Sensei's Morning Forecast: Meme Stocks, Tesla Troubles, and EU Tariff Talks

Meme stock frenzy, crypto sees $735M liquidation, Tesla faces EV credit cliff, Alphabet’s AI investments shock markets, EU tariff truce, Trump pressures Powell, Germany accelerates defence tech.

🧠 One Big Thing

The crypto market experienced a sharp sell-off in the past 24 hours, with more than $735 million in liquidations, primarily impacting long positions as leveraged traders were flushed out. While Bitcoin proved resilient—slipping only around 1%—altcoins witnessed much steeper declines, with several majors like Ethereum, XRP, and Solana dropping between 4% and 10% or more, highlighting a pronounced rotation out of riskier digital assets. Ethereum alone saw nearly $200 million worth of liquidations, making it the hardest hit among major cryptocurrencies, while losses across other altcoins far outpaced Bitcoin’s relatively mild move. This volatility leaves traders focused on whether the abrupt shift signals a broader correction or simply an extensive shakeout of speculative excess.

💰 Money Move of the Day

Watch the Bitcoin Dominance chart. When it hits key targets or shows oversold conditions, Bitcoin often outperforms altcoins — a prime signal to rebalance your crypto positions.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $118,471 (▼ -0.28%)

Ethereum (ETH): $3,622 (▼ -0.20%)

XRP: $3.11 (▼ -2.48%)

Equity Indices (Futures):

S&P 500 (SPX): 6,363 (▼ -0.10%)

NASDAQ 100: 23,371 (▲ +0.26%)

FTSE 100: 9,145 (▲ +0.33%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.406% (▲ +0.50%)

Oil (WTI): $67.08 (▲ +0.75%)

Gold: $3,365 (▼ -0.68%)

🕒 Data as of UK (BST): 12:00 / US (EST): 07:00 / Asia (Tokyo): 20:00

✅ 5 Things to Know Today

Tesla Faces Rough Road as U.S. EV Incentives Expire

Tesla posted its steepest revenue decline in over a decade, with Q2 2025 sales dropping 12% year-over-year to $22.5 billion, missing Wall Street’s $22.74 billion forecast (Bloomberg). Adjusted EPS came in at $0.40, down 23%, while operating income fell 42% to $0.9 billion with margins at 4.1% (Financial Post). Deliveries of 384,122 units marked a 14% decline, and regulatory credit revenue plunged 51% ahead of U.S. policy changes (CNBC). CEO Elon Musk warned that the expiration of the $7,500 federal EV credit on 30 September 2025, coupled with slow progress on autonomous driving, will create “a few rough quarters” before new revenue streams emerge (RTÉ). A lower-cost model is in production but won’t scale until next quarter, and Tesla’s robotaxi pilot in Austin remains limited to ~35 vehicles with no updated timeline for its 1,000-car milestone (Investing.com).

The expiration of the clean-vehicle credit under the “Big Beautiful Bill” is expected to trigger a Q3 demand pull-forward before a steep drop-off in Q4–Q1 sales, as roughly 20% of Tesla’s U.S. deliveries still depend on this subsidy (CBS News). Analysts also flagged a lack of clarity on key autonomy milestones, including hardware upgrades and Full Self-Driving monetization plans (Investors). Competitive pressures are intensifying, with GM’s U.S. EV sales surging 111% in Q2, while used Tesla prices are down 13–16% year-over-year (Fortune). Musk’s political controversies in the U.S. and Europe are also weighing on brand perception (Al Jazeera). Without a faster timeline for the sub-$30,000 model or a definitive robotaxi rollout, Tesla faces margin compression and muted earnings growth in the near term.

Sensei’s Insight: Tesla is approaching a critical inflection point—losing federal incentives while competitors gain momentum. The next quarter’s delivery figures and any concrete autonomy updates will be key to gauging whether the company can offset this looming demand cliff.

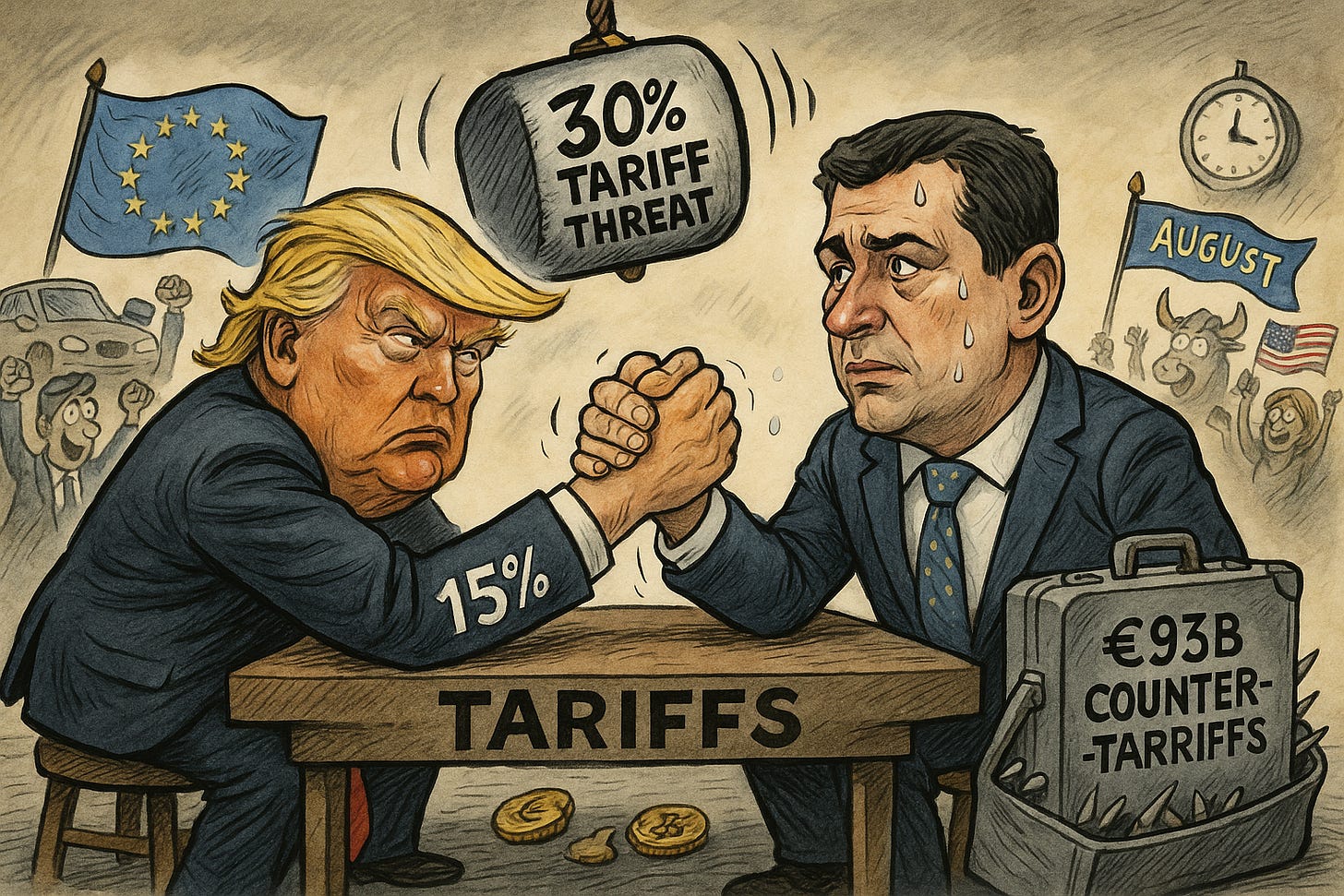

EU, US Poised for 15% Tariff Truce

Brussels is moving to accept a 15% baseline U.S. tariff on most European exports—mirroring Washington’s recent pact with Japan—in a draft agreement circulated to EU ambassadors late Wednesday (Telegraph, Reuters). The deal would prevent a looming 30% blanket levy that President Donald Trump has vowed to impose on EU goods starting August 1 if talks collapse. EU trade chief Maroš Šefčovič is set to speak with U.S. Commerce Secretary Howard Lutnick today, while member states have signed off on a €93 billion ($109 billion) counter-tariff list to activate August 7 if negotiations fail (RTE, Notre Temps). Diplomats say some categories—like aircraft, timber, and select pharma products—could avoid duties, but a 50% steel tariff remains unchanged. Markets responded positively, with the STOXX 600 up 0.6% and auto stocks surging roughly 3% on optimism for a trade de-escalation (Economic Times).

The truce would avert the worst-case tariff shock for EU exporters—European automakers alone shipped €38.9 billion worth of vehicles to the U.S. in 2024 (ACEA). Still, locking in a 15% tariff squeezes profit margins and leaves plenty of tension in the transatlantic relationship, with Brussels’ €93 billion retaliation package signaling that a renewed trade clash remains possible (RTE). Both sides face pressure to finalize the deal quickly, given the August deadlines and the potential economic fallout from escalating trade barriers.

Sensei’s Insight: A 15% tariff is far from ideal but beats the 30% alternative. Expect continued volatility in auto and steel sectors as markets weigh whether this fragile truce holds.

Alphabet Delivers Strong Q2 Beat Despite $10 Billion Capex Shock

Alphabet reported Q2 2025 earnings that topped Wall Street forecasts across the board, with revenue climbing 14% year-over-year to $96.43 billion (vs. $94 billion expected) and earnings per share rising 22% to $2.31 (vs. $2.18 expected) (Investopedia, Reuters). Net income grew 19% to $28.2 billion, driven by solid performance across Google Search, YouTube, and Cloud. Search revenue gained 12% to $54.19 billion, YouTube advertising rose 13% to $9.8 billion, and Google Cloud surged 32% to $13.62 billion—well above the 26.5% consensus. Operating margin expanded to 20.7% from 11.3% a year ago, with the cloud unit generating $2.83 billion in operating income versus $1.17 billion in Q2 2024 (Investing.com). CEO Sundar Pichai credited new AI features, noting AI Mode reached 100 million monthly active users just two months post-launch.

Despite the earnings beat, Alphabet’s stock initially slipped in after-hours trading due to a surprise $10 billion increase in 2025 capital expenditures to $85 billion, up from prior guidance of $75 billion (Times of India, Reuters). The 33% jump underscores Alphabet’s heavy push into AI infrastructure and data centers to meet swelling cloud demand, though it raises near-term margin pressure concerns. Analysts are watching to see if these bold investments secure Alphabet’s leadership in the AI race, especially as AI-native competitors intensify challenges in search and cloud services (NYTimes).

Sensei’s Insight: Alphabet’s capex shock shows just how aggressively tech giants are betting on AI infrastructure. Investors may grumble at the short-term hit to margins, but the real question is whether these AI-driven investments will cement Google’s dominance—or open the door for leaner AI-native rivals.

Trump’s Rare Fed Visit Ratchets Up Rate-Cut Pressure on Powell

President Donald Trump will visit the Federal Reserve’s Washington headquarters at 4:00 p.m. ET on Thursday—the first such appearance by a sitting president in nearly two decades—according to a White House schedule released late Wednesday (Reuters, CNBC). The visit follows weeks of sharp criticism directed at Fed Chair Jerome Powell for maintaining the policy rate at 4.25%-4.50% and overseeing a headquarters renovation whose cost has surged to $2.5 billion from $1.9 billion (ABC News). Trump has called for rate cuts of up to 300 basis points, drafted a dismissal letter for Powell, and this week labeled him a “numbskull” (Reuters, NYT).

The pressure campaign is already nudging markets: the 10-year Treasury yield rose 1 basis point to 4.4% ahead of the visit, and Thursday’s tour—rarely open to the press—will be closely scrutinized for any remarks that could influence policy expectations (WSJ). Analysts warn that Trump’s direct involvement threatens the perception of central-bank independence. Any indication that Powell could be ousted or coerced into deeper cuts could stoke volatility across interest rates, the U.S. dollar, and rate-sensitive equity sectors (CNN, Al Jazeera).

Sensei’s Insight: Central-bank credibility is the bedrock of market stability. A public clash at this level could push traders to price in political risk alongside economic data, magnifying rate volatility.

Germany’s Future-Warfare Push: €162 B Budget, Cyborg Cockroaches, and $12 B AI Unicorns

Germany plans to nearly triple its core defense spending to €162 billion ($175 billion) annually by 2029 and is drafting a fast-track procurement law that allows startups to bypass years of bureaucracy, including advance payments and EU-only tenders (Reuters). Two of Europe’s three defense unicorns are already German—AI battlefield software firm Helsing (valued at $12 billion) and drone-maker Quantum Systems (>€1 billion valuation) (TBS News). R&D initiatives are advancing autonomous ground robots and even cyborg cockroaches equipped with micro-camera backpacks for reconnaissance operations.

Venture capital is accelerating alongside this shift: European defense-tech funding reached $1 billion in 2024, up from $373 million in 2022, with German startups securing $1.4 billion over the past five years (Reuters). Berlin now invites smaller firms to advise the defense ministry alongside established players like Rheinmetall and Hensoldt, while Defence Minister Boris Pistorius has assured founders that “money is no longer an excuse” as contract lead times shrink from years to months (Reuters, TBS News). A streamlined procurement pipeline could unlock multi-billion-euro contracts for agile AI-hardware vendors and boost valuations across Europe’s defense-tech sector—though it raises ESG scrutiny for asset managers allocating capital to defense-linked industries (Reuters).

Sensei’s Insight: Germany’s shift toward a startup-friendly, fast-moving defense ecosystem signals a major opportunity for investors and tech innovators—but the ethical debate around AI-driven warfare and surveillance tech will intensify as these projects scale.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: The Summer 2025 Meme Stock Surge

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.