Sensei's Morning Forecast: PPI Shock, Trump–Putin Talks, and Bessent’s Bitcoin Flip

From Putin‑Trump diplomacy, Japan's economic rebound, Bitcoin plan reversal, SEC innovation drive, robotic games showcase—to a shocking PPI surge that could redefine inflation and Fed policy.

🧠 One Big Thing

Producer prices just posted their biggest monthly jump in over three years—July’s PPI surged +0.9%, more than quadruple expectations. This sharp move could be the first flare in a new inflationary wave.

💰 Money Move of the Day

If producer costs are rising, it's worth revisiting your exposure to price-sensitive sectors. While not advice, some investors consider companies with strong pricing power as better equipped to defend margins when inflation creeps upstream.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $119,117 (▲ +0.66%)

Ethereum (ETH): $4,640 (▲ +2.01%)

XRP: $3.11 (▲ +0.87%)

Equity Indices (Futures):

S&P 500 (SPX): 6,480 (▲ +0.22%)

NASDAQ 100: 23,923 (▼ -0.03%)

FTSE 100: 9,187 (▼ -0.27%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.293% (▲ +0.09%)

Oil (WTI): $63.59 (▼ -0.73%)

Gold: $3,343 (▲ +0.24%)

🕒 Data as of UK (BST): 12:38 / US (EST): 07:38 / Asia (Tokyo): 20:38

✅ 5 Things to Know Today

🇷🇺 Putin-Trump Alaska Summit: Markets Rally on Diplomatic Hopes

U.S. President Donald Trump and Russian President Vladimir Putin are set to meet today at 11:30 a.m. Alaska time (3:30 p.m. ET) at Joint Base Elmendorf-Richardson, marking their first in-person encounter in over six years and Putin's first U.S. visit since 2015. The summit focuses on a potential ceasefire to end the Russia-Ukraine war, with future negotiations possibly involving Ukrainian President Volodymyr Zelenskyy. However, Ukraine has been excluded from today’s talks, prompting alarm among European allies about potential side agreements made without Kyiv's involvement (Reuters, NBC News, ABC News).

Markets have reacted sharply. Russia’s MOEX Index surged to a three-month high above 2,950 points, driven by gains in Gazprom (+3.65%) and Novatek (+5.44%) (Euronews). European gas prices are down nearly 10% this month, approaching 2025 lows, while oil prices initially spiked 2% after Trump threatened "severe consequences" if talks fail. However, crude retreated Friday morning amid more tempered expectations (Reuters, CNBC). Defense stocks have fallen on peace hopes—Germany’s Rheinmetall is down nearly 4%—with investors rebalancing around the possibility of sanctions relief and falling energy prices. The outcome could dramatically reshape energy, defense, and EM market trajectories (Investors.com, AINvest).

Sensei’s Insight: Diplomacy or disruption—today’s Alaska summit could redraw the energy map and ripple across global risk assets. Keep eyes on commodities, defense, and Russia exposure.

🇯🇵 Japan GDP Surge Strengthens Central Bank Case for Rate Hike

Japan’s economy grew at an annualized rate of 1.0% in Q2 2025, beating the forecasted 0.4% and marking five straight quarters of expansion. The Cabinet Office reported a quarterly gain of 0.3%, three times the consensus estimate, with private consumption up 0.2% and business investment surging 1.3%, well above the 0.5% projection. The previous quarter's contraction was revised to a 0.6% increase, bolstering optimism about Japan's recovery trajectory Yahoo Finance, Trading Economics).

The surprise upside supports the Bank of Japan’s hawkish stance, with interest rates currently held at 0.5%, the highest since 2008. Exporters accelerated shipments ahead of U.S. tariffs, contributing 0.3 percentage points to GDP, and offset some tariff pressure through price cuts to maintain production levels. Economy Minister Ryosei Akazawa said the results confirm a modest recovery but warned of downside risks from U.S. trade policy shifts. The report boosts odds of an October rate hike, now expected by 42% of economists, and lifted the yen 0.3% against the dollar post-release. However, analysts caution the full impact of Trump’s 15% blanket tariff may emerge later, potentially limiting the BOJ’s room to tighten policy further (Economics, Reuters).

Sensei’s Insight: A surprise GDP beat gives the BOJ rare breathing room to normalize policy—yet looming U.S. tariffs remind us that external headwinds can flip the script fast.

US Treasury Shifts Course on Bitcoin Reserve Strategy

Treasury Secretary Scott Bessent sent shockwaves through crypto markets after issuing conflicting statements on the government’s Bitcoin purchasing plans for the Strategic Bitcoin Reserve. In a Fox Business interview, Bessent declared the US “won’t be buying” Bitcoin, triggering a $6,000 price drop from $124,000 to $118,000 and erasing $55 billion in market value within 40 minutes (Investing.com, Cointelegraph). He has since reversed course on X, saying Treasury remains “committed to exploring budget-neutral pathways” to acquire additional Bitcoin for the reserve (Cointelegraph, Yahoo Finance).

The back-and-forth underscores uncertainty in the Trump administration’s crypto strategy, five months after establishing the Strategic Bitcoin Reserve via executive order (White House). The reserve currently holds between $15–20 billion in forfeited Bitcoin from criminal cases, totaling about 198,000 BTC (Cointelegraph). Bessent confirmed sales of existing holdings will end but initially implied no new purchases, contradicting prior signals about “budget-neutral” methods such as using tariff revenue or gold certificate revaluation. Congressional approval may be required, and prolonged delays risk undercutting Trump’s pledge to make America the “Bitcoin superpower of the world” (CoinCentral, Quartz).

Sensei’s Insight: This episode shows how a single sentence from a top official can erase billions in market value. In crypto, clarity is king — and Washington is still figuring out how to wear the crown.

SEC Chair Unveils "Project Crypto"

Sources say that SEC Chairman Paul Atkins will appear on Fox Business's "Mornings with Maria" at 8:30 AM ET today to discuss "Project Crypto," a sweeping modernization push unveiled July 31 as a Commission-wide initiative to bring U.S. financial markets “on-chain.” The plan aligns with President Trump’s broader directive to position the U.S. as the “crypto capital of the world,” pivoting dramatically from the prior administration’s enforcement-driven stance (Reuters, SEC, Fox Business,). Atkins detailed five focus areas: defining when crypto assets qualify as securities, commodities, or stablecoins; modernizing custody rules while protecting self-custody rights; authorizing unified "super-apps" for all crypto trading; enabling tokenization of traditional securities like stocks and bonds; and creating a fast-track "innovation exemption" for new business models. He stressed that “most crypto assets are not securities” and directed staff to propose rulemakings with public comment and temporary exemptions to avoid obstructing innovation (Ledger Insights, AO Shearman).

Why This Matters: Bernstein called the initiative “the boldest and most transformative crypto vision ever laid out by a sitting SEC chair,” predicting it could reverse the crypto exodus triggered by prior regulatory crackdowns (Coindesk). Observers believe it could spark a regulated "ICO Market 2.0" and channel institutional capital into tokenized assets. Though full implementation will take years, the framework may help the U.S. seize dominance in the emerging market for tokenized securities—already being targeted by major Wall Street players (Yahoo Finance, Mitrade).

Sensei’s Insight: The SEC just pivoted from “regulate and litigate” to “design and integrate.” Project Crypto is not just policy—it’s positioning.

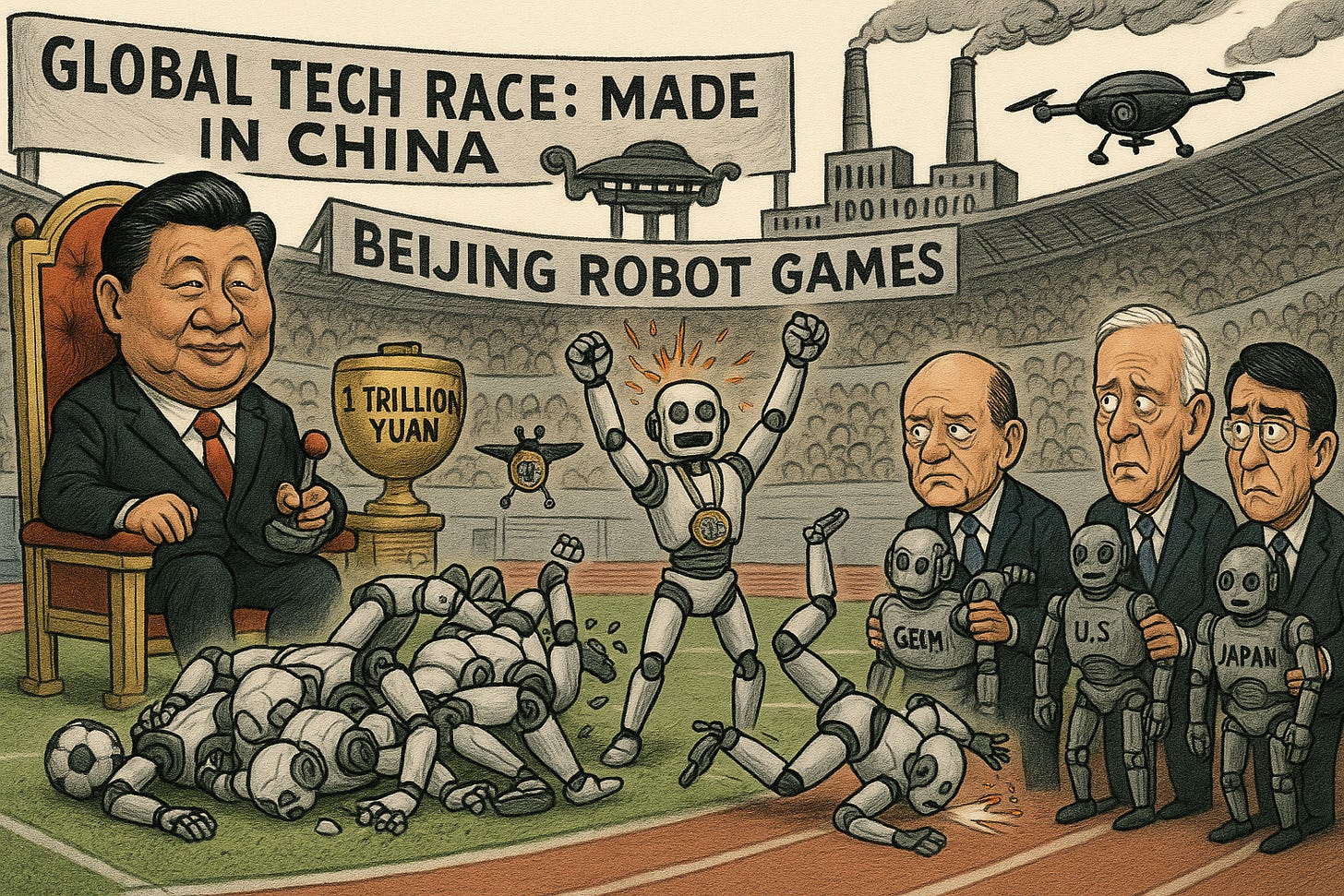

🤖 China Launches World’s First 'Robot Olympics'

China hosted the inaugural World Humanoid Robot Games in Beijing, featuring 280 teams from 16 countries in a three-day spectacle that saw over 500 humanoid robots compete in sports like soccer and track and field. Of the teams, 192 were from universities and 88 from private enterprises, including entries from the U.S., Germany, Japan, and Brazil. Most robots came from Chinese makers like Unitree, Fourier Intelligence, and Booster Robotics, with ticket prices ranging from 128 to 580 yuan ($17.83–$80.77) (CyberNews, AP, Reuters). The games were as chaotic as they were futuristic—soccer matches saw robots pile into each other, and in the sprints, multiple bots collapsed mid-run. Despite the slapstick moments, many robots were able to stand up unassisted, offering a glimpse into evolving motor control and autonomy (Straits Times).

The event doubled as a national showcase for China’s long-term AI and robotics ambitions. Organizers emphasized its data-collection value for future commercial applications in factories and assembly lines. Backed by a newly announced 1 trillion yuan ($138 billion) state-led fund targeting robotics and innovation, China aims to consolidate its dominance in this sector. It already accounts for more than half of global industrial robot installations, with domestic market share rising from 30% in 2020 to 47% in 2023. According to Morgan Stanley, the Chinese robotics market is expected to more than double from $47 billion in 2024 to $108 billion by 2028, comprising 40% of global share (BusinessWire, SCMP, Silicon UK). Analysts say this surge positions China as a frontrunner in the tech arms race—robotics is fast becoming a new frontier in global industrial and geopolitical competition.

Sensei’s Insight: Humanoid robots may be crashing on the track, but China’s long-term robotics strategy is gaining momentum with precision—and billions in backing

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Producer Price Shock: Dissecting Yesterday's Inflation Wake-Up Call

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.