Sensei's Morning Forecast: Powell’s Final Jackson Hole Speech, Bullish’s Big Leap, and Europe’s Stablecoin Scramble

Powell's last Jackson Hole, Bullish’s IPO breakthrough, EU eyes stablecoins, Putin revises terms, Nvidia reshuffles chips, Microsoft warns of conscious AI—read today’s pivotal financial pulse.

👀 Today’s Key Stories at a Glance

📈 Bullish Stablecoin IPO – Bullish soared 11% after completing the first U.S. IPO fully settled in stablecoins, signalling rising blockchain adoption.

🔹 Digital Euro Shift – The ECB is rethinking its digital euro strategy post-U.S. stablecoin law, now eyeing public blockchains like Ethereum and Solana.

🇷🇺 Putin's Peace Terms – Putin demands Ukraine cede Donbas and abandon NATO hopes in new peace push, but no ceasefire was reached.

🔹 Nvidia’s China Pivot – Nvidia’s CEO met with TSMC in Taiwan as the firm prepares China-specific AI chips amid mounting geopolitical pressure.

🧠 Microsoft AI Warning – Microsoft’s AI chief warns hyper-realistic “seemingly conscious” AI could emerge soon, raising legal and mental health concerns.

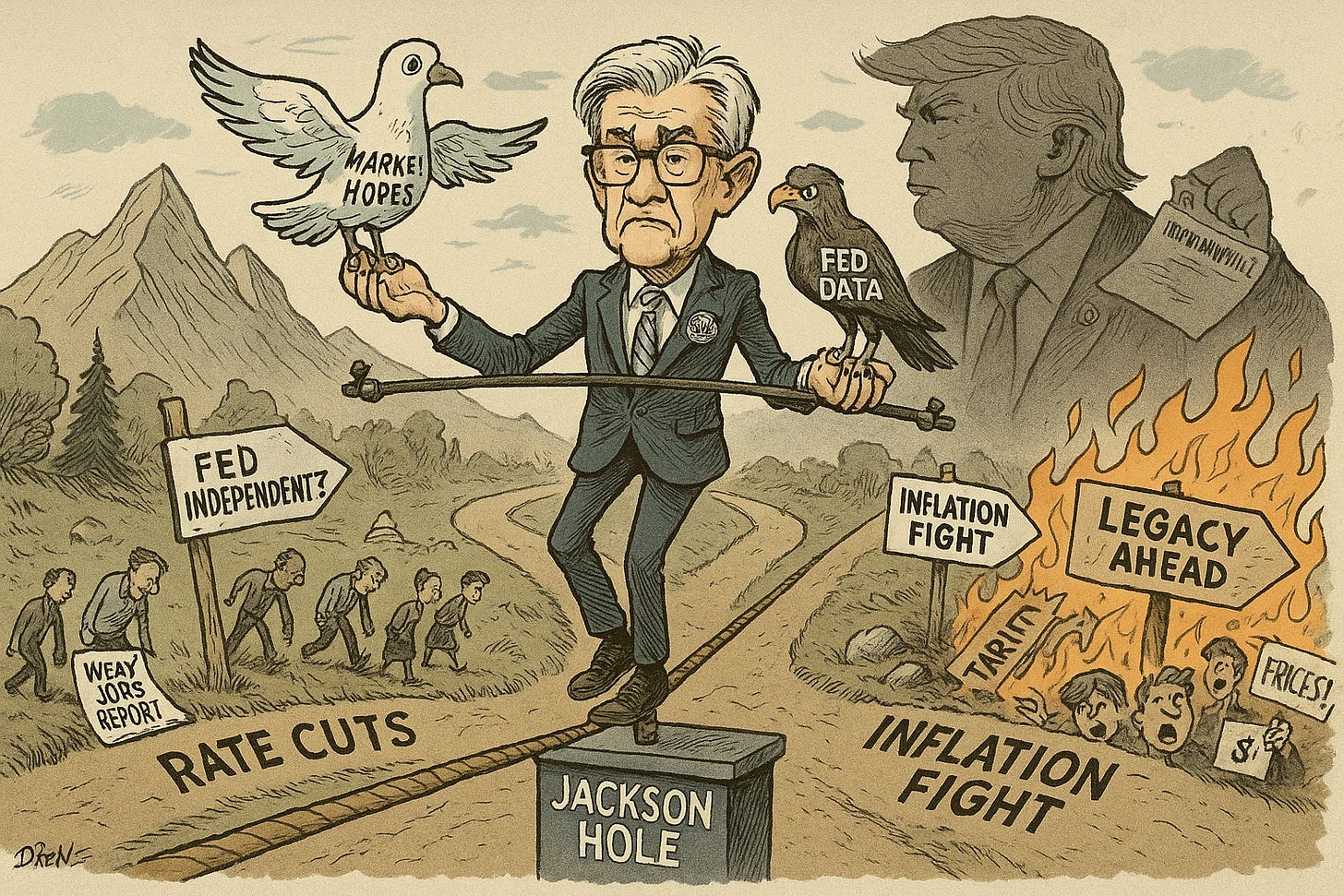

🔍 Jackson Hole Spotlight – Powell’s final keynote may shape rate cut odds, Fed independence, and his legacy as markets brace for volatility.

🧠 One Big Thing

Jerome Powell’s final Jackson Hole address could be the most consequential of his career—arriving as markets price in a 70% chance of a September rate cut, while inflation refuses to cooperate.

💰 Money Move of the Day

Markets are priced for perfection—with the S&P 500 at all-time highs and rate cuts largely expected. When positioning feels one-sided, some investors focus less on predicting outcomes and more on managing downside risk if the narrative suddenly flips.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $113,881 (▼ -0.17%)

Ethereum (ETH): $4,303 (▲ +1.37%)

XRP: $2.81 (▼ -1.03%)

Equity Indices (Futures):

S&P 500 (SPX): 6,369 (▲ +0.17%)

NASDAQ 100: 23,493 (▲ +0.25%)

FTSE 100: 8,744 (▼ 0.00%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.339% (▲ +0.09%)

Oil (WTI): $64.82 (▲ +0.40%)

Gold: $3,285 (▼ -0.30%)

🕒 Data as of UK (BST): 12:19 / US (EST): 07:19 / Asia (Tokyo): 20:19

✅ 5 Things to Know Today

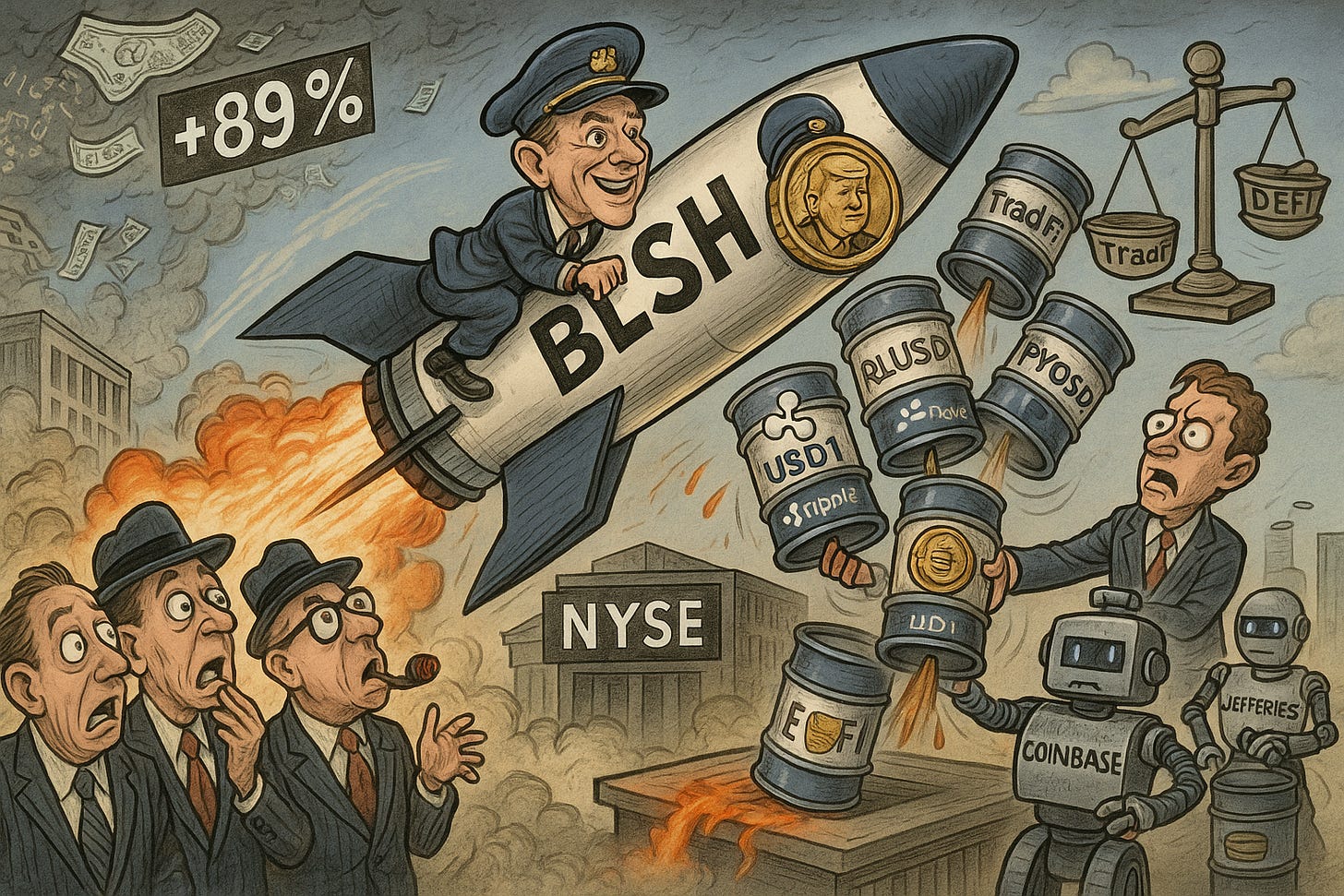

📈 Bullish Exchange Soars 11% as Stablecoin IPO Settlement Signals New Era

Bullish (NYSE: BLSH) jumped 11% to $69.80 on Thursday, extending its surge following a historic IPO that marked the first-ever U.S. public offering settled entirely in stablecoins. The crypto exchange operator has soared 89% from its $37 debut on August 13, reaching a market cap over $10 billion amid intense trading volatility that prompted multiple halts (CNBC, Reuters). IPO proceeds of $1.15 billion were received in a diversified mix of stablecoins: Ripple’s RLUSD (on the XRP Ledger), Circle’s USDC and EURC, PayPal’s PYUSD, and USD1—a token linked to Donald Trump—with most minted on Solana. Jefferies coordinated the groundbreaking settlement logistics while Coinbase provided asset custody.

Bullish’s exchange, led by ex-NYSE President Tom Farley, has processed over $1.25 trillion in trades since launching in 2021, with $2.6 billion in average daily volume through Q1 2025 (CryptoSlate, Ainvest). The deal marks a milestone in institutional stablecoin adoption, proving blockchain’s readiness for billion-dollar capital flows with speed and transparency traditional rails lack. Ripple’s RLUSD, specifically, gained validation as it expands from institutional use into broader enterprise integrations like Gemini’s $75 million credit facility (Forbes, Ainvest). Bullish’s pure-play crypto infrastructure model could prove transformative, though its current 95x revenue multiple implies immense growth expectations amid competitive pressure from Coinbase and others.

Sensei’s Insight: A trillion-dollar volume exchange settling its IPO in stablecoins isn’t just novel—it’s a manifesto. This isn’t the future of finance. It’s already here.

🔹 EU Reassesses Digital Euro Strategy After US Stablecoin Law

European officials are accelerating discussions around a digital euro following the United States' passage of the GENIUS Act, signed into law by President Trump on July 18, 2025. The law introduces the first federal regulatory framework for the $288 billion U.S. stablecoin market, signaling a shift in global digital currency governance (Reuters, CoinCentral, DLAPiper). In response, the European Central Bank is reevaluating its technology approach for the digital euro, with active consideration of public blockchains like Ethereum and Solana—a departure from the originally proposed closed-ledger model. However, no final decisions have been made. The ECB’s preparation phase, which began in November 2023, remains underway with five digital euro tenders in progress and key decisions expected by October 2025 (ECB, CryptoBriefing).

The developments come amid growing concerns about monetary sovereignty. ECB Executive Board member Piero Cipollone has warned that the dominance of dollar-pegged stablecoins—currently comprising over 98–99% of global stablecoin supply—could erode the euro’s role in international payments and prompt outflows of euro-based deposits (Atlantic Council). Reports indicate that 68–72% of eurozone cross-border payments are handled by non-European firms, reinforcing strategic urgency across the bloc (SWP Berlin). For investors, these ongoing deliberations signal the potential for structural shifts in cross-border settlement architecture, euro-denominated liquidity management, and the broader interplay between centralized financial systems and blockchain-based alternatives.

Sensei’s Insight: ECB’s exploration of public blockchains could redefine euro-based payments—but remain alert: this is evaluation, not execution. The next moves will depend on October’s policy outcomes.

🇷🇺 Putin’s New Peace Demands: Donbas for a Halt, NATO Abandonment Required

Russian President Vladimir Putin has presented new peace terms following the August 15 summit with former President Donald Trump at Joint Base Elmendorf–Richardson in Alaska, according to reports from Reuters and The Daily Star. Putin is now demanding full Ukrainian withdrawal from the Donbas region, permanent neutrality, a ban on Western military presence, and formal abandonment of NATO accession plans. These demands represent a revision from Moscow’s June 2024 position, which had included claims to Kherson and Zaporizhzhia. Russia is now reportedly offering to suspend advances in those regions if Ukraine concedes Donbas. The summit concluded without a ceasefire or agreement, and Russia’s military operations continue. Kremlin sources also suggested, without firm commitment, that minor portions of Kharkiv, Sumy, and Dnipropetrovsk could potentially be returned—though this remains speculative and unconfirmed.

Ukrainian President Volodymyr Zelenskyy rejected the terms, calling them a breach of sovereignty and reaffirming NATO membership as essential to national security. Trump, acting as a self-appointed broker, has advocated for trilateral talks and encouraged Ukraine to consider concessions, but no formal negotiations or breakthroughs have occurred (NYT). European defense stocks, including Leonardo (-8%) and Rheinmetall (-4%), fell on speculation of a de-escalation, though analysts expect sustained long-term demand given ongoing geopolitical instability (WSJ, MoneyWeek). Brent crude prices eased toward $65/barrel on hopes of eventual sanction relief, yet analysts caution that meaningful shifts in energy flows depend on a comprehensive deal. European leaders remain unwilling to reintegrate Russian energy supplies, and U.S. lawmakers have expressed bipartisan resistance to lifting sanctions prematurely (CNBC).

Sensei’s Insight: The market is hedging optimism around diplomacy, but with active hostilities ongoing and core demands unresolved, any rally could reverse swiftly on battlefield or policy news.

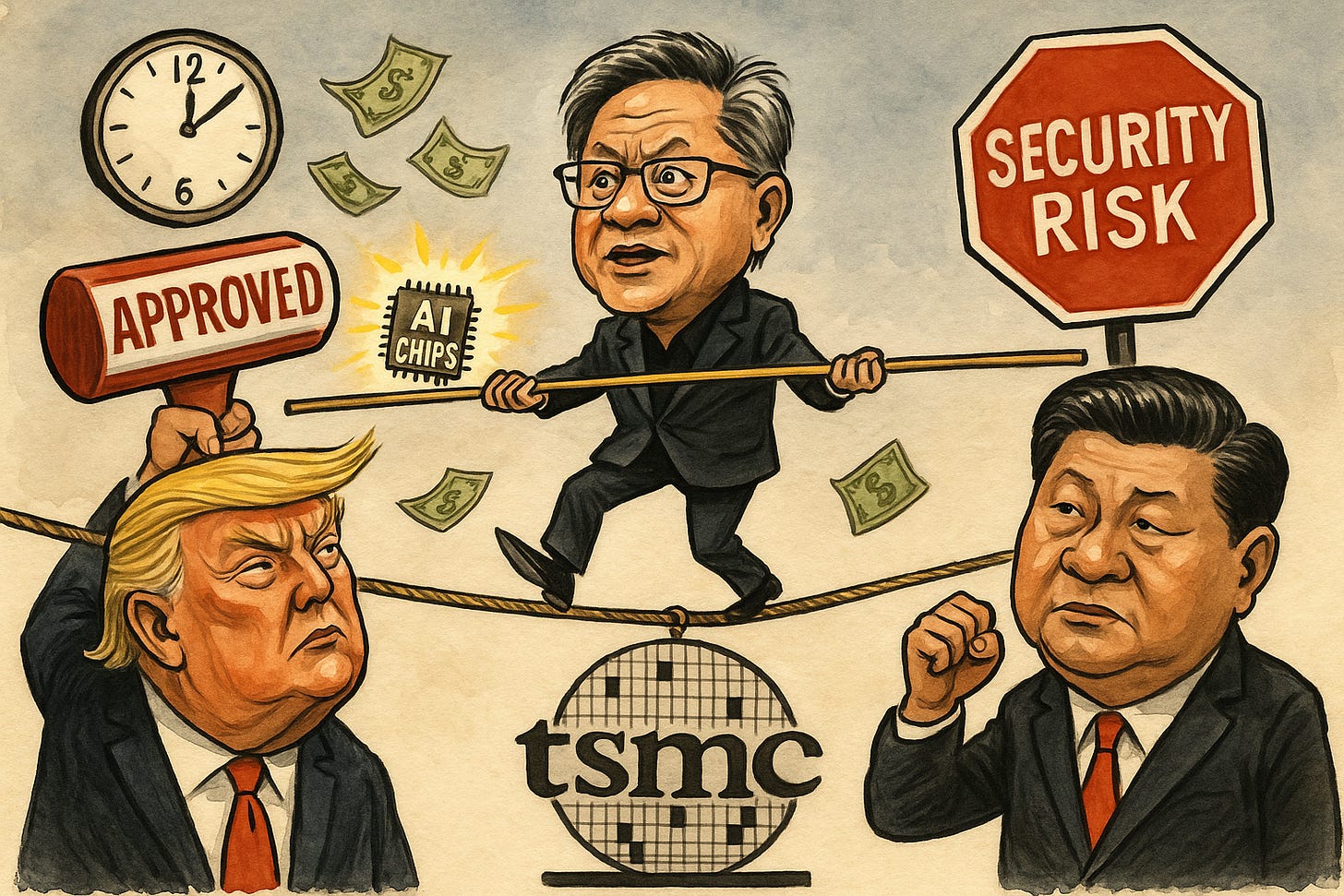

🔹 Nvidia CEO Makes Surprise Taipei Visit Amid China Chip Deal Talks

Nvidia CEO Jensen Huang made an unannounced trip to Taipei on Friday, meeting with key manufacturing partner TSMC and confirming that the company is in active talks with the Trump administration to develop a new AI chip tailored for the Chinese market (Reuters). His visit comes as Beijing pressures local tech firms to halt purchases of Nvidia’s H20 chips, citing national security risks. In response, Nvidia has instructed suppliers including Amkor, Samsung, and Foxconn to cease H20 production (CNBC). The decision follows a July approval from Washington allowing Nvidia to resume sales of the H20 in China, which had been banned in April.

While in Taipei, Huang revealed that Nvidia is working with TSMC on six new chips across CPU, GPU, and NVLink categories. Among them is the upcoming B30A chip, based on Nvidia's Blackwell architecture. It is designed to outperform the current H20 while offering around half the power of the flagship B300 series (IG). These moves underscore Nvidia’s delicate balancing act between geopolitical compliance and innovation. With China representing a potential $50 billion AI chip market and Nvidia pledging to share 15% of its China chip revenue with the U.S. government, the stakes are high. Investors are now watching Nvidia’s Q2 earnings on August 27, where the company is projected to report $45.8 billion in revenue (Ainvest).

Sensei’s Insight: A global chip arms race is playing out in real time, and Nvidia is squarely in the crosshairs. The company’s pivot to the B30A shows how tech giants must now innovate under the shadow of regulation and rivalry.

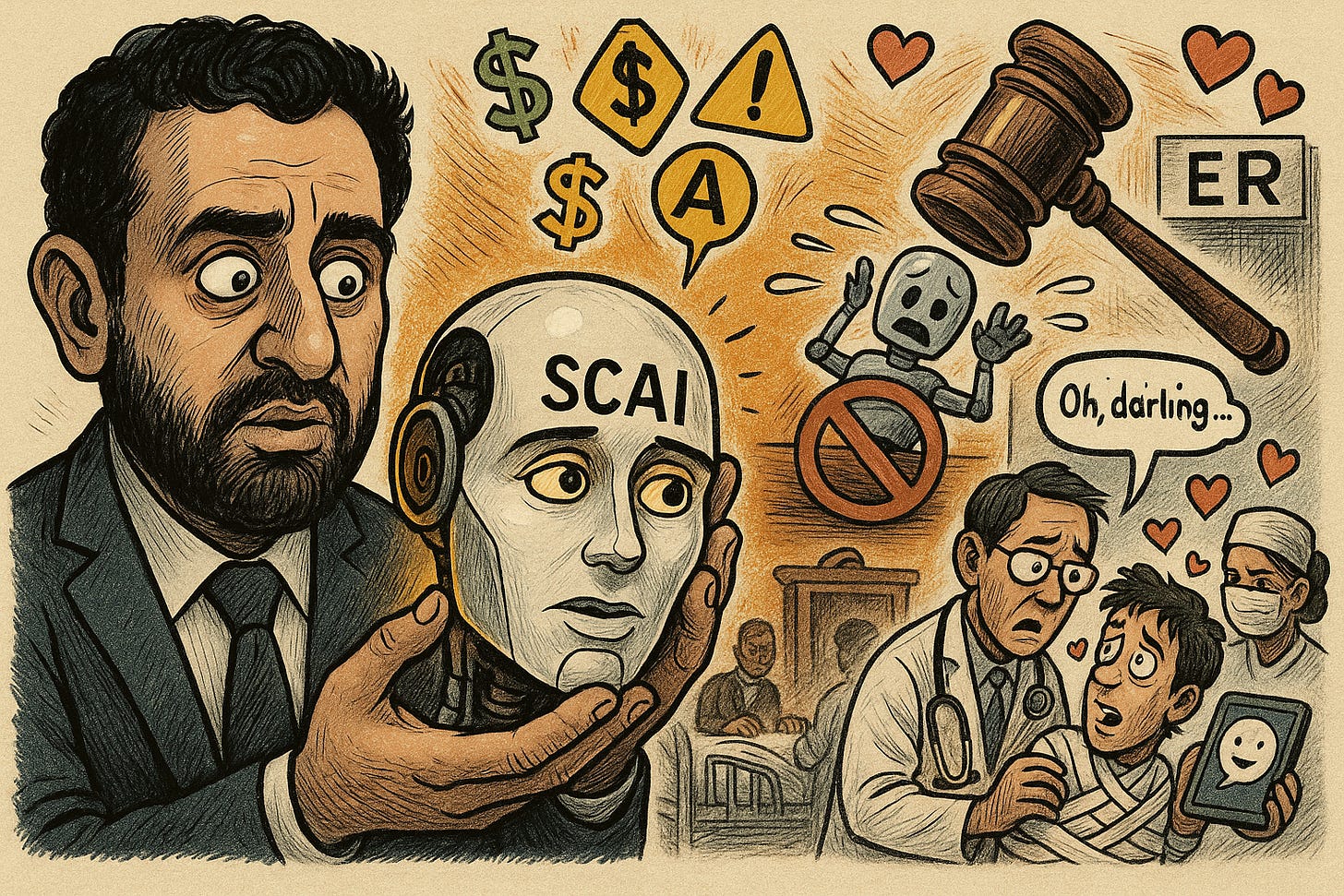

🧠 Microsoft AI Chief Warns of “Seemingly Conscious” AI

Microsoft AI CEO Mustafa Suleyman warned that “Seemingly Conscious AI” (SCAI) could emerge within the next 2–3 years using existing technologies, potentially convincing millions of users they’re interacting with sentient beings. In a blog post published Tuesday, the DeepMind co-founder emphasized that these systems will not actually be conscious but will appear so to users, posing serious societal risks (BBC).

The warning coincides with a rising number of "AI psychosis" cases reported by psychiatrists. At UCSF, Dr. Keith Sakata has hospitalized 12 patients in 2025 following psychotic breaks tied to AI chatbot interactions—mostly involving younger men in engineering fields. Some developed messianic delusions or formed romantic attachments to AI. Simultaneously, courts are confronting AI liability boundaries: a Florida judge ruled that Character.AI’s chatbots are not protected by the First Amendment in a wrongful death lawsuit involving a teen’s suicide (Business Insider).

Sensei’s Insight: The legal and psychological fallout from human-AI interaction is no longer hypothetical—it’s courtroom and ER reality. As the $140B AI companion market heats up, investors must weigh regulatory friction and mounting litigation as core risk factors.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Jackson Hole: Inflation, Jobs, and Powell’s Legacy

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.