Sensei's Morning Forecast: Trump’s Fed Clash (Again), ETFs Eclipse Stocks, BTC Flows to ETH, Saylor in Spotlight

Fed independence under fire, ETFs surpass stocks, Trump escalates digital tax fight, crypto rotates to Ethereum, Saylor faces scrutiny, and U.S.–Russia energy overtures stir uncertainty.

👀 Today’s Key Stories at a Glance

🇺🇸 Trump Tries to Fire Fed Governor Cook: Trump’s unprecedented move threatens Fed independence, risking legal chaos and market confidence in U.S. monetary policy.

📊 ETFs Outnumber U.S. Stocks: ETFs now outnumber stocks for the first time, reflecting shifting investor behavior and market structure transformation.

🇺🇸 Trump Targets Digital Taxes with Tariffs: Trump threatens tariffs and chip export curbs over digital taxes, escalating global tech trade tensions.

🪙 Bitcoin Drops as Capital Rotates to Ethereum: Bitcoin hits 7-week low amid $930M in liquidations, with institutional capital shifting into Ethereum ETFs.

🇺🇸🤝🇷🇺 Energy Proposals in U.S.–Russia Peace Talks: Speculative talks hint at energy concessions for sanctions relief, but remain unverified and diplomatically fragile.

🧠 One Big Thing

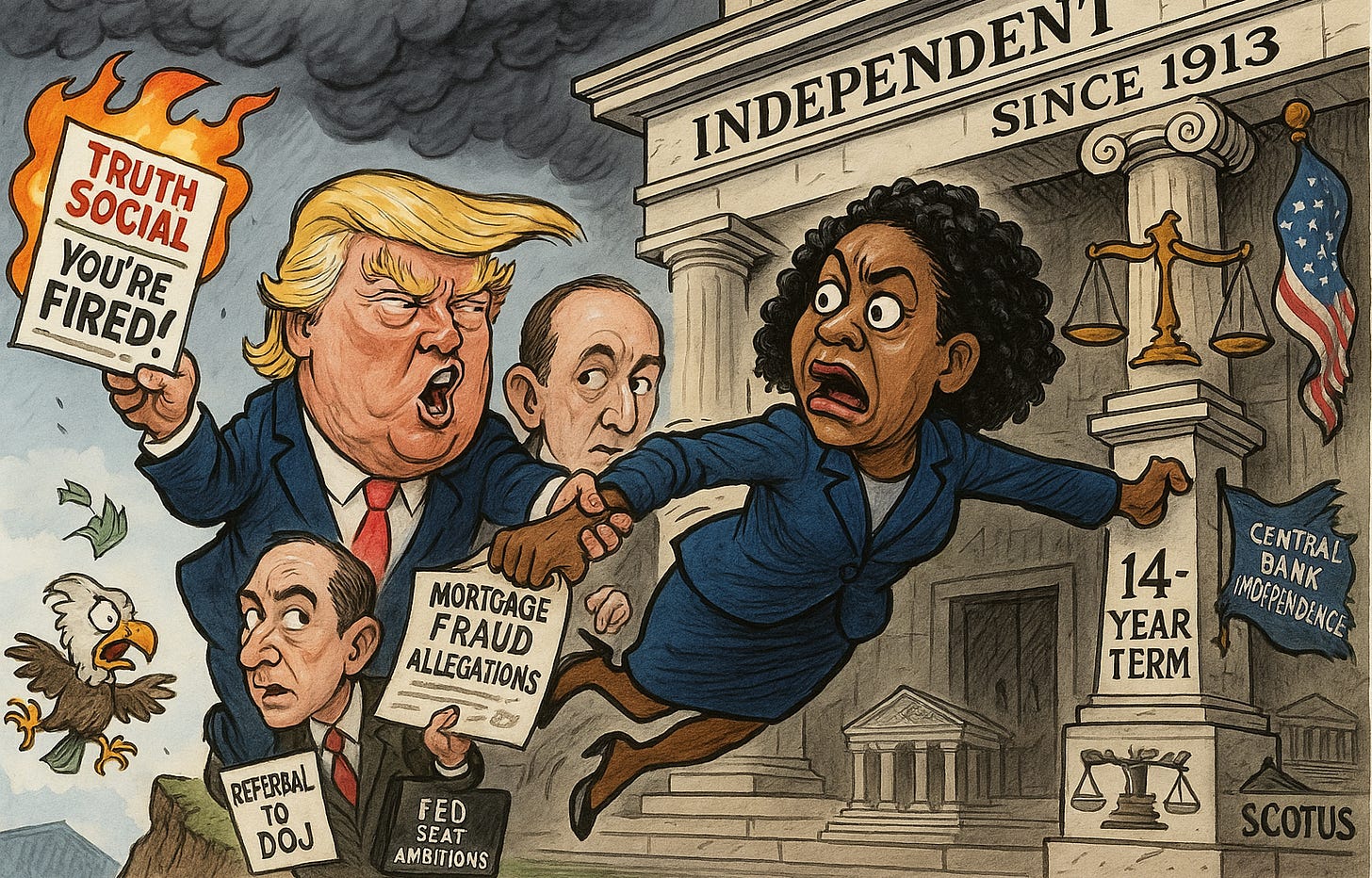

Trump’s unprecedented attempt to fire Fed Governor Lisa Cook could mark the first major political intervention in the central bank’s leadership in over a century—potentially upending 111 years of Federal Reserve independence.

💰 Money Move of the Day

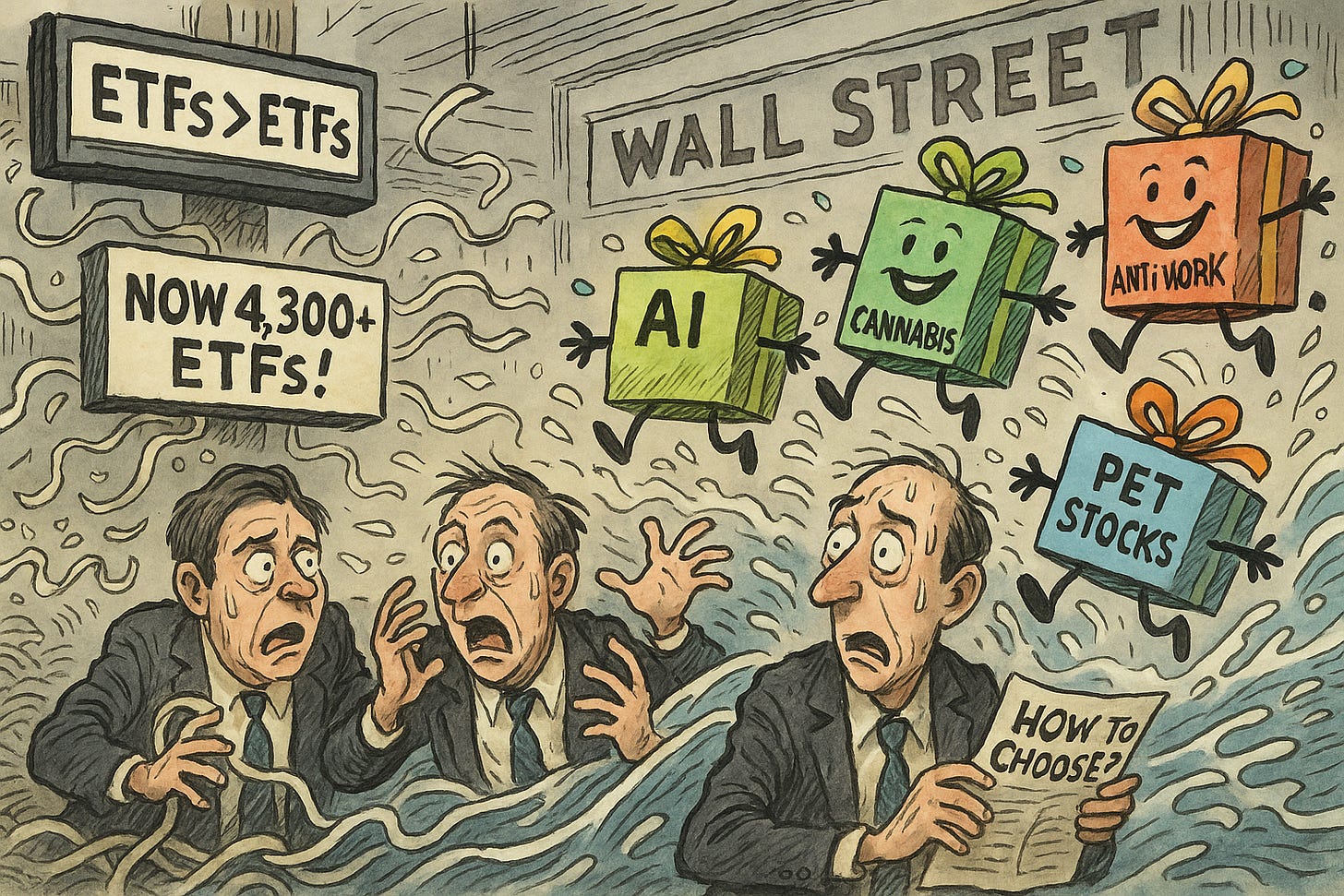

The explosion of ETFs—now outnumbering individual U.S. stocks—highlights a shift in investor behavior toward thematic diversification. While more choice can be powerful, having a simple, written plan helps cut through the noise and avoid decision overload.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $104,890 (▲ +0.09%)

Ethereum (ETH): $2,608 (▲ +2.02%)

XRP: $2.20 (▲ +1.81%)

Equity Indices (Futures):

S&P 500 (SPX): 5,972 (▼ -0.11%)

NASDAQ 100: 21,725 (▼ -0.02%)

FTSE 100: 8,817 (▼ -0.66%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.339% (▲ +0.42%)

Oil (WTI): $62.93 (▼ -1.68%)

Gold: $3,396 (▲ +0.30%)

🕒 Data as of UK (BST): 12:08 / US (EST): 07:08 / Asia (Tokyo): 20:08

✅ 5 Things to Know Today

🇺🇸 Trump Tries to Fire Fed Governor Lisa Cook, Sparking Legal Showdown

President Trump ignited a historic confrontation over the Federal Reserve's independence by announcing the immediate removal of Governor Lisa Cook, citing unproven allegations of mortgage fraud. Cook, the first Black woman on the Fed Board and a Biden appointee with a term ending in 2038, swiftly rejected the dismissal as illegal, arguing through her attorney that Trump lacks the authority to fire a sitting Fed governor "for cause" under existing law. Trump’s accusation, posted on Truth Social, claims Cook misrepresented multiple properties in Michigan and Georgia as primary residences to secure favorable loan terms. The allegations originated from a criminal referral filed by Federal Housing Finance Agency Director Bill Pulte, who urged Attorney General Pam Bondi to investigate. While a Justice Department probe is underway, no charges have been filed, and Cook continues her official duties amid the unprecedented attempt to remove her.

If successful, Trump would gain a four-member majority on the Fed’s seven-person board, fundamentally altering the institution’s leadership. Coupled with his nomination of economic adviser Stephen Miran to another vacant seat, the board would have Trump-aligned control over regulatory frameworks, budgeting, and appointments of regional bank presidents. Although the 12-member Federal Open Market Committee would still determine interest rates, analysts warn that Trump’s move could dismantle long-standing Fed independence, a risk that has already rattled markets and weakened the dollar. Legal experts expect a drawn-out battle that could ultimately reach the Supreme Court, as scholars debate whether the president can legally remove a Fed governor—something never before attempted in the institution’s 111-year history.

Sensei’s Insight: The attempted firing isn’t just about Cook—it’s a seismic test of the Fed’s independence, with global markets now watching whether U.S. monetary policy will remain insulated from political control.

📊 ETFs Now Outnumber Individual US Stocks for First Time

The U.S. ETF market has reached a historic milestone, with more than 4,300 exchange-traded funds now exceeding the approximately 4,200 individual stocks listed on American exchanges. This is the first time ETFs have outnumbered individual equities since comprehensive record-keeping began, based on Bloomberg data compiled via Morningstar. Back in 2010, there were just 1,100 ETFs versus 4,300 stocks—underscoring a remarkable 15-year transformation in market structure. In 2025 alone, over 640 new ETFs have launched through August, averaging four new listings per trading day and already accounting for 80% of 2024’s full-year global total of 878, as reported by Trustnet.

The ETF boom reflects both market innovation and changing investor behavior. ETFs now span themes from AI and cannabis to pets and “anti-work” portfolios, highlighting an explosion in investor choice—and complexity. While their proliferation has democratized access to institutional-grade strategies and lowered costs, analysts warn of a growing "paradox of choice" that can overwhelm less experienced investors. The pivot from individual stock-picking to packaged products continues to reshape the financial landscape, with ETF assets surpassing $10 trillion in the U.S. market, according to ETFdb.

Sensei’s Insight: The surge in ETF offerings is rewriting the playbook—investing is no longer just about picking winners but choosing the right package of winners.

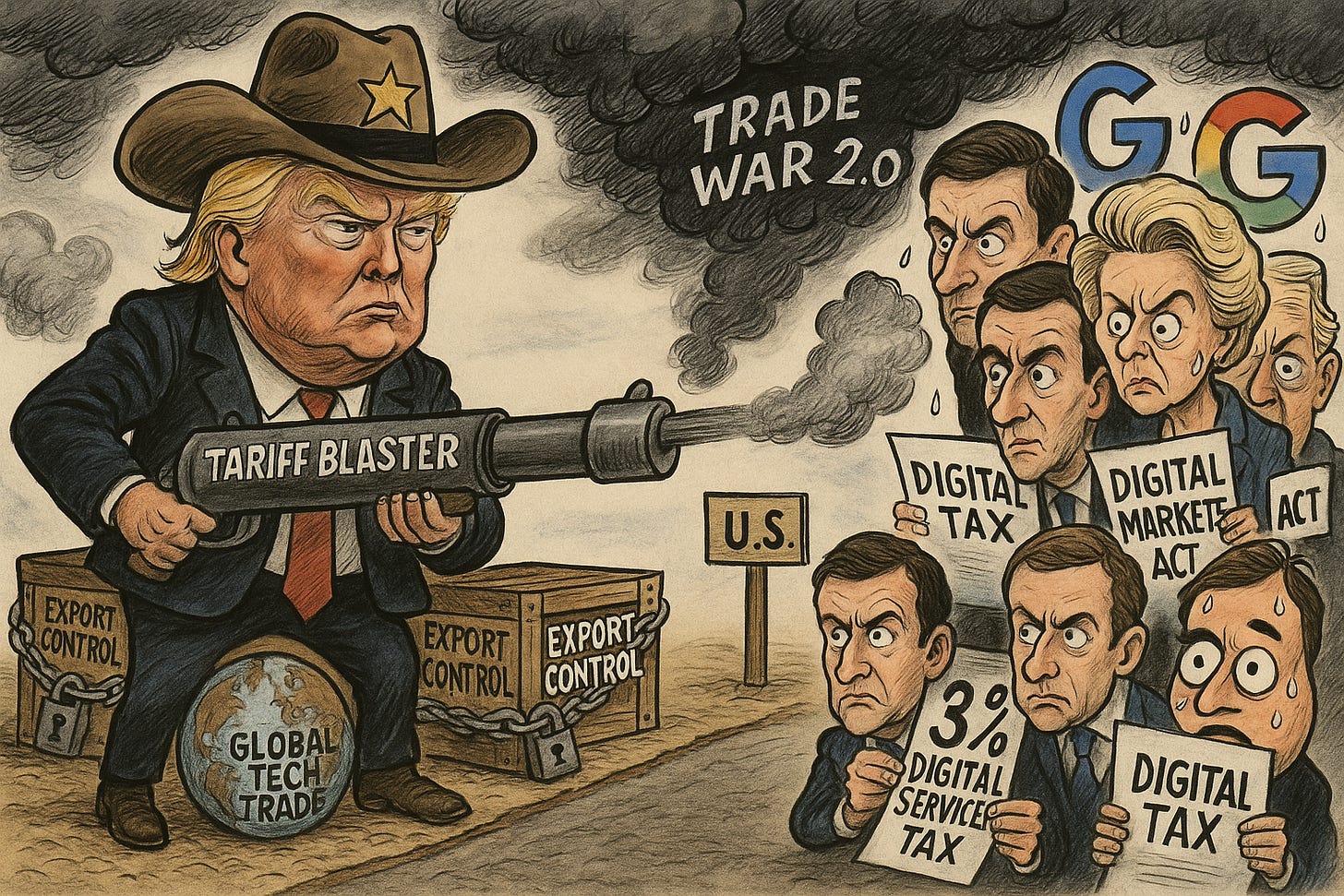

🇺🇸 Trump Vows Export Curbs, Tariffs in Digital Tax Reprisal

President Donald Trump issued a blunt threat on Monday to impose “substantial additional tariffs” and export restrictions on advanced technology and semiconductors targeting nations that maintain digital services taxes aimed at U.S. tech firms. He labeled such taxes, along with digital markets and digital services legislation, as “discriminatory” and accused them of unfairly favouring Chinese tech giants. The move follows a recent U.S.–EU agreement not to apply customs duties on electronic transmissions, though the EU emphasised that its Digital Markets Act and Digital Services Act remain non-negotiable. Existing digital taxes include the UK’s 2% levy, France’s 3% tax which generated €680 million in 2023, and Spain’s version that raised €303 million. Canada abruptly suspended its own digital tax plans just hours before implementation following Trump’s pressure.

The threat of semiconductor export restrictions adds new urgency given the U.S.’s lead in advanced chip manufacturing and equipment. This escalation may ignite broader trade conflict and affect companies like Amazon, Alphabet (Google), and Meta (Facebook), who currently bear the brunt of digital tax regimes. A global 3% digital services tax could cost U.S. firms up to $23 billion annually and cut U.S. federal revenues by as much as $5 billion, according to industry analysis. For investors, this presents high-stakes risks for affected tech firms and potential upside in domestic chipmakers and automation firms as reshoring accelerates in response to the mounting trade friction.

Sensei’s Insight: A direct shot across the bow—this isn’t just tax talk; it’s a strategic pivot that could redraw global tech supply chains and supercharge U.S. semiconductor reshoring.

🪙 Bitcoin Hits Seven-Week Low as Crypto Capital Rotates Into Ethereum

Bitcoin fell to a seven-week low of $108,719 during Asian trading hours on Tuesday, August 26, marking a 7% decline from the August 19 peak above $117,000. The sell-off followed Federal Reserve Chair Jerome Powell’s dovish Jackson Hole remarks but was largely triggered by a whale transaction involving 24,000 BTC worth $2.7 billion, which ignited over $930 million in liquidations across exchanges (Bloomberg, MEXC). As of 08:00 UTC on August 26, total crypto market capitalization had dropped by $205 billion to approximately $2.2 trillion. Bitcoin was down 3.2% to around $109,826, while Ethereum took a sharper hit, declining 5–8% from recent highs near $4,700 to approximately $4,400. The liquidation cascade impacted over 205,000 traders, with Ethereum accounting for $320 million in forced unwinds compared to Bitcoin’s $277 million. Altcoins including Solana, XRP, and Dogecoin posted losses between 6–8% during the same trading window (CoinCentral, CryptoPotato).

Despite Powell’s rate-cut signals, investor sentiment appears to be rotating sharply toward Ethereum. As of August 25, Ethereum ETFs had absorbed $2.5 billion in inflows for the month, while Bitcoin ETFs posted $1 billion in outflows, pushing Bitcoin's dominance to 59.3%—down notably from earlier August levels (Cointelegraph). Spot Ethereum ETF inflows now exceed the network’s total issuance since the Merge, signaling a structural reallocation of institutional capital (Forklog). Analysts warn that Bitcoin's $105,000 level has become a critical technical support; breaching it could accelerate losses toward the $92,000–$100,000 zone (FX Leaders). Seasonal trends compound this risk—Bitcoin and Ethereum have averaged 3.77% and 6.42% monthly declines, respectively, during September over the past five years.

Sensei’s Insight: Ethereum’s breakout isn't just price action—it reflects a reprogramming of institutional strategy. The capital isn't just moving, it's committing.

🇺🇸🤝🇷🇺 Energy Proposals Floated in US-Russia Peace Framework Talks

During recent backchannel Ukraine peace discussions, US and Russian officials reportedly floated potential energy-related proposals aimed at incentivizing negotiations. According to multiple sources, including Reuters, ideas under informal consideration included Exxon Mobil possibly reclaiming its 30% stake in the $4.6 billion Sakhalin-1 project—expropriated by Russia in 2022—and loosening restrictions to allow US equipment sales to Russia’s heavily sanctioned $21.3 billion Arctic LNG 2 development. These speculative discussions are said to have occurred during a visit to Moscow by US Special Envoy Steve Witkoff and in the context of a proposed August 15 summit between Trump and Putin in Alaska. President Putin signed a decree that same day outlining conditions under which foreign investors might regain access to Sakhalin-1, contingent on progress toward sanctions relief (AINvest). There is no independent confirmation of a Witkoff-Putin meeting, nor verified evidence that the Alaska summit took place or that formal negotiations on these deals are underway.

These floated proposals align with what appears to be a broader US strategy of pairing economic incentives with potential sanctions relief to accelerate a negotiated end to the war. However, implementing any such measures would require dismantling key sanctions that have successfully choked off critical Russian energy infrastructure. Arctic LNG 2 remains paralyzed by equipment shortages and shipping constraints (Wood Mackenzie), while Russia’s domestic gasoline prices have spiked 38–49% amid sustained refinery attacks and export limits (CNN). Any sanctions rollback—especially in exchange for unverified concessions—could embolden similar tactics in future conflicts, weakening Western deterrence and inadvertently bolstering Russia’s wartime financing capabilities.

Sensei’s Insight: With no confirmed meetings or finalized deals, these floated proposals should be treated cautiously. They suggest strategic intent but remain speculative and unverified.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

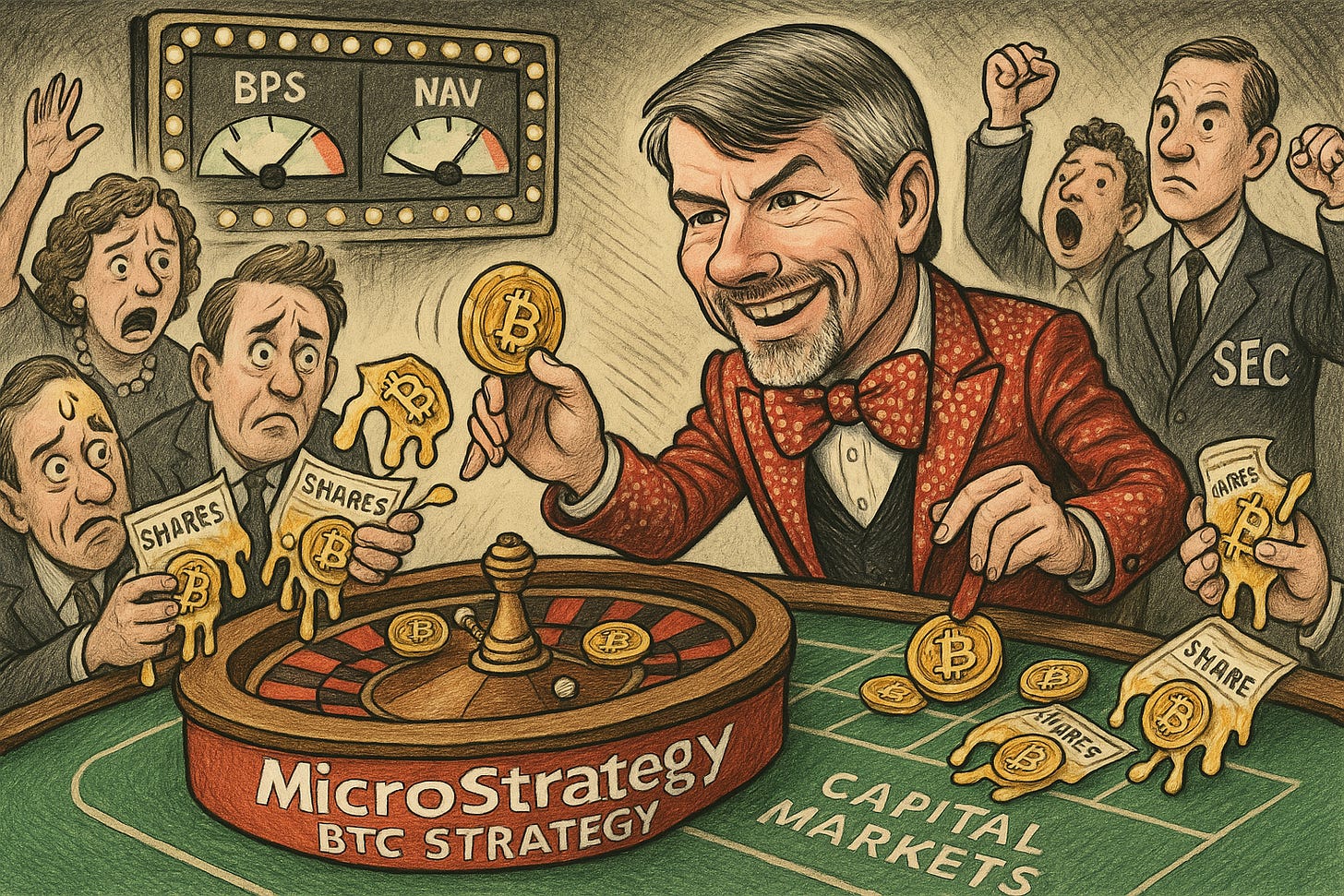

🔍 Deeper Dive: Genius or Gambler? The Truth About Saylor & His BTC Strategy

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.