Sensei’s Morning Forecast: Will This Week’s CPI Data Ignite a Q4 Rally or Kill the Soft-Landing Dream?

Markets face a pivotal week as UK and US CPI, a Fed decision, record earnings, China’s tariff defiance, Trump’s shrinking deficit, and gold’s flash crash collide.

👀 Today’s Stories at a Glance

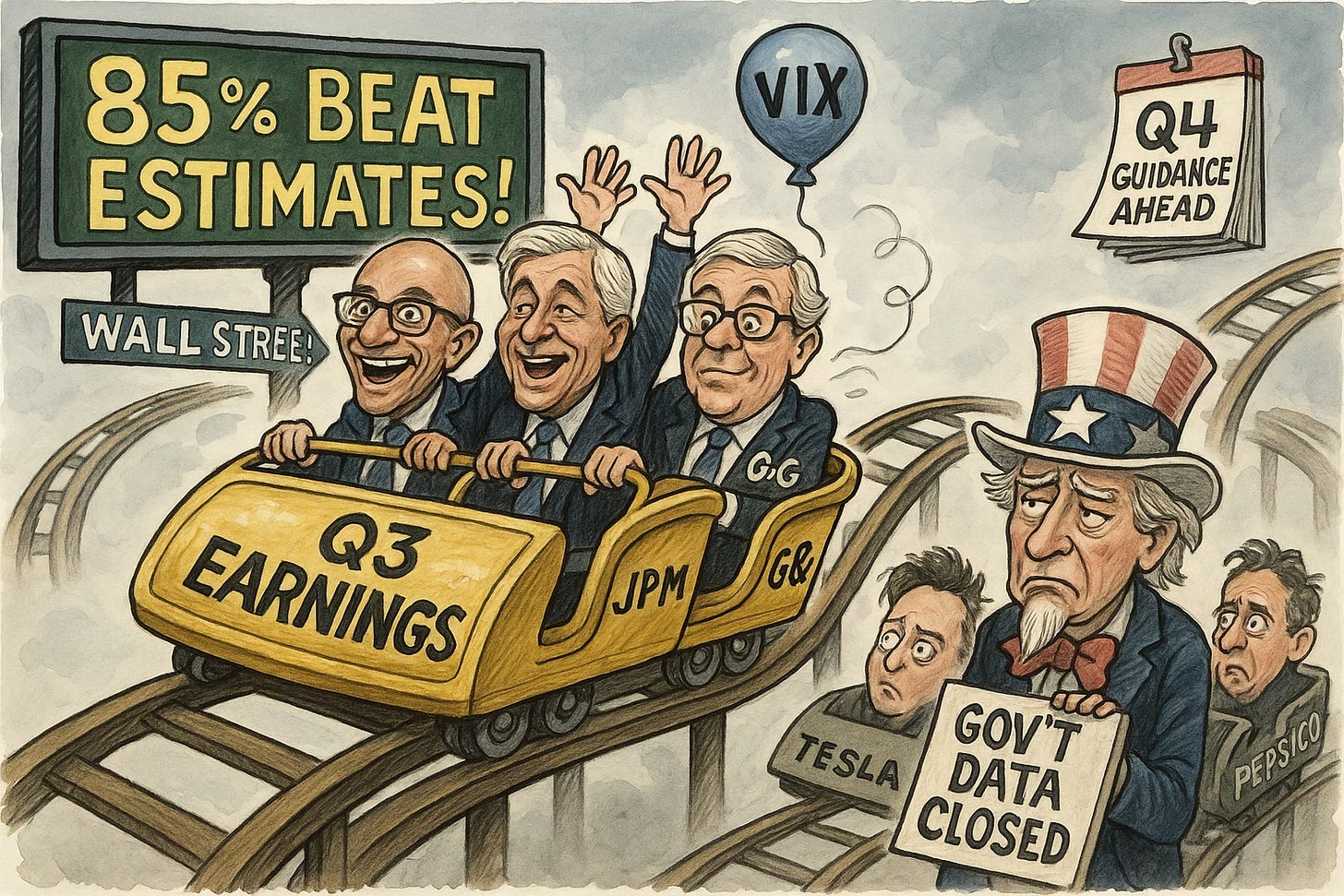

💼 Earnings Beat Boom: Over 85% of S&P 500 firms beat earnings, marking the strongest season since 2021.

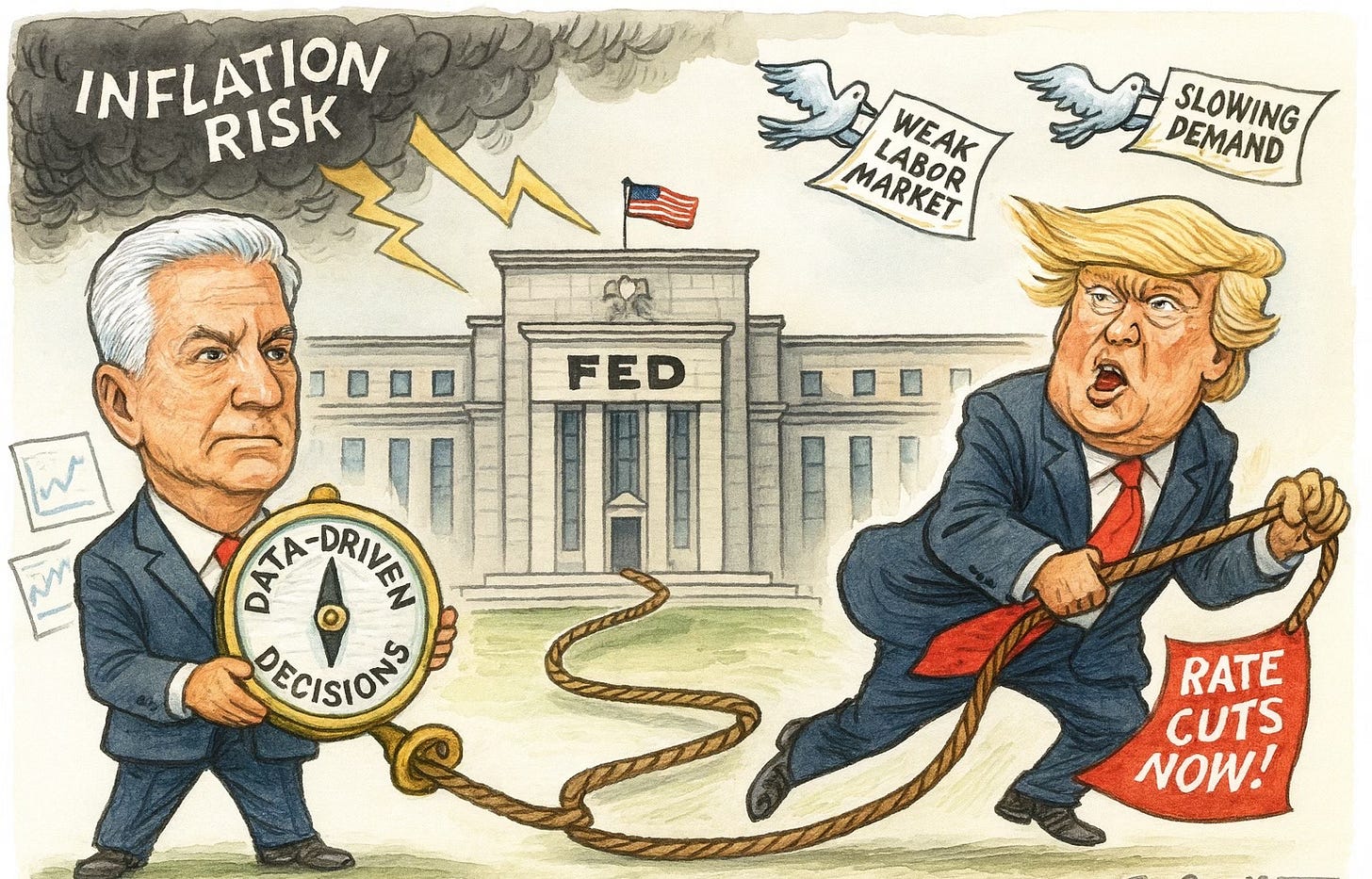

📉 Waller Eyes Cuts: Fed’s Waller supports a 25bps rate cut, citing labor market softness and maintaining independence from Trump.

📦 China’s Export Grit: Despite 55% tariffs, China ships $1B/day to U.S., retaining short-term leverage in trade talks.

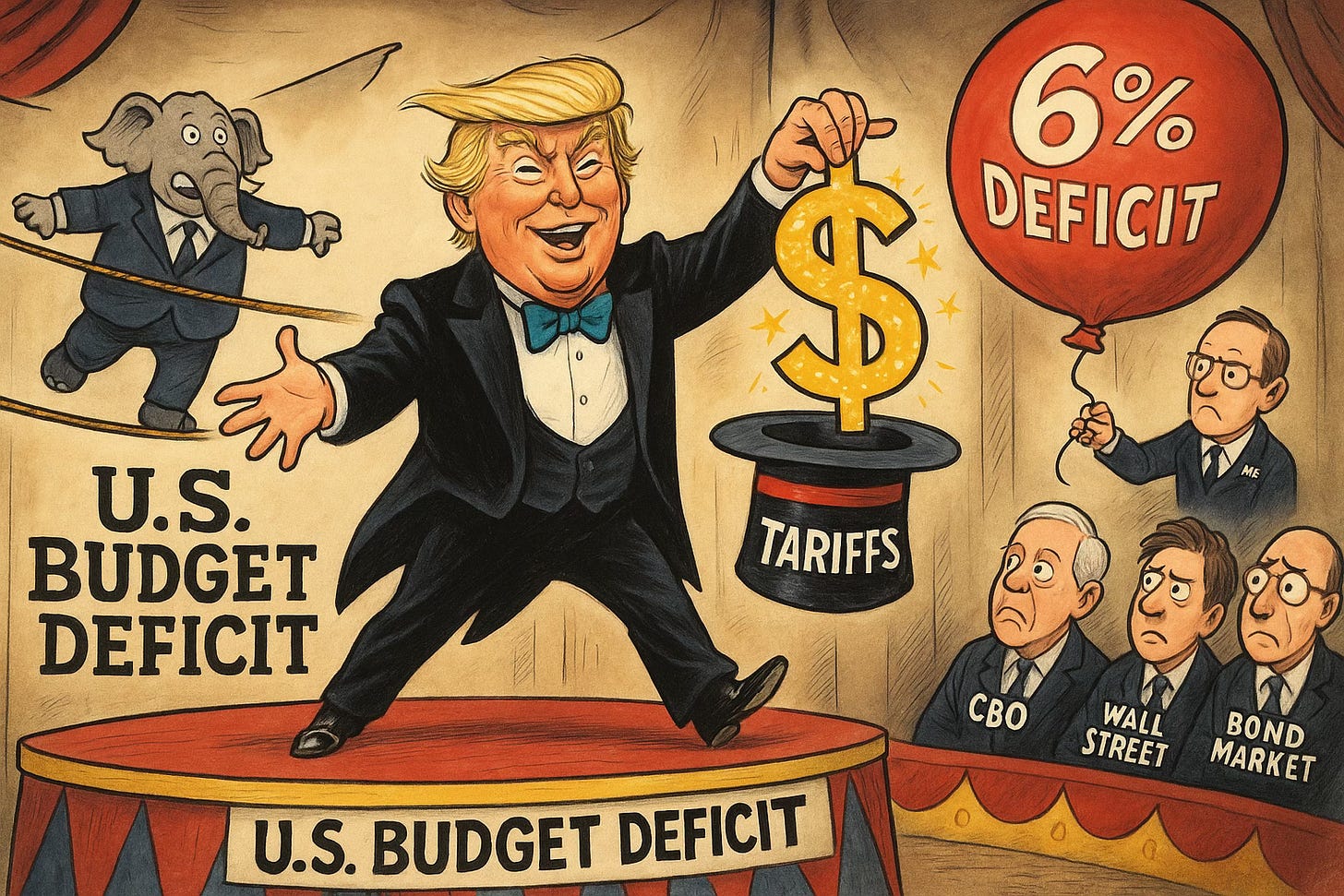

🧮 Deficit Shrinks: Treasury says Trump-era tariffs and spending restraint could halve the U.S. deficit by 2026.

🟡 Gold Flash Crash: Gold plunged 5% intraday in Asia, driven by algo triggers and stop-loss cascades in thin liquidity.

🔍 Three Inflation Tests Ahead: UK CPI, US CPI, and the Fed meeting this week will dictate Q4’s market tone.

🧠 One Big Thing

Fed Governor Christopher Waller just backed a rate cut—even as recession talk fades and GDP stays solid. Markets are now pricing in a 25-bps cut at the October 28–29 FOMC meeting, signaling a clear shift toward easing. With Waller emerging as a likely successor to Powell, his support matters. It adds weight to the view that policy could soften regardless of who’s in the White House.

💰 Money Move of the Day

When the Fed signals cuts, bond prices tend to rise while yields fall. Some investors use this moment to explore longer-duration Treasuries or bond ETFs to potentially benefit from that inverse relationship.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $108,159.60 (▼ -0.19%)

Ethereum (ETH): $3,832.77 (▼ -1.08%)

XRP: $2.4034 (▼ -0.82%)

Equity Indices (Futures):

S&P 500 (US500): 6,737.10 (▲ +0.05%)

NASDAQ 100 (NQ1!): 25,231.00 (▼ -0.25%)

FTSE 100 (FTSE10): 9,519.97 (▲ +1.07%)

Commodities & Bonds:

10-Year US Treasury Yield: 3.951% (▼ -0.35%)

Oil (WTI): $58.82 (▲ +1.52%)

Gold: $4,039.60 (▼ -2.05%)

Silver: $47.95 (▼ -1.47%)

🕒 Data as of UK (BST): 12:20 / US (EST): 07:20 / Asia (Tokyo): 20:20

✅ 5 Things to Know Today

💼 Early U.S. Earnings Signal Strongest Profit Season Since 2021

Roughly 85% of S&P 500 companies that have reported so far this quarter have beaten earnings estimates, marking the strongest performance since late 2021 and suggesting resilient corporate profitability despite higher-for-longer rates. According to data compiled by FactSet, the blended earnings growth rate for the S&P 500 now sits near 7.9% year-over-year, up sharply from the 6.2% forecast at the start of the reporting season. Notable beats from Microsoft, JPMorgan Chase, and Procter & Gamble helped drive aggregate upside surprises, with only a handful of large-cap laggards—such as Tesla and PepsiCo—missing projections. Analysts noted that this quarter’s results are particularly significant because Wall Street had raised profit estimates heading in, reversing the usual pattern of lowered expectations seen in prior seasons (Bloomberg).

The stronger-than-expected earnings wave comes during a period of limited macro data releases due to the ongoing U.S. government shutdown, leaving corporate results as the primary sentiment driver for equity markets. The S&P 500 indexhas held near its highest levels since August, while the CBOE Volatility Index (VIX) remains subdued around 14, reflecting renewed investor confidence in earnings durability. Sector strength has been broad-based, with financials, communication services, and industrials leading gains. However, analysts at Goldman Sachs cautioned that margin expansion remains uneven, with cost pressures lingering in labor-intensive industries. The earnings trend is likely to shape Fed expectations and equity allocations heading into year-end rebalancing.

Sensei’s Insight: Corporate earnings are anchoring U.S. market sentiment amid policy uncertainty. Sustained beats at this scale could reinforce the soft-landing narrative—but any reversal in Q4 guidance will test that optimism fast.

📉 Waller Signals Rate Cuts Even Amid Trump Pressure

Christopher Waller, one of the leading contenders to succeed Jerome Powell as chair of the Federal Reserve, publicly backed a 25-basis-point rate cut at the upcoming October meeting of the Federal Open Market Committee (FOMC), citing warning signs in the labour market and suggesting a neutral policy rate around 2.75–3.00% (Reuters). He noted that despite solid GDP growth, “the broad message of all the labour-market data is one of weakening in demand, relative to supply,” reinforcing his case for easing (Reuters). Waller’s remarks come as investors price in growing odds of policy action at the October 28–29 meeting, with markets now expecting a cut of roughly 25 bps, signalling mounting dovish momentum across U.S. monetary policy expectations (Reuters).

Waller also underscored the Fed’s independence, stating he would not cut rates “to please Donald Trump,” but rather because economic fundamentals justify it (Reuters). He added that recent Trump-era tariff measures were likely to have only a “modest” and short-lived impact on inflation—insufficient to derail easing plans (Reuters). With Waller widely viewed as a front-runner for Fed Chair in a potential Trump administration, his insistence on data-driven decision-making could reassure markets of policy continuity amid political change.

Sensei’s Insight: Waller’s message strengthens the case for a near-term policy pivot. Investors should expect lower yields and equity tailwinds—but remain alert to inflation shocks that could quickly tighten the path.

📦 China’s $1B-a-Day Exports Signal Short-Term Leverage Despite 55% U.S. Tariffs

Six months into President Trump’s renewed tariff campaign, China is still moving roughly $1 billion per day of goods to the U.S., with September shipments ticking up from August even as overall bilateral trade has fallen double-digits in recent months. Beijing’s entrenched role in global supply chains—especially electronics, industrial components, and intermediate inputs—means many U.S. importers cannot quickly substitute away, muting the immediate bite of higher levies. Bloomberg economists argue this resilience gives China near-term bargaining power with U.S. buyers amid ongoing talks. ((Bloomberg) (Bloomberg Tax)) Recent trade prints show mixed dynamics—headline U.S.-bound flows remain softer year-on-year, even as monthly momentum improves—highlighting how demand for Chinese inputs is proving sticky. ((Reuters))

For markets, the key is duration risk. If elevated tariffs (now widely cited around ~55% on Chinese goods under the combined regime) persist, firms will accelerate supplier diversification, with potential cost pass-throughs and margin pressure in tariff-sensitive categories; if talks yield relief or carve-outs, inventory and input cost headwinds could ease. ((Cathay Bank Insight) (PIIE)) In the interim, watch logistics and policy signals (port fees, export controls) that can whipsaw delivery times and working capital. The upshot: China’s flow stability under high tariffs keeps near-term supply chains functioning, but policy volatility remains a live overhang for equities tied to China-sourced inputs and for commodity demand. ((AP))

Sensei’s Insight: Treat China-exposure as a timing problem, not a binary. Screen for names with (1) high China input reliance and (2) credible alt-sourcing timelines—your spread between the two is where near-term risk sits.

🧮 Trump Admin on Track to Narrow U.S. Deficit, Treasury Finds

A new Treasury Department analysis shows the Trump administration is on track to narrow the U.S. budget deficit through restrained spending and rising tariff revenues. In the first full quarter of Trump’s second term ending June 2025, federal outlays rose just 0.2% year-on-year, compared with 7–28% growth in prior quarters. By Q3, spending fell 2.5%, according to Treasury data. The report projects tariffs will generate roughly $300 billion in 2025 and $400 billion in 2026, while the deficit—currently near 6% of GDP—could fall toward 3% under current policy assumptions (Financial Times).

Despite the encouraging trend, fiscal risks remain high as entitlement costs and debt-service payments rise. The Congressional Budget Office (CBO) warned that tariff revenue gains could be offset by slower growth or renewed tax-cut pressures (Bloomberg). Analysts also note that the U.S. still runs one of the largest deficits in the developed world, leaving Treasury yields sensitive to policy reversals or softer demand for government debt (Reuters).

Sensei’s Insight: A narrowing deficit may steady the dollar and ease bond-market pressure—but lasting credibility depends on whether Washington can maintain fiscal restraint beyond this election cycle.

🟡 Gold Slips After Flash Crash as Stock Bulls Pause

Gold prices tumbled sharply on Tuesday after a sudden “flash crash” in Asian trading sent spot prices plunging more than 5% to briefly trade below $2,330/oz before recovering part of the loss. Futures on the COMEX also saw a steep intraday drop as traders unwound leveraged long positions amid thin liquidity. Analysts cited algorithmic triggers and stop-loss liquidations as the main culprits behind the move, which followed weeks of record inflows into gold ETFs and speculative futures contracts. Silver mirrored the fall, down over 6%, while the Bloomberg Dollar Spot Index strengthened as yields rebounded (Reuters).

Meanwhile, global equities paused after a strong multi-week rally. The S&P 500 edged lower by 0.4%, Europe’s STOXX 600 slipped 0.3%, and Treasury yields rose modestly as investors rotated out of defensives. Traders are eyeing upcoming central bank meetings, with Fed funds futures pricing a 25-bp cut next week and Bank of England odds of a December move now near 75%. The pullback in gold reflects short-term exhaustion after months of risk hedging amid geopolitical jitters and dollar weakness, though analysts say longer-term fundamentals remain intact (Bloomberg).

Sensei’s Insight: After one of the strongest gold runs in years, today’s whiplash reminds investors that liquidity gaps and leverage can distort short-term pricing—an opportunity for disciplined, patient buyers.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: Three Inflation Tests Before the Fed — The Week That Sets Q4’s Tone

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.