Sensei’s Morning Forecast: XDC Crypto Deep Dive, BP’s Brazil Bonanza, and Cathie Wood’s Tesla Prediction

BP's mega-discovery, Trump reshapes data governance, BoE mulls cuts, Tesla bets on AI, UK lags in crypto—plus a deep dive into XDC’s booming real-world adoption.

🧠 One Big Thing

BP’s 500-meter hydrocarbon column in Brazil’s Santos Basin marks its biggest oil discovery in 25 years—part of a strategic fossil fuel pivot that could generate returns above 15% and redefine its 2030 production mix.

💰 Money Move of the Day

When oil majors shift billions from renewables back into high-margin fossil assets, it’s a reminder: capital follows margins. Tracking where the biggest companies place their bets can reveal broader economic cycles—and where opportunities or risks may concentrate next.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $114,320 (▲ +0.12%)

Ethereum (ETH): $3,556 (▲ +1.71%)

XRP: $2.98 (▲ +1.21%)

Equity Indices (Futures):

S&P 500 (SPX): 6,270 (▲ +0.56%)

NASDAQ 100: 23,045 (▲ +0.70%)

FTSE 100: 9,094 (▼ -0.07%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.228% (▲ +0.28%)

Oil (WTI): $66.80 (▼ -1.73%)

Gold: $3,368 (▲ +0.15%)

🕒 Data as of UK (BST): 12:22 / US (EST): 07:22 / Asia (Tokyo): 20:22

✅ 5 Things to Know Today

🛢️ BP Strikes Largest Oil Discovery in 25 Years Off Brazil Coast

BP has unveiled its most substantial oil and gas discovery in a quarter-century at the Bumerangue field, located 218 nautical miles off the coast of Rio de Janeiro in Brazil’s Santos Basin (BP). The exploration well penetrated a 500-meter hydrocarbon column across a 300-square-kilometer reservoir, revealing high-quality pre-salt carbonate rock at a total depth of 5,855 meters in 2,372 meters of water (Investegate). This marks BP’s tenth discovery of 2025 and highlights its strategic pivot back toward fossil fuels under CEO Murray Auchincloss (Share Talk). The company owns 100% of the Bumerangue block, secured in 2022 under favorable fiscal terms, including 80% cost oil and 5.9% profit oil.

Laboratory testing is underway to assess the commercial viability of the reservoir, following rig-site analysis that detected elevated CO₂ levels (Telegraph). The timing is pivotal: BP shares rose 1.6% to 402.65 pence after the announcement (Investing.com), offering momentum ahead of Tuesday’s second-quarter earnings release (MarketBeat). Activist investor Elliott Management is pressing for deeper cost cuts—an additional £5 billion beyond BP’s existing £4–5 billion target (Reuters). The discovery may bolster BP’s strategic position as it targets 2.3–2.5 million barrels of oil equivalent per day by 2030 and sustains its $10 billion annual capex through 2027 (Global Banking & Finance).

Sensei’s Insight: The Bumerangue discovery is not just a geological triumph—it's a strategic cornerstone for BP’s reenergized fossil fuel ambitions.

🇺🇸 Trump to Fill Key Economic Posts After BLS Firing

President Trump announced Sunday he will soon nominate a new Federal Reserve governor and Bureau of Labor Statistics (BLS) chief, moves that could dramatically reshape economic governance amid growing scrutiny of data integrity and monetary policy direction (Fox Business, Yahoo Finance). These plans follow Trump’s controversial dismissal Friday of BLS Commissioner Erika McEntarfer, citing alleged political manipulation after a disappointing July jobs report showing just 73,000 new jobs and downward revisions of 258,000 jobs across May and June (NBC News, CNBC). McEntarfer, confirmed 86-8 by the Senate just 18 months ago with support from key Republicans, has denied wrongdoing, and critics—including Trump’s own former appointee William Beach—warn her removal sets a dangerous precedent for politicized economic data (ABC News, Fortune).

Separately, the Fed opening comes after Governor Adriana Kugler announced her resignation effective August 8, cutting her term short by five months to return to academia (CNBC, Federal Reserve, Reuters). Her departure gives Trump another seat on the rate-setting Federal Open Market Committee amid his escalating pressure on Chair Jerome Powell to cut rates from the current 4.25%-4.5% level (Fortune, Yahoo Finance). Reported Fed contenders include Treasury Secretary Scott Bessent, former Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and current Governor Christopher Waller (CNBC, Reuters). Analysts warn that these picks may further Trump’s long-term strategy to influence central bank leadership when Powell’s term expires in 2026, raising alarms among economists and markets about the erosion of the Fed’s independence (Bloomberg, NYT).

Sensei’s Insight: Trump’s swift moves to reshape the Fed and BLS are unprecedented in scope and timing. Market watchers and institutional leaders are right to be concerned—the credibility of economic data and the independence of central banking hang in the balance.

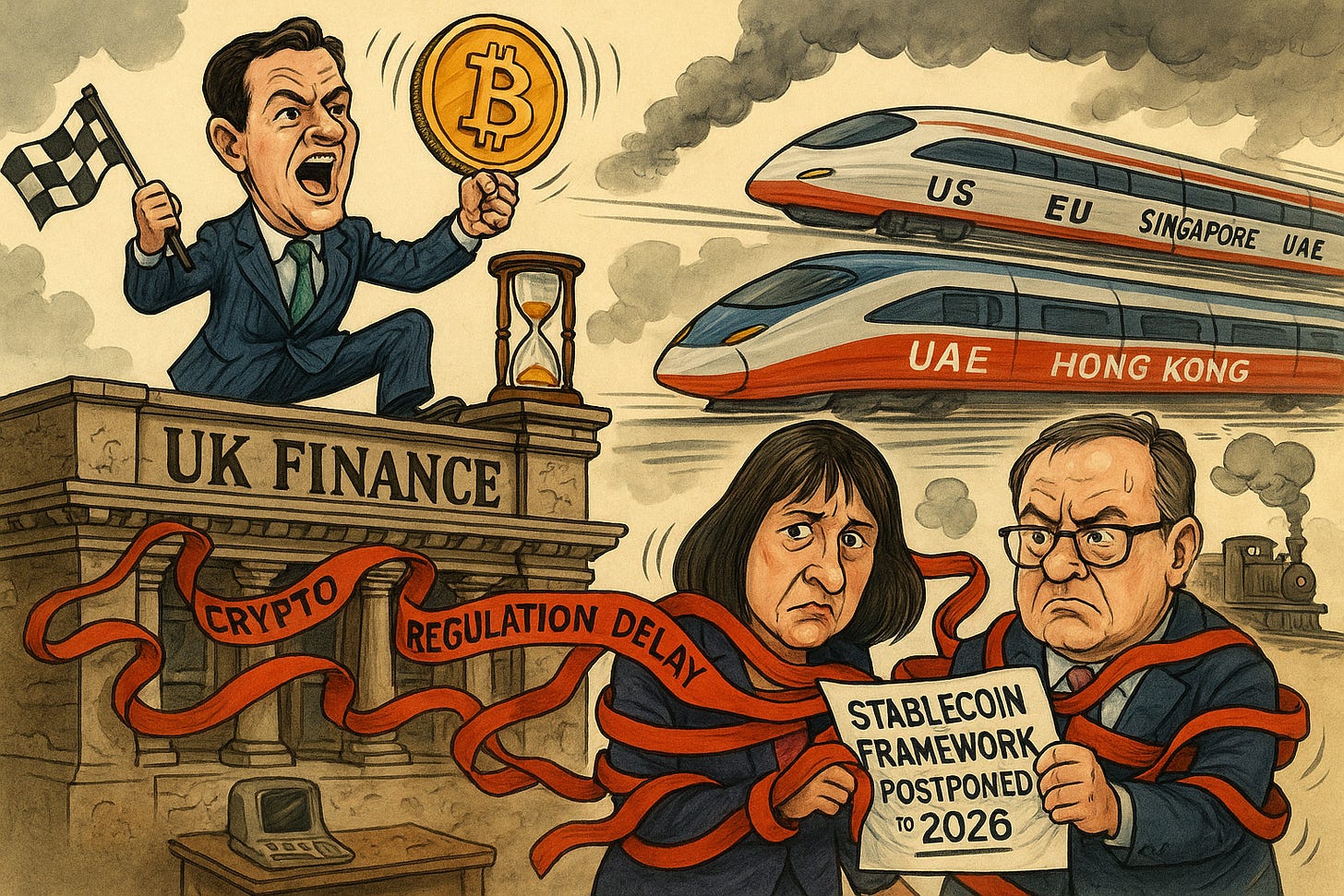

🇬🇧 UK’s Crypto Lag: Osborne Issues Stark Warning

Former UK Chancellor George Osborne has warned that Britain risks falling behind in the global cryptocurrency race due to its sluggish regulatory pace. Now a member of Coinbase’s Global Advisory Council since January 2024 (Markets Media), Osborne urged current Chancellor Rachel Reeves and Bank of England Governor Andrew Bailey to implement a comprehensive stablecoin framework and accelerate digital asset regulations. He stressed that other jurisdictions—including the US, EU, Singapore, UAE, and Hong Kong—are already attracting crypto capital and talent by creating clear, proactive policies (AInvest; Mitrade).

Osborne likened the current moment to the 1980s "Big Bang" reforms, warning that London’s future as a financial hub hinges on embracing digital asset innovation now. With 12% of UK adults owning cryptocurrency—up from just 4% in 2021 (Gov.uk)—the call comes amid concerns that Britain's delay in implementing its April 2025 draft crypto legislation until 2026 places it at a competitive disadvantage (Global Government Fintech).

Sensei’s Insight: When a former Chancellor compares crypto policy urgency to the financial Big Bang of the '80s, investors should take note. Regulatory clarity isn’t just compliance—it’s a competitive moat.

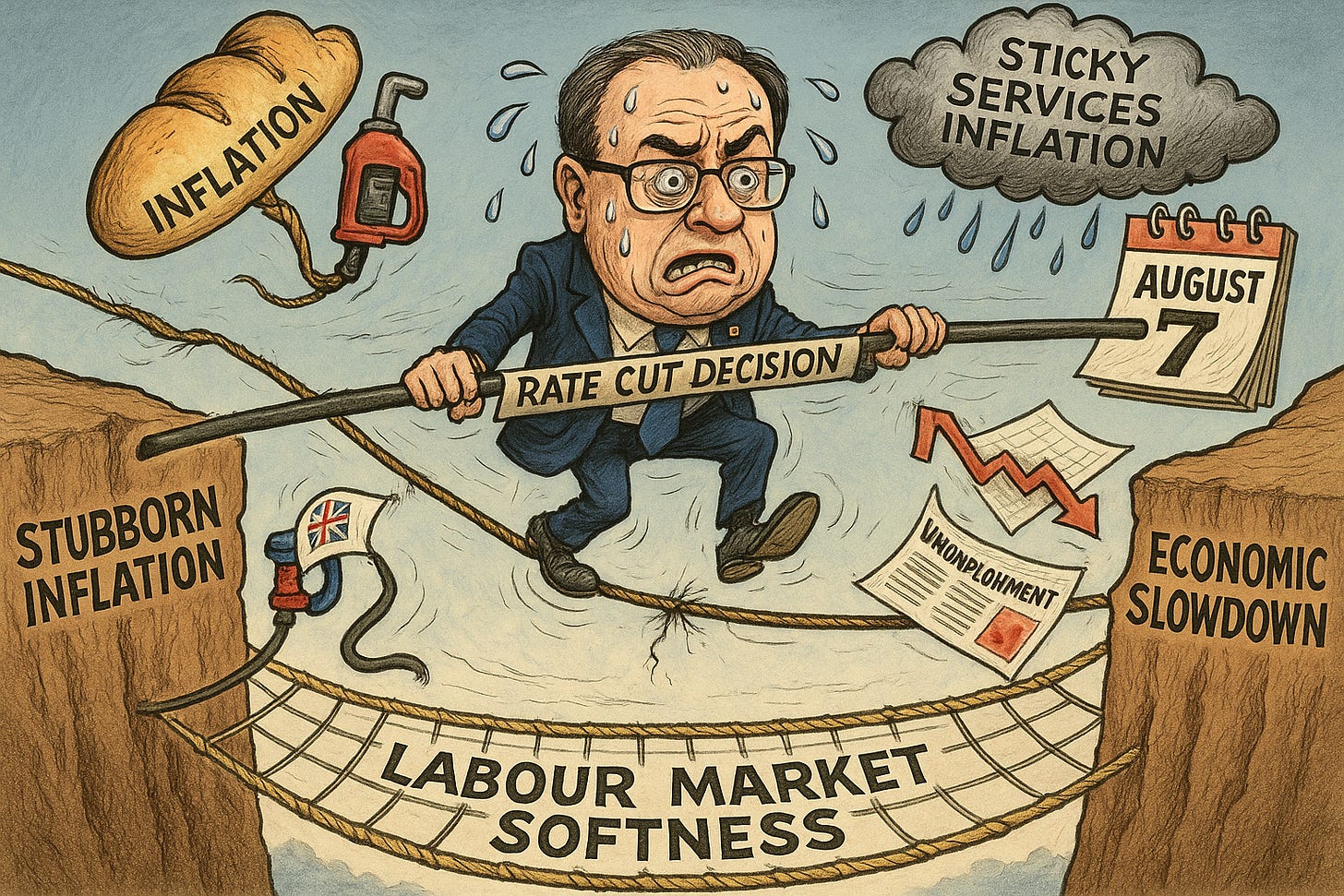

🇬🇧 Bank of England Faces Inflation Challenge as Rate Cut Looms

The Bank of England is navigating a high-stakes policy dilemma ahead of its August 7 meeting, with markets pricing in a 93.6% chance of a 25 basis point rate cut to 4% (Morningstar, Bloomberg). This comes as UK inflation unexpectedly rose to 3.6% in June, up from 3.4% in May, driven by transport and food costs (Trading Economics, CNBC). Food inflation hit 4.5%, its highest since February 2024. Core inflation climbed to 3.7%, while services inflation stayed sticky at 4.7%. The BoE had forecast a 3.7% peak for inflation between July and September before a return toward the 2% target (Bank of England).

Meanwhile, labor market softness provides cover for rate cuts. Unemployment has risen to 4.7%, a four-year high, with wage growth moderating to 5% (Yahoo Finance, BBC). GDP contracted 0.1% in May following a 0.3% drop in April, though Q1 posted 0.7% quarterly growth from services and investment (ONS). Employment has dropped by 115,000 since March, and job vacancies have been in decline for three years (Reuters). Still, the BoE must weigh cutting against persistently high services inflation and real wage growth. Markets anticipate a fourth cut in November, potentially lowering rates to 3.75% by year-end (Independent, Reuters).

Sensei’s Insight: The BoE is walking a tightrope—too fast, and inflation resurges; too slow, and labor market weakness hardens.

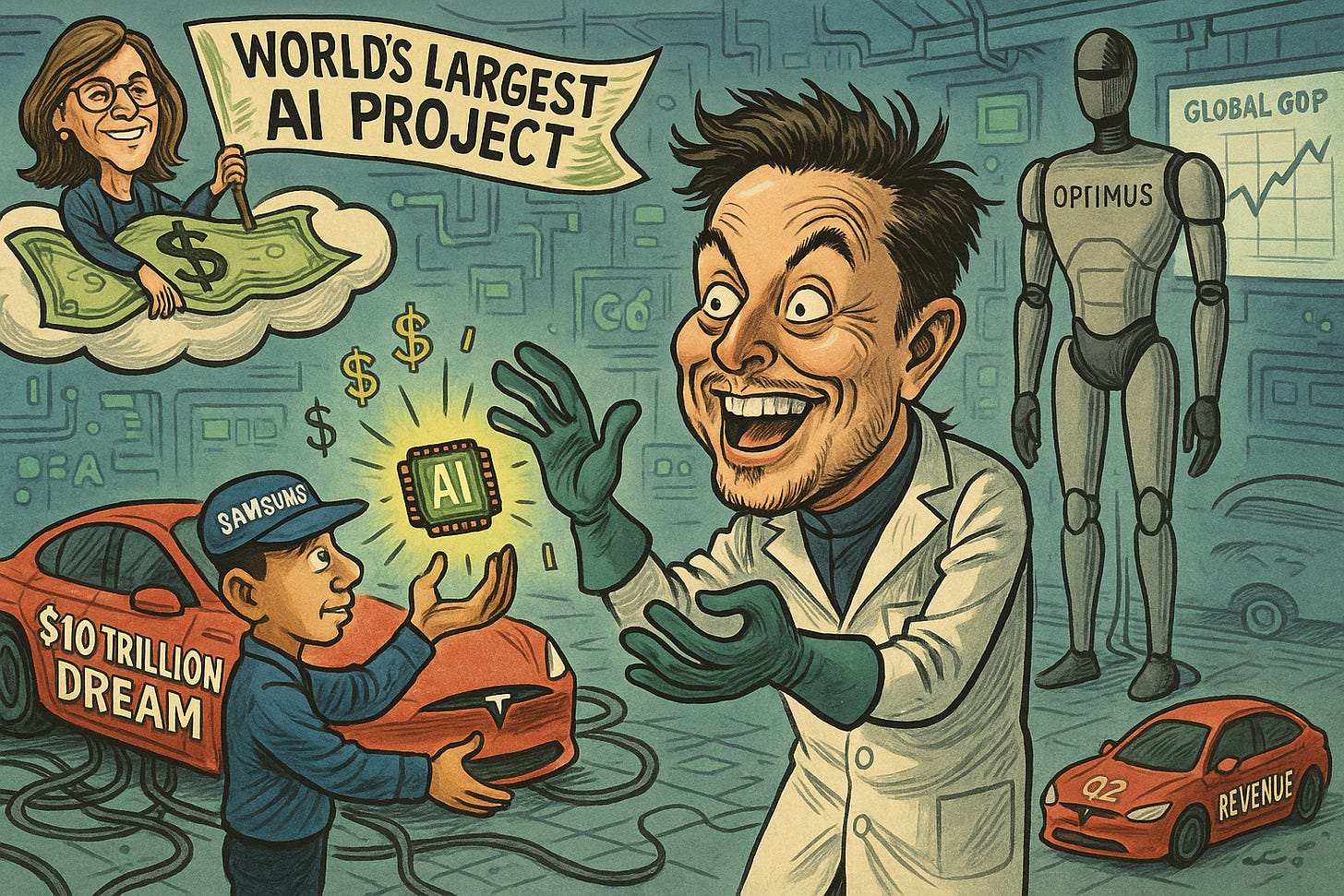

🚗 Wood & Musk: Tesla Is the World's Largest AI Project

ARK Invest CEO Cathie Wood called Tesla the "largest AI project on Earth," with Elon Musk affirming the claim with a simple “True” on X (AINVEST, X). Wood forecasts the autonomous taxi ecosystem could drive $8–10 trillion in global revenue over the next 5–10 years—almost 9% of today's $113 trillion global GDP. She believes platform providers like Tesla could capture roughly half of that opportunity. This outlook aligns with Tesla's AI-centric shift, supported by a $16.5 billion partnership with Samsung Electronics to manufacture its next-gen AI6 chips in Texas (Investors). The chips will power Tesla's upcoming robotaxis and Optimus humanoid robots, with Musk hinting the true value of the deal may exceed initial estimates.

Tesla shares are up 52% over the past year despite a 20% drop in 2025 year-to-date performance, as markets recalibrate the company’s value beyond EVs (Benzinga). Wedbush analyst Dan Ives now pegs Tesla’s AI and autonomous segments alone at a $1 trillion valuation. The Samsung chip deal could streamline Tesla’s hardware supply chain and localize advanced manufacturing near Musk’s operational hubs. Still, despite these AI ambitions, Tesla’s Q2 revenue fell 12% YoY to $22.5 billion, reflecting the tension between future promise and present performance (AINVEST).

Sensei’s Insight: Cathie Wood’s AI valuation thesis is bold—but it's Musk’s quiet “True” that might carry the most weight.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

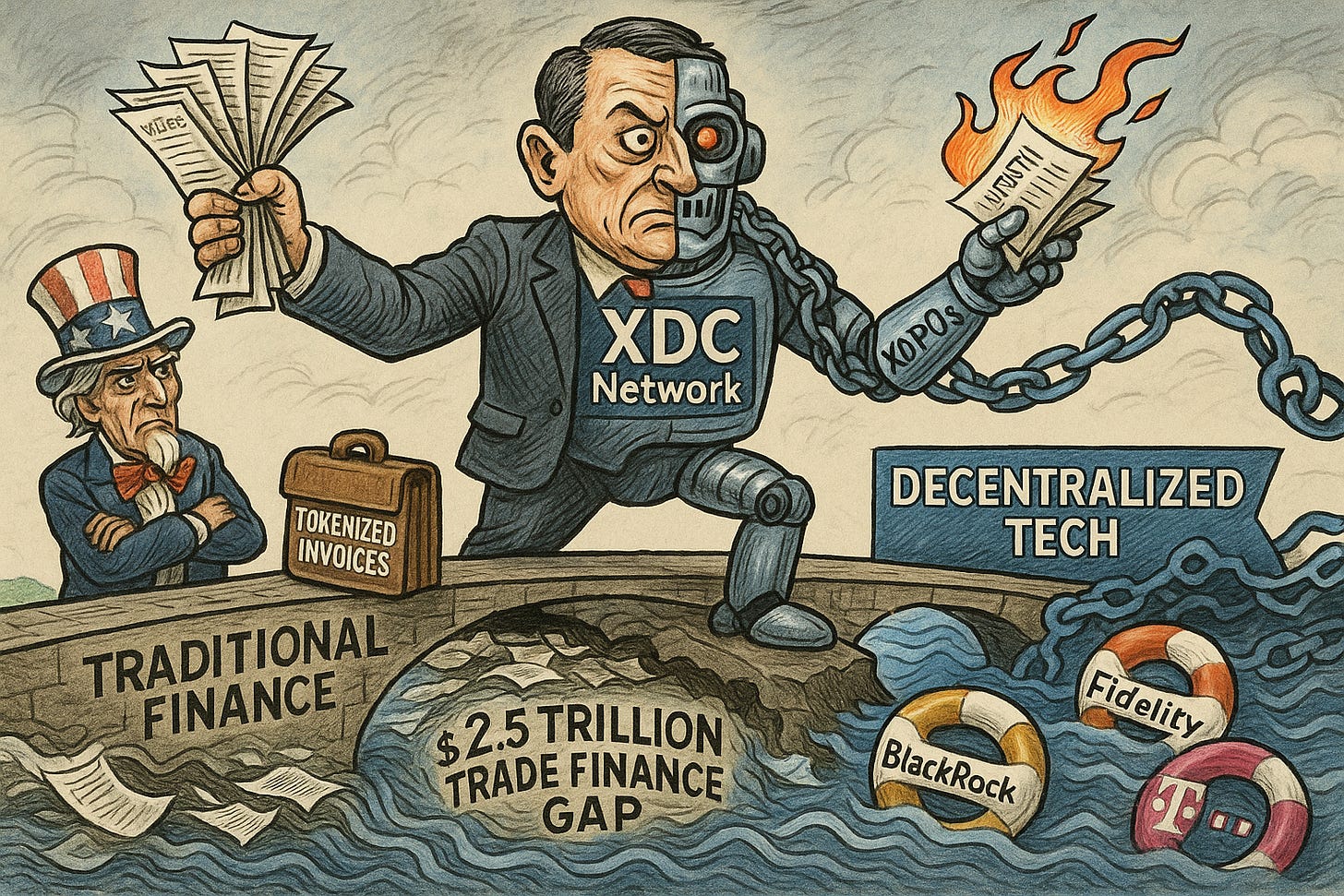

🔍 Deeper Dive: XDC Network (XDC)

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.