Sensei’s Morning Forecast: SEC Drops XRP Case, Fed Waller’s Rise, Tesla Reshapes AI Plan

A dovish Fed chair pick, institutional crypto fervor, BoE’s unease, Tesla’s AI shift, Trump’s tariffs, and XRP’s clearance—Sensei covers all the game‑changers shaking markets today.

🧠 One Big Thing

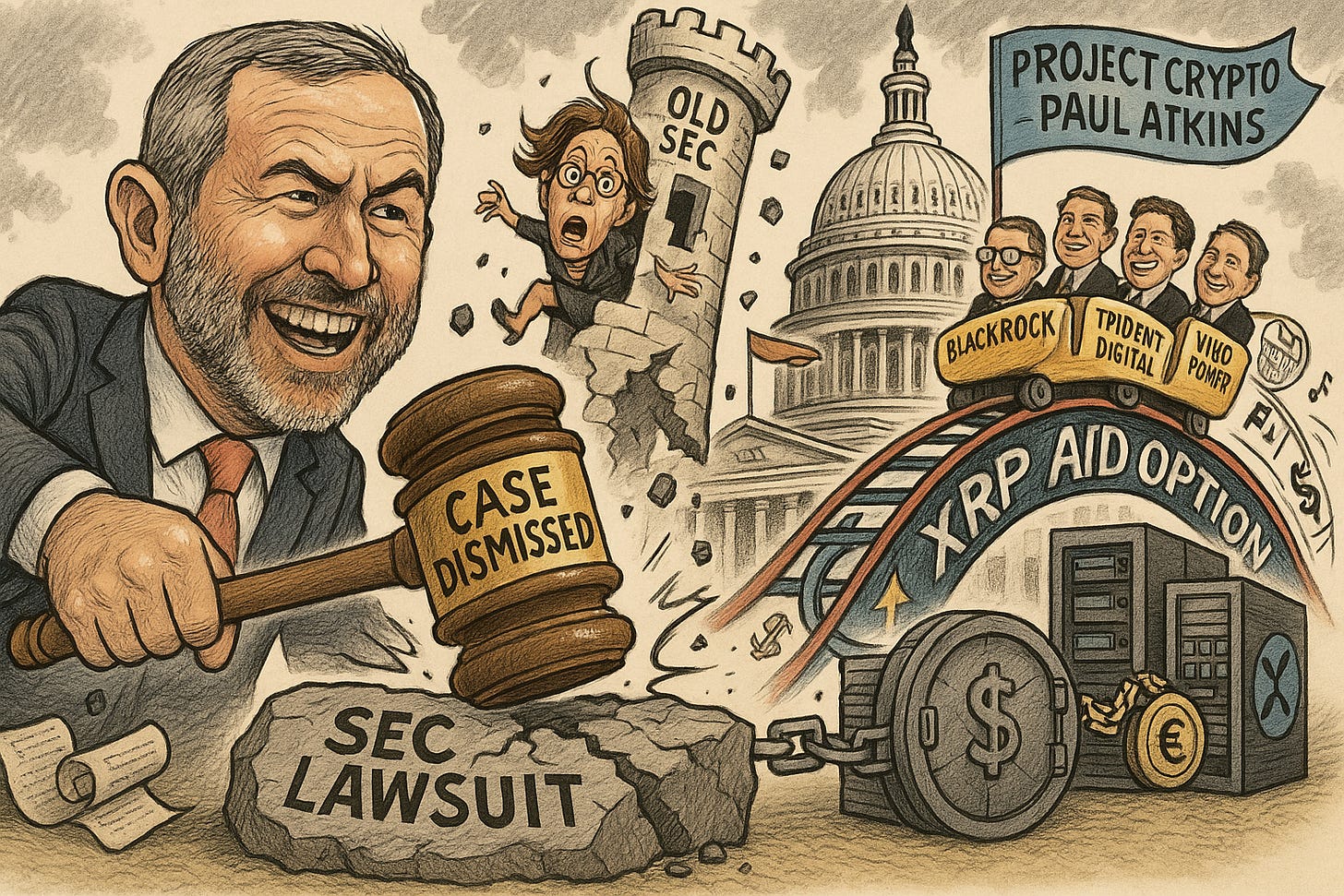

XRP is no longer a question mark. With the SEC case officially closed, XRP becomes the first major cryptocurrency to emerge from years of legal scrutiny with a definitive regulatory status—clearing the runway for ETF approvals and institutional adoption at scale.

💰 Money Move of the Day

Regulatory clarity doesn’t just move markets—it can reshape them. Watching how companies like Trident Digital and VivoPower are structuring XRP into treasury and operational strategies might offer insight into how corporate finance and crypto could increasingly overlap.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $116,805 (▼ -0.59%)

Ethereum (ETH): $3,907 (▼ -0.09%)

XRP: $3.33 (▲ +0.27%)

Equity Indices (Futures):

S&P 500 (SPX): 6,363 (▲ +0.23%)

NASDAQ 100: 23,579 (▲ +0.35%)

FTSE 100: 9,094 (▲ +0.07%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.250% (▲ +0.05%)

Oil (WTI): $64.75 (▲ +0.63%)

Gold: $3,383 (▼ -0.49%)

🕒 Data as of UK (BST): 12:31 / US (EST): 07:31 / Asia (Tokyo): 20:31

✅ 5 Things to Know Today

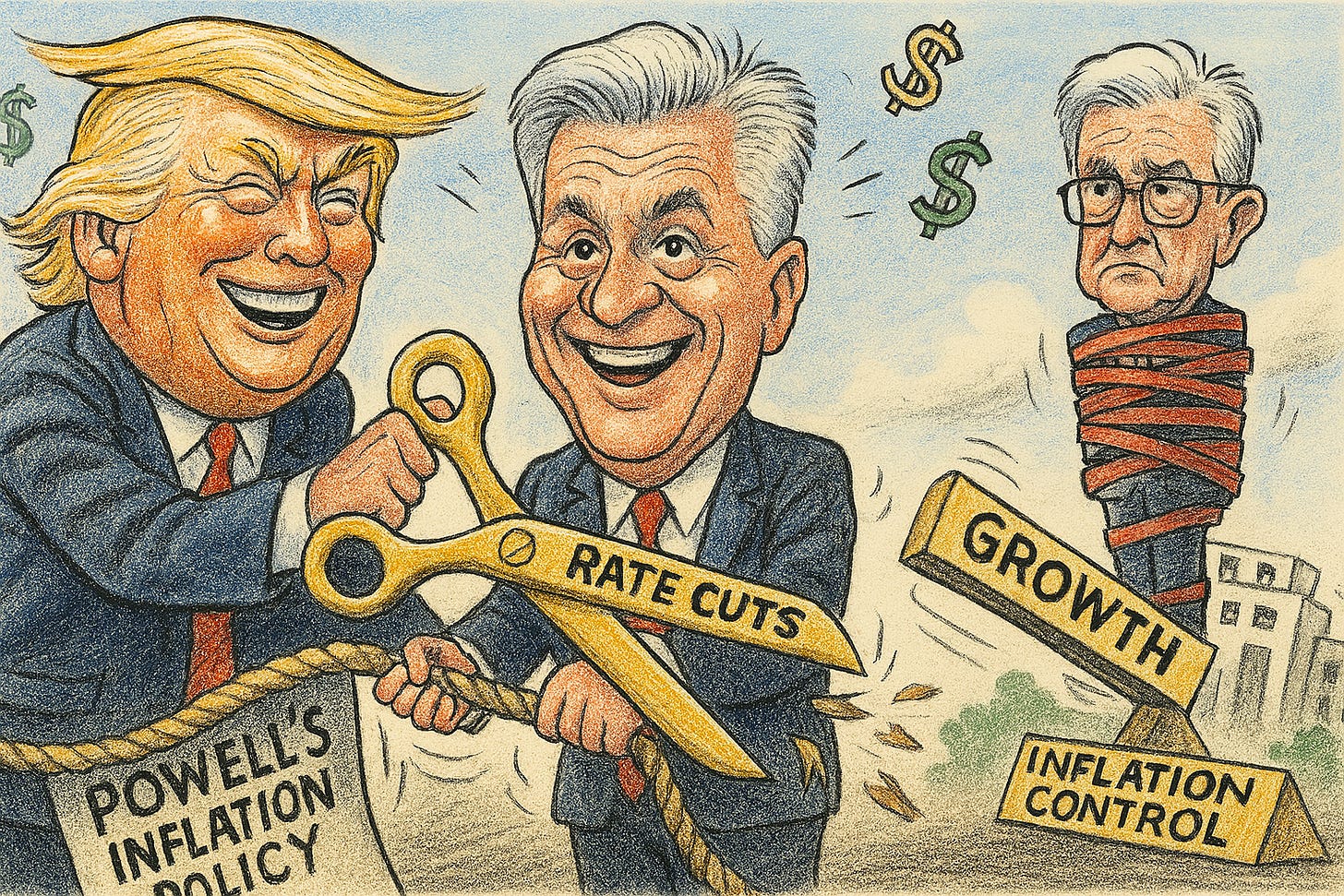

🇺🇸 Waller Emerges as Trump Team's Top Pick for Fed Chair

Fed Governor Christopher Waller, a Trump appointee known for his dovish stance, has become the leading candidate to replace Jerome Powell when his term as Federal Reserve Chair expires in May 2026. Waller has reportedly held discussions with Trump’s economic team, who favor his forward-looking approach to monetary policy and advocacy for rate cuts based on forecasts rather than trailing data. He notably dissented at the July FOMC meeting—alongside Vice Chair Michelle Bowman—arguing for a 25-basis-point cut when the majority opted to hold. This position aligns with Trump's long-standing criticism of Powell's restrictive policy direction (Caliber.az, RISMedia, NY Post).

Prediction markets now give Waller over 50% odds of succeeding Powell, following Bloomberg reports that lifted investor hopes for a more dovish Fed trajectory. Unlike potential rivals Kevin Warsh and Kevin Hassett, Waller offers institutional credibility as a sitting Fed governor and would face fewer hurdles in the Senate. His speeches have labeled tariff-driven inflation as "transitory," and he’s emphasized the need to support a softening labor market—indicating a bias toward growth over inflation control (Federal Reserve, Federal Reserve). A Waller-led Fed could signal a decisive pivot away from Powell's cautious policy line, with implications for rate-sensitive markets and the broader credibility of central bank independence.

Sensei’s Insight: The market’s bet on Waller reveals a deeper shift: policy forecasts may soon depend less on economic prints and more on political forecasts.

🪙 Crypto's $25 Billion Spree Triggers Insider Warnings

Digital Asset Treasury Companies (DATCs) have declared plans to raise a staggering $79 billion in 2025 for Bitcoin purchases, with $31 billion in announced deals and $18 billion already secured. This unprecedented fundraising wave signals soaring institutional demand for crypto exposure but has drawn caution from market veterans who highlight structural vulnerabilities beneath the surface exuberance (Economic Times, Galaxy, Ainvest). The capital deployment isn’t limited to Bitcoin—firms are expanding into Ethereum, Solana, XRP, and TON. BitMine now holds the world’s largest Ether treasury, totaling 833,137 ETH ($2.9 billion), while Verb Technology has raised $558 million in a private placement to launch the first publicly listed Toncoin treasury (Coindesk).

These treasury strategies hinge on maintaining equity premiums averaging 73% above the crypto holdings’ net asset value. But Standard Chartered’s Geoffrey Kendrick warns of a potential “death spiral” if Bitcoin prices fall 20–22% below the average purchase cost—a scenario that could trigger widespread liquidations as newer DATCs are forced to sell into declining markets (Ainvest, Yahoo Finance). Billions in convertible debt maturing between 2027 and 2028, combined with valuation pressures and strategy homogeneity, may expose the ecosystem to cascading failures if market sentiment shifts sharply.

Sensei’s Insight: When everyone’s using the same playbook, the first misstep becomes everyone’s fall.

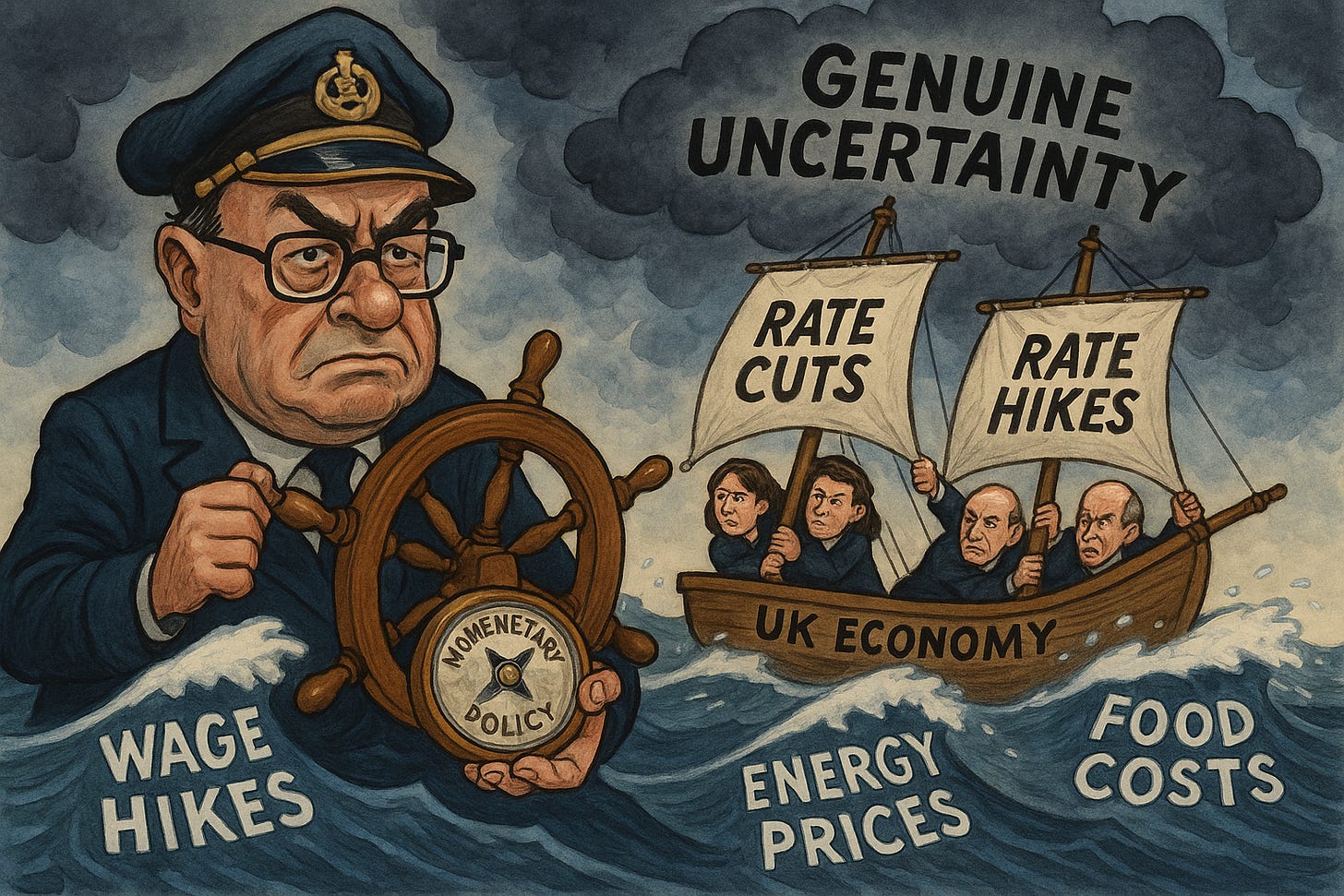

🇬🇧 BoE Warns of "Genuine Uncertainty" as Inflation Persists

The Bank of England executed its fifth straight rate cut yesterday, lowering the base rate to 4%—but Governor Andrew Bailey's declaration of "genuine uncertainty" over future policy direction rattled markets. The vote to cut was historically close: a rare 5-4 split that required two rounds of voting, marking a first in the BoE's 28-year history. Inflation is now projected to peak at 4% in September—double the 2% target—with a return to target delayed until Q2 2027, a deterioration from prior forecasts (Reuters, Bank of England).

Multiple inflationary forces are converging: food inflation has surged to 4.5%, energy prices are rising due to utility tariff hikes, and wage and tax increases are feeding into core services inflation, which remains elevated at 4.7%. The BoE also warned that medium-term inflationary risks have "moved slightly higher since May." Despite cutting rates, the Bank’s tone turned more hawkish. Market odds for a December rate cut dropped from 100% to 75%, and the terminal rate is now seen settling at 3.5%—higher than previously expected. Investors face an increasingly difficult landscape as fiscal tightening from October’s budget looms, further complicating the macroeconomic backdrop (Politico, Chatham Financial, Mettis Global).

Sensei’s Insight: The BoE may be easing rates, but its inflation alarm suggests rate cuts won't be smooth sailing. Brace for a policy path that could swing harder than expected.

🧠 Tesla Streamlines AI Chip Strategy After Dojo Shutdown

Tesla has officially disbanded its Dojo supercomputer team, consolidating its AI chip development under a single architecture. CEO Elon Musk confirmed the strategic pivot on X, stating that “it doesn’t make sense for Tesla to divide its resources and scale two quite different AI chip designs.” Dojo project leader Peter Bannon has left the company after nearly 10 years, and about 20 team members have joined the startup DensityAI. The rest have been reassigned to other Tesla initiatives in data centers and computing (Reuters, TechCrunch, Stocktwits).

Instead of building proprietary supercomputing infrastructure, Tesla will now rely more heavily on external partners like Nvidia, AMD, and Samsung. The company has signed a $16.5 billion deal with Samsung to manufacture its next-generation AI6 chips at a Texas facility, with production slated between 2027–2028 (Bloomberg, TechCrunch, Reuters). Musk added that Tesla’s upcoming AI5, AI6, and later chip models will be “excellent for inference and at least pretty good for training.” This marks a major departure from the company’s original Dojo-centric AI roadmap, which Morgan Stanley had previously valued at a potential $500 billion in market cap upside (Yahoo Finance, AInvest).

Sensei’s Insight: Tesla isn’t abandoning AI—it's just ditching the solo mission. The move to consolidate design and leverage deep-pocketed chip partners is a bet on faster, scalable deployment, not less ambition.

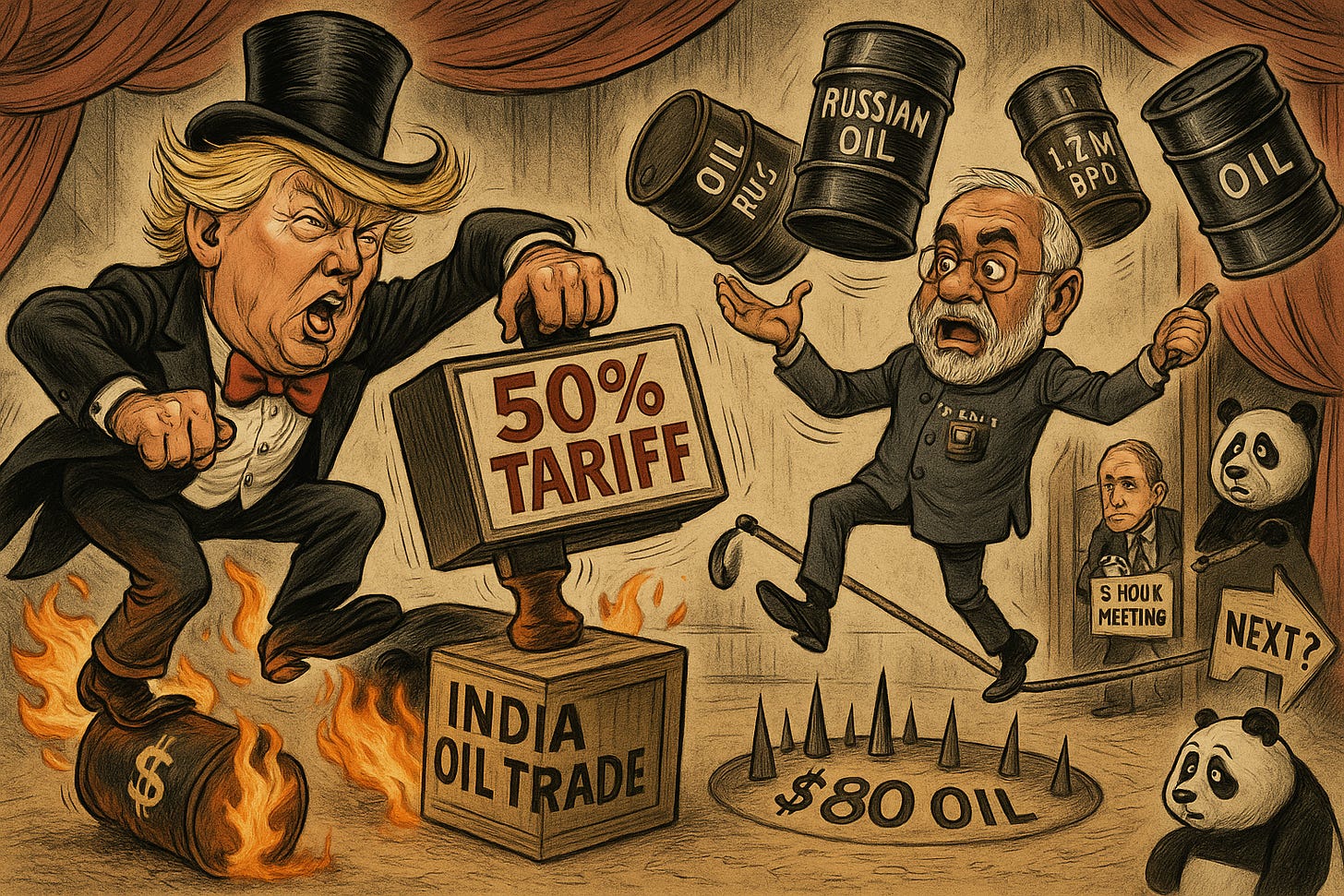

🇺🇸 Trump's Tariff Gambit Escalates Russian Oil Pressure With 50% Levy on India

President Donald Trump has imposed a new 25% tariff on Indian goods, doubling the duty rate to 50% in retaliation for India's continued purchase of Russian oil. The new tariff, taking effect August 27, marks the highest U.S. trade penalty against a major partner and is the first financial punishment targeting a buyer of Russian oil in Trump’s second term (Reuters, Time, EnergyNews). This move follows Trump's ultimatum last Friday for Russia to secure a peace deal in Ukraine or face secondary sanctions on countries purchasing its oil. While envoy Steve Witkoff met with Vladimir Putin for a three-hour discussion, Trump warned that "a lot more" tariffs are on the way—specifically citing China as a possible next target. Oil prices initially rose nearly 1% but later stabilized, with market analysts interpreting the actions more as negotiation leverage than fixed policy (CNBC, CNN, Reuters).

This escalation injects fresh volatility into global energy and trade markets. India currently imports 1.7 million barrels of Russian crude daily—about 2% of global supply—meaning any trade interruption could drive oil prices from $66 toward or above $80 per barrel. With U.S.-India bilateral trade valued at over $190 billion annually, the move risks straining key alliances. Energy experts caution that if Trump expands pressure to China—Russia’s top oil customer—the resulting disruption could mirror 2022’s spike when crude neared $130 per barrel amid the Ukraine invasion (BBC, Global Banking & Finance, S&P Global).

Sensei’s Insight: Trump’s tariff strategy isn’t just targeting India—it’s a warning shot to all Russian oil buyers. The ripple effects could jolt both energy prices and international trade ties.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Ripple-SEC Case Concludes: XRP's New Era of Institutional Adoption

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.