.3% cautions against complacency. With underlying pressures still simmering, the ECB gains room to pause—but not to relax.

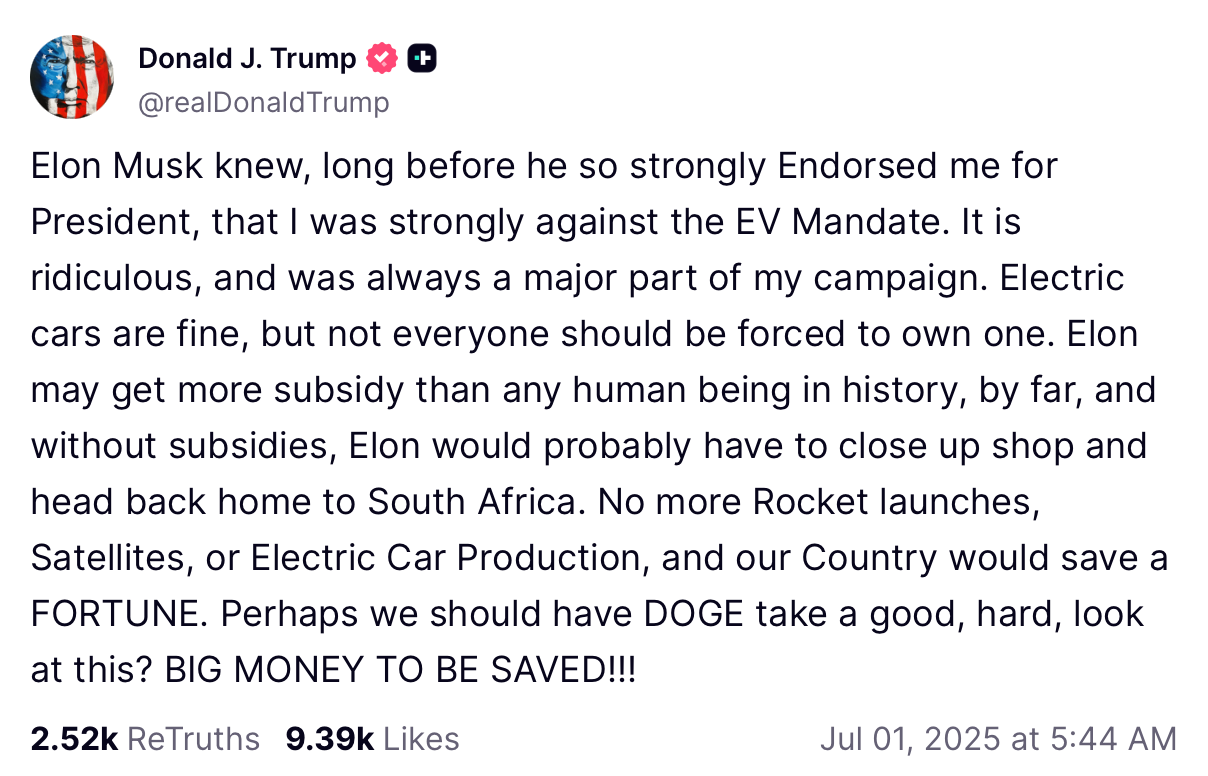

🚨 Trump Targets Musk with DOGE Audit Threat

President Donald Trump reignited his feud with Elon Musk via a 5:44 a.m. ET Truth Social post on July 1, accusing Musk of benefiting from excessive government subsidies and calling on the Department of Government Efficiency (DOGE) to audit federal support to Musk’s ventures. Trump claimed that without these subsidies, Musk “could close up shop and head back home to South Africa,” slamming the Biden-era EV mandate and federal funding policies (Forbes; Newsweek). The DOGE reference, likely a jab at Musk’s crypto interests, came amid broader Republican efforts to scale back clean-energy tax credits (NPR).

Over two decades, Musk-controlled firms like Tesla and SpaceX have drawn more than $38 billion in U.S. federal and state support, including EV tax credits and launch contracts (Le Monde; Subsidy Tracker). SpaceX alone will earn an estimated $3.4 billion from U.S. contracts this year, making up about 25% of its 2024 revenue (NY Post; Scripps News). The political attack triggered a 5.8% dip in Tesla shares during early European trading hours (Yahoo Finance). Policy risks are mounting for clean-tech equities as Washington reconsiders the future of EV and space-sector subsidies.

Sensei’s Insight: With campaign rhetoric morphing into targeted fiscal threats, expect rising volatility for companies anchored to government incentives. Tesla and SpaceX may soon face political headwinds as real as their engineering challenges.

📈Robinhood Hits Record High on Tokenized Stock Push in Europe

Robinhood Markets (HOOD) soared 13% on Monday, June 30, closing at $93.63 and touching an all-time high of $94.24 during the session (Yahoo Finance, CNBC, StockAnalysis). The surge pushed its market cap to $82.6 billion and marked a 313% gain year-over-year. The rally followed Robinhood’s “To Catch a Token” event in Cannes, where it launched tokenized US stock and ETF trading for European users. EU users now have commission-free access to 200+ tokenised US securities, including OpenAI and SpaceX, with 24/5 trading and dividend payouts via app (Finance Magnates, NBC Washington).

The platform is giving away €5 in OpenAI and SpaceX tokens to new eligible EU users who sign up by July 7, with $1M in OpenAI and $500K in SpaceX tokens allocated for the campaign (NBC Washington, AInvest). Tokens are initially issued on Arbitrum blockchain, with migration to Robinhood’s proprietary Layer 2 in the pipeline (Proactive Investors). The company also rolled out crypto perpetual futures with 3x leverage for EU customers and reintroduced crypto staking for Ethereum and Solana in the US (GlobeNewswire). These moves position Robinhood—now with 25.9 million funded accounts (Robinhood IR)—as a vanguard in blockchain-based finance, unlocking access to high-profile assets and extending trading beyond Wall Street’s hours.

Tokenized stocks are digital representations of real-world shares, issued on a blockchain. Each token mirrors the price and value of an actual stock, allowing for fractional ownership, 24/5 trading, and seamless global access without relying on traditional exchanges. Robinhood launched them in Europe to bypass legacy financial infrastructure and give retail investors direct access to assets like OpenAI and SpaceX, which are typically restricted. Tokenization is important because it democratizes finance—breaking down barriers to private markets, enhancing liquidity, and enabling continuous trading beyond market hours.

Sensei’s Insight: Robinhood’s explosive push into Europe with tokenized equities—especially OpenAI and SpaceX—signals a generational shift. By decentralizing access to blue-chip and unicorn stocks, the firm isn’t just expanding geography—it’s redrawing the investment map.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Bloomberg ETF Approval Forecasts: Analyst Confidence, SEC Outlook, and What It Means for Altcoin Season & Retail Investors

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.