Sensei's Morning Forecast: XRP ETF DAY, Fed Decision, and UK Trade Pact

Markets brace for Fed and SEC moves, Ripple settlement nears, XRP ETF deadline hits, UK and US ink trade deal, and eVTOL leaders shine at the Paris Air Show.

🧠 One Big Thing

The SEC could move today on the first-ever spot XRP ETF, filed by Franklin Templeton. No decision yet, but approval odds are soaring (88%) for an ETF this year. A green light would mark a seismic shift—opening the door to retirement funds, unleashing institutional inflows, and potentially igniting a new wave of crypto adoption.

💰 Money Move of the Day

ETF speculation is heating up—but don’t overlook how these products actually reshape access. If approved, a spot XRP ETF would allow exposure through standard brokerage accounts, retirement plans, and even robo-advisors—removing custody complexity and tax headaches for everyday investors.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $105,944 (▼ -0.81%)

Ethereum (ETH): $2,556 (▲ +0.43%)

XRP: $2.21 (▼ -1.15%)

Equity Indices (Futures):

S&P 500 (SPX): 5,999 (▼ -0.56%)

NASDAQ 100: 22,028 (▼ -0.63%)

FTSE 100: 8,835 (▼ -0.09%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.422% (▼ -0.63%)

Oil (WTI): $73.15 (▲ +2.09%)

Gold: $3,397 (▲ +0.35%)

🕒 Data as of UK (BST): 12:02 / US (EST): 07:02 / Asia (Tokyo): 20:02

🎥 Live Show Link – Join the Market Breakdown

Catch the full morning breakdown live with Sensei on YouTube. Watch Now:

We go deeper into today’s moves, charts, and headlines. Bring your coffee, questions, and watchlist.

✅ 5 Things to Know Today

SEC and Ripple File Status Report; Judge’s Decision on Settlement Now Pending

Ripple and the SEC met the June 16 court deadline by jointly filing a status report with the U.S. Court of Appeals, confirming they are still actively negotiating a settlement and requesting the appeals process remain paused until August 15, 2025. This was the expected next step as both parties await Judge Analisa Torres’ ruling on their joint motion to dissolve the injunction on XRP institutional sales and reduce Ripple’s penalty to $50 million. Importantly, this is not just another routine extension: the case is now in Judge Torres’ hands, and she can issue a ruling on the proposed settlement at any time. If approved, the litigation and appeals would end; if denied, the case could return to appeals. If no decision is made soon, another status update will be required in August, but the timing of a final resolution is entirely at the judge’s discretion.

Why it matters: The next move is Judge Torres’. Her ruling will determine whether Ripple’s legal overhang is lifted and could set a key precedent for crypto regulation in the U.S. The market is watching closely, as a decision could come at any moment.

[CryptoTimes] [FXEmpire] [Coingape] [AInvest]

Sensei’s Insight: Ripple’s long legal saga is finally on the knife’s edge. Judge Torres holds the pen—and her ruling won’t just decide Ripple’s fate, but could redraw the U.S. crypto playbook. I believe she’ll get it right and close the case before the August deadline. This resolution could land any day now.

BoJ Holds Rates, Slows Bond Taper as Inflation Persists and Growth Stalls

Bank of Japan Stays Cautious on Policy Normalisation

The Bank of Japan (BoJ) held its benchmark interest rate at 0.5% for the third straight meeting, signaling a measured approach amid global economic uncertainty and sticky domestic inflation. The decision, reached unanimously, also included a slower tapering plan for Japanese Government Bond (JGB) purchases. From April 2026, the BoJ will reduce JGB purchases by ¥200 billion per quarter, targeting a monthly pace of ¥2 trillion by March 2027. This move aims to avoid further volatility in ultra-long yields as the bank gradually unwinds stimulus (FXStreet, Reuters, Capital Brief, BoJ, CNBC).

Inflation Pressure Meets Sluggish Growth

While headline inflation remains elevated at 3.5%—above the BoJ's 2% target for over three years—Japan's economy shows signs of softening. Corporate profits and exports are down, GDP contracted 0.2% in Q1 2025, and food inflation is rising due to supply issues like rice shortages. In response, markets showed mild movement: the yen traded around 144.80 per USD and 10-year JGB yields nudged to 1.465%. Governor Kazuo Ueda reiterated a cautious outlook, noting future hikes remain on the table depending on economic developments. The central bank will revisit its tapering strategy in June 2026, keeping flexibility as uncertainties persist, including global trade friction and Middle East tensions (FXStreet, XTB, BoJ).

Sensei’s Insight: The BoJ’s steady hand and ultra-low rates keep Japan central to global carry trade dynamics. With rates still near zero while other central banks stay hawkish, Japan remains a prime funding source for leveraged bets abroad. The slower bond taper adds to this appeal, reinforcing yen-funded trades even as inflation lingers. But any hint of a future hike—or shift in taper pace—could unwind these positions fast, making BoJ meetings critical for global risk sentiment.

Coinbase CEO Presses UK for Faster Crypto Rules to Compete Globally

Coinbase CEO Urges UK to Accelerate Crypto Regulation Rollout

Coinbase CEO Brian Armstrong met with UK lawmakers this week in London, pressing for rapid implementation of comprehensive crypto regulations. The visit aligns with the UK’s release of draft crypto asset legislation set for full enactment by 2026, which incorporates tax transparency and aligns with the OECD’s Cryptoasset Reporting Framework. Armstrong emphasized the UK's opportunity to rival the U.S. as a crypto hub, highlighting the importance of clear regulatory signals to attract institutional investment and talent. Meanwhile, the Financial Conduct Authority (FCA) is finalizing rules on stablecoins, custody, and DeFi following a recently closed consultation (BeInCrypto, AInvest, Coinpedia, Coincu).

Industry Momentum Builds Despite Readiness Concerns

Armstrong’s engagement highlights growing institutional and retail momentum in the UK crypto market, bolstered by moves such as lifting the retail ban on crypto ETNs and IG Group enabling crypto trading for retail clients. However, readiness remains uneven: just 15% of industry professionals believe the UK is on the right track, and only 9% of firms feel prepared for the incoming regime. Without clarity or timely progress, startups may shift operations to more favorable jurisdictions—making the next policy phase pivotal for the UK’s crypto aspirations (BeInCrypto, AInvest, Coinpedia).

Sensei’s Insight: Armstrong’s push reflects a broader trend—crypto leaders are now lobbying not just for legitimacy, but for regulatory environments that can anchor global leadership. The UK’s next steps could determine whether it becomes a crypto innovation hub or watches talent migrate elsewhere.

🏛️ Fed Watch: Markets Brace for June FOMC Decision

The Federal Reserve’s Federal Open Market Committee (FOMC) kicks off its two-day policy meeting today, June 17–18, 2025, with the rate decision and policy statement scheduled for release at 2:00 p.m. ET on June 18 (Federal Reserve, Equals Money, AOL, Forbes). Markets widely expect the Fed to keep its benchmark federal funds rate unchanged at 4.25%–4.50%, as inflation remains above the 2% target but has moderated from its peak. With labor market resilience and solid consumer spending, policymakers are seen as having the flexibility to hold steady for now.

The spotlight will be on potential forward guidance about the timing and scale of future rate cuts, with projections from March suggesting two to three quarter-point reductions in the second half of 2025. Fresh economic forecasts—covering inflation, GDP, and unemployment—could significantly move markets, especially if the Fed's “dot plot” shifts. Fed Chair Jerome Powell’s press conference will be closely analyzed for policy cues amid mixed economic signals and global uncertainties. The decision’s implications stretch far beyond Wall Street, potentially influencing global risk sentiment and central bank policy abroad (Investopedia).

Sensei’s Insight: The June FOMC meeting isn’t just about holding rates—it’s about recalibrating expectations. With inflation cooling but still sticky, and geopolitical risks muddying the macro picture, the Fed’s tone on rate cuts will steer global sentiment. Watch the dot plot and Powell’s language—this is where 2025’s monetary path takes shape.

🇺🇸🇬🇧 Landmark US-UK Trade Pact Unveiled at G7

The United Kingdom and United States have finalized a landmark trade agreement, unveiled on the sidelines of the G7 summit in Canada and signed by President Donald Trump and Prime Minister Keir Starmer. The "Economic Prosperity Deal" slashes tariffs on UK exports in the automotive and aerospace sectors while granting US agricultural exporters greater access to British markets. The US will now permit up to 100,000 UK-manufactured vehicles annually at a 10% tariff—down from 27.5%—Sky News, Financial Express. Aerospace tariffs will be completely removed, while a quota-based exemption system will apply to British steel and aluminium exports EFE, Avalara.

In return, the UK will lower tariffs and expand quotas on US beef and ethanol , White House. Though not a full free trade agreement, the deal removes major barriers imposed earlier in 2025 and lays the groundwork for further talks on unresolved issues like industrial tariffs and pharmaceuticals Dentons. Both leaders hailed the accord as a jobs-boosting milestone, with continued negotiations expected to solidify and expand the pact Reuters, BBC.

Sensei’s Insight: This isn’t a full-blown trade agreement—it’s a sharp, sector-focused pact delivering real tariff cuts fast. Unlike stalled comprehensive deals, it shows the UK can still strike meaningful bilateral wins post-Brexit—this one, notably, with the US.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

✈️ Paris Air Show 2025 Kicks Off – We’re On The Ground

The 2025 edition of the Paris Air Show has launched with energy, innovation, and some major headlines. As the world’s premier aerospace event, it continues to set the stage for the future of aviation. We are closely monitoring developments across both traditional and advanced aviation markets, with Vaz arriving on-site later this week. Our Saturday eVTOL Live Show will be streamed directly from Hall 5, home to the Advanced Air Mobility and eVTOL pavilion, bringing exclusive updates, interviews, and analysis. Each day, we’ll also name our Top 3 Winners from the eVTOL world, starting with Day 0 and Day 1.

🥉 3rd Place – BETA Technologies: Quiet Execution, Big Results

BETA Technologies impressed onlookers with not one, but two piloted demonstration flights of its electric conventional takeoff and landing (eCTOL) aircraft on Day 1. This comes shortly after the company made history with the first passenger-carrying eCTOL flight in U.S. airspace. The display marks BETA's steady, under-the-radar progress and affirms its status as a serious player not just in the eVTOL race, but across the electric aviation landscape. We covered the first passenger flight on our Saturday eVTOL LIVE show with Vaz.

🥈 2nd Place – Archer Aviation ($ACHR): Southeast Asian Expansion

Archer Aviation took a significant commercial step by securing its third customer through the Launch Edition program. The new partnership with Industri Ketehana Nasion, an Indonesian strategic logistics provider, is valued at $18 million upfront. More importantly, the agreement includes options for up to 50 aircraft, potentially growing the deal to $250 million. This move underscores Archer’s growing international footprint and strengthens its appeal among early-adopter markets.

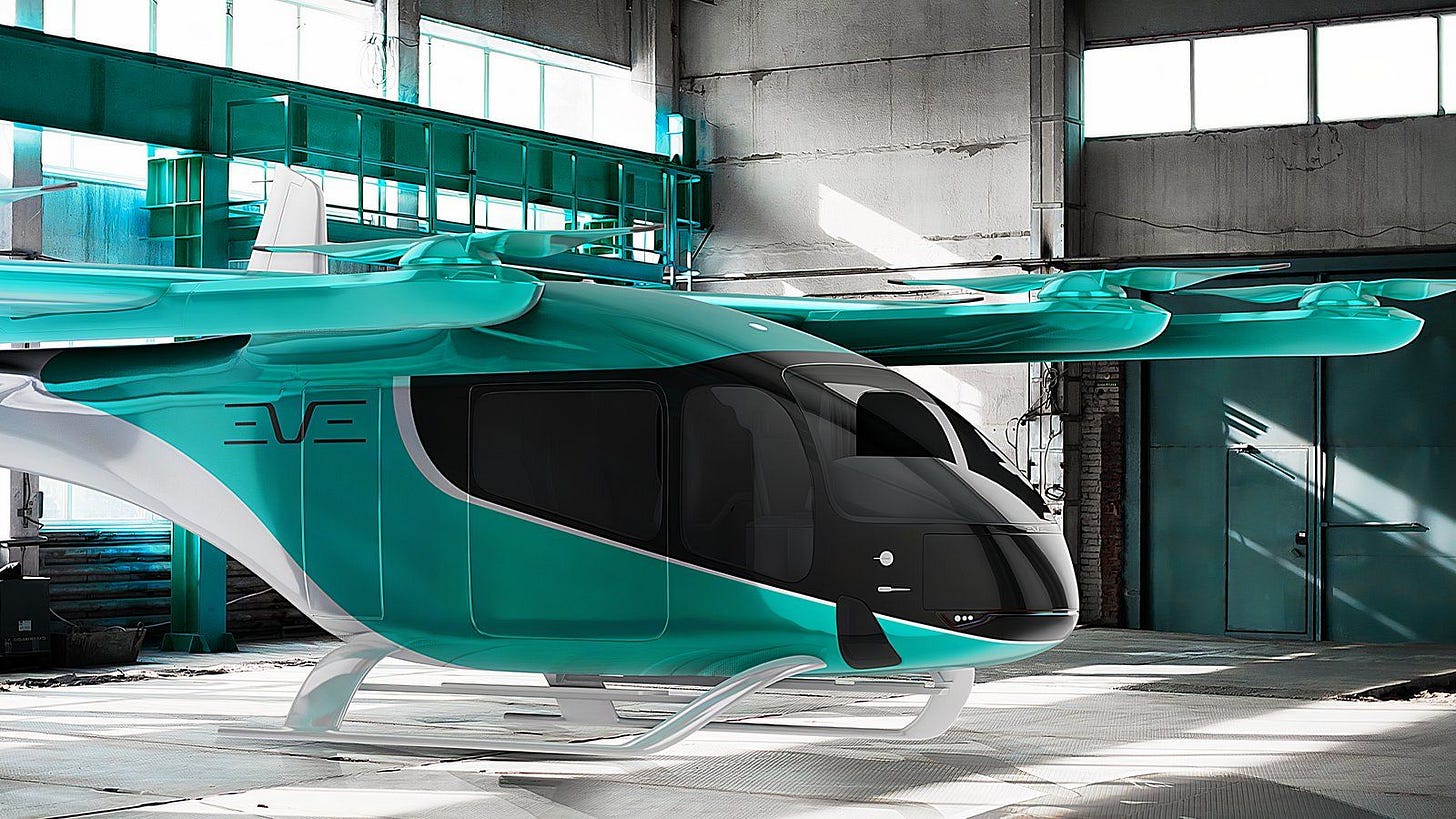

🥇 1st Place – EVE Air Mobility ($EVEX)/Embraer: Home Market Triumph

Our top eVTOL performer of the day is EVE Air Mobility, the Embraer-backed player that announced a major order for 50 aircraft to Brazil-based Revo. Valued at $250 million, this deal not only reinforces EVE’s home-market dominance but also brings credibility to Brazil’s early infrastructure and regulatory support for urban air mobility. With Revo aiming for early commercial operations, this agreement could serve as a blueprint for how to launch regional eVTOL services at scale.

💥 Bonus Highlight – Airbus ($AIR): The Traditional Titan Strikes

While our focus is eVTOL, Airbus was the clear winner of Day 1 overall. The European aerospace giant locked in firm orders for 132 aircraft, plus options for 141 more, bringing the potential total to 273 jets valued between $20–22 billion. Deals were struck with LOT Polish Airlines, AviLease, ANA Holdings, and Riyadh Air, covering A220s, A320neos, A350 freighters, and A350-1000s. It was a commanding show of force—and a reminder that while AAM is rising, traditional OEMs are still flexing with full strength.

Vaz comments:

I cannot wait to see HALL 5 live at the end of the week! We have seen some massive market moves on the very first day of the show, and even on the Day Zero evening of Sunday, before the show was officially open. I would be surprised if anyone beats Airbus' historical day, but who knows! Congratulations to everyone, we are getting the proof that the eVTOL market is taking off faster and faster (pun intended).

🔍 Deeper Dive – XRP ETF Deep Dive: Catalysts, Implications, and Market Impact

The U.S. race to approve a spot XRP ETF is gaining serious traction. With filings from major issuers like Franklin Templeton, Bitwise, and Grayscale, markets are watching closely as key SEC deadlines approach. A decision on Franklin Templeton's application is expected today, June 17 (FXStreet).

XRP Spot ETF Filings – Status as of June 17, 2025

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.