Sensei’s Morning Forecast: Recession Watch Heats Up: UK Jobs Slide, U.S. Shutdown Drags, and China Targets America

JPMorgan launches its blockchain deposit token, Beijing accuses Washington of a $13B Bitcoin hack, Labour infighting deepens, UK unemployment hits 5%, and markets brace for a soft-landing test as the

👀 Today’s Stories at a Glance

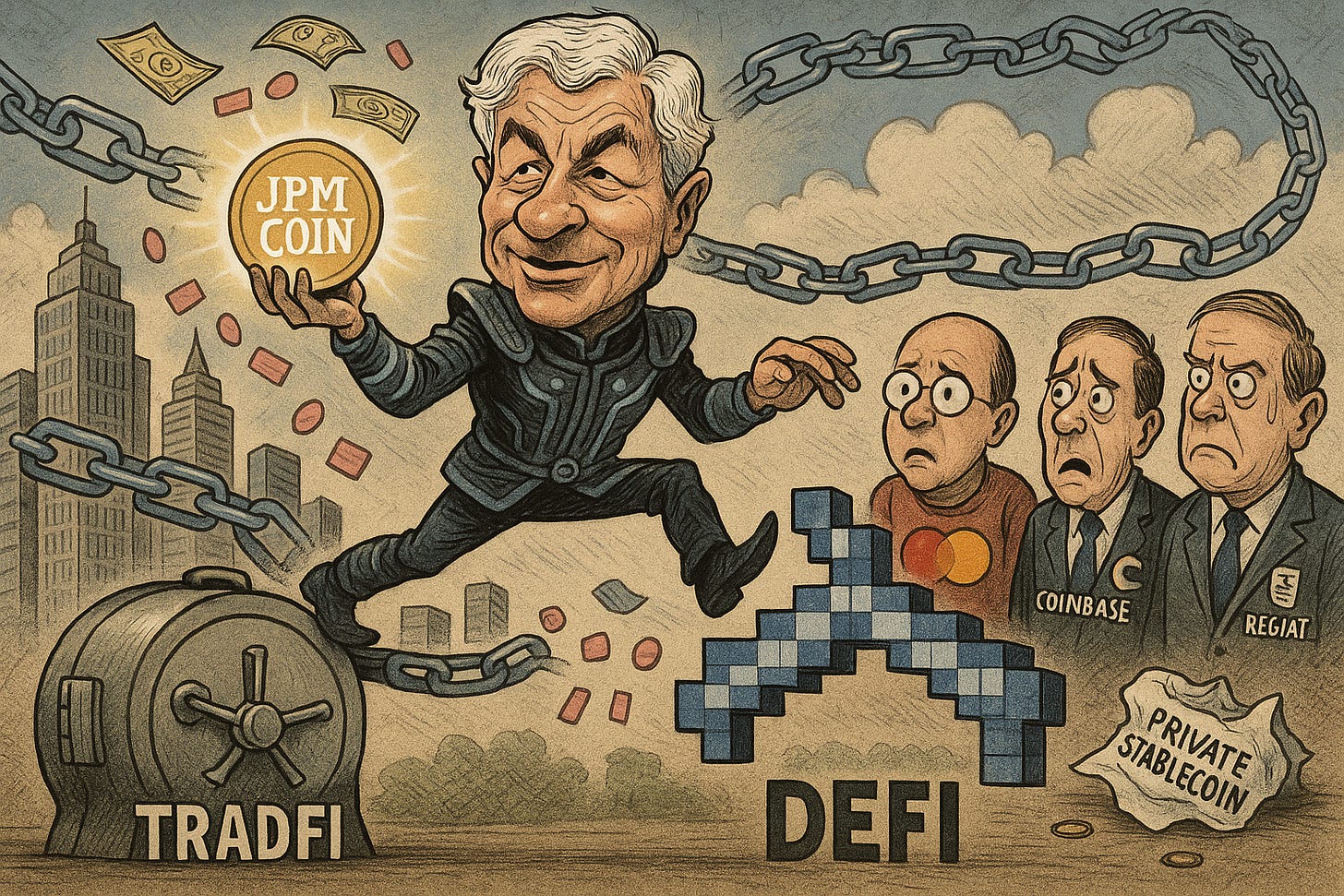

🏦 JPMorgan’s Deposit Token Launch

JPMorgan unveils blockchain-based JPM Coin (JPMD) for institutions, enabling instant on-chain settlements and expanding tokenized banking infrastructure.🧨 China vs U.S. Bitcoin Clash

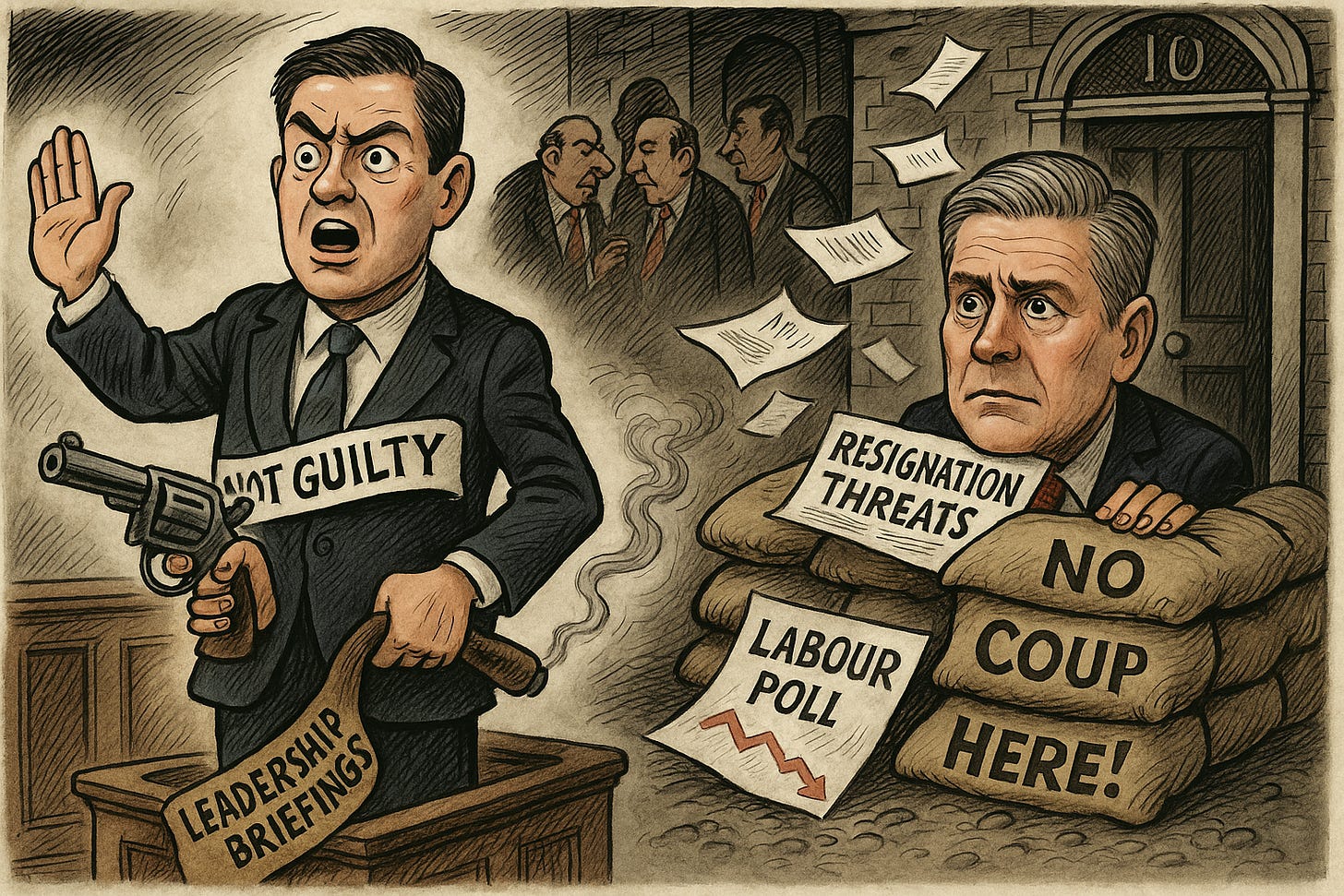

Beijing accuses Washington of stealing 127,000 BTC in a $13 billion hack; the U.S. insists it was a legal DOJ seizure.🇬🇧 Labour Party in Turmoil

Health Secretary Wes Streeting denies coup rumours as Labour infighting erupts, polls collapse, and Starmer’s leadership weakens.📉 UK Jobless Rate Hits 5%

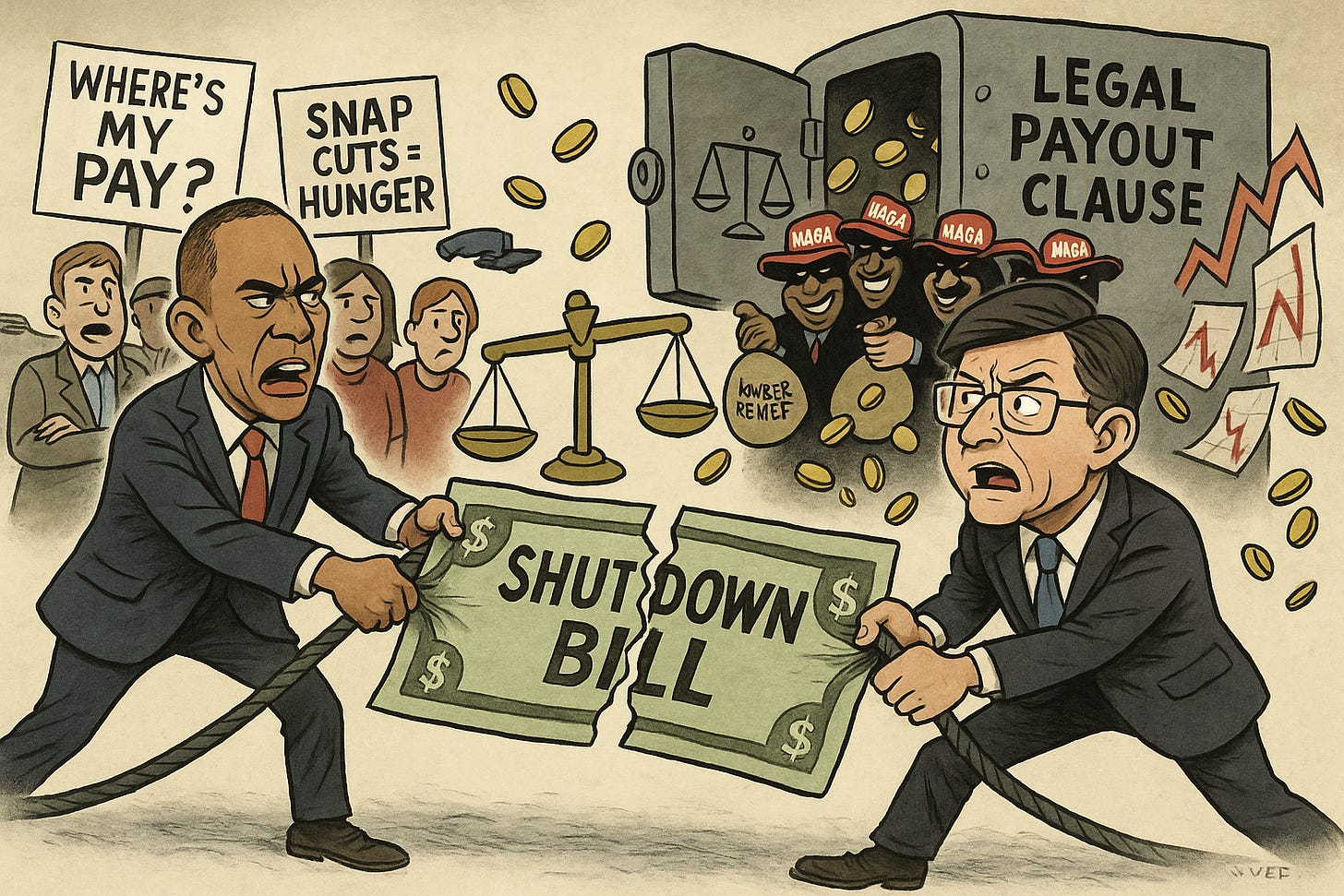

Unemployment reaches 5%, the highest since 2021, pushing traders to expect a December Bank of England rate cut.🇺🇸 Shutdown Endgame Nears

The 43-day U.S. shutdown nears resolution, but disputes over healthcare cuts and GOP “payout” clauses threaten the fragile deal.🔍 Recession Watch: Cooling, Not Crashing

Global growth is slowing but not collapsing—labour softens, inflation lingers, yet data still supports a soft-landing scenario.

🧠 One Big Thing

The data shows a world economy slowing, not collapsing — unemployment rising, inflation sticky, and credit tightening. Yet GDP remains positive and liquidity is improving, suggesting a soft landing is still possible. It’s a delicate balance: too much tightening risks a downturn, but too little could reignite inflation.

💰 Money Move of the Day

In recessionary environments, patience and positioning matter more than timing. History shows that early-rate-cut periods are often strong entry points for quality stocks, index funds, and hard assets. If the slowdown deepens, think long-term accumulation — volatility may be painful, but it’s when future returns are born.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $104,824 (▲ +1.73%)

Ethereum (ETH): $3,529 (▲ +3.30%)

XRP: $2.42 (▲ +1.37%)

Equity Indices (Futures):

S&P 500 (SPX): 6,868 (▲ +0.29%)

NASDAQ 100: 25,803 (▲ +0.63%)

FTSE 100: 9,898 (▼ -0.11%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.087% (▼ -0.80%)

Oil (WTI): $60.54 (▼ -0.97%)

Gold: $4,125.89 (▼ -0.02%)

Silver: $51.79 (▲ +1.16%)

🕒 Data as of UK (BST): 10:44 / US (EST): 05:44 / Asia (Tokyo): 19:44

✅ 5 Things to Know Today

🏦 JPMorgan Launches Deposit Token “JPM Coin” in Digital Asset Push

JPMorgan Chase & Co has begun rolling out a blockchain-based deposit token called JPM Coin (ticker JPMD) for institutional clients, marking a major step in the bank’s digital asset strategy (Bloomberg). The token represents dollar deposits held at JPMorgan and allows users to transfer funds via Coinbase’s Base network, enabling near-instant, 24/7 settlement instead of multi-day banking cycles. The pilot, conducted with Mastercard, Coinbase, and B2C2, has now entered its production phase. JPMorgan’s blockchain arm Kinexys plans to expand JPM Coin to other blockchains and currencies—such as a euro-denominated token (JPME)—pending regulatory approval. Unlike stablecoins, which are backed by reserves and rarely pay holders yield, deposit tokens reflect actual bank balances and can be interest-bearing, providing a regulated on-chain alternative for large institutions seeking liquidity and settlement efficiency (CoinDesk).

For investors, the launch extends JPMorgan’s push into tokenized finance and signals how traditional banks are adapting to blockchain payment infrastructure without ceding ground to private stablecoins. JPMorgan’s Kinexys network already processes more than $3 billion in transactions daily, and the deposit token could broaden that capacity by bridging regulated deposits with public blockchains. Peers including BNY Mellon and HSBC are exploring similar initiatives as regulators formalize frameworks for stablecoin and deposit-token issuance under the new Genius Act in the U.S. If successful, bank-issued tokens may reshape cross-border payments, collateral management, and interbank liquidity flows across digital asset rails (Finance Magnates).

Sensei’s Insight: Institutional tokenization is entering the mainstream. JPMorgan’s JPMD bridges TradFi and DeFi, and its success could set a template for how banks monetize deposits on public blockchains.

🧨 China Accuses U.S. of Orchestrating $13 Billion Bitcoin Hack

China’s top cybersecurity agency has accused the United States government of orchestrating the 2020 theft of 127,272 Bitcoin—now worth over $13 billion—from the LuBian mining pool, calling it a “state-level hacker operation” rather than a criminal act (Bloomberg). The allegation from China’s National Computer Virus Emergency Response Center (CVERC) claims the funds stolen in December 2020 remained dormant for nearly four years before being transferred in mid-2024 to wallet addresses later identified by Arkham Intelligence as controlled by the U.S. government. Beijing argues that this long dormancy and coordinated movement suggest official involvement rather than ordinary criminal behavior. The CVERC’s “black-eats-black” theory accuses Washington of hacking the stolen Bitcoin under cover of law enforcement operations—an extraordinary claim in the ongoing escalation of U.S.–China cyber-espionage disputes (The Cyber Express).

U.S. officials reject the accusation, stating that the Bitcoin was legally seized by the Department of Justice as part of a money-laundering and forced-labor investigation into Cambodian tycoon Chen Zhi and his Prince Group, operators of Asia-wide “pig-butchering” scams (Reuters). The DOJ filed a civil forfeiture complaint in October 2025, describing the 127,271 BTC as criminal proceeds, not U.S.-stolen assets. Blockchain forensics by Chainalysis, Elliptic, and Arkham confirm the coins’ origin in the LuBian hack but cannot identify who exploited the mining pool’s weak private-key system. The result is a geopolitical standoff: Beijing calls it cyber-theft, Washington calls it law enforcement, and roughly 0.6% of all Bitcoin supply now sits in U.S. government custody pending forfeiture proceedings (Chainalysis).

Sensei’s Insight: This case fuses cyber-espionage and crypto enforcement. The U.S. now controls $13 billion in Bitcoin—proof that blockchain assets are fast becoming instruments of geopolitical power.

🇬🇧 “No Coup Here”: Streeting Fires Back as Starmer’s Labour Melts Down

Health Secretary Wes Streeting has forcefully denied claims that he’s plotting to oust Prime Minister Keir Starmer, after a dramatic overnight briefing war from within Downing Street accused him of rallying up to 50 Labour frontbenchers to resign if Chancellor Rachel Reeves’s November 26 budget “lands badly.” The leaks—intended to suppress rumours—had the opposite effect, igniting a political crisis that’s laid bare the dysfunction inside Starmer’s government. Streeting called the allegations “categorically untrue” and ridiculed them on Sky News, joking: “Nor did I shoot JFK. I don’t know where Lord Lucan is… and I think the moon landings really happened” (Sky News; ITV News). His legal team has since issued a formal rebuttal, branding the reports “false and defamatory.”

Senior ministers have condemned Number 10’s handling of the situation, describing Downing Street as being in “bunker mode” and accusing it of “turning on its own.” The backlash comes amid a collapse in Labour’s polling, now trailing Reform UK at 33% and the Conservatives at 28%, with Starmer’s approval at –45% (Opinium). Insiders warn that Streeting’s humiliation has unified Cabinet dissent and exposed a deeper leadership vacuum ahead of a budget that could break Labour’s tax promises. The Prime Minister’s team insists Starmer remains secure, but the episode has revived Westminster’s perennial question: not if Labour will replace him—but when (Bloomberg).

Sensei’s Insight: Streeting’s rebuttal landed—but so did the damage. The infighting now defines Labour’s brand, and with the budget looming, Starmer’s authority may already be past the point of rescue.

📉 UK Unemployment Hits 5% — Markets Now See December BOE Rate Cut as Inevitable

The UK labour market has weakened sharply, with unemployment rising to 5.0% in the three months through September—the highest level since early 2021—according to the Office for National Statistics (ONS). The figures revealed a loss of 32,000 payroll jobs for the second consecutive month and a jump in redundancies to 4.5 per thousand workers, up from 3.6 a year earlier. Average regular pay growth eased to 4.6%, signalling cooling wage pressures as job vacancies fall across most sectors. Markets reacted immediately: two-year gilt yields dropped seven basis points, and traders lifted the probability of a December 18 Bank of England rate cut to more than 80%, up from 35% before the release (Bloomberg). The data reinforced concerns that the economy is stalling ahead of Chancellor Rachel Reeves’s November 26 budget, with household confidence low and savings ratios elevated.

For the Bank of England, which narrowly voted 5–4 to hold rates at 4% last week, the labour data shifts the calculus decisively. Policymakers such as Megan Greene and Huw Pill—who had already favoured a cut—are now backed by market consensus that monetary conditions are overly restrictive as unemployment climbs and inflation expectations stabilise. The rise above the psychologically important 5% threshold has historically coincided with the start of rate-cutting cycles, suggesting the first reduction to 3.75% could come as soon as next month (ITV News). With growth faltering and political instability deepening in Westminster, investors are betting the BOE will move to pre-empt a recession rather than risk tightening into a downturn.

Sensei’s Insight: Joblessness has become the BOE’s tipping point. With unemployment now flashing red at 5%, the debate isn’t if rates fall in December—it’s how fast the easing cycle begins.

🇺🇸 Record U.S. Shutdown Nears Endgame — But Healthcare Fight and GOP “Payout Clause” Threaten Final Deal

After 43 days of federal paralysis, the longest government shutdown in U.S. history is inching toward resolution—but not yet over. The Senate approved a bipartisan funding bill (60–40) late Sunday, and the House is scheduled to vote Today, a move that would finally reopen agencies shuttered since October 1 (CBS News). The package would restore pay to 1.4 million federal workers, restart SNAP benefits for 42 million low-income Americans, and resume flight operations after weeks of delays and cancellations. But the deal has triggered outrage across the political spectrum. Progressives accuse party leaders of capitulating on healthcare—after the bill dropped Democratic demands to extend Affordable Care Act premium subsidies—while Republicans face backlash for a new $500,000 legal payout clause benefitting eight GOP senators tied to the January 6 probe (CNN; Bloomberg Law).

Until the House passes the bill, the shutdown continues to exact heavy costs. Roughly $21 billion in federal pay remains frozen, and FAA limits have reduced flight capacity by up to 6% at 40 major airports. American, Delta, and United Airlines collectively canceled more than 1,100 flights on November 11 due to staffing shortages, while millions of SNAP recipients are surviving on 75% of normal benefits (ABC News). Economists estimate the 43-day closure has already shaved 1.5 percentage points off quarterly GDP and stalled procurement spending across defense and logistics. If Wednesday’s vote passes, federal workers could receive back pay within days—but if it fails, markets fear a renewed impasse could extend the shutdown into December. As of Tuesday, Speaker Mike Johnson says the bill “will pass narrowly,” while Democratic Leader Hakeem Jeffries has urged members to vote no, calling it “a corrupt surrender to Trump’s demands.”

Sensei’s Insight: The U.S. isn’t out of the woods yet. Until the House vote lands, 43 days of shutdown pain hang in limbo—and Washington’s next fiscal crisis is already loading.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: Recession Watch — Are We There Yet?

The macro fog is thick. UK unemployment has climbed to 5%, the highest since early 2021. In the US, job growth has slowed, the Sahm Rule—a key recession indicator—is edging higher, and the recent shutdown froze official data releases for weeks. Yet, paradoxically, the S&P 500 hover near all-time highs.

So are we in a recession, entering one, or just watching the economy cool off after years of overheating?

Let’s cut through the noise and look at what the data — not the drama — actually says.

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.