Sensei’s Morning Forecast: Soft Landing or Sudden Shock? The Fed, Trump, and Tech Giants Are About to Tell Us

Fed cuts, Trump’s Tokyo trade push, and mega-cap earnings dominate; Japan’s stablecoin and India’s FDI reform add intrigue—our Deep Dive unpacks how this week could redefine risk.

👀 Today’s Stories at a Glance

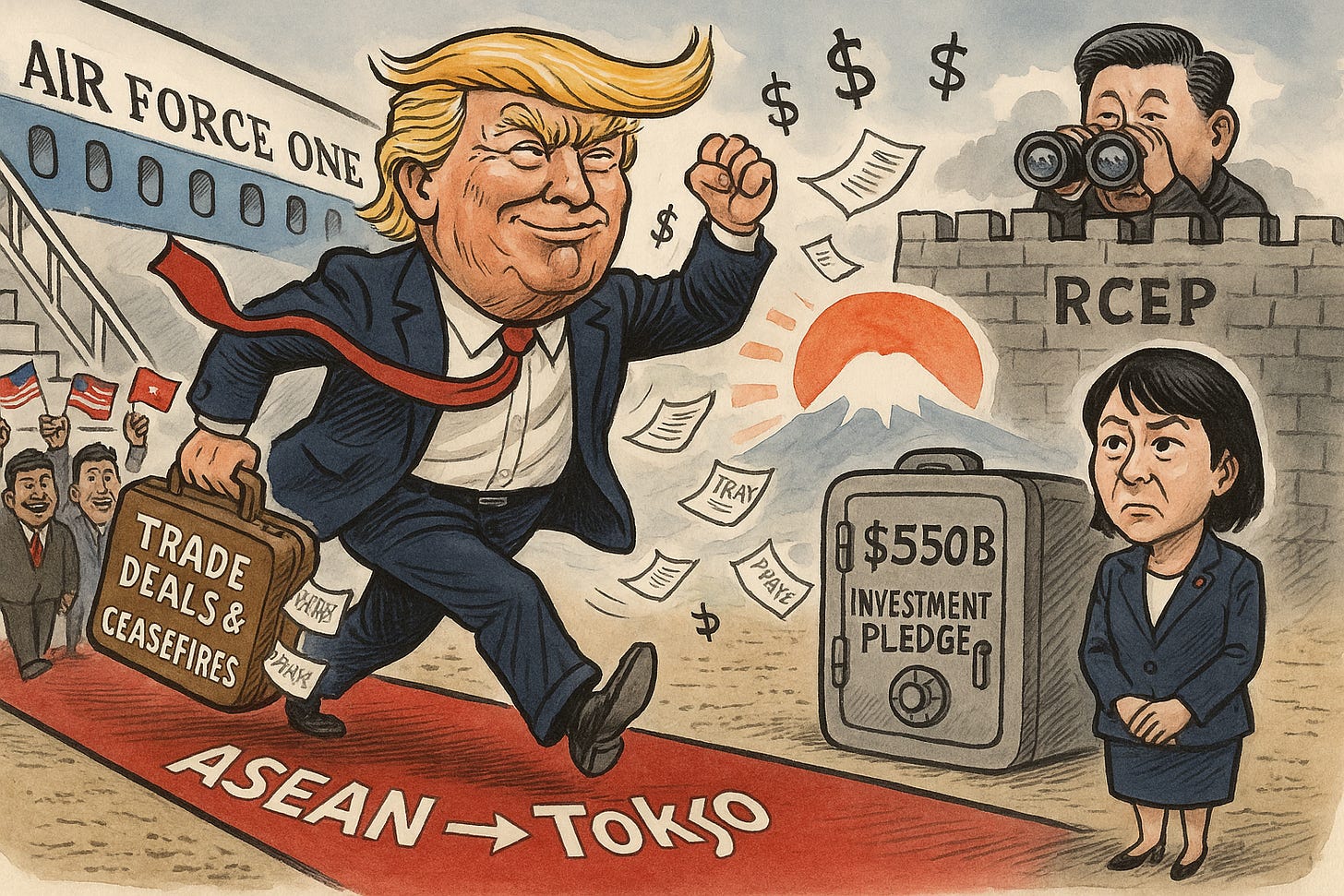

📰 Trump Lands in Tokyo Amid ASEAN Trade Progress

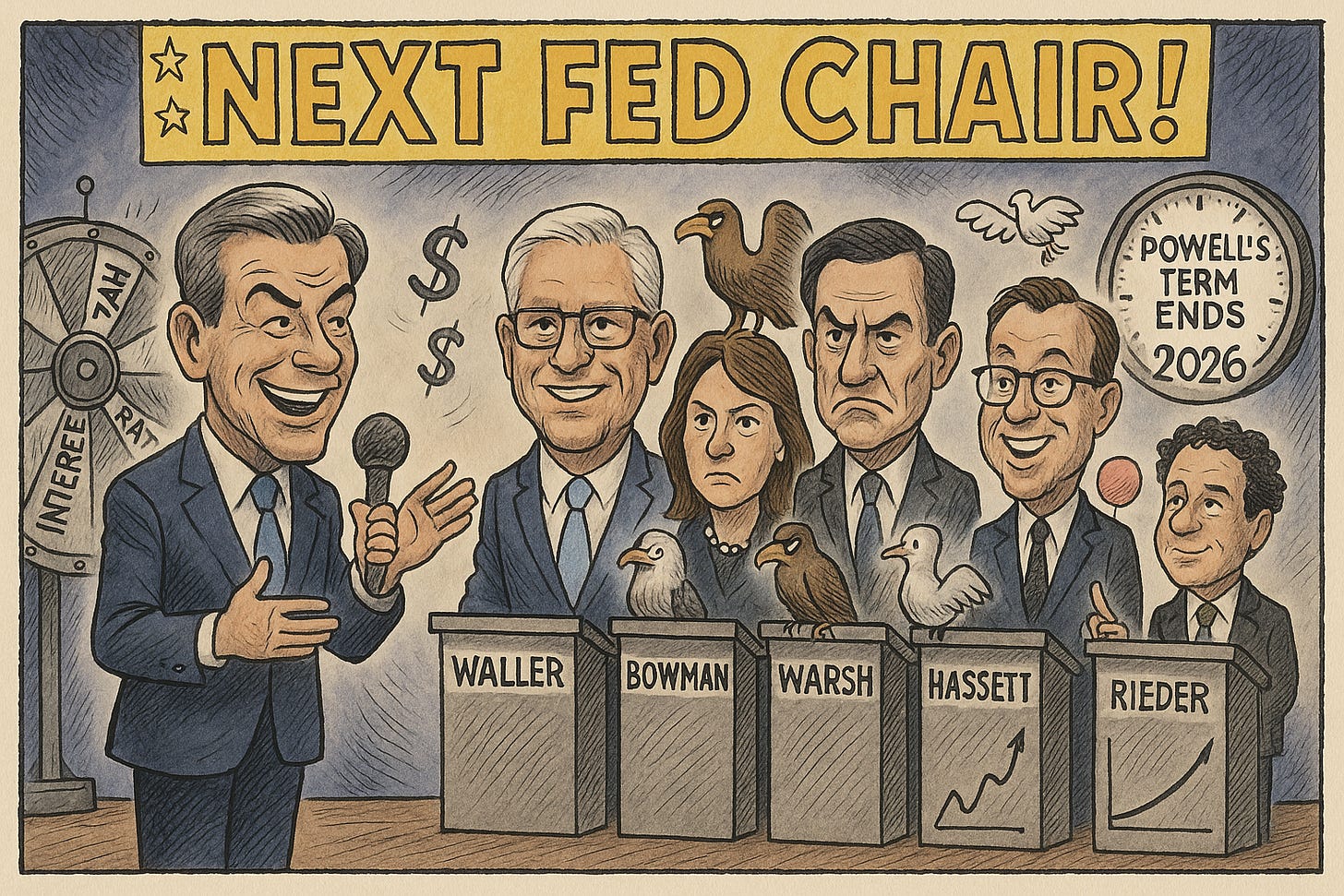

Trump arrives in Japan after securing Southeast Asian trade deals and aims for new U.S.–Japan economic pacts.🏛️ Fed Chair Finalists Confirmed by Treasury

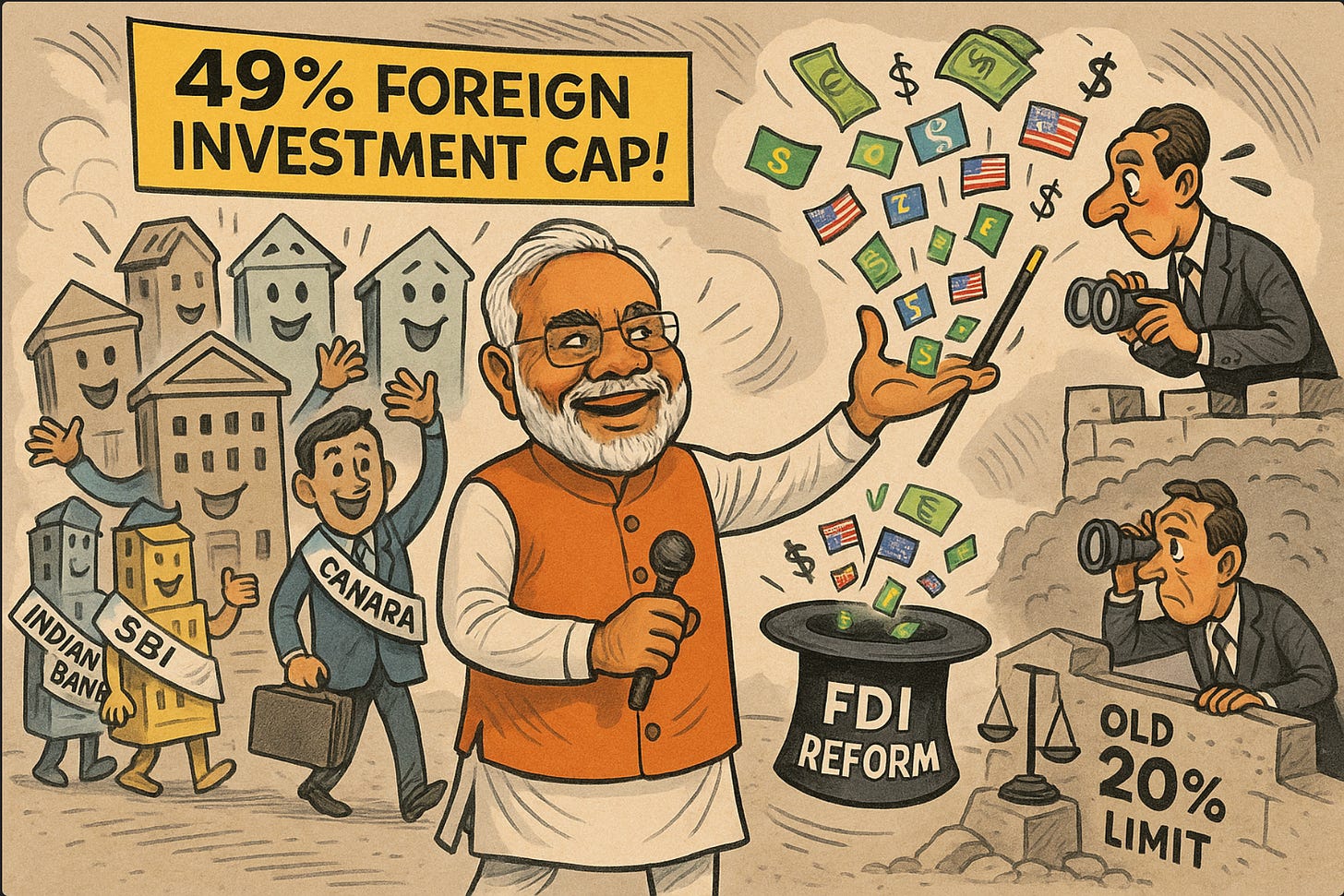

Treasury shortlists five Fed Chair candidates, signaling possible shifts in monetary policy ahead of Powell’s 2026 term end.💰 India Plans 49% Foreign Cap in State Banks

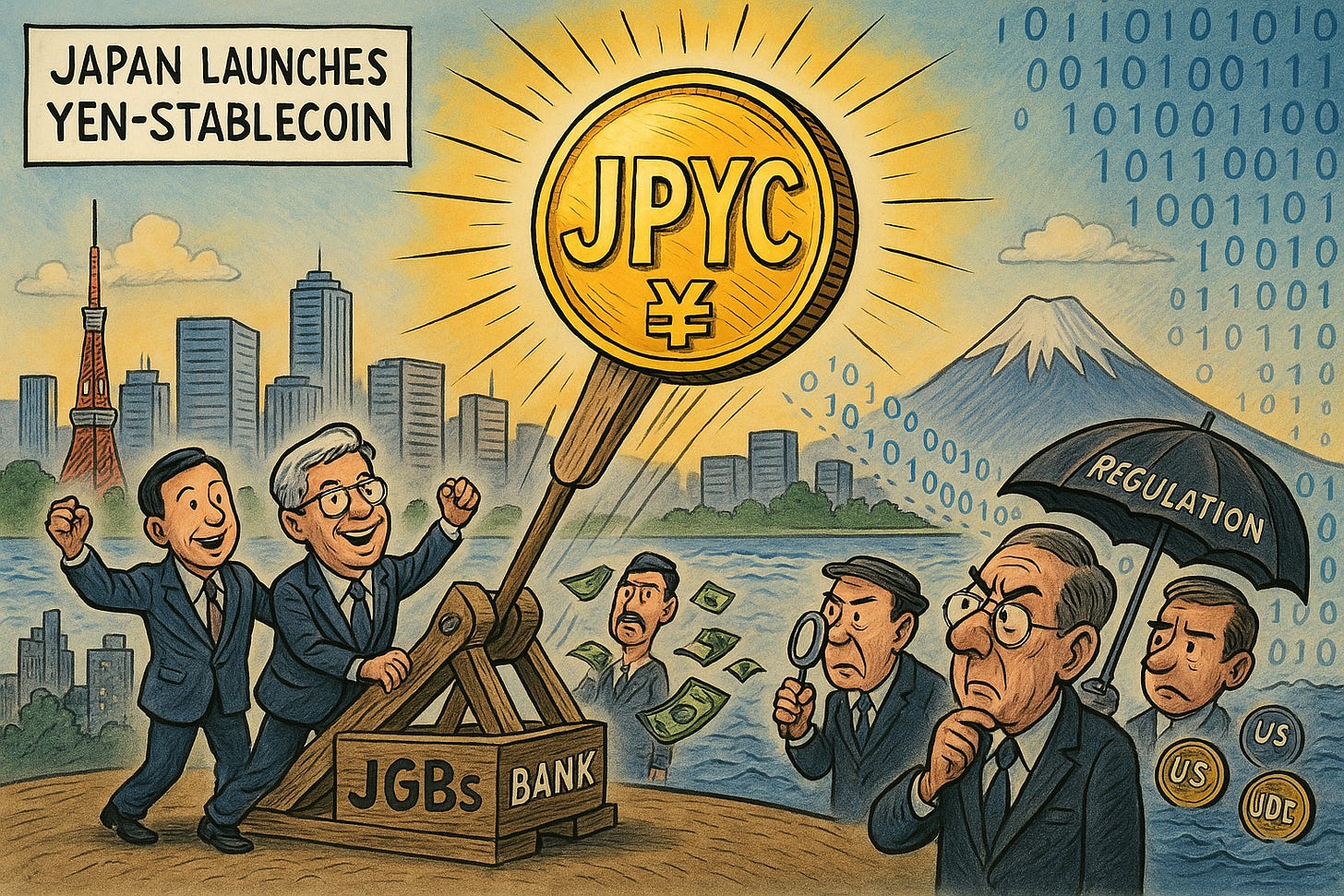

India may raise foreign investment limit in public banks to 49%, sparking PSU bank rally and global investor interest.🪙 Japan Launches First Yen-Pegged Stablecoin

JPYC stablecoin debuts with JGB backing, marking a bold move into digital FX infrastructure with global settlement potential.💹 U.S. Futures Rally on Trade & Tech Hopes

S&P and Nasdaq futures spike on easing inflation, trade optimism, and anticipation of mega-cap tech earnings.⚖️ Markets Face Make-or-Break Week with Key Catalysts

Tech earnings, a Fed decision, inflation data, and trade talks converge—this week will define Q4’s direction.

🧠 One Big Thing

The Fed Chair shortlist is out — and markets are already reacting.

The Treasury named five finalists to succeed Jerome Powell, including two Fed insiders and three market-aligned candidates. A dovish tilt could mean softer rate policy ahead. With Powell’s term ending in 2026, traders are watching closely — rate expectations, dollar strength, and yield curves are all in play.

💰 Money Move of the Day

Rate-sensitive assets may swing as Fed leadership shifts. A dovish successor could lift long bonds and growth stocks. This isn’t a call to chase headlines — just a timely reminder to assess how exposed your portfolio is to future rate cuts.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $115,495.95 (▲ +0.80%)

Ethereum (ETH): $4,169.50 (▲ +0.23%)

XRP: $2.6235 (▼ -0.88%)

Equity Indices (Futures):

S&P 500 (US500): 6,853.3 (▲ +0.92%)

NASDAQ 100 (NQ1!): 25,847.75 (▲ +1.33%)

FTSE 100: 9,649.34 (▲ +0.12%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.024% (▲ +0.52%)

Oil (WTI): $61.22 (▼ -1.01%)

Gold: $4,041.22 (▼ -1.71%)

Silver: $47.6736 (▼ -1.95%)

🕒 Data as of UK (GMT) 10:44 / US (EST): 06:44 / Asia (Tokyo): 18:44

✅ 5 Things to Know Today

📰 Trump Arrives in Tokyo After ASEAN Trade Talks Progress

U.S. President Donald Trump arrived in Tokyo on Monday following major progress at the ASEAN summit in Malaysia, where he brokered four new trade frameworks with Southeast Asian nations and a cease-fire pact between Cambodia and Thailand. The meetings also featured preliminary discussions with China aimed at pausing U.S. tariffs and easing Chinese export curbs on rare earths (Reuters). Trump’s Asia tour now turns to Japan, where he is expected to meet Prime Minister Sanae Takaichi to advance a U.S.–Japan economic security pact tied to a $550 billion Japanese investment pledge in exchange for potential tariff relief (Reuters). The visit also precedes Trump’s highly anticipated meeting with China’s Xi Jinping later this week, where both sides are expected to outline a framework for de-escalation and technology-sector cooperation.

The diplomatic momentum is already rippling through markets: the U.S. dollar briefly climbed to a two-week high above ¥153 before paring gains, while Asian equities rallied on optimism around renewed trade dialogue (Reuters). Investors are also watching whether Japan’s commitment to large-scale U.S. investments extends to semiconductor and EV-supply-chain sectors, potentially benefiting global chip equipment and logistics firms. Still, risk remains elevated as China pushes for greater influence under the Regional Comprehensive Economic Partnership (RCEP), positioning itself as a counterweight to Washington’s bilateral deals (Reuters).

Sensei’s Insight: Diplomacy now moves markets as much as data prints. Watch for follow-through in Xi–Trump negotiations—Asia’s next leg depends on how credible those trade pledges become.

🏛️ Treasury Confirms Final 5 for Fed Chair Succession

Scott Bessent, U.S. Treasury Secretary, has formally confirmed that five candidates are finalists to succeed Jerome Powell as Chair of the Federal Reserve. The shortlisted individuals are current Fed Board members Christopher Waller and Michelle Bowman; former Fed Governor Kevin Warsh; White House National Economic Council Director Kevin Hassett; and Rick Rieder, Chief Investment Officer at BlackRock Inc.. The administration expects a decision before year-end. (Reuters)

The process reflects strong White House involvement: Bessent will deliver a narrower list of three or four candidates to be interviewed after Thanksgiving, ahead of the final selection. All five finalists have distinct profiles — two internal Fed governors (Waller, Bowman) signal continuity of the current regime; Warsh brings long-standing Fed experience and hawkish credentials; Hassett and Rieder represent a tilt towards rate-cuts, markets and private-sector alignment — a clear nod to fiscal-monetary coordination under the current administration. The timing is notable: Powell’s term ends May 2026, and markets are already pricing for both policy continuity and a potential shift in Fed bias.

Sensei’s Insight: Pick-and-choose at the Fed will ripple into interest-rate expectations, dollar strength and yield‐curve shape. Investors should track the nominee’s public comments for early clues on inflation vs labour priorities before the formal confirmation.

💰 India to Raise Foreign Investment Cap in State-Run Banks to 49%

India is preparing to raise the foreign direct investment (FDI) ceiling in its 12 state-run banks from 20% to 49%, according to senior government sources familiar with ongoing talks between the Finance Ministry and the Reserve Bank of India (Reuters). The proposal would allow global institutional investors and foreign banks to acquire larger stakes while keeping government control at a minimum 51%. India’s state-run lenders collectively hold more than ₹171 trillion ($1.95 trillion) in assets, representing about 55% of total banking sector assets as of March 2025. The change aligns with Prime Minister Narendra Modi’s broader banking reforms designed to improve capitalization, efficiency, and governance within the public-sector banking system. Under the plan, voting rights for foreign shareholders would remain capped at 10%, preserving state influence in key lending and policy decisions.

The potential reform triggered immediate market reaction, with the Nifty PSU Bank Index rising as much as 1.6% on the news. Shares of Indian Bank, Canara Bank, and Punjab National Bank gained between 2–3% amid optimism about higher foreign inflows (5Paisa). Analysts at Kotak Institutional Equities estimate that the State Bank of India (SBI) alone could attract up to $466 million in passive foreign inflows if the limits are raised (Economic Times). The proposal also aligns with India’s ambition to deepen capital markets and strengthen its investment appeal ahead of the 2026 budget cycle, where further privatization and capital reforms are expected to feature prominently.

Sensei’s Insight: A 49% FDI cap would open the floodgates for foreign capital—but execution and political timing will determine whether India’s public banks can truly compete on global terms.

🪙 Japan Launches First Yen-Pegged Stablecoin

Japan’s fintech startup JPYC Inc. has issued the world’s first stablecoin anchored to the Japanese yen (JPY), a milestone in Asia’s digital-asset evolution. The token—also named “JPYC”—is fully convertible to the yen and backed by domestic bank deposits and Japanese Government Bonds (JGBs), under Japan’s revised Payment Services Act. The issuer aims to mint up to ¥10 trillion (≈ $66 billion) of JPYC over three years and plans to charge zero transaction fees, generating revenue instead from interest on its JGB reserves. (Reuters, CoinDesk)

From an investor perspective, the launch signals a meaningful push by Japan into the digital-currency infrastructure space. Unlike many Asian peers whose stablecoins are limited to domestic usage, the yen’s status as a freely convertible currency presents JPYC with potential cross-border appeal and inclusion in global on-chain USD/JPY pools. This development could enhance tokenised settlement and liquidity in FX markets, but it also raises regulatory implications around banks’ deposit roles, capital flows and crypto-asset oversight—as voiced by Bank of Japan Deputy Governor Ryozo Himino. (Reuters)

Sensei’s Insight: A yen-stablecoin opens door to new FX rails and liquidity—but until adoption scales and regulation settles, it remains a speculative infrastructure bet with major global-settlement implications.

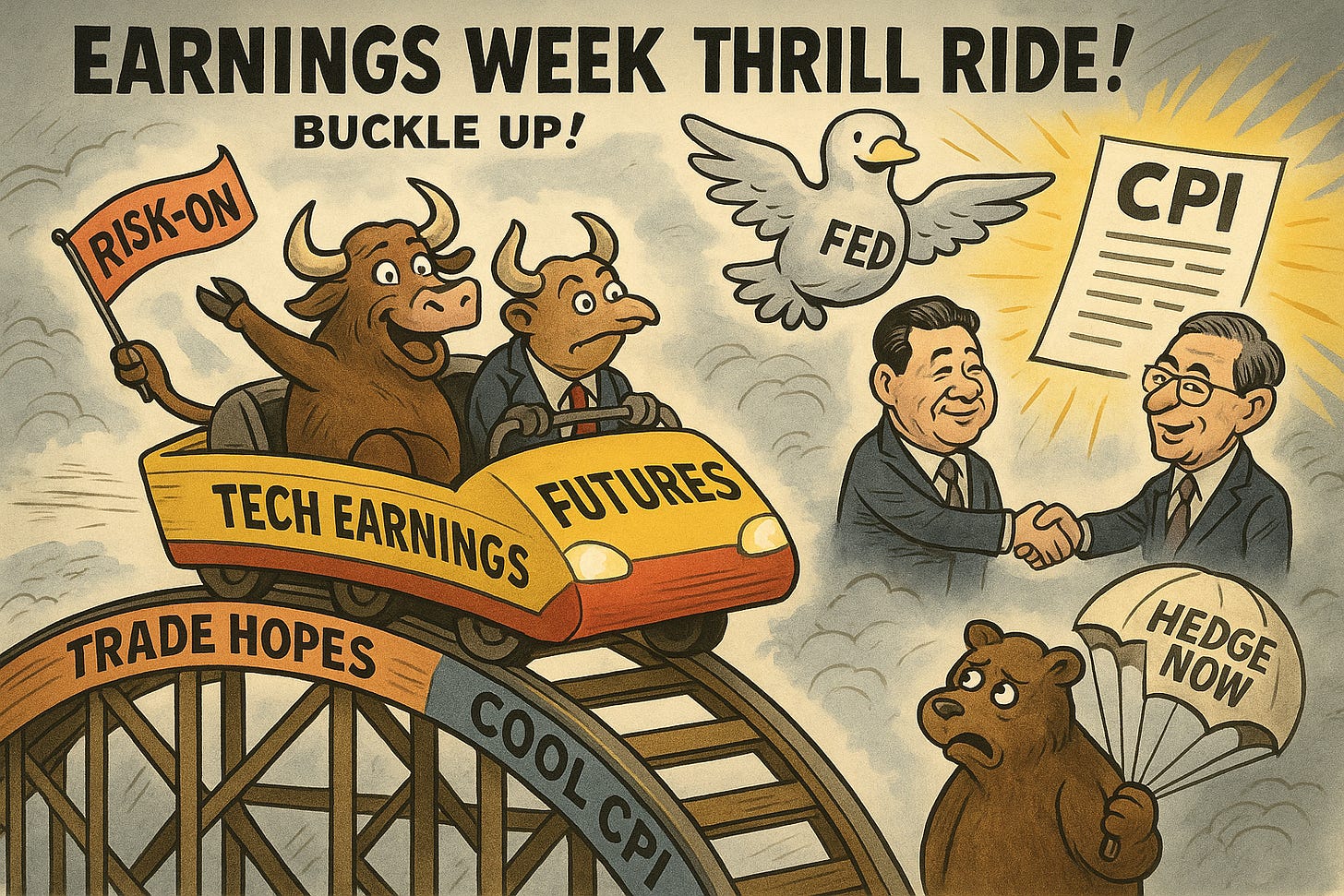

💹 U.S. Futures Spike Ahead of Trade & Tech Catalysts

U.S. index futures rose sharply overnight — with the S&P 500 futures up roughly 0.7 % and Nasdaq 100 futures climbing nearly 0.9 % — as markets digest a convergence of positive signals: cooler-than-expected inflation, improving U.S.–China trade-deal hopes, and a heavy week of mega-cap tech earnings ahead. (TradingView) The September CPI print came in slightly lower than forecast, bolstering expectations that the Federal Reserve could deliver a rate cut later this year. Concurrently, comments from both U.S. and Chinese officials suggest progress on export-controls and shipping duties, underpinning risk-appetite in overnight trade.

The implications for markets are significant: the jump in futures suggests investors are leaning into a “risk-on” environment. Tech stocks — especially those in the “Magnificent Seven” — could lead the charge if earnings align with elevated expectations. At the same time, the anticipation of Fed easing is feeding into longer-duration assets and supporting equities more broadly. That said, key risks remain: any misstep in the U.S.–China dialogue, or an inflation surprise, could reverse sentiment quickly. Futures gains are not a guarantee of a smooth open — traders should still brace for volatility when the cash market reopens.

Sensei’s Insight: Pre-open futures moves reflect sentiment shifts, not certainties. With trade, inflation and earnings converging this week, track where flows concentrate — then hedge for the move back.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: ⚖️ The Week That Decides the Market

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.