Sensei’s Morning Forecast: These 4 Metrics Say This Rally Can’t Last

Pound plunges, Klarna sounds AI alarm, IPOs fast-tracked, chip exports curbed, and EU imports Russian gas — all as markets test historic valuation extremes.

👀 Today’s Stories at a Glance

🇬🇧 Pound Tanks on Fiscal Fears

Sterling heads for worst week since January, sliding on tax hike worries and sticky inflation.🤖 Klarna CEO Sounds AI Alarm

AI will hit white-collar jobs hard, warns Klarna chief—cost cuts now meet economic disruption risk.🇺🇸 Senate Tightens Chip Exports to China

U.S. passes law giving Nvidia buyers at home priority, shaking up global AI chip trade routes.🚨 SEC Unblocks IPOs Amid Shutdown

Emergency SEC rule lets IPOs proceed without review, risking post-listing scrutiny for disclosures and pricing.🇪🇺 EU Buys Russian Energy Despite Ukraine Stance

European nations ramp Russian imports, clashing with pro-Ukraine stance and exposing firms to backlash risk.📈 Are We Near the Top?

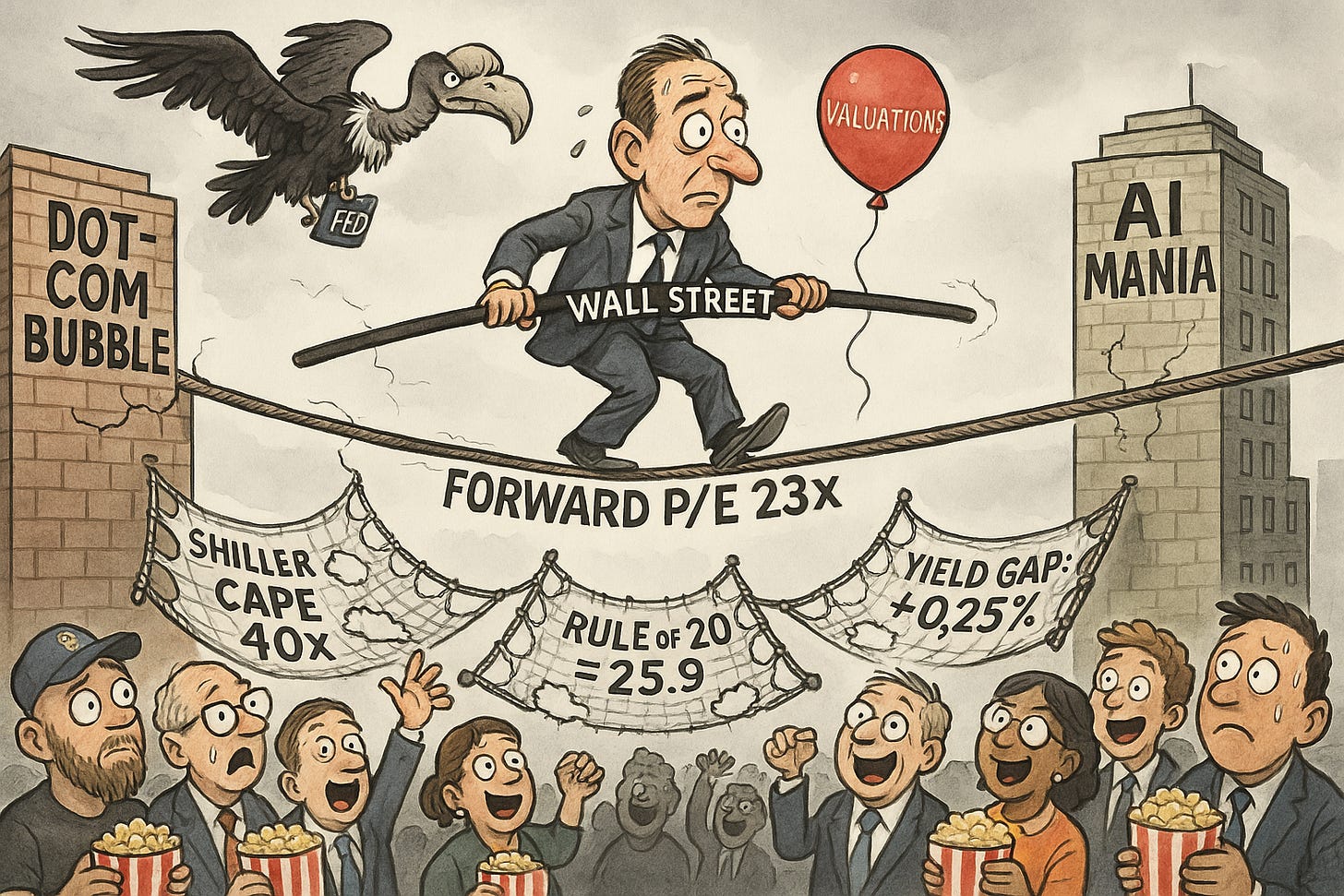

Valuation metrics scream late-cycle; stretched P/Es, weak breadth, and thin yield gaps hint at looming risk.

🧠 One Big Thing

The SEC is letting IPOs proceed without full review during the government shutdown. Companies like BitGo and Navan can now list using a 20-day auto-approval rule. It keeps markets moving—but shifts risk to after the bell rings.

💰 Money Move of the Day

Fast-tracked IPOs mean higher post-listing risk. Before jumping in, check cash flow, revenue, and sector strength. Hype fades—fundamentals don’t.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $121,421.84 (▼ -0.23%)

Ethereum (ETH): $4,328.78 (▼ -0.93%)

XRP: $2.81 (▲ +0.41%)

Equity Indices (Futures):

S&P 500 (SPX): 6,735.4 (▲ +0.04%)

NASDAQ 100: 25,282.00 (▼ -0.03%)

FTSE 100: 9,501.81 (▲ +0.01%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.107% (▼ -0.85%)

Oil (WTI): $60.98 (▼ -1.11%)

Gold: $3,993.32 (▲ +0.47%)

🕒 Data as of UK (BST): 11:24 / US (EST): 06:24 / Asia (Tokyo): 19:24

✅ 5 Things to Know Today

🇬🇧 Pound Heads for Worst Week Since January

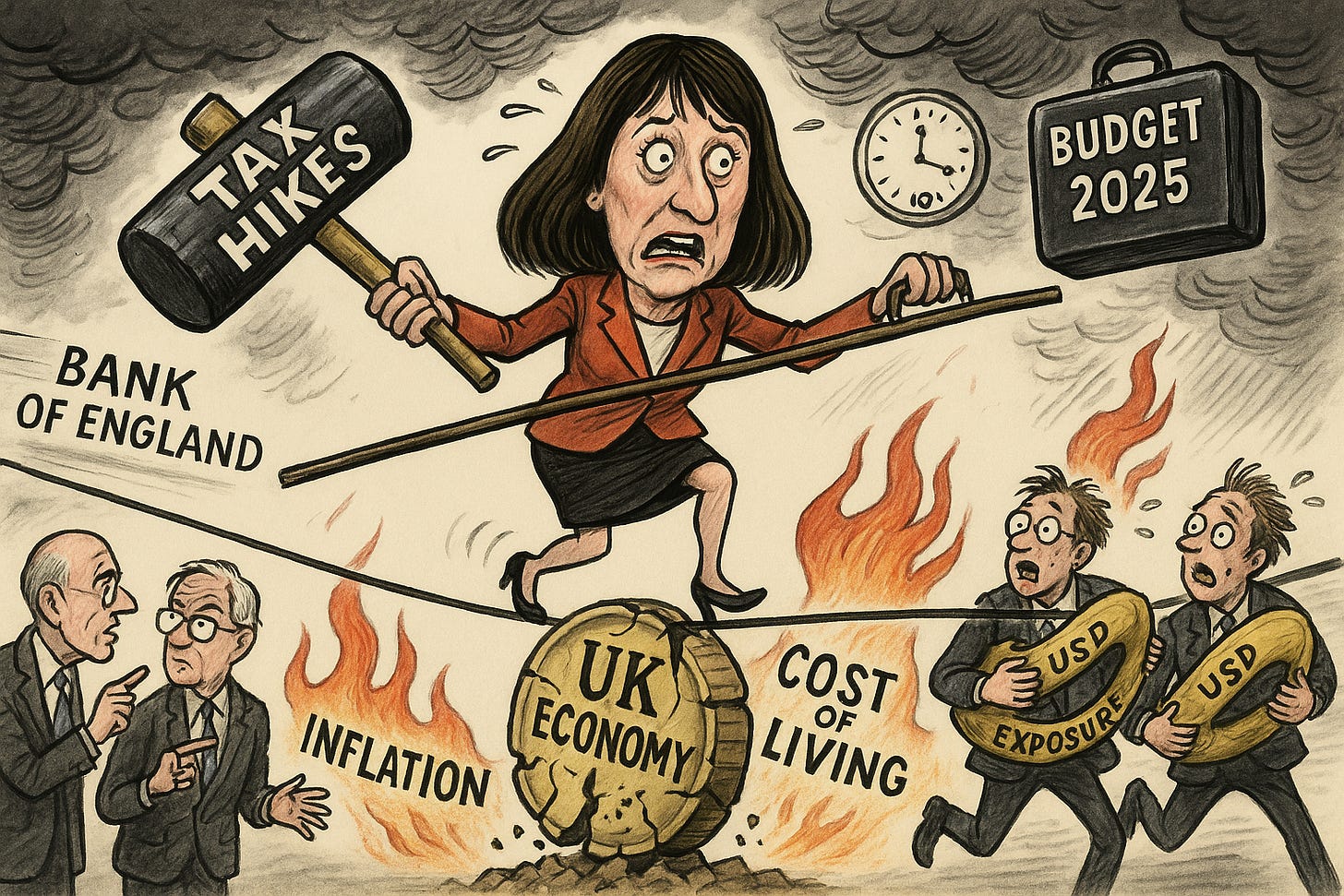

The British pound is on pace for its steepest weekly loss since January 2025, sliding approximately 2.11% over the past month and hitting a ten-week low of $1.328 on October 10. Sterling edged down another 0.09% in the latest session, driven by intensifying domestic fiscal anxieties and continued dollar strength (Reuters). Market focus is firmly on the upcoming November 26 budget from Chancellor Rachel Reeves, with expectations of major tax hikes to address a growing fiscal deficit. Investors fear that aggressive fiscal tightening could stall the UK’s already fragile economic recovery.

Those concerns are compounded by persistent inflationary pressures and high living costs. The UK’s inflation rate held steady at 3.8% in August—matching July and tying the highest level since January 2024—while core inflation eased slightly to 3.6%. Services inflation, however, remains stubborn at 4.7% (ONS). Meanwhile, 65% of UK adults reported rising living expenses in September, up from 62% in August (ONS). The Bank of England held rates at 4% in September, with only two policymakers voting for cuts—underscoring a cautious stance despite economic headwinds (Bank of England).

Sensei’s Insight: With inflation still hot and the fiscal outlook uncertain, the pound remains under siege. UK investors with dollar exposure and firms reliant on international revenues should prepare for continued volatility as the November budget draws near.

🤖 Klarna CEO Warns of Imminent AI Jobs Shock

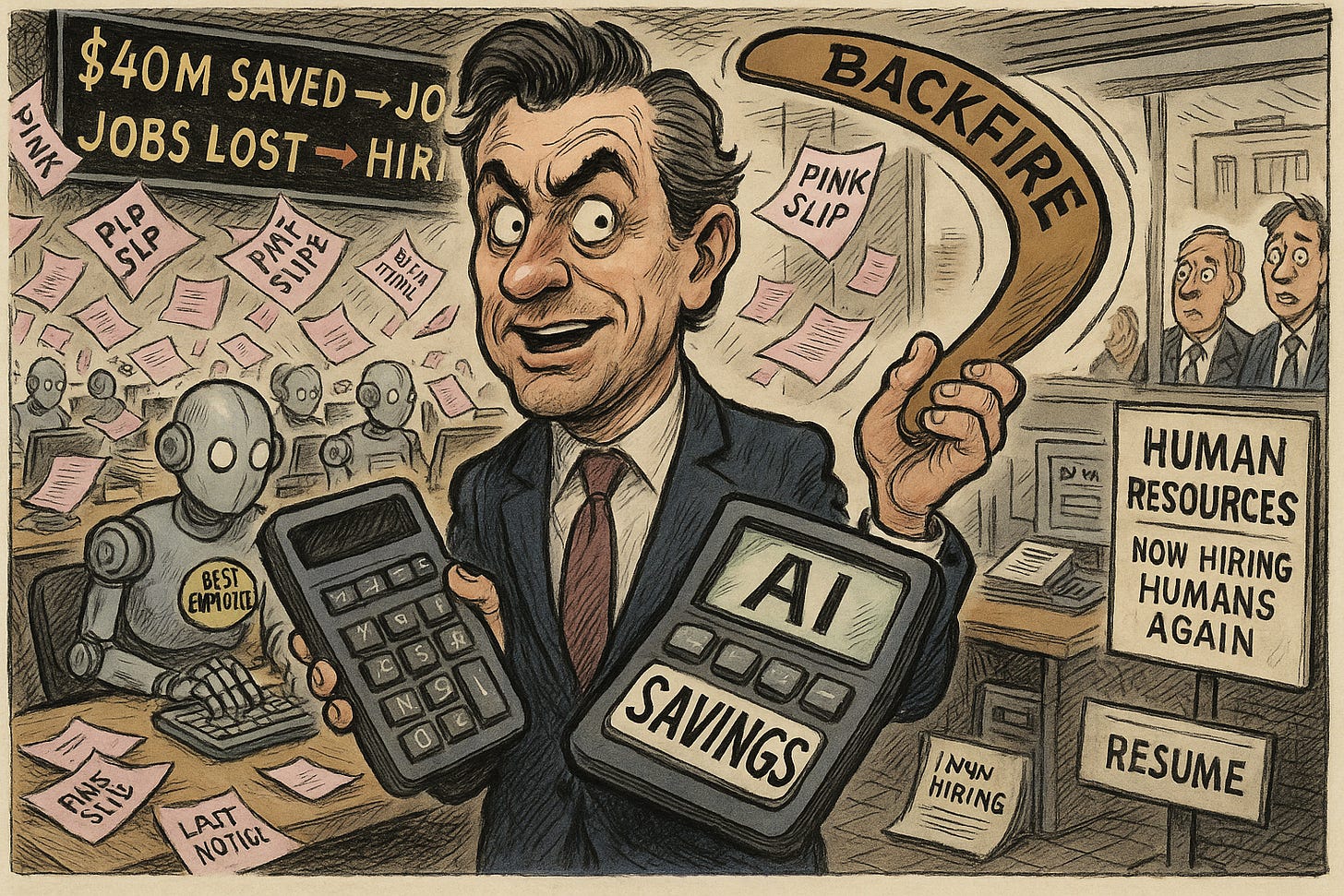

Klarna CEO Sebastian Siemiatkowski warned that businesses are dangerously unprepared for the sweeping disruption AI will bring to white-collar sectors ranging from banking to translation. In an interview on Bloomberg Television, he criticised fellow tech leaders for downplaying the consequences, stating there’s “a massive shift coming to knowledge work” that extends beyond fintech to society at large. Siemiatkowski, whose company went public on the NYSE in September at a $17.5 billion valuation, has aggressively implemented AI across Klarna’s operations—reducing its workforce from 5,500 to 3,000 over two years. The company’s AI assistant now handles 69% of customer service chats, reportedly doing the work of 700 full-time agents and saving $40 million annually.

However, Klarna has since reversed course on full AI automation, acknowledging quality issues and beginning to rehire staff in 2025. Siemiatkowski admitted that “cost unfortunately seems to have been too predominant an evaluation factor” in the company’s early AI decisions (BBC, Computing). More critically, he predicted AI would erode “excess profits” in sectors like banking and software by enabling seamless customer switching between services, potentially triggering an economic downturn. His remarks mark a stark warning from a high-profile AI advocate now grappling publicly with the technology’s economic consequences (Business Insider, Fortune).

Sensei’s Insight: One of AI’s most aggressive adopters is now tapping the brakes. This isn’t just about call centers—it’s a high-level shift that could destabilize how entire industries compete, hire, and generate profit.

🇺🇸 Senate Passes AI Chip Export Limits on Nvidia, AMD to China

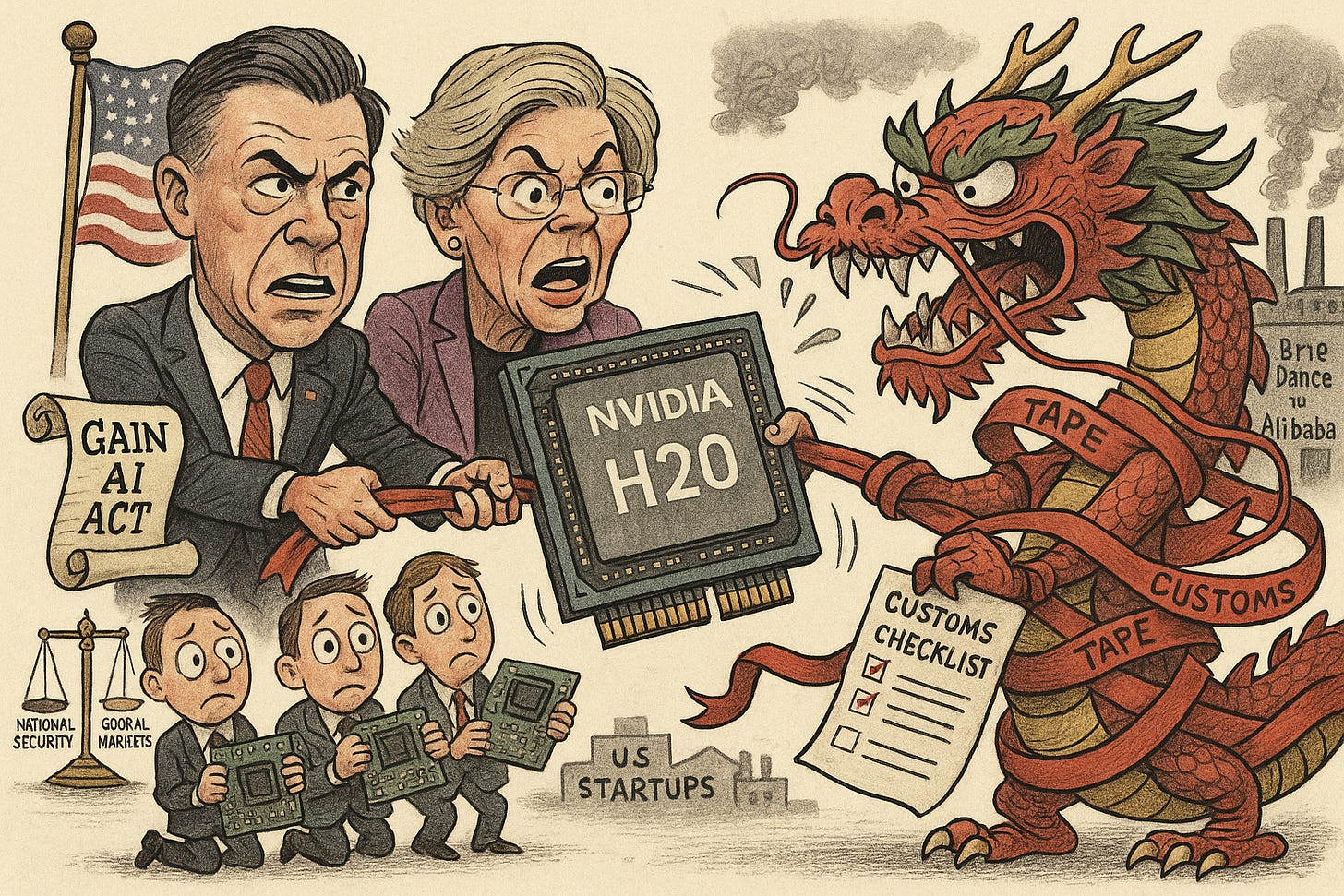

The U.S. Senate has passed the GAIN AI Act, a bipartisan measure requiring Nvidia and AMD to prioritize domestic customers over Chinese buyers when selling advanced AI chips. Passed 77-20 as part of the annual National Defense Authorization Act, the legislation mandates that U.S. companies, including startups and small businesses, receive “priority access” to high-performance AI semiconductors before they are exported to countries considered foreign adversaries. Co-sponsored by Senators Jim Banks (R-Indiana) and Elizabeth Warren (D-Massachusetts), the bill targets chips with high memory bandwidth, including Nvidia’s H20 models built for China (Bloomberg).

For investors, the implications are broad. Nvidia reported $4.6 billion in first-quarter China revenue before recent export curbs, and the legislation could reshape global AI chip dynamics. The House passed its version of the NDAA without export controls, meaning the final language hinges on conference negotiations. Industry groups such as the Semiconductor Industry Association have pushed back, citing “complex requirements” that could weaken U.S. firms’ global competitiveness (SLGuardian). Meanwhile, China has ramped up its own countermeasures, tightening customs checks on semiconductors and reportedly ordering tech giants like ByteDance and Alibaba to halt Nvidia chip purchases (FT).

Sensei’s Insight: A new era of AI chip nationalism is here—investors should watch how this dual pressure reshapes supply chains and profit margins in the coming quarters.

🚨 SEC Provides Emergency IPO Relief Amid Government Shutdown

The Securities and Exchange Commission issued emergency guidance on October 9 to allow companies to proceed with initial public offerings despite the ongoing government shutdown, which has sidelined roughly 90% of its staff since October 1. Companies can now file registration statements without specific pricing information and still go effective automatically after 20 days, bypassing the usual SEC review process. This workaround leverages Rule 430A and Section 8(a) of the Securities Act and aims to unblock the IPO pipeline frozen by the furlough. Firms such as Navan, Andersen Group, and BitGo—which filed in September—can now move forward with marketing efforts under the new framework (Reuters, Bloomberg).

The SEC emphasized it won’t penalize companies for omitting pricing details in prospectuses filed during the shutdown, but companies must still comply with antifraud laws and remain liable for the accuracy of disclosures. While this temporary guidance keeps the IPO window open in a year that’s already raised $33.4 billion as of October 5, it also shifts regulatory risk to post-listing, as the SEC can still issue stop orders or demand amendments later. Investors could face elevated exposure to misstatements without the traditional review safeguards, creating a delicate balance between capital markets continuity and investor protection (TechCrunch).

Sensei’s Insight: The IPO market dodges a shutdown-induced freeze, but this fast-track path means due diligence now trails the trading bell.

🇪🇺 European Allies Still Funding Putin’s War Machine Despite Ukraine Support

Despite positioning themselves as key backers of Ukraine, several European Union countries have ramped up their Russian energy imports. In the first eight months of 2025 alone, EU member states collectively imported over €11 billion worth of Russian energy. France topped the list with a 40% surge to €2.2 billion, while the Netherlands recorded a 72% spike, hitting €498 million. Belgium, Croatia, Romania, and Portugal also posted sharp increases between 55% and 167%, underscoring the widening disconnect between political posturing and economic action (Reuters).

The contradiction intensifies when looking at totals since the 2022 invasion—€213 billion in Russian energy payments versus €167 billion in aid to Ukraine. Energy giants like TotalEnergies, Shell, Naturgy, and SEFE remain bound by long-term contracts tied to Russia’s Yamal LNG project, some extending into the 2040s. These firms argue that without explicit EU sanctions, they are legally compelled to continue operations, leaving European ports—especially in France, Spain, and Belgium—as redistribution hubs for Russian gas across the continent. This sustained dependency exposes EU energy companies to significant regulatory and reputational risk, even as the bloc aims to fully phase out Russian imports by 2028 (Modern Diplomacy, European Newsroom).

Sensei’s Insight: Watch for escalating EU policy shifts or enforcement actions as public scrutiny mounts. Firms with Russian exposure could face sudden regulatory tightening.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive —Are We Near the Top of the Cycle?

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.