Sensei's Morning Forecast: No Jobs Report? Here’s What It Means – Plus Bitcoin’s Next Move and a Pilot CEO to Watch

CEO of Horizon Aircraft shares hybrid eVTOL vision, while shutdown delays jobs data, Bitcoin breaks out, Trump fuels Ukraine strikes, and states warn of weakened crypto fraud oversight.

👀 Today’s Stories at a Glance

🚁 Meet Horizon’s CEO:

Horizon Aircraft’s CEO joins us Oct 7 to discuss hybrid eVTOLs and aviation’s next frontier.

💵 Multinationals Outperform:

A weaker dollar boosts U.S. multinationals like Netflix and Pepsi, while domestic firms fall behind.

🛰️ Trump’s Ukraine Pivot:

Trump approves intel sharing with Ukraine, enabling long-range strikes on Russia’s energy infrastructure.

₿ Bitcoin Reclaims $120K:

Bitcoin rallies past $120K amid ETF inflows and shutdown-driven macro fears, fueling bullish momentum.

⚖️ Crypto Bill Clash:

States warn new crypto bill could gut fraud enforcement, risking investor protections during market highs.

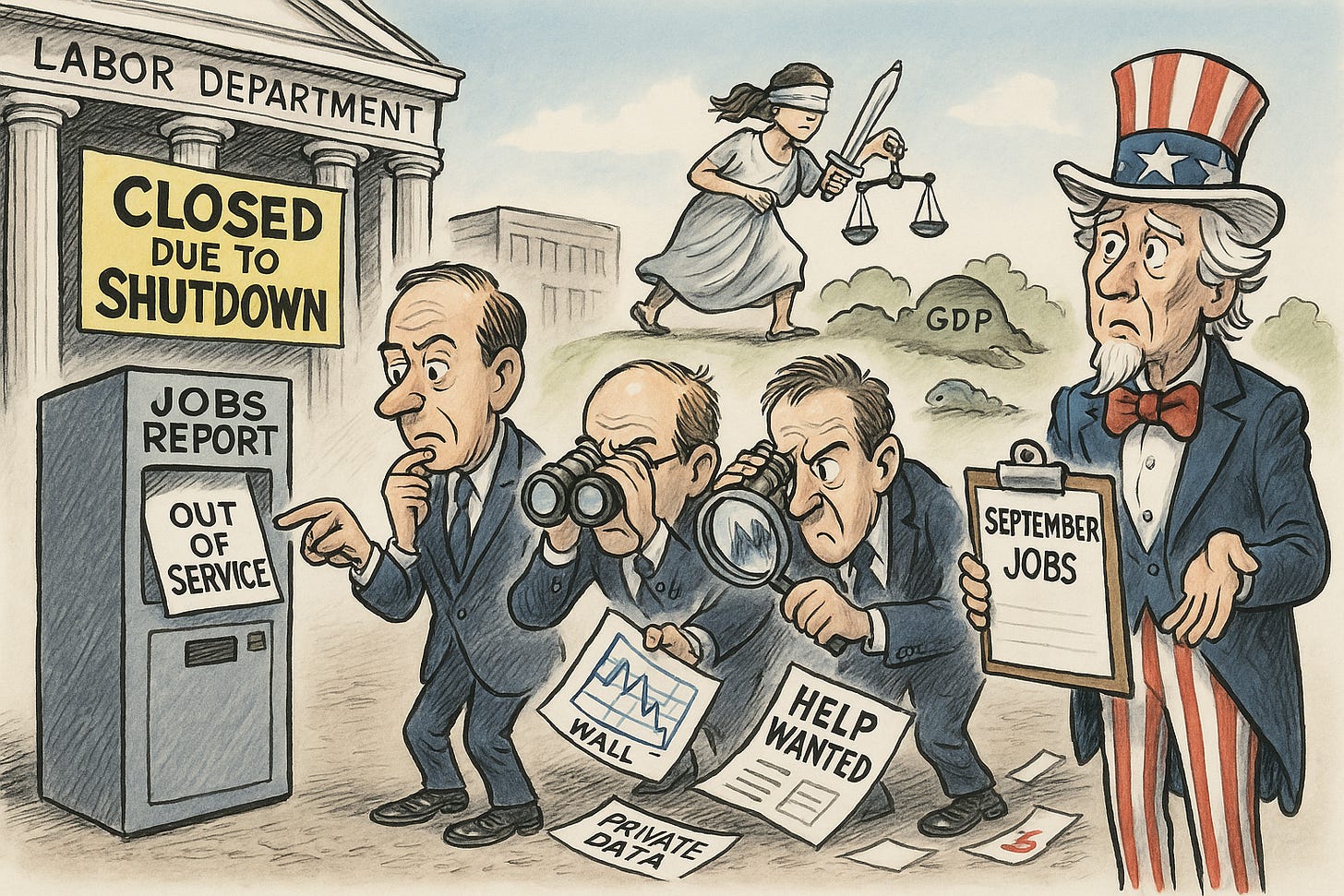

📉 Jobs Report Missing:

Shutdown delays key labor data; private proxies signal softer hiring, boosting odds of October rate cut.

🧠 One Big Thing

The U.S. economy lost its most-watched jobs report today due to the government shutdown, leaving investors to rely on weaker private signals—like ADP’s minus 32,000 September payrolls—for insight. With key economic data going dark, markets are now pricing an October rate cut as a near certainty.

💰 Money Move of the Day

When official data stalls, your financial outlook doesn’t have to. Watching high-frequency private indicators—like job postings or time-clock data—can help you stay informed on economic trends even when the government goes silent.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $120,537 (▼ -0.06%)

Ethereum (ETH): $4,493 (▲ +0.13%)

XRP: $3.05 (▲ +0.26%)

Equity Indices (Futures):

S&P 500 (SPX): 6,733 (▲ +0.27%)

NASDAQ 100: 25,171 (▲ +0.24%)

FTSE 100: 9,495 (▲ +0.66%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.090% (▲ +0.12%)

Oil (WTI): $60.95 (▲ +0.11%)

Gold: $3,866 (▲ +0.26%)

🕒 Data as of UK (BST): 11:59 / US (EST): 06:59 / Asia (Tokyo): 19:59

✅ 5 Things to Know Today

🚁 Meet the CEO: Brandon Robinson, Horizon Aircraft

Next week, in our Meet the CEO series, we welcome Brandon Robinson, CEO of Horizon Aircraft, for an exclusive live interview on Tuesday, October 7 at 2PM ET.

Horizon Aircraft is a Canadian aerospace innovator developing hybrid-electric vertical takeoff and landing (eVTOL) aircraft with a design philosophy that sets it apart from much of the industry. While many players focus on short-range urban air taxis, Horizon is engineering aircraft built for longer range, higher speed, and broader utility. Their flagship Cavorite X-series blends vertical lift capability with efficient fixed-wing flight — a world-first concept that has already caught the attention of both investors and operators.

At the center of this vision is Brandon Robinson, a former pilot whose aviation background directly shapes Horizon’s approach. His time in the cockpit provides practical insight into what makes an aircraft not just flyable, but truly useful. Brandon is applying that experience to guide Horizon toward creating aircraft that are safe, practical, and adaptable — with potential across civil, commercial, and defence markets.

Horizon’s hybrid approach offers extended range, built-in redundancy, and operational flexibility. These strengths open the door to applications such as medical transport, regional connectivity, and defence missions where battery-only eVTOLs may fall short. With early customer engagement already underway, Horizon’s pathway is clear: to bridge the gap between helicopters and fixed-wing aircraft while leading the first wave of sustainable aviation.

Join us live with Martyn Lucas and Vaz on Tuesday, October 7 at 2PM ET for this exclusive CEO Special. Don’t miss the chance to hear Brandon Robinson discuss Horizon’s vision, their unique design, and how hybrid-powered eVTOL could reshape the future of flight.

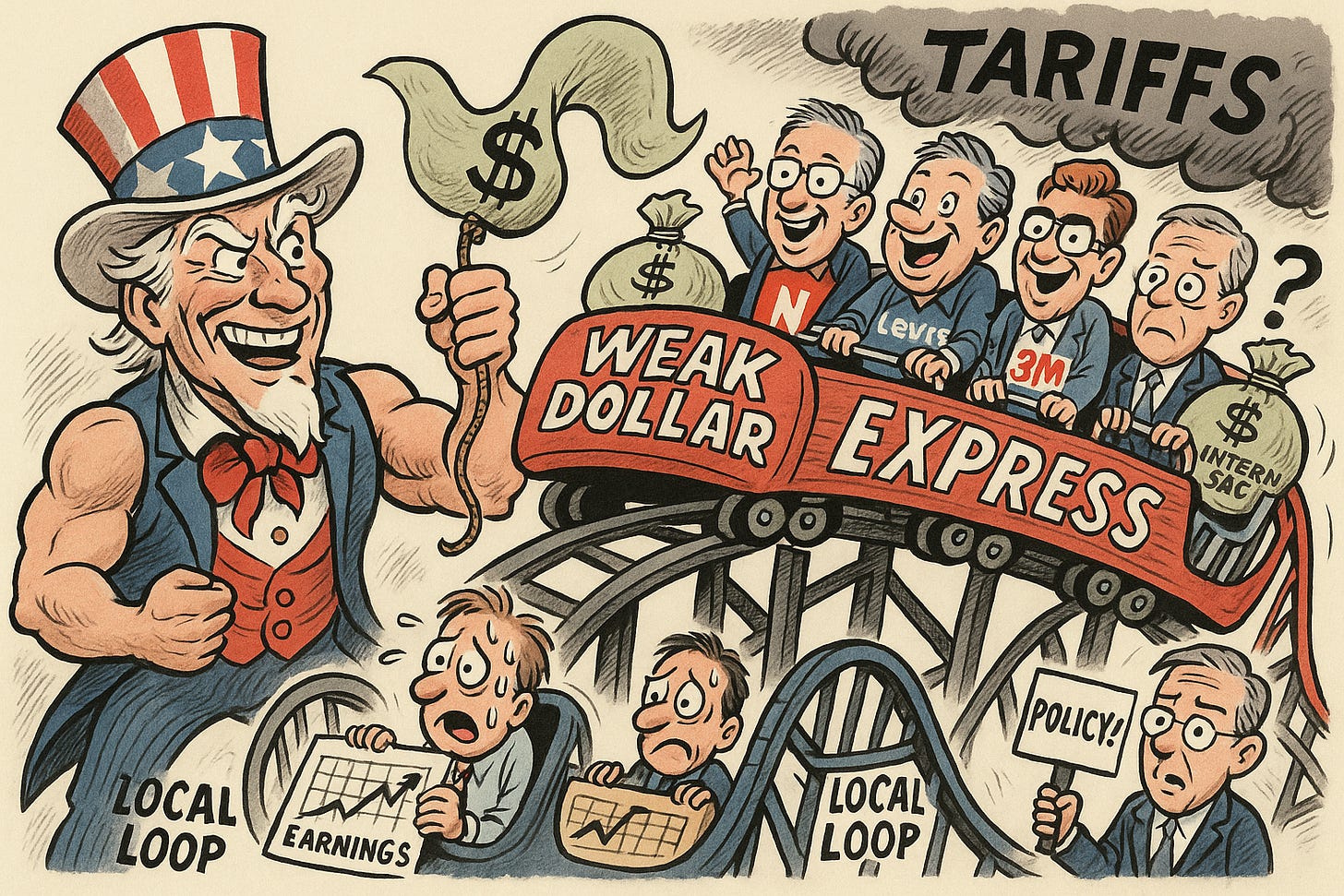

💵 Dollar Weakness Divides US Market as Multinationals Outperform

The US dollar’s sharp decline—down nearly 10% year-to-date, its worst first-half drop since 1973—has driven a pronounced divergence in equity market performance. Multinational firms and exporters are benefiting from favorable currency translation, while domestic-focused companies lag. Major beneficiaries include Netflix, PepsiCo, Levi Strauss, and 3M, which have reported earnings boosts tied largely to the weaker dollar. The information technology sector leads the way with 55% of revenue from overseas, trailed by materials and communication services at 52% and 49%, respectively—sectors now well-positioned to capture the tailwinds of currency softness (Investing.com, Finimize).

Still, analysts urge caution. Though S&P 500 companies derive about 41% of their revenue internationally, Goldman Sachs warns that markets often discount currency-driven earnings versus organic growth. Additionally, companies exposed to tariffs may see those gains diluted. Amid a government shutdown and Fed policy limbo, the focus is shifting to whether corporate earnings reflect genuine operational strength or currency distortion. This growing bifurcation presents both opportunity and risk for portfolio strategists weighing sector rotation and valuation durability (Reuters, Morgan Stanley).

Sensei’s Insight: Watch how international revenue exposure reshapes market leadership—currency tailwinds lift multinationals, but discerning real growth from FX sugar highs is now essential.

🛰️ Trump Greenlights Intelligence Sharing for Ukrainian Long-Range Strikes on Russian Energy

President Donald Trump has approved the transfer of U.S. intelligence to assist Ukraine in executing long-range missile strikes against Russian energy infrastructure, marking the first significant expansion of U.S. support since his return to office. The announcement coincided with a social media post in which Trump claimed Ukraine could retake all occupied territory with European support—signaling a notable rhetorical shift in Washington’s posture toward Kyiv. Ukrainian President Volodymyr Zelenskyy confirmed that during private meetings at the UN in September, he discussed Tomahawk cruise missiles with Trump, who was reportedly “amenable” to the request. The U.S. is also pressuring NATO allies to offer similar intelligence support, while considering direct provision of Tomahawk missiles capable of reaching targets up to 1,500 miles away (WSJ, Kyiv Independent, Euronews).

This intelligence-sharing initiative represents a calculated escalation designed to disrupt Russia’s critical energy sector and apply economic pressure that could force negotiations. Ukraine’s targeted campaign has already slashed Russian diesel and gasoline exports by 30%, contributing to severe fuel shortages in occupied areas. Enhanced U.S. intelligence could significantly amplify these disruptions to Russia’s $200+ billion energy export stream. However, defense stocks may face conflicting signals as Trump simultaneously entertains peace talks and deliberates on supplying advanced long-range weapons—introducing fresh uncertainty for contractors who have benefited from sustained aid flows since 2022 (Barron’s, Morningstar, Saxo).

Sensei’s Insight: Trump’s greenlight on battlefield intelligence sharing signals a pivotal inflection in U.S. strategic intent—merging diplomatic maneuvering with kinetic escalation. Investors should monitor defense sector volatility as messaging toggles between peace overtures and offensive enablement.

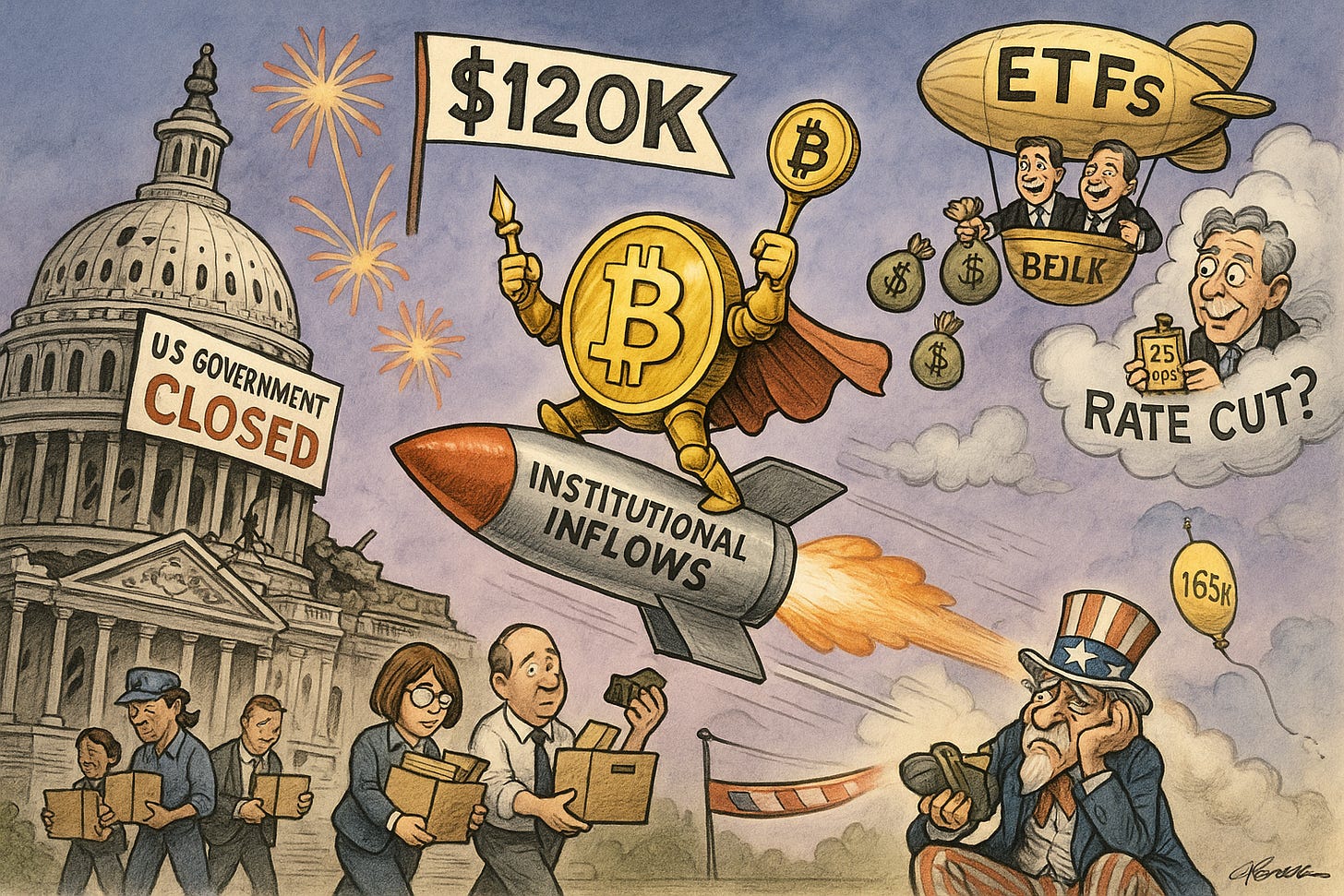

💰 Bitcoin Breaks $120,000 for First Time Since August Record High

Bitcoin surged past the $120,000 mark on October 2, 2025, its first return to this level since peaking at $124,457 in mid-August. The cryptocurrency briefly reached $121,000 during Thursday trading before stabilizing near $120,000—up 2% in the past 24 hours and nearly 10% on the week. The rally unfolded alongside the U.S. government shutdown, triggered when the Senate voted 55-45 against a stopgap funding bill on October 1, furloughing approximately 150,000 federal workers (Reuters, Yahoo Finance).

Institutional inflows into Bitcoin ETFs were a major catalyst, with $627 million entering the market over four days. BlackRock’s IBIT saw $466.55 million in a single day, followed by Fidelity’s FBTC at $89.62 million (Coinpedia). JPMorgan raised its year-end target to $165,000, noting Bitcoin’s undervaluation relative to gold and a declining volatility ratio below 2.0. As futures open interest hits a record $32.6 billion and October’s historical bullish trend continues, all eyes are now on the Federal Reserve, which could accelerate momentum with a 25 basis point rate cut later this month (CoinDesk).

Sensei’s Insight: Institutional appetite meets macro instability—Bitcoin’s breakout isn’t just technical; it’s philosophical. The “debasement trade” is officially mainstream.

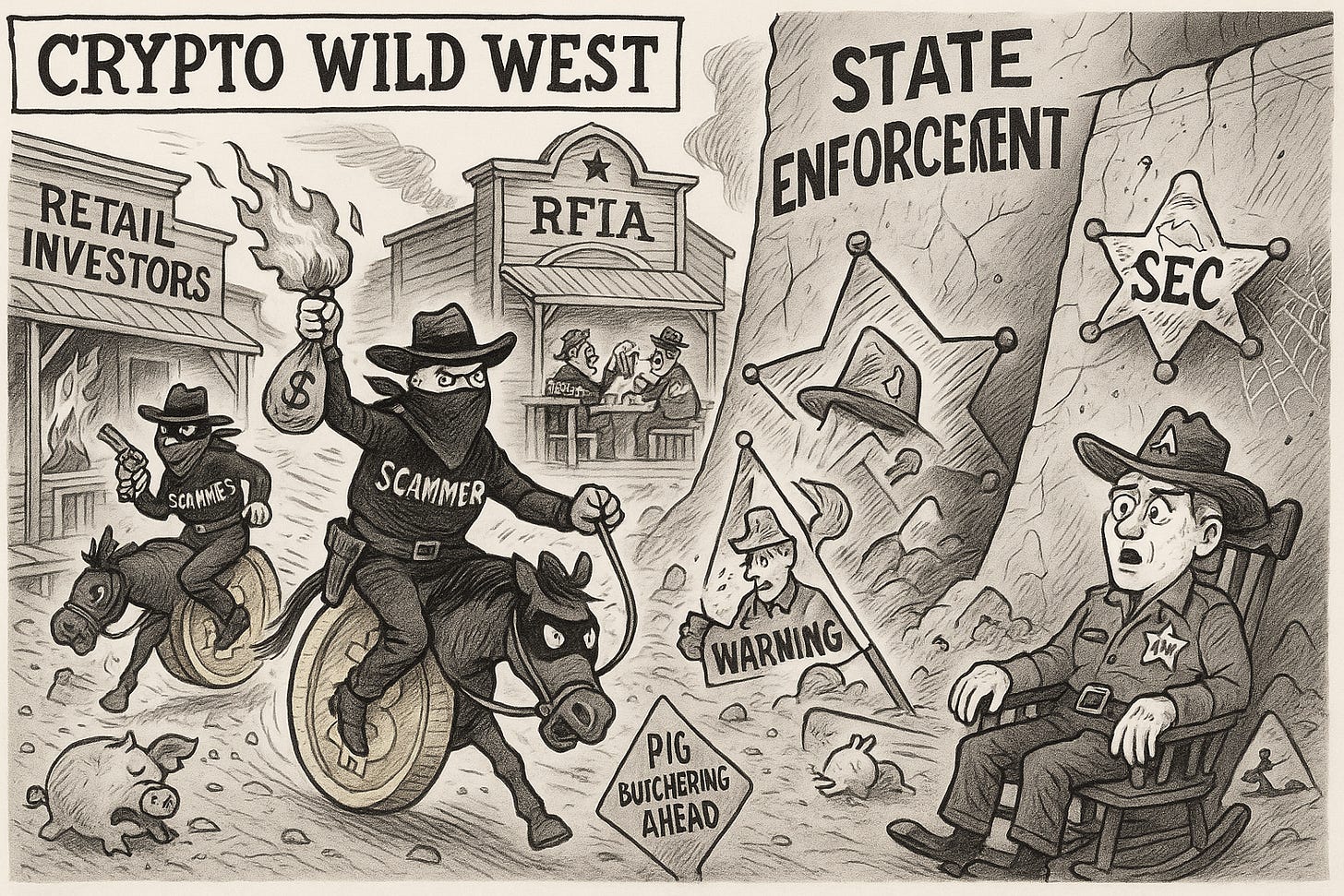

🚨 States Warn Crypto Bill Could Cripple Fraud Prosecutions

State securities regulators are raising red flags over the Responsible Financial Innovation Act (RFIA), a federal cryptocurrency bill currently before the U.S. Senate that could drastically reduce their ability to prosecute digital asset fraud. The proposed legislation includes language that, according to state authorities from Alabama to Montana, may remove their implicit authority to supervise crypto firms and take legal action against bad actors. A key concern is the bill’s redefinition of “investment contract,” which could create legal loopholes exploited by crypto scammers. Amanda Senn, director of the Alabama Securities Commission, warned that “the dam is going to break” without state-level enforcement. While the SEC has dramatically scaled back enforcement—filing just nine crypto-related actions through 2025, down from 47 in 2023—state regulators have remained active, launching over 330 enforcement cases since 2017, including 155 last year alone involving non-staking digital assets (Bloomberg, TAF).

This jurisdictional standoff comes at a critical time for retail investors, as crypto fraud losses have surged to $9.3 billion in 2024—a 66% increase over 2023. State regulators have historically been the front line against scams such as “pig butchering,” a trend that could worsen if their oversight is diminished. The North American Securities Administrators Association (NASAA) is now urging Congress to include clear language in federal crypto legislation that protects state enforcement power, backing a counterproposal known as the Support Anti-Fraud Enforcement Act. Advocates argue that without dual-layer oversight, retail investors may face heightened exposure just as digital asset prices near all-time highs, a period often exploited by fraudsters (Wealth Management, TRM Labs).

Sensei’s Insight: When the SEC retreats, state regulators fill the vacuum. Gutting their authority as crypto scams surge is like disarming firefighters during wildfire season.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive — Sensei’s Jobs Report

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.