Sensei’s Morning Forecast: UK Budget Pressure, Taiwan Chip Risk, SMCI’s Earnings Miss

UK faces £51B shortfall, Taiwan chips under threat, OpenAI eyes $500B, oil jumps, directors flee taxes, and SMCI trims AI revenue forecast amid rising competition.

🧠 One Big Thing

The UK faces a £51 billion fiscal black hole, forcing Chancellor Rachel Reeves into a high-stakes balancing act between keeping tax promises, funding public services, and calming bond markets.

💰 Money Move of the Day

In uncertain economic climates, consider reviewing your exposure to interest rate and inflation-sensitive assets. Understanding how your portfolio reacts to policy shifts can help you prepare—not predict—for the next market move.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $114,206 (▲ +0.07%)

Ethereum (ETH): $3,625 (▲ +0.36%)

XRP: $2.95 (▼ -0.38%)

Equity Indices (Futures):

S&P 500 (SPX): 6,314 (▲ +0.26%)

NASDAQ 100: 23,166 (▲ +0.15%)

FTSE 100: 9,157 (▲ +0.02%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.239% (▲ +0.74%)

Oil (WTI): $66.87 (▲ +1.66%)

Gold: $3,364 (▼ -0.48%)

🕒 Data as of UK (BST): 12:20 / US (EST): 07:20 / Asia (Tokyo): 20:20

✅ 5 Things to Know Today

🇬🇧 UK Chancellor Faces £51 Billion Fiscal Black Hole

Chancellor Rachel Reeves is confronting a staggering £51 billion shortfall that threatens to break her fiscal rules, according to the National Institute of Economic and Social Research (AInvest, SSBCrack News, Upday). The gap stems from weaker-than-expected growth, elevated borrowing costs, and costly U-turns on welfare reforms that were intended to save £5.5 billion annually (ITV, University of Birmingham). NIESR projects Reeves will miss her stability rule—requiring day-to-day spending to match tax revenue—by £41.2 billion in 2029-30. Adding the need to replenish her £9.9 billion fiscal buffer brings the total shortfall to £51 billion (Business Matters).

To close the gap, the think tank warns income tax rates for both basic and higher earners would need to rise by five percentage points—measures that would break Labour’s manifesto pledge not to raise taxes on working people. NIESR describes an “impossible trilemma”: meeting fiscal rules, honoring spending commitments, and keeping tax promises simultaneously. Reeves may face some of the largest tax hikes in a generation at the autumn budget, just as UK gilt yields remain elevated above other G7 nations (Sky News), limiting borrowing flexibility and forcing tough decisions on the size and scope of government spending.

Sensei’s Insight: Reeves isn’t just juggling three balls—she’s doing it on a tightrope, in high winds, with markets watching her every move.

Emerging-Market Stocks Fall on Chips Tariff Threat, Taiwan Probe

Emerging-market equities slid Wednesday as U.S. President Donald Trump warned that semiconductor tariffs could be announced “within the next week or so,” shaking chip stocks across Asia Pacific (Bloomberg, Action Forex). Taiwan’s TAIEX dropped 0.90% to 23,447.36, with turnover at NT$349.92 billion ($11.68B) (Focus Taiwan). Losses were led by semiconductor shares after authorities detained three TSMC employees for allegedly stealing trade secrets tied to advanced 2-nanometer chip technology (CNN, Focus Taiwan).

Taiwan took the hardest hit, with TSMC shares down 2.17% following a 2.73% drop in U.S. ADRs (CNBC), accounting for ~200 points of the TAIEX decline. United Microelectronics fell 1.69% to NT$40.70, and Nanya Technology lost 2.36% to NT$43.35 (Focus Taiwan). Pressure spread to South Korean chipmakers and Japanese equipment firms (Reuters). The selloff reflects mounting geopolitical and operational risks: Trump’s Section 232 semiconductor probe could impose tariffs exceeding the existing 20% levy on Taiwan (Techovedas), while Taiwan—holding over 60% of global foundry capacity and exporting ICT products as 70%+ of its U.S. trade—faces a major economic blow if chips are targeted (Focus Taiwan).

Sensei’s Insight: This is a textbook case of how geopolitics and supply chain security can double-team a sector. With Taiwan anchoring global chip output, tariffs and espionage fears aren’t just bad news for Taipei—they could ripple across every market plugged into the semiconductor ecosystem.

Exodus Accelerates: Thousands of UK Company Directors Leave After Labour Tax Overhaul

The UK has seen a sharp acceleration in company director departures following Labour’s sweeping tax reforms, with 3,790 directors removing the UK as their official country of residence between October 2024 and July 2025—a 40% increase from the 2,712 who left during the same period a year earlier (City A.M., Order-Order). April 2025 saw the highest monthly figure at 691 departures, coinciding with the implementation of Labour’s non-domicile tax changes, marking a 79% surge from April 2024 and 104% higher than April 2023 (Reddit). High-profile figures include former Reckitt Benckiser CEO Bart Becht, FTSE Russell founder Mark Makepeace, AC Milan backer Riccardo Silva, boxing promoter Eddie Hearn, and Ineos director John Reece. The UAE has emerged as the top destination, attracting over 150 UK-based company directors between April and June 2025 alone.

Labour’s October 2024 Budget abolished the 200-year-old non-domicile regime and introduced 40% inheritance tax on worldwide assets for long-term UK residents, alongside tighter capital gains tax rules and VAT on private school fees (BBC, Bloomberg). With just 5,000 individuals contributing almost all UK capital gains tax revenue, the Treasury’s projection of £33 billion in additional revenue over five years from these reforms could be undermined if departures persist. The trend signals potential capital flight, reduced investment, and possible pressure for policy reversals that may impact market sentiment toward UK assets and Labour’s fiscal credibility.

Sensei’s Insight: When tax policy becomes the wind, wealth often becomes the sail—and the UAE looks like the current harbour of choice.

🧠 OpenAI Eyes $500B Valuation in Secondary Share Sale

OpenAI is in early talks for a potential secondary stock sale that would value the AI leader at roughly $500 billion (Reuters, Bloomberg, The CFO), a 66.7% jump from the $300 billion valuation set during SoftBank’s $40 billion funding round in March (Caliber, RTÉ). The deal would enable current and former employees to sell several billion dollars’ worth of shares, with investors like Thrive Capital reportedly interested in participating (Yahoo Finance). Annualized revenue has doubled to $12 billion in the first seven months of 2025, with forecasts to reach $20 billion by year-end, up from $10 billion in June (CNBC, TechCrunch). ChatGPT now has 700 million weekly active users—up from 400 million in February—and processes over 3 billion daily messages, holding over 70% of the large language model market with 5 million paying business subscribers (OTET Markets).

If completed, the deal would make OpenAI the world’s most valuable private tech company, surpassing SpaceX’s $400 billion valuation (AINvest, Caliber). It also doubles as a talent-retention strategy amid intense competition, with Meta reportedly offering OpenAI researchers nine-figure packages (RTÉ). Investors’ appetite remains strong—the last funding round was oversubscribed fivefold (Fortune)—but the company is still unprofitable, burning through an estimated $8 billion annually (Business Standard). This raises ongoing questions about the sustainability of AI’s rapid growth cycle.

Sensei’s Insight: A $500B valuation before profitability is like winning a marathon at mile 18—you’re ahead, but the real endurance test is still coming.

Oil Rebounds on Trump Threats Over Russian Crude Buyers

Oil prices rebounded from a five-week low on Wednesday as supply disruption fears outweighed oversupply concerns (Reuters, Yahoo Finance). Brent crude rose 1.4% to $68.59 per barrel, while WTI gained 1.5% to $66.13 (Barron’s). The rally followed U.S. President Donald Trump’s threat to “substantially” raise tariffs on Indian goods within 24 hours due to New Delhi’s continued purchases of Russian oil (Times of India, Independent). India, Russia’s largest seaborne oil buyer since 2022, now sources about one-third of its crude from Moscow (Yahoo Finance). Trump also signaled possible secondary sanctions on China, another key buyer (Investing.com). Indian officials dismissed the U.S. warnings as “unjustified” and vowed to safeguard national interests.

Russia exports 4.4 million barrels per day—around 4.5% of global demand—with India and China as the top customers (Reuters). While OPEC+ has spare capacity, analysts caution that disruptions across multiple buyers could strain the market. The tension comes as OPEC+ prepares to add 547,000 barrels per day in September, compounding existing oversupply concerns that had driven a four-day oil price slump (Arab News, Reuters).

Sensei’s Insight: This is less about today’s price bump and more about the geopolitical tripwire—if India or China shifts buying patterns, volatility could spike beyond what spare capacity can cushion.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

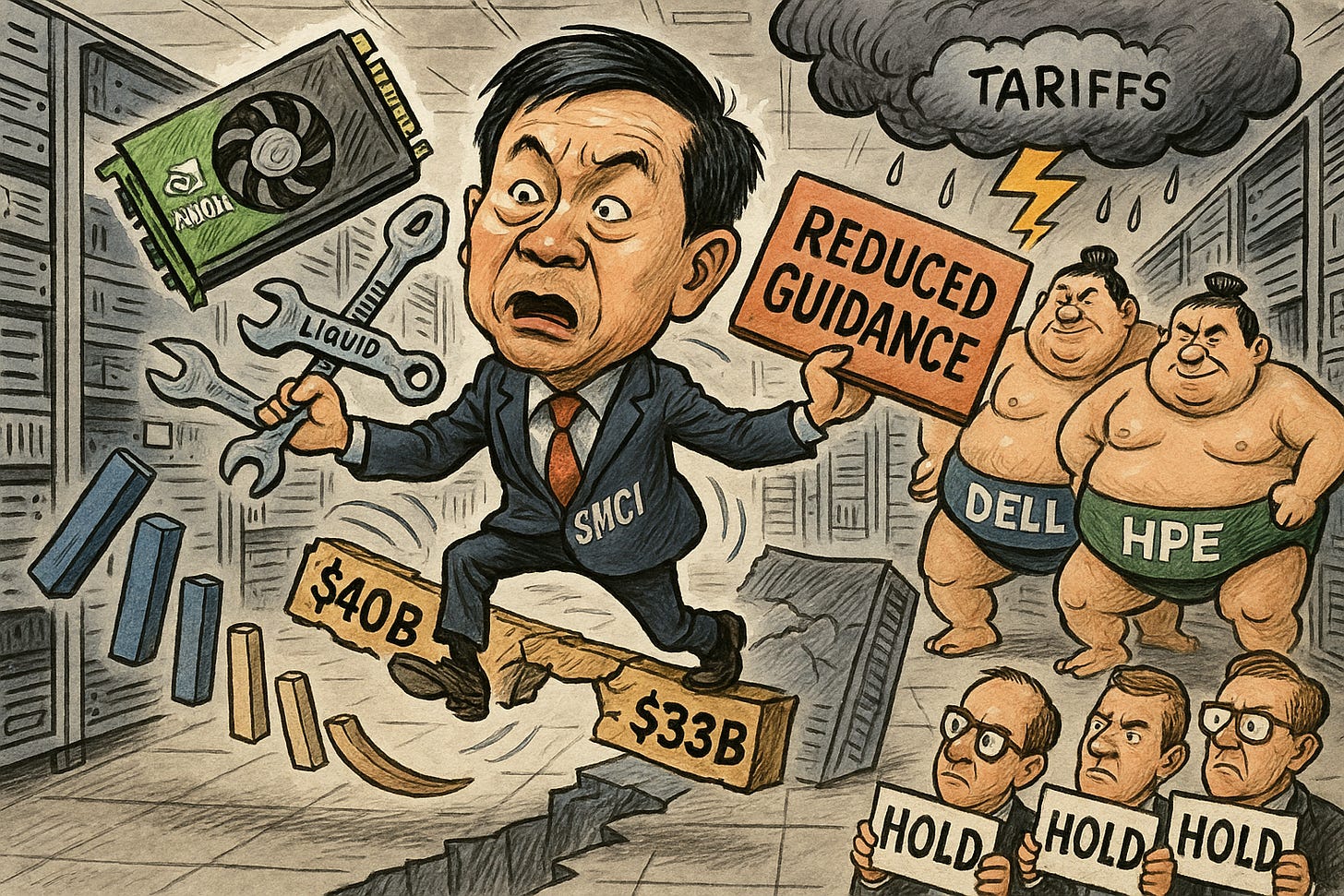

🔍 Deeper Dive: Super Micro Computer (SMCI) – Navigating the AI Server Crossroads

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.