Sensei’s Morning Forecast: XRP Clock Ticks, CPI Countdown Begins

Markets brace for inflation shocks, Trump’s Fed shake-up, the XRP ETF decision, Apple’s WWDC, and deepening US-China trade fractures.

🧠 One Big Thing

$103.2 billion — that’s China’s trade surplus for May, its widest in over a year, even as exports to the U.S. plunged 34.5%. The disconnect underscores how tariff volatility and weak global demand are reshaping the balance of trade—and sending fresh shockwaves through global supply chains.

💰 Money Move of the Day

High returns often come with hidden overlap. Tech and crypto tend to move together, especially during macro shocks. Blending in assets that behave differently—like gold, Treasuries, or international stocks—can reduce drawdown risk without capping potential.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $107,217 (▲ +1.35%)

Ethereum (ETH): $2,538 (▲ +1.05%)

XRP: $2.26 (▼ -0.21%)

Equity Indices (Futures):

S&P 500 (SPX): 6,001 (▼ -0.01%)

NASDAQ 100: 21,784 (▼ -0.03%)

FTSE 100: 8,826 (▼ -0.12%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.490% (▼ -0.40%)

Oil (WTI): $64.95 (▼ -0.05%)

Gold: $3,314 (▲ +0.14%)

🕒 Data as of UK (BST): 11:50 / US (EST): 06:50 / Asia (Tokyo): 19:50

🎥 Live Show Link – Join the Market Breakdown

Catch the full morning breakdown live with Sensei on YouTube. Watch Now:

We go deeper into today’s moves, charts, and headlines. Bring your coffee, questions, and watchlist.

✅ 5 Things to Know Today

US-China Trade Talks Resume in London

High-level delegations from the United States and China are meeting in London today to address the ongoing trade conflict that has disrupted global markets. The talks follow a fragile truce brokered in Geneva last month, where both sides agreed to temporarily reduce tariffs and negotiate further. However, tensions have since resurfaced, with both countries accusing each other of violating the agreement—especially over the export of critical rare earth minerals vital to technology and manufacturing.

The US team, led by Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Trade Representative Jamieson Greer, is meeting with China’s Vice Premier He Lifeng at an undisclosed London venue. The discussions are expected to focus on restoring trade in rare earths and resolving disputes over tariffs and export controls. Global investors are closely watching the outcome, as the trade war has already caused significant slowdowns in both economies and rattled supply chains worldwide (reuters).

The current 90-day pause on US-China tariffs, which began on May 14, 2025, is set to expire on August 12, 2025. If no further agreement is reached or the pause is not extended, tariffs could revert to previous higher levels after this date.

Trump Slams ‘Too Late’ Powell, Signals Fed Chair Decision Coming Soon

President Trump intensified his criticism of Fed Chair Jerome Powell, branding him “Too Late” for holding rates steady and urging an aggressive full-point rate cut—even as May’s jobs report beat expectations. Trump claims Powell’s inaction is costing the country “a fortune” and argues that lower rates would be “rocket fuel” for growth, especially as Europe cuts rates and U.S. inflation cools. With Trump promising to announce his pick for the next Fed chair “very soon,” investors should brace for potential shifts in Fed policy and market volatility as leadership uncertainty collides with political pressure on rates. [Bloomberg]

Markets Eye CPI Data and Fed Meeting: Two Rate Cuts Still Priced In, But Key Data Looms

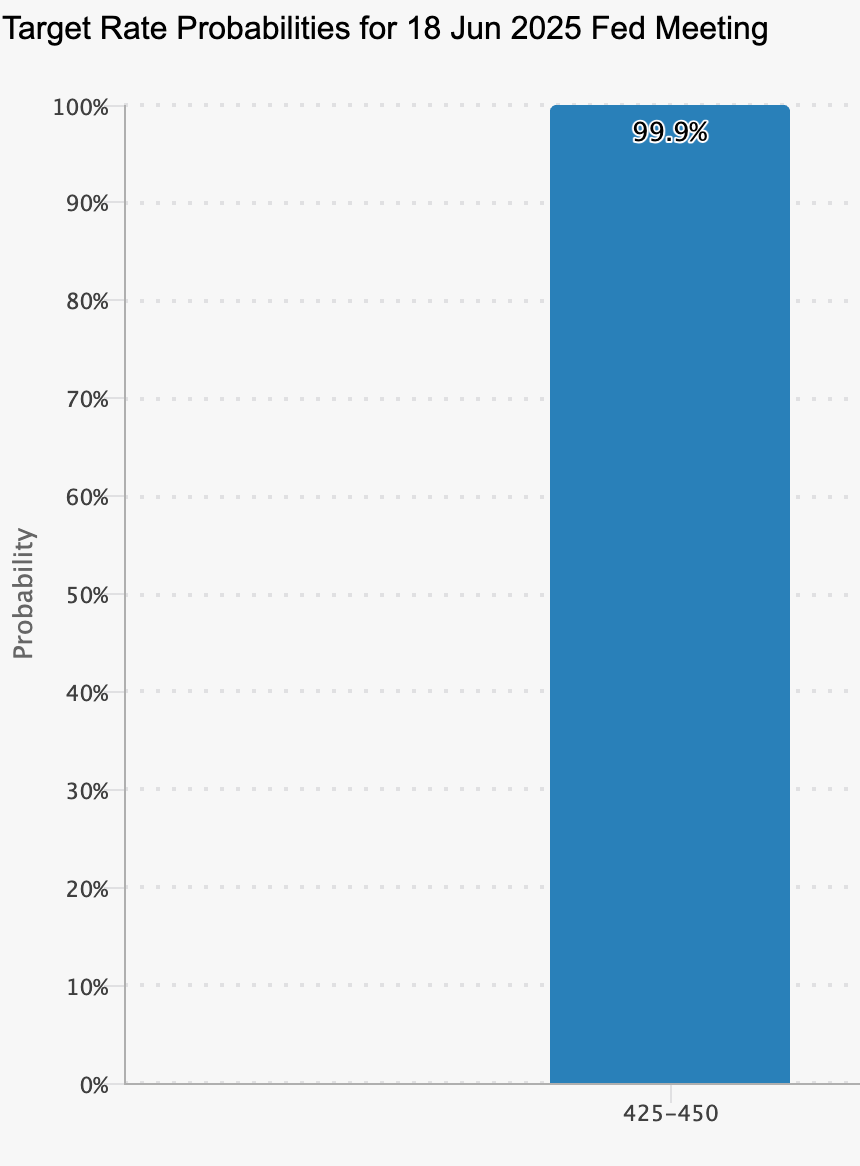

Markets are currently pricing in two rate cuts from the Federal Reserve by year-end, with futures implying the fed funds rate could fall to the 3.75%–4.00% range. There have been zero Federal Reserve rate cuts so far in 2025. However, all eyes are on this Wednesday’s US CPI inflation report, which will be pivotal for shaping expectations ahead of the Fed’s next policy meeting on June 18. Fed officials have signaled a cautious stance, and the consensus is for no rate change next week, but softer inflation data could tip the balance toward a cut as early as July or September. The most likely scenario: the Fed holds steady in June, waits for more evidence of cooling inflation, and potentially starts cutting in September.

Why it matters: Retail investors should watch for volatility around the CPI release and Fed meeting, as surprises could quickly shift rate cut expectations and move stocks, bonds, and mortgage rates.

Markets are betting big on the Fed holding steady — Futures now imply a 99.9% probability that the Fed will leave rates unchanged at the next meeting, reflecting a sharp pullback in rate-cut expectations amid sticky inflation and resilient job data.

NASA’s SpaceX Reliance: A Double-Edged Sword for U.S. Space Ambitions

NASA is now critically dependent on SpaceX for transporting astronauts and cargo to the ISS, with the Dragon capsule as the only reliable U.S. crew vehicle since the Shuttle era. Boeing’s Starliner delays leave NASA vulnerable—if SpaceX withdrew Dragon, NASA might need to rely again on Russia’s Soyuz system (Axios).

The dependence deepens with the Artemis program, where SpaceX’s Starship is essential for Moon and Mars missions. NASA has awarded billions in contracts, placing its next-gen exploration goals squarely in Musk’s hands (Reuters).

Why it matters: U.S. space ambitions are now tightly coupled with a single private company led by a volatile CEO. Technical issues, political shifts, or internal disputes at SpaceX could delay or derail NASA’s entire strategy. Investors should track SpaceX’s operational stability and NASA’s urgency in diversifying partnerships (OpIndia).

Global Trade Growth Slows Sharply as Tariff Uncertainty Hits China-US Flows

China’s exports rose just 4.8% in May, missing forecasts and sharply down from April’s 8.1%, while imports declined 3.4%, reflecting domestic weakness. The standout stat: Chinese exports to the U.S. plunged 34.5% year-over-year, the steepest drop in over five years. New reciprocal tariffs—up to 145% by the U.S. and 125% by China—hit in early May before a brief truce was reached mid-month. Despite a growing trade surplus ($103.2B), the data highlight worsening supply chain pressure and policy uncertainty (Türkiye Today, Reuters, Time).

Why it matters: For investors, this signals mounting risk to global supply chains, export-heavy sectors, and consumer demand. Tariff volatility and weak import signals point to a fragile Chinese recovery and greater macro uncertainty heading into Q3.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: XRP ETF Momentum – A Regulatory Breakthrough or Mirage?

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.