Sensei's Morning Forecast: Trump’s $1T Tech Blitz Meets Ethereum Whale Frenzy Whilst Wages Loom

Explore Silicon Valley’s multi‑trillion AI pledges, tariff pivots, Tether’s gold shift, Aptera’s Nasdaq leap, Ethereum whale ramp‑up—and how wage and payroll data could sway September’s rate‑cuts.

👀 Today’s Key Stories at a Glance

🇺🇸 Trump Secures $1.4T in U.S. Tech Investments

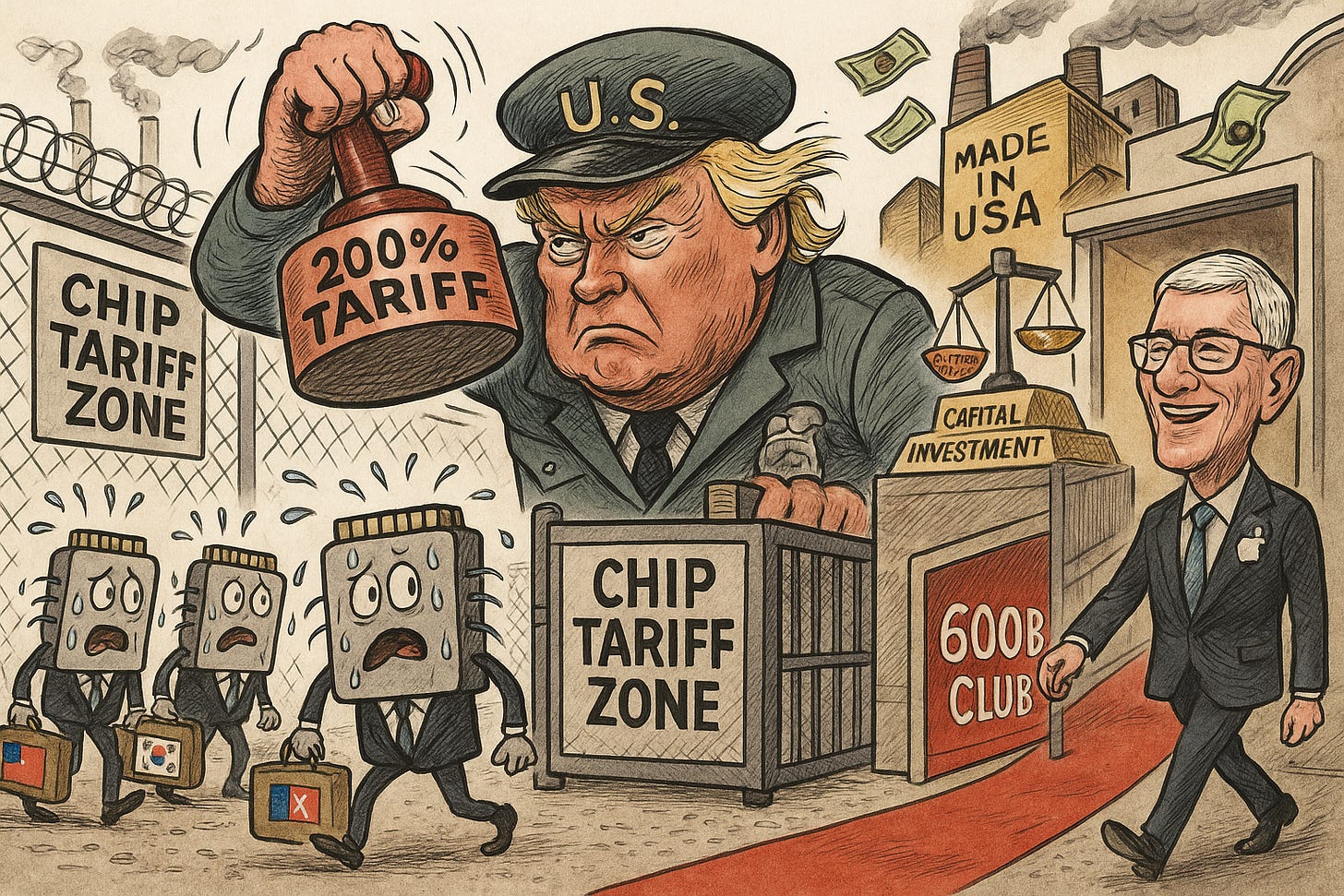

Trump won $600B+ each from Apple and Meta, plus billions from Google and Microsoft, to bolster U.S. AI.🔧 Semiconductor Tariffs Incoming, Exemptions for U.S. Investors

Trump to hit foreign chip imports with steep tariffs—but exempts firms building in the U.S. like Apple, TSMC.🪙 Tether Bets Big on Gold After $5.7B Profit Surge

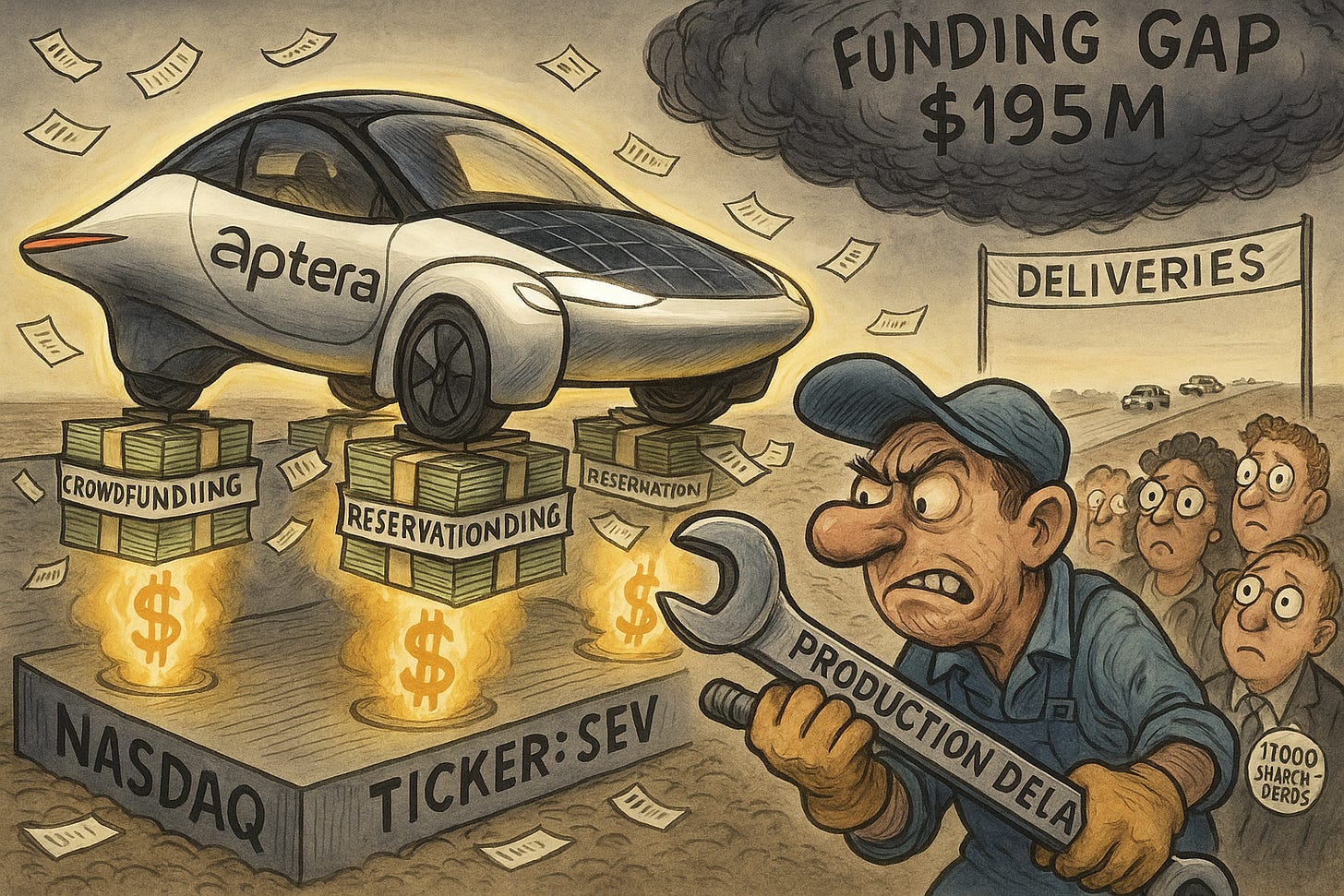

Tether pivots into gold mining and royalties, seeking real-asset backing as regulators eye stablecoin reserves.🚗 Aptera Files for Nasdaq Direct Listing Despite No Revenue

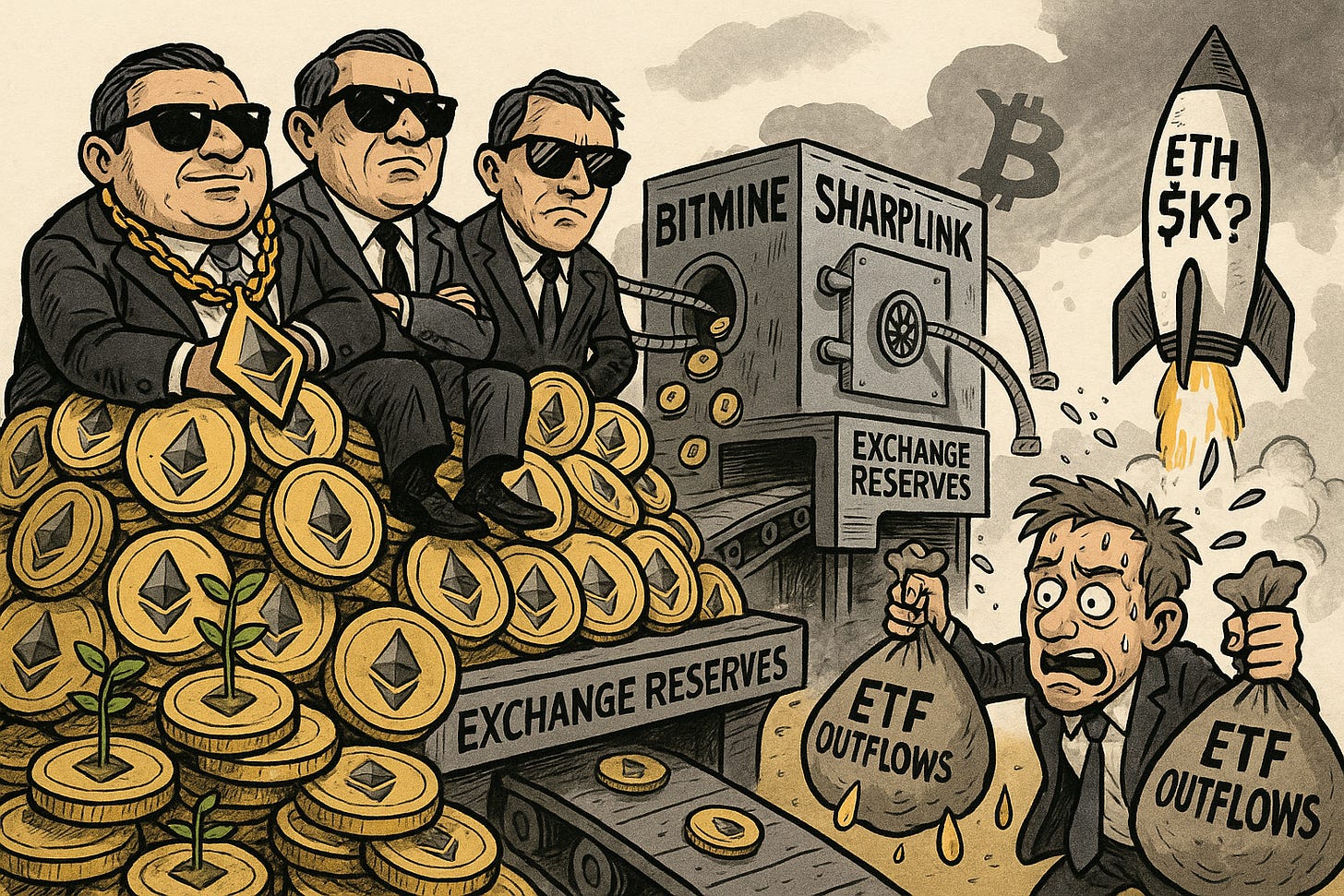

Solar EV startup Aptera plans to go public via direct listing, but production delays and funding gaps loom.🐋 Ethereum Whales Fuel 200% Rally as Treasuries Pile In

ETH surges as whales and corporate treasuries scoop up billions—draining exchange supply and lifting prices.📉 Labor Data Could Make or Break September Rate Cut Odds

Wage growth sets the inflation tone; job creation seals the path—today’s combo could shake markets hard.

🧠 One Big Thing

3.7% — that’s the consensus year-on-year wage growth expected in today’s jobs report. It’s the one number that could tilt the entire market’s view on inflation, rate cuts, and risk appetite before lunchtime.

💰 Money Move of the Day

Watch how markets react to payrolls and wages—not just the headlines. Learning how asset classes behave in response to macro data is one of the cleanest ways to sharpen your strategy, whether you're trading or just trying to better time long-term buys.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $112,394 (▲ +1.46%)

Ethereum (ETH): $4,422 (▲ +2.83%)

XRP: $2.85 (▲ +1.80%)

Equity Indices (Futures):

S&P 500 (SPX): 6,514 (▲ +0.20%)

NASDAQ 100: 23,799 (▲ +0.55%)

FTSE 100: 9,243 (▲ +0.16%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.157% (▼ -0.10%)

Oil (WTI): $63.48 (▼ -0.42%)

Gold: $3,549 (▲ +0.06%)

🕒 Data as of UK (BST): [12:33] / US (EST): [07:33] / Asia (Tokyo): [20:33]

✅ 5 Things to Know Today

🇺🇸Trump Courts Silicon Valley With $600 Billion Investment Promises

President Trump hosted top tech executives at the White House on Thursday, securing unprecedented domestic investment pledges aimed at reinforcing U.S. dominance in artificial intelligence. Meta CEO Mark Zuckerberg and Apple’s Tim Cook each committed to $600 billion in U.S.-based investments. Google’s Sundar Pichai pledged $250 billion over two years, while Microsoft’s Satya Nadella confirmed annual spending between $75–80 billion. The event, originally planned for the Rose Garden but relocated indoors due to weather, took place in the State Dining Room and brought together top industry figures including OpenAI’s Sam Altman, Google co-founder Sergey Brin, and Microsoft co-founder Bill Gates. Elon Musk, once a vocal Trump supporter, was notably absent following a public fallout with the administration earlier this year. Trump praised the group as “high IQ people” and went around the room demanding hard investment figures rather than focusing on technical discussions (Reuters, Bloomberg).

The dinner emphasized a growing alignment between Trump's policy platform and Silicon Valley’s strategic interests, particularly in AI infrastructure and U.S.-based manufacturing. Trump promised streamlined energy permitting and floated “fairly substantial” semiconductor tariffs, signaling that companies like Apple may gain tariff exemptions in exchange for domestic production commitments. This $1.4 trillion wave of pledged capital could reshape global tech supply chains and generate ripple effects across construction, energy, and chip sectors. For investors, the pivot to homegrown AI infrastructure points to an inflection point in the race for tech supremacy—backed not just by code but by capital (Yahoo Finance, CNBC).

Sensei’s Insight: Trump’s investment-first posture transforms tech policy into a capital contest. This isn’t just about AI leadership—it’s about who’s putting real dollars on the table.

🔧Trump to Impose 'Fairly Substantial' Semiconductor Tariffs

President Trump confirmed plans to impose “fairly substantial” tariffs on semiconductor imports “very shortly,” while exempting companies investing in domestic manufacturing. At a White House dinner with tech executives, Trump indicated that the tariffs would target firms “that aren’t coming in,” while sparing those with U.S. production commitments. Apple CEO Tim Cook, present at the event, was said to be “in pretty good shape” due to Apple’s pledged $600 billion domestic investment over four years (Reuters, CNBC). Trump previously floated the idea of tariffs as high as 200–300%, up from the initial 100% threat made in August. Leading semiconductor firms such as Taiwan’s TSMC (with a $165 billion U.S. investment), South Korea’s Samsung, and SK Hynix have secured exemptions through substantial American manufacturing commitments.

The exact implementation date remains unclear, but Trump hinted the tariffs could arrive “within weeks rather than months.” The policy is being enabled through ongoing Section 232 national security investigations, providing legal backing for trade barriers on semiconductor imports (Al Jazeera, Supply Chain Dive). These tariffs mark a pivotal shift in global chip supply chains, favoring firms with deep pockets capable of meeting U.S. capital allocation demands. While accelerating America’s chip independence, the policy risks sidelining smaller companies unable to absorb steep 100–300% import duties. Analysts caution that implementation timelines and exemption criteria will shape the winners and losers of this strategic industrial pivot (Channel News Asia).

Sensei’s Insight: Capital commitment, not competition, is the new gatekeeper in the semiconductor race.

🪙 Tether Eyes Gold Amid Record $5.7B Profit Surge

Tether, the issuer of USDT and operator of $8.7 billion in gold reserves, is actively pursuing investments across the gold supply chain, including mining, refining, trading, and royalty firms, according to the Financial Times. The move follows a massive $5.7 billion in profits during H1 2025. CEO Paolo Ardoino described gold as a “natural Bitcoin,” highlighting it as a complementary asset to BTC. Tether already offers Tether Gold (XAU₮), a token backed by physical gold, with a market cap near $880 million (CryptoBriefing).

The company took a major step in June by acquiring a 33.7% stake in Elemental Altus Royalties for $105 million and holds an option to increase its stake to 47.7% (Elemental Altus). Tether has since pledged another $100 million as Elemental merges with EMX Royalty to form Elemental Royalty Corp (Yahoo Finance). While talks with other companies like Terranova Resources haven’t led to deals, Tether’s pivot into royalty financing marks a significant diversification away from its $127 billion in US Treasury holdings—making it the 18th largest holder globally (Tether). However, with impending EU and US stablecoin regulations, the firm may soon face legal challenges over gold-backed reserves.

Sensei’s Insight: Crypto meets commodities as Tether leverages digital profits to go long on hard assets—just as regulators circle with new stablecoin rules.

🚗 Aptera Motors Pursues Nasdaq Direct Listing as Solar EV Production Timeline Shifts

Aptera Motors has filed an S-1 registration with the SEC for a direct listing on Nasdaq under the ticker symbol “SEV,” allowing up to 31.7 million existing shares to be sold by current shareholders. The solar electric vehicle startup, still pre-revenue, has raised $135 million from more than 17,000 equity crowdfunding investors and holds close to 50,000 reservations—representing $1.7 billion in potential future revenue. Aptera showcased its production-ready three-wheeled SEV at CES 2025, offering up to 400 miles of range and 40 miles of daily solar charging. The direct listing structure bypasses traditional IPO methods, enabling liquidity for existing shareholders without raising new capital.

Despite high interest, Aptera has adjusted its production outlook, now aiming to deliver only 60 customer vehicles in 2025 while seeking an additional $60 million to initiate low-volume production. Full-scale annual output of 20,000 units will require about $195 million more in funding. Execution risks remain elevated due to regulatory hurdles, a lack of commercial revenue, and the need to convert reservations into profitable deliveries. However, the listing offers a path to public market exposure while spotlighting Aptera’s ambitious vision for solar-integrated vehicle efficiency.

Sensei’s Insight: Aptera’s bold move into public markets without revenue highlights the evolving paths to EV commercialization—but its success now rides on proving it can actually build what it’s promised.

🐋Ethereum Whale Accumulation Drives 200% Rally Amid Corporate Treasury Surge

Ethereum whales holding between 1,000 and 100,000 tokens have grown their holdings by 14% over the past five months, accumulating 5.54 million ETH worth $24.2 billion since April’s yearly low of $1,472. This sustained accumulation aligns with Ethereum’s 200% rally to current levels near $4,366 (Cointelegraph). Alongside whales, corporate treasuries have become powerful market drivers. BitMine Immersion Technologies, led by Fundstrat’s Tom Lee, now holds 1.87 million ETH valued at $8.1 billion, the largest corporate Ethereum treasury. SharpLink Gaming follows with 837,230 ETH worth $3.6 billion, bringing combined corporate holdings to nearly $15.83 billion—or 2.97% of Ethereum’s total supply (CryptoBriefing; Coinlaw).

At the same time, exchange reserves have dropped to three-year lows at 17.4 million ETH, down 38% from 2022 peaks, signaling a supply squeeze as institutional buyers continue to withdraw tokens from trading platforms (Cointelegraph). This dynamic comes despite $338 million in ETF outflows across three consecutive days in early September (Crypto.News). The pattern mirrors Bitcoin’s 2020 corporate adoption cycle but with Ethereum’s added staking yields, positioning ETH as both a store of value and productive asset. With resistance forming near $4,500, traders are watching whether continued accumulation can drive a push toward $5,000 (Cointelegraph).

Sensei’s Insight: Ethereum’s dual momentum—from whales and corporate treasuries—creates an institutional “floor” under price action. If this structural demand holds, ETH could outpace Bitcoin’s past adoption cycle by coupling scarcity with staking-driven returns.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Wages Set the Tone, Jobs Seal the Deal: How Today’s Labor Data Could Reshape Rate Expectations

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.