Sensei's Morning Forecast: UK Inflation Rises, XRP in Focus, Trump Faces House Revolt

ISO 20022 shift spotlights BoA-Ripple potential; XRP gains ETF traction; UK inflation surprises; GOP crypto drama unfolds; Trump arms Europe; EU drops tax; U.S. hits Mexico, backs Indonesia.

🧠 One Big Thing

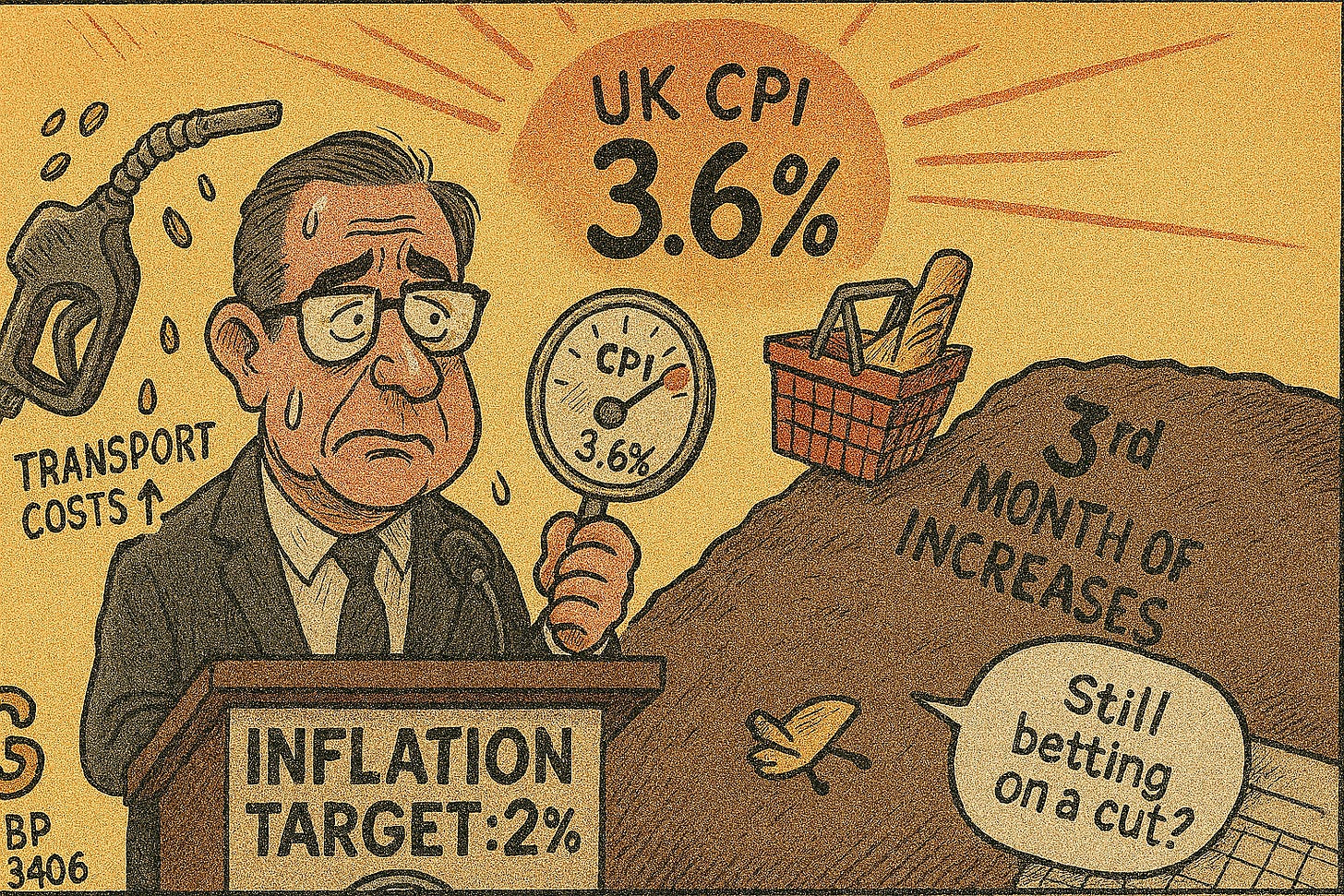

UK inflation just flipped the script: CPI unexpectedly accelerated to 3.6% in June—raising serious doubts about the Bank of England’s next move and jolting rate cut bets off the table.

💰 Money Move of the Day

When inflation surprises to the upside, it’s a reminder that cash sitting idle can quietly lose value. Exploring high-interest savings accounts or short-term bond ladders could help your money work a bit harder without adding major risk.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $118,874 (▲ +0.93%)

Ethereum (ETH): $3,156 (▲ +0.52%)

XRP: $2.95 (▲ +1.01%)

Equity Indices (Futures):

S&P 500 (SPX): 6,240 (▲ +0.11%)

NASDAQ 100: 23,013 (▼ -0.19%)

FTSE 100: 8,958 (▲ +0.16%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.483% (▼ -0.18%)

Oil (WTI): $66.31 (▼ -1.06%)

Gold: $3,337 (▲ +0.38%)

🕒 Data as of UK (BST): 12:30 / US (EST): 07:30 / Asia (Tokyo): 20:30

✅ 5 Things to Know Today (+2 Bonus Stories)

🇬🇧 UK CPI Surprise: Inflation Accelerates to 3.6%

The U.K.’s headline CPI rose to 3.6% year-over-year in June, above both May’s 3.4% and consensus expectations, marking the highest level since January 2024 (ONS). The core CPI also edged up to 3.7%, and services inflation held steady at 4.7%, indicating sustained domestic cost pressures. Transport costs—particularly motor fuel—were the primary driver, contributing 0.15 percentage points to the headline rate (ONS). Food prices climbed for the third consecutive month, while owner-occupiers’ housing costs slowed to 6.4%, softening the CPIH index. The market reaction was swift: sterling climbed modestly to $1.3406 against the dollar (YouInvest), and interest rate futures shifted to price in just a 35% chance of a rate cut at the BoE’s August 7 meeting (FXStreet).

The higher-than-expected inflation print has cast doubt on the timing of further BoE easing, with CPI now running 160 basis points above the 2% target. Gilt markets responded with front-end yields rising 7 basis points intraday, while FX traders pushed GBP/USD above the $1.34 mark as dovish bets were pared back (LSE). Rising transport costs are also squeezing real incomes and pressuring margins in logistics and retail sectors, although lower housing-service inflation offered minor relief. Persistent services inflation underscores the BoE’s challenge in anchoring expectations, with disinflation trends now looking bumpier ahead of next month’s MPC decision.

Sensei’s Insight: This is a pivotal signal: the UK is moving from “crisis protection” to “capital liberation.” For bank stocks, the regulatory tailwind is real—but so is the rising risk premium.

🇺🇸 After GOP Revolt, Trump Poised for Comeback in Today’s Crypto Vote

House Republicans defied President Trump on Tuesday, blocking a procedural vote on three major cryptocurrency bills central to the administration's "Crypto Week" agenda. The 196-223 defeat saw 13 conservative Republicans join Democrats in rejecting the legislative package, which included the GENIUS Act for stablecoin regulation, the CLARITY Act for crypto market structure, and the Anti-CBDC Surveillance State Act (ABC News, Cointelegraph). Dissenting lawmakers, led by Rep. Marjorie Taylor Greene, raised alarms about potential backdoors for central bank digital currencies (CBDCs) in the GENIUS Act—even though the bill contains explicit language prohibiting the issuance of a CBDC—demanding stricter prohibitions despite existing language in the Anti-CBDC Act (Forbes). They also criticized House Speaker Mike Johnson’s refusal to allow amendments or separate votes on the three measures (Cointelegraph).

Trump hosted a late-night meeting at the White House, later claiming on Truth Social that he persuaded 11 of the 12 holdouts to back the legislation. House Majority Leader Steve Scalise scheduled a re-vote for Wednesday at 12:20 p.m. (The Block). This rare public GOP defiance underscores deeper internal tensions as the party navigates its crypto stance while aligning behind Trump’s broader agenda. The GENIUS Act, already passed in the Senate, would impose federal stablecoin standards, including full dollar reserves and mandatory audits for large issuers (The Block, Blockworks). The stakes are personal for Trump, whose family holds investments in World Liberty Financial—issuer of the USD1 stablecoin—making the legislation crucial both politically and financially (Yahoo Finance, ABC News).

Sensei’s insight: Trump’s attempt to turn “Crypto Week” into a legislative win may now hinge on a tight Wednesday vote—and whether his influence still commands GOP unity in a splintering caucus.

XRP ETF Launch Wave Hits Markets This Week As Dubai Tokenizes Real Estate on XRP Ledger

The XRP ecosystem is entering a pivotal phase as the ProShares Ultra XRP ETF (UXRP) becomes the first SEC-approved, NYSE Arca–listed leveraged XRP exchange-traded fund, officially launching on July 18 (Finbold). Offering 2x daily exposure through the Bloomberg XRP Index, this futures-based ETF sets off a sequence of upcoming XRP ETF releases. Turtle Capital will debut its 2x Long XRP Daily Target ETF on July 21, alongside Volatility Shares, which plans both standard and 2x leveraged products (TheCryptoBasic). Meanwhile, the Rex-Osprey XRP ETF, a spot-based ETF, awaits a critical SEC decision on July 25 (Binance). These launches align with Crypto Week in Washington D.C. (July 14–18), where policymakers are reviewing the Clarity Act and Anti-CBDC Surveillance State Act, creating a favorable climate for crypto adoption (FXEmpire).

Simultaneously, Ripple has partnered with Ctrl Alt to enable the Dubai Land Department's Real Estate Tokenization Project using XRP Ledger tech (Gulf News). This initiative marks the first government-backed property tokenization program in the Middle East, offering fractional ownership starting at AED 2,000 ($545) and forecasting $16 billion in tokenized assets by 2033 (Coindesk). Ctrl Alt, licensed by Dubai's VARA, has already completed three successful tokenized sales, including a $653,000 listing that sold out in under two minutes (Cryptopolitan).

Sensei’s Insight: As institutional vehicles and real-world use cases converge, XRP is transitioning from regulatory limbo into the financial mainstream. Keep a sharp eye on July 18, 21, and 25—these are not just dates; they’re tipping points.

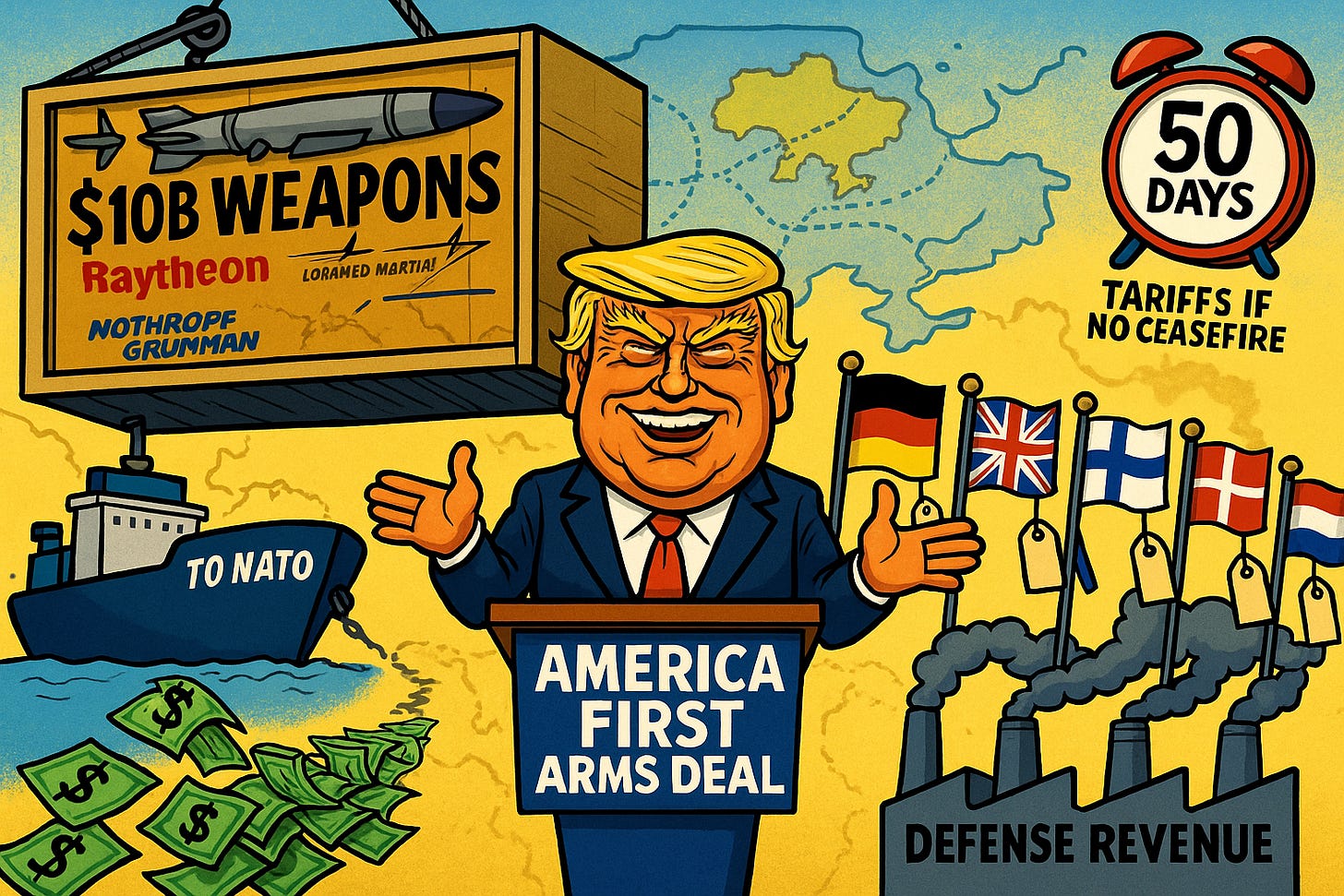

🇺🇸 Trump’s Ukraine Weapons Reversal Signals Major Policy Shift

President Trump announced a dramatic pivot in Ukraine policy on July 14, unveiling a plan that enables European NATO allies to purchase billions of dollars in U.S. weapons for transfer to Ukraine (CNN, Argus Media). The move, revealed during an Oval Office meeting with NATO Secretary-General Mark Rutte, marks Trump's first tangible military aid package to Ukraine since returning to the presidency (UK Defence Journal, Le Monde). The first phase involves roughly $10 billion in sales of Patriot missile systems, artillery shells, and advanced munitions (UBN, Axios), with eight countries—Germany, Finland, Denmark, Sweden, Norway, the UK, the Netherlands, and Canada—already committing to participate (Forces News).

The arrangement channels profits to U.S. defense giants like Raytheon Technologies (RTX), Lockheed Martin (LMT), and Northrop Grumman (NOC) while leaving Europe to foot the bill—allowing Trump to maintain his "America First" stance (AINvest). Simultaneously, Trump issued a 50-day ultimatum to Russia, threatening secondary tariffs on nations trading with Moscow if a ceasefire isn’t reached (Reuters, Politico). Analysts view the deal as a blueprint for future military aid models—locking in U.S. arms revenue while pushing European allies toward long-term commitments, including a NATO-wide 5% GDP defense spending target by 2035 (AINvest, US Funds).

Sensei’s Insight: Nvidia’s restored China pipeline and $4T valuation crown it the undisputed AI king—for now. But with inflation data imminent, the mood can flip fast.

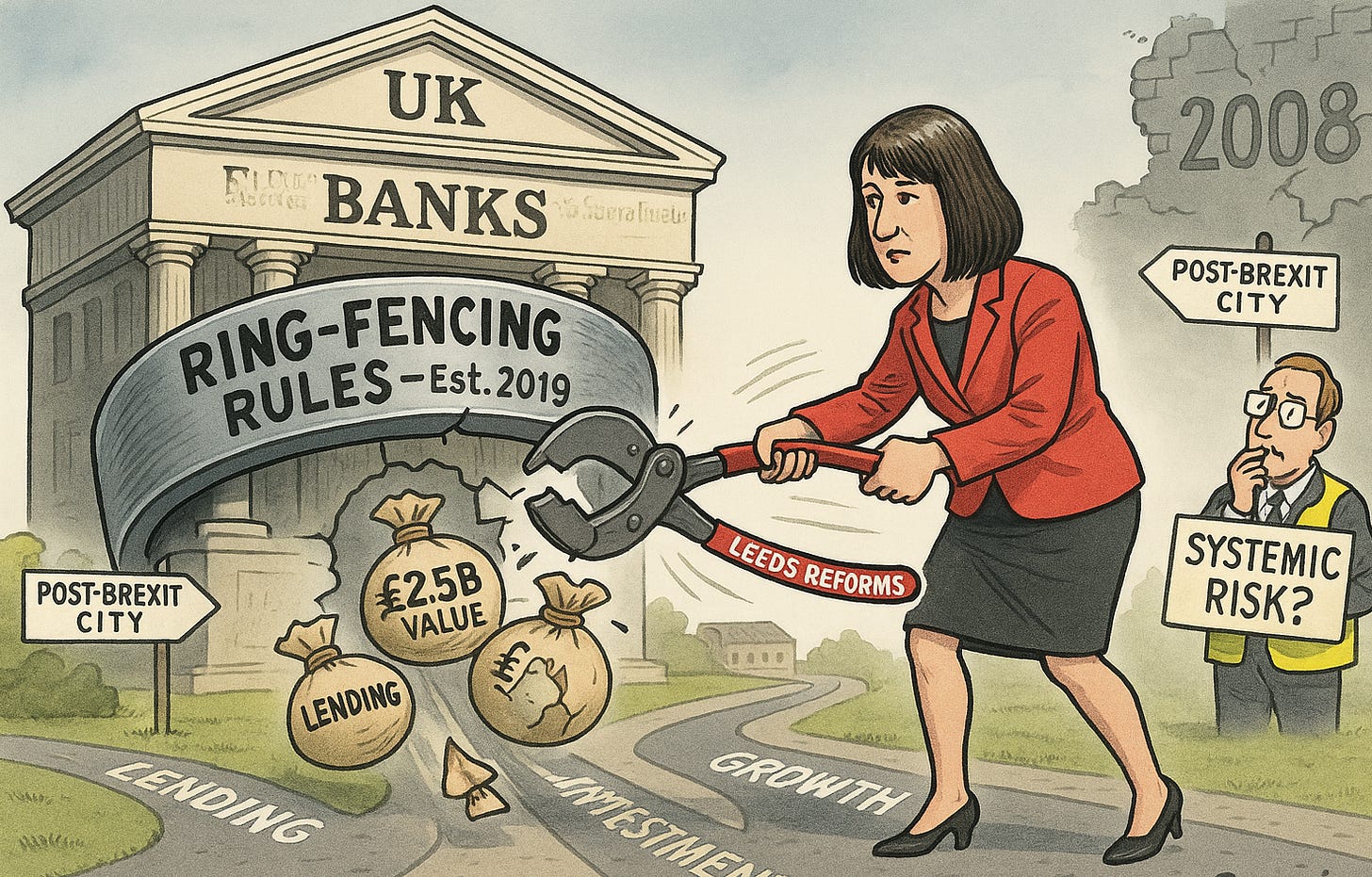

🇬🇧 UK Pledges Major Reform to Banking Ring-Fencing Rules

Chancellor Rachel Reeves has unveiled plans to overhaul the UK's banking ring-fencing regime as part of her sweeping “Leeds Reforms” aimed at boosting City competitiveness. In her Mansion House speech on July 15, Reeves promised a full review of the post-crisis rules that require banks with over £35 billion in deposits to separate their retail and investment arms—a framework unique to the UK (Sky News, Independent, Gov.uk).

Economic Secretary Emma Reynolds will lead the review, with analysts estimating the changes could unlock up to £2.5 billion in value—benefitting banks like NatWest, Lloyds, HSBC, and Santander (City A.M., Reuters, Telegraph). Critics argue ring-fencing has led to capital inefficiencies and stifled lending, while supporters caution that removing guardrails may reintroduce systemic risk. Investors will be watching closely as the UK repositions itself in a post-Brexit global financial landscape.

Sensei’s Insight: This is a pivotal signal: the UK is moving from “crisis protection” to “capital liberation.” For bank stocks, the regulatory tailwind is real—but so is the rising risk premium.

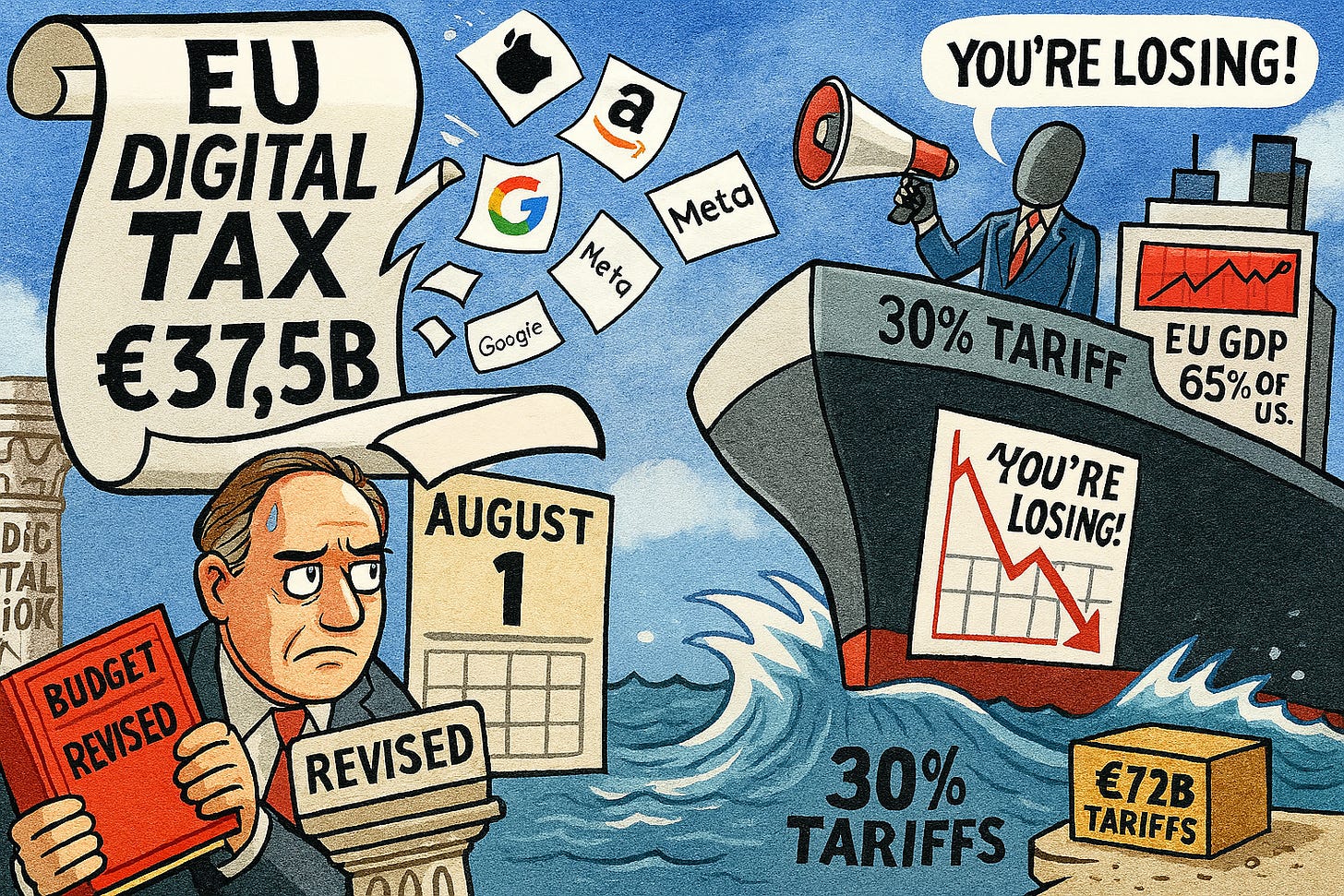

🇪🇺Europe Buckles on Digital Tax as Wall Street Demands Tougher Trade Stance

The European Union’s abrupt decision to abandon its digital services tax—originally aimed at tech giants like Apple, Google, Meta, and Amazon—reflects growing anxiety over President Trump’s looming 30% tariffs on EU imports starting August 1. Quietly scrubbed from the EU’s 2028–2035 budget, the levy had been projected to raise €37.5 billion annually and narrow the tax gap between digital and traditional firms (Politico, MacRumors, CEPS). The reversal comes amid fears that escalating trade friction could collapse ongoing negotiations, with EU Trade Commissioner Maroš Šefčovič warning the tariffs would make trade “nearly impossible” (CNN). Analysts now view the retreat not just as a fiscal compromise but a strategic submission to U.S. economic coercion, potentially emboldening future pressure on Brussels’ digital sovereignty agenda.

Wall Street is taking notice—and speaking out. JPMorgan CEO Jamie Dimon, speaking in Dublin ahead of Trump’s tariff announcement, issued a blunt message: “You’re losing.” Dimon pointed to Europe’s GDP slide—from 90% of U.S. levels to just 65% in 15 years—as evidence that the continent must unify its financial infrastructure to compete globally (CNBC, Fortune). As U.S. banks begin to lose deals in Europe due to rising anti-American sentiment, Wall Street fears deepening retaliation could destabilize financial markets (Reuters). The EU’s €72 billion counter-tariff package targeting Boeing, U.S. autos, and bourbon hints at a more confrontational stance (Bloomberg). Yet the digital tax reversal may undermine the credibility of that response, casting doubt on Europe’s readiness to defend its economic autonomy under escalating U.S. pressure.

Sensei’s Insight: As Wall Street urges defiance and Brussels quietly retreats, Europe stands at a crossroads—either forge true economic unity or watch its regulatory clout dissolve under Washington’s trade hammer.

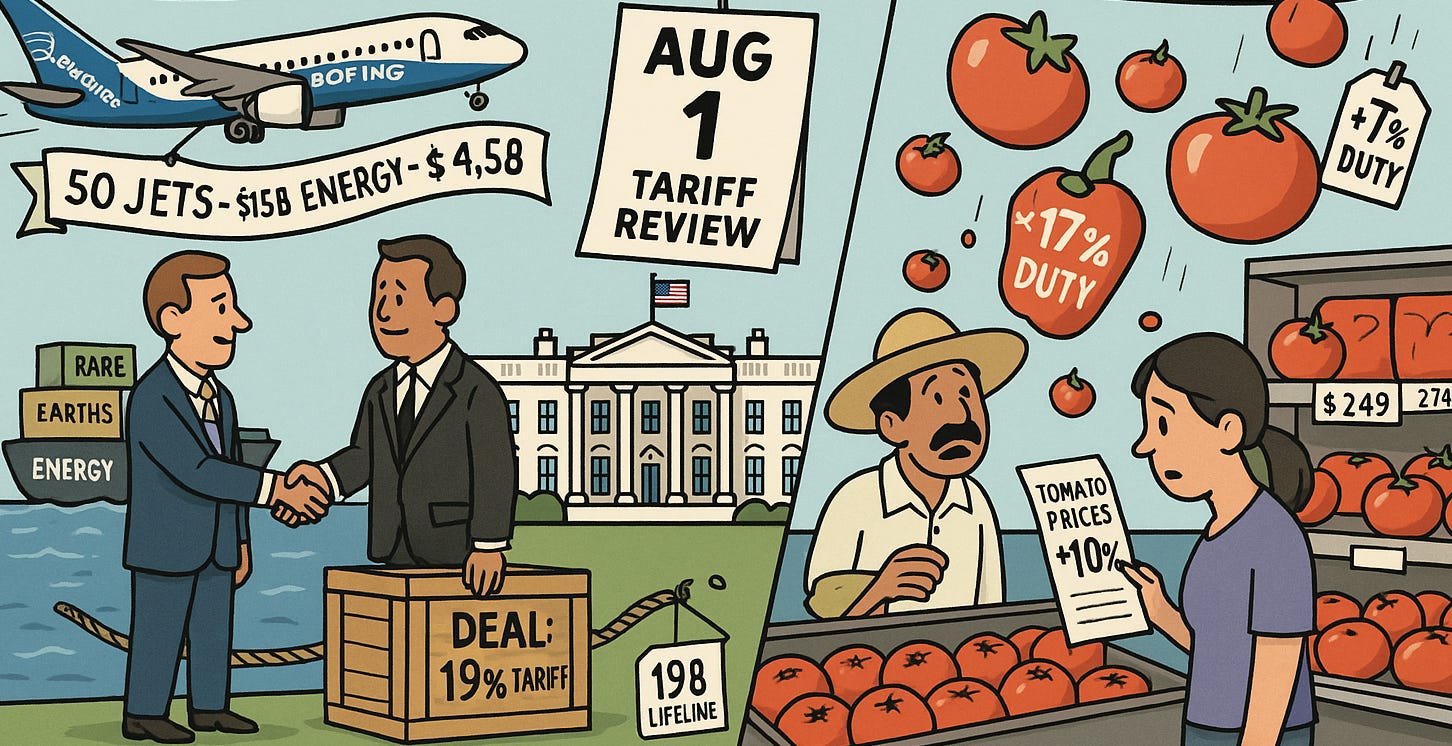

🛃 Trade Turbulence: U.S. Locks in Indonesia Deal, Hits Mexico with Tomato Tariffs

The U.S. has finalized a trade agreement with Indonesia, reducing a threatened 32% tariff to a fixed 19% ad-valorem rate on Indonesian imports (Bloomberg, BBC). In return, Jakarta will eliminate its own duties and commit to buying $15 billion in U.S. energy, $4.5 billion in agricultural products, and 50 Boeing jets (Reuters). Meanwhile, the U.S. Commerce Department has terminated the 2019 Tomato Suspension Agreement and immediately imposed a 17.09% antidumping duty on fresh tomatoes from Mexico—affecting a country that supplies 70% of U.S. tomato consumption (CBS News, US News). Analysts expect a 10% increase in shelf prices and a 5% drop in demand (Axios).

These moves highlight a broader White House campaign for “reciprocal” trade terms ahead of a planned August 1 tariff review that could raise baseline rates to 15–20% on multiple partners (Trade Compliance Resource Hub). While the Indonesia pact offers growth tailwinds for sectors like apparel, energy, and rare earths, it also throws Boeing a potential $19 billion lifeline amid rising European tariff headwinds (AINvest). Conversely, the Mexican tomato duty tightens margins for grocers and restaurants and adds to inflationary pressures as CPI climbed to 2.7% y/y in June (Politico).

Sensei’s Insight: Dual-front tariff maneuvers signal rising volatility for agribusiness, aviation, and emerging-market trade partners—investors should brace for policy-driven swings through August.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Bank of America, ISO 20022, and the XRP Opportunity

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.