Sensei's Morning Forecast: Trump in UK, Tariff Deals, and AI Chips

Samsung secures Tesla chip deal, US-China rare-earth truce, Starlink controversy, EU-US tariff compromise, Starmer-Trump summit, and the UK deep dive into services-led exports drive.

🧠 One Big Thing

The U.S. and EU just averted a trade war with a 15% tariff deal — cutting the planned U.S. duty in half but still leaving European exporters facing triple the pre-2017 rate, a structural drag on both sides of the Atlantic.

💰 Money Move of the Day

Tariffs can shift market dynamics — historically, companies with strong domestic supply chains have been less exposed to rising trade costs. It’s worth watching how U.S.-centric firms respond compared to global exporters as these tariffs take effect.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $118,670 (▼ -0.65%)

Ethereum (ETH): $3,877 (▲ +0.10%)

XRP: $3.23 (▼ -0.30%)

Equity Indices (Futures):

S&P 500 (SPX): 6,402 (▲ +0.15%)

NASDAQ 100: 23,499 (▲ +0.33%)

FTSE 100: 9,115 (▼ -0.32%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.404% (▲ +0.41%)

Oil (WTI): $66.93 (▲ +1.24%)

Gold: $3,336 (▲ 0.00%)

🕒 Data as of UK (BST): 12:15 / US (EST): 07:15 / Asia (Tokyo): 20:15

✅ 5 Things to Know Today

EU-US Reach 15% Tariff Deal, Averting Transatlantic Trade War

President Donald Trump and EU Commission President Ursula von der Leyen reached a last-minute trade agreement at Turnberry, Scotland, on Sunday, July 27, halving the planned U.S. tariff on European imports from 30% to a flat 15% starting August 1 ( Reuters ). In exchange, the EU pledged $600 billion in new investment in the U.S. and agreed to purchase $750 billion in American LNG and energy products over Trump’s term, along with major orders for U.S. defense equipment ( Bloomberg ). The deal averted a full-blown trade war that could have escalated sharply in August.

The framework exempts key sectors—including aircraft and parts, semiconductor equipment, generic drugs, and certain farm goods—while shifting 50% steel and aluminum tariffs to a quota system pending further negotiations ( Reuters ). The 15% rate, described by U.S. officials as “across-the-board,” is notably harsher than the 10% tariff agreement recently secured by the U.K. ( DW ). Markets reacted positively, with the Euro Stoxx 50 up 1.1% and the euro gaining 0.2% against the dollar early Monday, though the new baseline duty remains triple the pre-Trump average of 4.8%—a potential drag on EU exporters and a source of inflationary pressure in the U.S. ( Telegraph ). Analysts caution tariffs could rise again if Brussels fails to meet its investment and purchasing commitments ( CNBC ).

Sensei’s Insight: A 15% tariff may seem like a win compared to 30%, but it’s still triple pre-2017 levels—an uneasy truce with economic costs baked in.

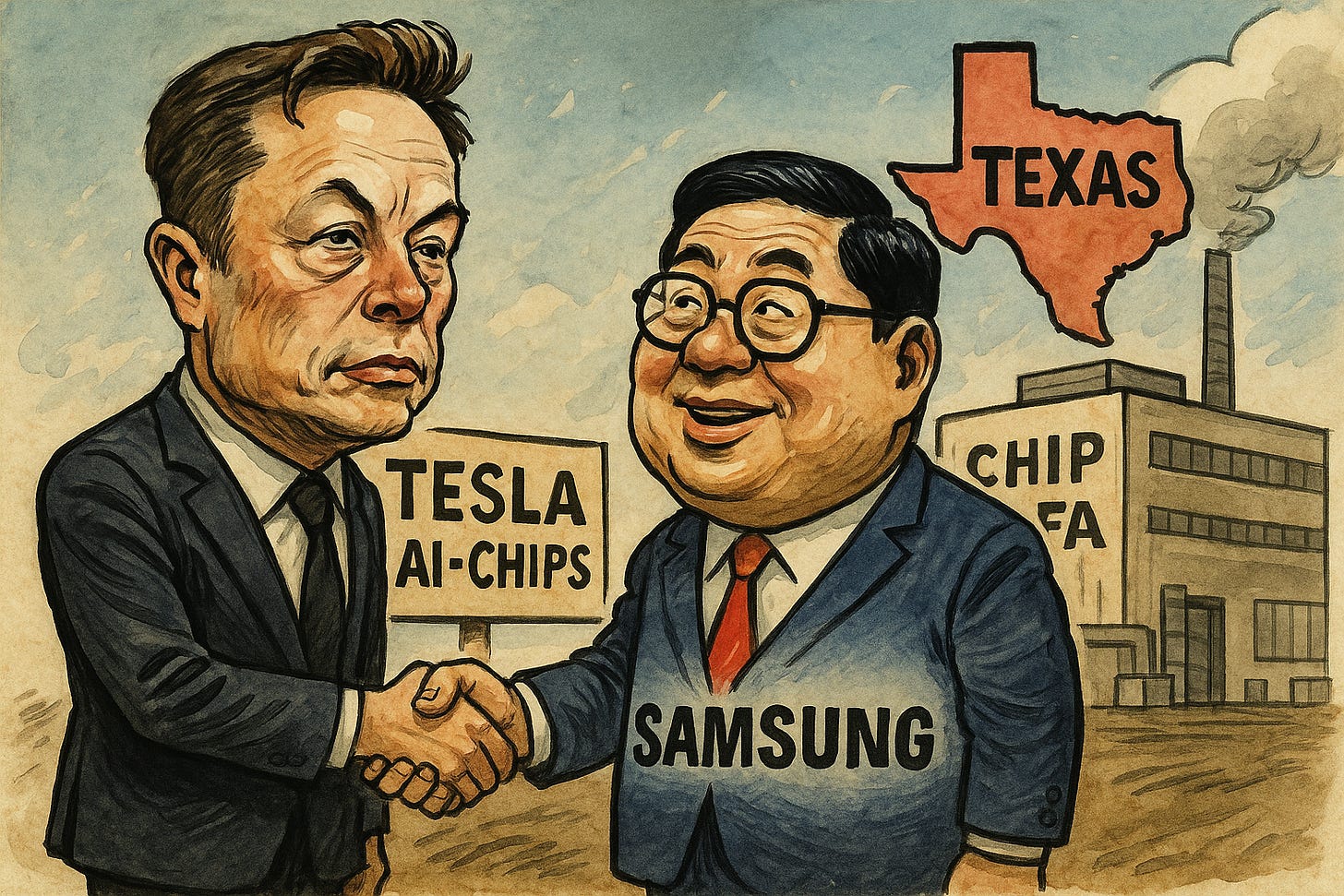

Samsung Snags Tesla AI-Chip Foundry Contract in Texas Fab

Samsung Electronics has secured a landmark $16.5 billion (22.8 trillion won) contract to manufacture Tesla’s next-generation AI6 semiconductor through 2033 (Yahoo Finance). Production will be handled at Samsung’s advanced fab in Taylor, Texas, with volume output set to begin in 2026 (Forbes). Elon Musk called the partnership “hard to overstate” in strategic importance on X, noting that the $16.5 billion figure is “just the bare minimum” with eventual volumes potentially reaching “several times higher” (BusinessKorea). Samsung’s Seoul-listed shares jumped as much as 6.8% on the news (Bloomberg).

The multiyear agreement provides a major boost to Samsung’s struggling foundry business, which has been losing ground to TSMC and recording multiple quarters of operating losses (NDTV Profit). Analysts say the Tesla order could help fill idle capacity and attract new clients to Samsung’s 2nm roadmap (News9Live). For Tesla, the Texas-based chip production strengthens supply-chain resilience, reduces dependence on Asia, and advances vertical integration of its autonomous-driving and robotics silicon stack (Forbes).

Sensei’s Insight: Samsung’s win is more than a revenue boost — it signals a strategic realignment in the semiconductor race. By locking in Tesla as a marquee U.S.-based EV client, Samsung gains credibility at advanced nodes, positioning itself as a formidable challenger to TSMC while leveraging CHIPS Act incentives to expand its U.S. manufacturing footprint.

Starlink Shutdown Order Resurfaces: What Investors Need to Know

Reuters has confirmed that Elon Musk personally ordered a Starlink coverage blackout during Ukraine’s September 2022 Kherson counteroffensive, cutting connectivity to over 100 frontline terminals and stalling critical drone and artillery operations (Reuters). The report, citing internal SpaceX communications and Ukrainian battlefield logs, reveals that on 25 July 2025 Musk directed a senior engineer to “cut coverage” over Kherson, Beryslav, and parts of Donetsk, marking the first documented instance of Musk actively disabling battlefield communications rather than merely declining service extensions (Reuters). Sources suggest Musk acted out of fear of a potential Russian nuclear response—a unilateral decision that shocked SpaceX employees and reignited political scrutiny across the U.S. and Europe.

This disclosure follows a separate 2.5-hour global Starlink outage on 24 July 2025 that disrupted Ukrainian frontline operations (Telegraph). With Starlink expected to generate $11.8 billion in 2025 revenue—$3.0 billion of which is tied to U.S. government contracts (Analysys Mason)—the concentration of control in a single individual underscores significant geopolitical and regulatory risk. Investors are watching closely for Pentagon reviews, potential contract stipulations to ensure continuity of service, and any ripple effects on a potential Starlink IPO or spin-off valuation.

Sensei’s Insight: Musk’s unilateral control over Starlink now represents a clear “key-man risk” for both national security and investors. Expect contract renegotiations and regulatory probes aimed at reducing single-point failure exposure—a theme likely to weigh on Starlink’s valuation narrative moving forward.

Starmer–Trump Summit: Trade & Geopolitical Stakes

UK Prime Minister Keir Starmer’s meeting with US President Donald Trump at Turnberry today could determine the trajectory of transatlantic trade for the rest of 2025. Central to the talks is the Economic Prosperity Deal (EPD), a supplemental framework to the existing US-UK tariff pact. London is pushing for the removal of the 25% duty on UK steel, which remains at 25% following the 9 July review but could still double to 50% if no deal is finalized before Q4, while also seeking to keep aerospace parts at 0% and shield pharmaceuticals from possible Section 232 tariffs (BBC, Commons Library, Gov.uk). Automakers are lobbying to raise the current 100,000-vehicle quota that faces a 10% tariff, as any exports above that threshold are hit with a 25% duty—threatening profit margins for Jaguar Land Rover, Mini, and Nissan UK (CNBC, White House).

The summit also carries geopolitical weight. Starmer will urge Trump to press Egypt, Qatar, and Israel for a 60-day Gaza ceasefire, arguing that the US has “real leverage” via security aid and UN veto power (Telegraph, Reuters). A breakthrough could reduce Middle East risk premiums embedded in Brent crude prices and defense sector valuations. Conversely, failure to secure an agreement could see tariffs escalate, especially on steel, while ongoing Section 232 probes into pharmaceuticals remain a potential shock risk for AstraZeneca and GSK. With Q4 2025 targeted for a binding EPD text, today’s outcome will be critical for trade flows, corporate earnings, and investor positioning (TwoBirds, Hogan Lovells).

Sensei’s Insight: This summit is a binary event for UK steel and auto stocks—expect sharp moves if tariff terms shift. A ceasefire breakthrough would also have knock-on effects in energy and defense markets.

U.S.–China Trade Deal Restarts Rare-Earth Flow, Tariff Truce Faces August Deadline

Beijing and Washington formalized a limited trade accord on 27 June, aiming to cool months of tariff tensions. China’s Commerce Ministry agreed to accelerate export licenses for restricted rare-earth minerals and magnets, while the U.S. responded by easing select technology-export curbs (CNBC; CNN). The impact was immediate: Chinese rare-earth magnet shipments to the U.S. soared to 353 tons in June, a staggering 660% month-on-month surge (Reuters).

However, the broader tariff wall remains largely intact. The U.S. continues to impose an effective 55% duty on most Chinese imports—10% “reciprocal,” 20% fentanyl-related, and 25% legacy charges—while China maintains a 10% counter-tariff (Reuters). Treasury Secretary Scott Bessent and Vice-Premier He Lifeng open talks in Stockholm today to extend the 90-day tariff truce, which otherwise expires on 12 August, with reports pointing to a likely 90-day extension (CNBC; SCMP). For investors, while restored rare-earth access provides short-term relief for EV, defense, and semiconductor supply chains, the narrow scope of the deal keeps policy risk elevated. A failure to renew the truce before the August deadline would trigger a tariff snapback to triple-digit levels, fueling cost inflation, margin pressure, and supply-chain rerouting, especially for auto suppliers, advanced-materials firms, and multinationals heavily tied to China (Reuters; Reuters).

Sensei’s Insight: Rare-earth flows may be restored, but the tariff clock is ticking. Watch for volatility in EV and defense stocks as the 12 August deadline looms.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: The UK’s Export Puzzle – Goods Collapse, Services Surge

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.