Sensei's Morning Forecast: World’s First ETH-Staking ETF, AMD-OpenAI Shock Deal, Bitcoin’s $100B ETF Crown

Ethereum ETFs now pay yield, AMD snags a $6B OpenAI deal, and asset tokenization is already reshaping finance.

👀 Today’s Stories at a Glance

🚁 Brandon Robinson Live Today — Horizon’s CEO joins MLI to discuss hybrid eVTOLs and redefining real-world sustainable flight.

🖥️ AMD Soars on OpenAI Deal — AMD jumps 23% after a $6B GPU supply deal with OpenAI including stock warrants.

🇺🇸 Trump Open to Health Talks — Trump signals negotiation on ACA subsidies as U.S. shutdown continues into second week.

🪙 Grayscale Adds Staking to ETFs — Grayscale launches U.S. crypto ETFs with Ethereum staking rewards, unlocking passive yield for investors.

💰 BlackRock Bitcoin ETF Nears $100B — IBIT becomes BlackRock’s most profitable ETF, highlighting Bitcoin’s rise as a core allocation.

🔗 The Tokenization Era Begins — Assets from real estate to art are moving on-chain, reshaping how ownership is issued and traded.

🧠 One Big Thing

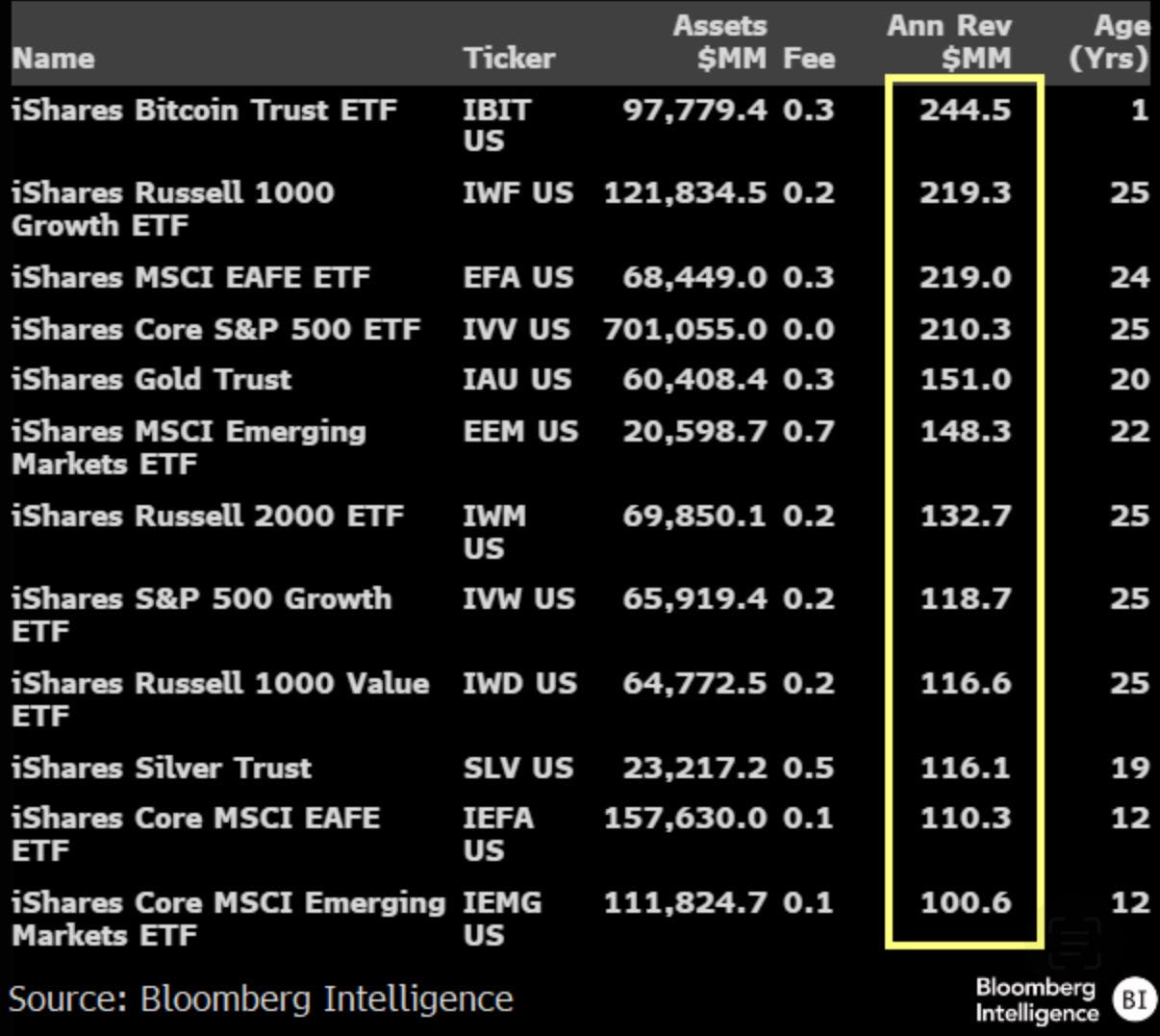

$244.5 million. That’s the annual revenue BlackRock’s Bitcoin ETF (IBIT) is now generating—making it the most profitable ETF in the firm’s entire portfolio. In just over a year, IBIT has amassed nearly $100 billion in assets, reshaping Bitcoin from fringe asset to institutional core.

💰 Money Move of the Day

Follow the yield — even in crypto. With Grayscale’s Ethereum ETFs now offering staking rewards, investors can access yield-bearing ETH exposure inside a regulated vehicle. This marks a new frontier: passive income meets crypto growth.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $124,400 (▼ -0.24%)

Ethereum (ETH): $4,698 (▲ +0.27%)

XRP: $2.98 (▼ -0.35%)

Equity Indices (Futures):

S&P 500 (SPX): 6,741 (▼ -0.01%)

NASDAQ 100: 25,181 (▼ -0.01%)

FTSE 100: 9,488 (▲ +0.12%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.168% (▲ +0.24%)

Oil (WTI): $61.73 (▼ -0.25%)

Gold: $3,959 (▼ -0.01%)

🕒 Data as of

UK (BST): 11:35 / US (EST): 06:35 / Asia (Tokyo): 19:35

✅ 5 Things to Know Today

🚁 Live Today: Brandon Robinson, CEO of Horizon Aircraft — 3 PM ET / 8 PM UK

Our next Meet the CEO special goes live today at 3PM ET / 8PM UK, starting as a members-only premiere before becoming available to all viewers shortly after.

We’re joined by Brandon Robinson, the pilot-turned-CEO leading Horizon Aircraft, a Canadian innovator charting a different course in advanced air mobility. While most eVTOL makers chase short urban hops, Horizon is building for range, speed, and real-world practicality. Its flagship Cavorite X-series blends vertical lift with efficient fixed-wing flight—delivering hybrid-electric performance, built-in redundancy, and endurance where pure battery designs fall short.

Robinson’s hands-on flying experience anchors Horizon’s vision: to create aircraft operators actually want to use—for medevac, regional connectivity, and defence missions. We’ll explore what makes the Cavorite’s design stand out, Horizon’s route to certification and commercialization, and how hybrid power could bridge the gap between helicopters and fixed-wing aircraft.

Join us live with Martyn Lucas and Vaz at 3PM ET / 8PM UK for this CEO Special, and don’t miss your chance to hear firsthand how Horizon plans to redefine sustainable flight.

🖥️ AMD Surges After Securing 5-Year, 6 GW AI Chip Deal with OpenAI

AMD shares jumped more than 23% after announcing a landmark five-year partnership with OpenAI to supply up to 6 gigawatts of AI GPUs, beginning with a 1 GW rollout of its next-generation Instinct MI450 chips in late 2026. The deal includes warrants allowing OpenAI to purchase up to 160 million AMD shares—around 10% of the company—tied to deployment and performance milestones. CEO Lisa Su described the agreement as “highly accretive” to both revenue and earnings from day one, calling it a pivotal step in meeting surging AI compute demand (Reuters; AMD IR).

OpenAI president Greg Brockman said the move complements, rather than replaces, the company’s existing work with Nvidia, emphasizing that “the industry needs as much computing power as we can possibly get.” The long-term deal positions AMD as a credible alternative in large-scale AI infrastructure, potentially reshaping the competitive balance in high-performance compute markets (Business Insider).

Sensei’s Insight: This partnership cements AMD’s place in the AI arms race—opening multi-billion-dollar upside tied to OpenAI’s expansion curve. But execution will be key: delivering reliable, gigawatt-scale deployments will determine whether AMD’s newfound momentum translates into sustained leadership.

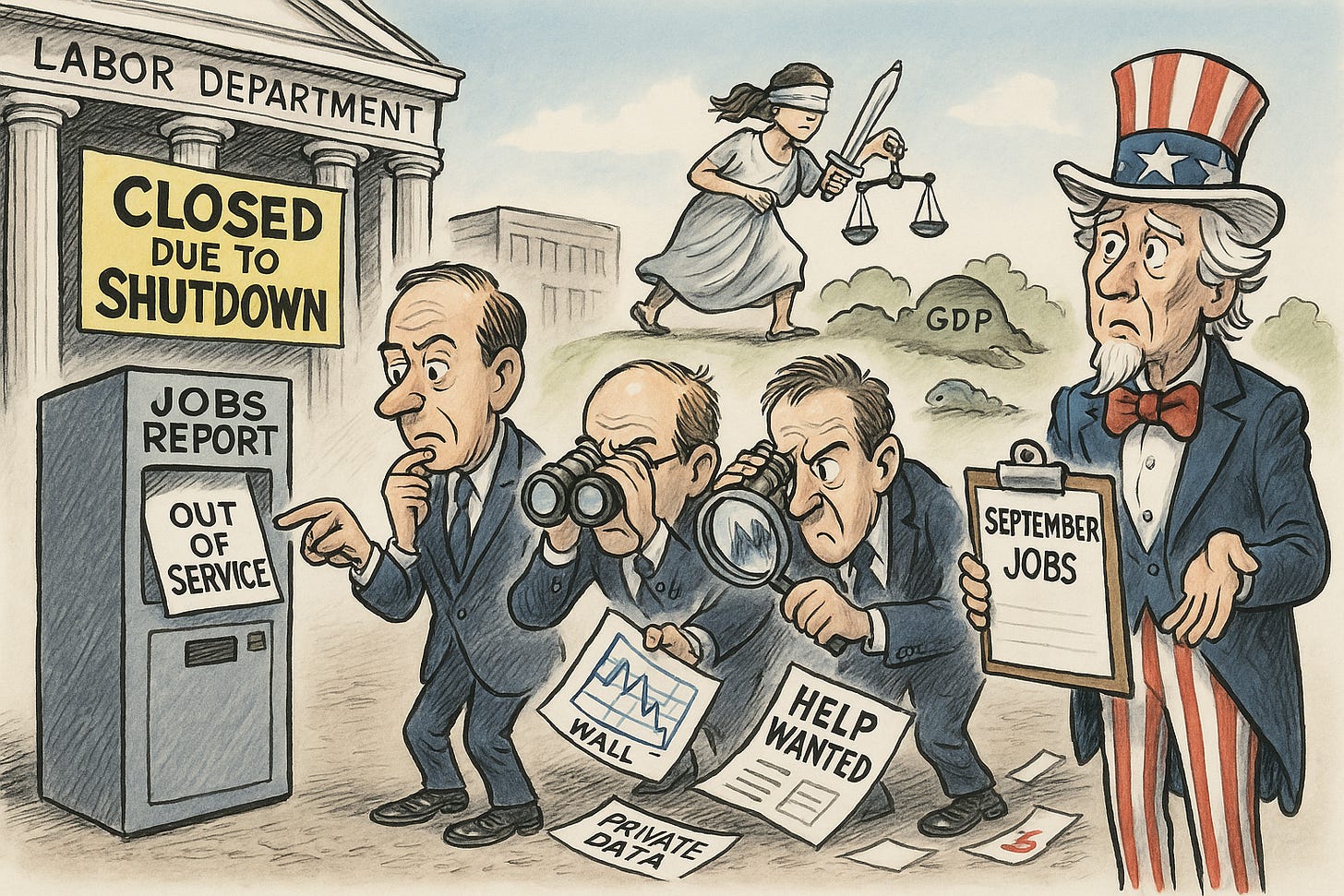

🇺🇸 Trump Signals Openness to Healthcare Talks Amid Ongoing Shutdown

President Donald Trump said he is willing to negotiate with Democrats over expiring Affordable Care Act subsidies—a key sticking point in the funding impasse that has kept the U.S. government partially closed since October 1. Senate Democratic Leader Chuck Schumer responded that no talks are taking place and insisted Democrats will only engage if Republicans commit to extending ACA subsidies and reversing recent Medicaid cuts (AP). The Senate on Monday rejected a Republican stopgap bill 52–42, leaving roughly 900,000 federal employees furloughed or working without pay as the shutdown entered its second week (Bloomberg).

The White House has warned of “sharp measures,” including potential layoffs, if the deadlock persists (AP). While moderate senators from both parties have discussed a compromise to pair temporary funding with a future healthcare vote, no concrete deal has emerged (Politico). For now, Republicans demand that the government reopen before healthcare talks begin, while Democrats insist the two issues remain linked.

Sensei’s Insight: The longer the standoff drags, the greater the risk of market spillover—from delayed data releases to federal spending freezes. A resolution tied to healthcare could ease volatility into year-end, but entrenched positions suggest no quick fix ahead.

🪙 Grayscale Launches First U.S. Ethereum ETF With Staking Rewards

Grayscale has become the first U.S. issuer to integrate staking rewards into spot crypto ETFs, activating the feature for its Ethereum Trust (ETHE), Ethereum Mini Trust (ETH), and Solana Trust (GSOL). The three products collectively manage around $8.25 billion in assets, with ETHE accounting for roughly $4.8 billion and the Mini Trust $3.3 billion. At launch, the funds staked approximately 32,000 ETH (≈ $150 million) to begin earning network rewards, according to company filings and industry data (CoinDesk). Grayscale will use institutional validators and custodians to manage staking and plans to distribute rewards as either reinvested value or cash payouts (Markets Media).

The move follows fresh SEC guidance clarifying that liquid staking doesn’t automatically constitute a securities offering, a key regulatory breakthrough that allows yield to be incorporated within registered crypto products (CryptoSlate). Analysts estimate staking yields of around 3%, which could offset management fees and attract yield-seeking institutions. However, only a portion of fund holdings can be staked due to redemption liquidity rules, with potential withdrawal delays of up to 40 days for unstaking. The addition of staking positions Ethereum ETFs as hybrid yield assets—blurring the line between growth and income in crypto investing (Blockonomi).

Sensei’s Insight: By embedding staking directly into ETF structures, Grayscale just opened the door to yield-bearing crypto exposure in mainstream portfolios. Expect competitors like BlackRock and Fidelity to follow—turning ETH into the first major digital asset to offer both capital appreciation and passive yield inside regulated funds.

💰 BlackRock’s Bitcoin ETF Nears $100B—Becomes Firm’s Most Profitable Fund

Bitcoin briefly surged above $126,000 this week before stabilizing around $124,000, while BlackRock’s iShares Bitcoin Trust (IBIT) closed in on a milestone that underscores how mainstream crypto investing has become. According to Bloomberg ETF analyst Eric Balchunas, IBIT’s assets under management have reached $97.8 billion, generating an estimated $244.5 million in annual revenue, making it BlackRock’s most profitable ETF—surpassing long-established funds like the iShares Russell 1000 Growth ETF (IWF) and iShares Core S&P 500 ETF (IVV) (Bloomberg Intelligence).

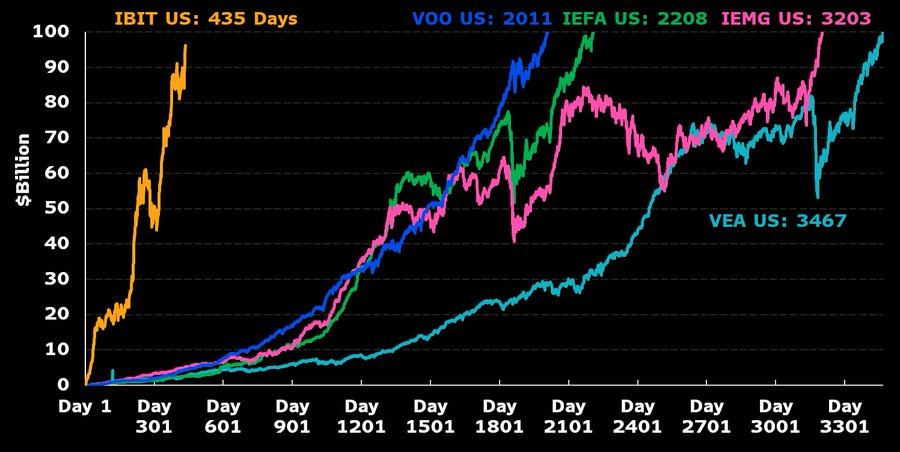

Launched just over a year ago, IBIT has grown at a record pace—amassing nearly $100 billion in assets in just 435 days, compared to over 2,000 days for the next-fastest fund, the Vanguard S&P 500 ETF (VOO). This makes it the fastest-growing ETF in history by assets and profitability. Balchunas called the feat “absurd,” noting that all other top-10 iShares funds took over a decade to reach comparable size (Eric Balchunas/X).

Sensei’s Insight: The explosive rise of IBIT reflects a structural shift: Bitcoin exposure is now a core institutional allocation, not a speculative play. With derivatives and options volume climbing and odds markets pricing a >70% chance of Bitcoin setting new highs this quarter, ETF inflows could remain a powerful tailwind for the crypto complex.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive — The Tokenisation Era: How Everything We Own Is Moving On-Chain

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.