Sensei’s Morning Forecast: XRP Joins Wall Street, But Will Shutdown 2.0 Arrive Before the Market Even Prices It In?

Fragile UK GDP, U.S. shutdown damage, Starbucks’ Red Cup walkouts, Gopuff’s valuation reset, and XRP’s long-awaited ETF launch, alongside a full Virgin Galactic deep dive before earnings tonight.

👀 Today’s Stories at a Glance

📉 UK Q3 GDP slows to 0.1% — Stalling growth and falling investment fuel rate cut bets before Reeves’ budget.

🛑 US Shutdown ends after 43 days — Government reopens, but healthcare fights and economic damage keep “Shutdown 2.0” risk alive.

☕ Starbucks workers strike on Red Cup Day — 1,000+ baristas protest scheduling instability and pay issues across 40 cities.

🚚 Gopuff valuation drops 43% to $8.5B — New funding signals shift to cost control over growth amid delivery market reset.

💥 XRP launches first U.S. spot ETF — Institutional access unlocks, with today’s volume set to define long-term demand trajectory.

🔍 Virgin Galactic faces a binary outcome — With no revenue and mounting losses, success hinges entirely on Delta-class launch timing.

🧠 One Big Thing

The 43-day U.S. government shutdown is over, but the next one may be just 78 days away. It cost $14 billion in lost output, froze economic data collection, and disrupted aid to millions. With ACA subsidy talks unresolved, markets now face a fresh risk catalyst in late January.

💰 Money Move of the Day

Shutdowns show how fast income flows can freeze. Keeping a small cash buffer—ideally in a high-yield account—can help weather delays in pay, benefits, or tax refunds. It’s not advice, just a hedge against uncertainty.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $102,772.03 (▲ +1.13%)

Ethereum (ETH): $3,496.86 (▲ +2.43%)

XRP: $2.49 (▲ +4.25%)

Equity Indices (Futures):

S&P 500: 6,838.7 (▼ -0.15%)

NASDAQ 100: 25,591.00 (▼ -0.13%)

FTSE 100: 9,864.08 (▼ -0.44%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.098% (▲ +0.81%)

Oil (WTI): $58.869 (▲ +0.63%)

Gold: $4,225.93 (▲ +0.75%)

Silver: $53.613 (▲ +0.66%)

🕒 Data as of UK (BST): 11:35 / US (EST): 06:35 / Asia (Tokyo): 20:35

✅ 5 Things to Know Today

📉 UK Growth Stalls as Q3 GDP Slips to 0.1% Ahead of Reeves’ Budget

UK economic momentum slowed sharply in the third quarter, with GDP rising just 0.1%—half the pace of Q2 and below the 0.2% expected by economists, according to the Office for National Statistics (ONS). September output fell 0.1%, driven by a steep drop in manufacturing after a cyberattack forced Jaguar Land Rover to halt production for more than five weeks, leading to a near 30% collapse in motor vehicle output. Manufacturing declined 1.7% and industrial production 2.0%, while services edged up 0.2%. Household and government spending rose only modestly, and business investment fell for a second consecutive quarter amid caution over expected tax increases in Chancellor Rachel Reeves’ 26 November budget. Trade also weakened: exports slipped in Q3 and goods exports to the US dropped 11.4% in September to their lowest level since early 2022, reflecting the impact of new US tariff measures (Reuters).

For markets, the data confirms the UK has moved back into a slower and more fragile growth phase after outperforming G7 peers earlier this year. Weak capex, softer trade and one-off manufacturing disruption have strengthened expectations for monetary easing, with traders now pricing an 80%+ probability of a 25bp Bank of England cut in December (Reuters). Sterling briefly dipped before stabilising, and gilts were little changed as investors look to Reeves’ upcoming fiscal plans. The budget now represents the key macro risk: broad-based tax rises would add fiscal tightening to an already weak backdrop, influencing domestic demand and shaping the BoE’s policy path into 2026.

Sensei’s Insight: With growth stalling, investment slipping, and unemployment rising, the UK is drifting toward recession territory. Reeves’ budget and the BoE’s response will determine whether this slowdown stabilises—or rolls into a deeper contraction.

🛑 US Shutdown Ends After 43 Days — But Another Standoff Looms

The US government reopened after President Trump signed a stop-gap funding bill on 12 November, ending the 43-day shutdown, the longest in American history. The legislation restores federal operations through 30 January 2026 but leaves the core dispute unresolved: whether to renew the enhanced Affordable Care Act premium subsidies that expire at year-end. Those credits support nearly 24 million Americans, and losing them would more than double average marketplace premiums next year, according to analysis from KFF (KFF). The shutdown caused major operational strain across federal agencies, halted October economic data collection, and forced 900,000 employees into furlough while 2 million worked without pay. Air travel saw severe disruption, with more than 8,000 flights canceled between 7–11 November, driven by unpaid air-traffic controllers calling out and FAA-mandated capacity restrictions (Independent). The interim deal includes a Senate-secured commitment for a December vote on ACA subsidies, though House Speaker Mike Johnson has not committed to bringing any bill to the floor (CNN).

Markets and policymakers now face the economic aftermath. The Congressional Budget Office estimates the shutdown knocked roughly 0.8 percentage points off Q4 real GDP growth by late October, with as much as $14 billion in activity permanently lost due to foregone consumption and halted services (CBO). The data blackout is a major challenge for the Federal Reserve: October jobs and inflation reports were never collected, leaving policymakers to prepare for the 9–10 December FOMC meeting with limited visibility into labour-market and price dynamics (Fortune). Airlines warned of lasting earnings hits, while SNAP disruptions left 42 million recipients without November benefits until systems are fully restored (CBS News). With only 78 days until the next funding deadline and no agreement on healthcare, the structural drivers of the shutdown remain in place, keeping the prospect of a “Shutdown 2.0” firmly on the table.

Sensei’s Insight: The shutdown’s GDP drag, missing data, and SNAP shock add recession-style pressure beneath the surface. The next cliff date—30 January—now becomes a macro catalyst: if ACA talks fail, markets will re-price US growth risk rapidly.

☕ Starbucks Workers Strike Across 40 Cities on Red Cup Day

Unionised Starbucks baristas launched a coordinated walkout across at least 40 cities on the company’s high-traffic Red Cup Day, a key promotional event that typically drives one of the busiest sales days of the year. Workers United—the union representing staff at roughly 550 of Starbucks’ 10,000 US stores—said more than 1,000 workers at 65 cafes would participate, calling it what could be the largest strike in Starbucks’ history. The union claims Starbucks has refused to negotiate a fair contract and rejected the company’s April proposal, which included a 2% annual raise and no guaranteed scheduling stability, leaving workers at risk of receiving too few hours to qualify for benefits. Starbucks denies the accusations, stating that Workers United has “abandoned negotiations” and insisting that “nearly all” stores will remain open during the action (Bloomberg).

For investors, the walkout coincides with heightened scrutiny of Starbucks’ cost structure, labour relations, and traffic trends. Shares traded around $87.26, down about 1% during the session, as the company emphasised that average barista pay now exceeds $19 per hour, with total compensation above $30 per hour, while union organisers say pay progression and scheduling remain unresolved flashpoints. Starbucks is simultaneously focused on store expansion, operational efficiency, and margin recovery—areas exposed to risk if labour disputes scale further or extend into the holiday season. Although management maintains the strike will have minimal operational impact, ongoing contract tensions add headline risk and could influence sentiment around labour costs, staffing stability, and near-term same-store sales performance (Reuters).

Sensei’s Insight: Labour tensions won’t derail Starbucks, but they can drag on margins and sentiment. Consistency in staffing and scheduling is becoming a competitive advantage—watch how quickly management moves to stabilise relations.

🚚 Gopuff’s Valuation Marked Down 43% to $8.5B in New Funding Round

Instant-delivery platform Gopuff raised $250 million at an $8.5 billion valuation, a sharp 43% decline from its $15 billion pandemic-era peak. The round, led by Eldridge Industries and Valor Equity Partners, includes continued backing from long-time investors such as Baillie Gifford and signals a strategic shift toward financial discipline rather than expansion (Reuters). Alongside the raise, Gopuff appointed Matt McBrady—formerly at BlackRock’s multistrategy hedge fund—as its new CFO, replacing Saurabh Tejwani. The company says new capital will be channeled into AI, customer experience, and infrastructure, while avoiding any commitment to an IPO timeline. The repricing reflects the broader reset across rapid delivery, a sector where pandemic-era valuations proved unsustainable as consumer behaviour normalised and competitors exited key markets.

For investors, Gopuff’s markdown underscores the structural constraints facing ultra-fast delivery economics. Competitors including Getir, once valued above $10 billion, have withdrawn from major markets after heavy losses, while others such as Buyk and Fridge No More shut down entirely. Gopuff has responded with significant cost reductions—multiple rounds of layoffs since 2022 and consolidation of its European footprint—to push toward cash-flow positivity. The company’s vertically integrated model still offers higher gross margins than aggregator platforms, but capex intensity and thinning demand remain core challenges. With retail partnerships (including Amazon in the UK) and shoppable media initiatives offering new margin levers, Gopuff’s path now hinges on whether operational discipline can compensate for slower top-line growth in a consolidated, cost-sensitive delivery market.

Sensei’s Insight: The valuation cut signals reality catching up with rapid delivery. Watch Gopuff’s cash-flow discipline—profitability, not growth, will determine whether this $8.5B reset becomes a floor or another step down.

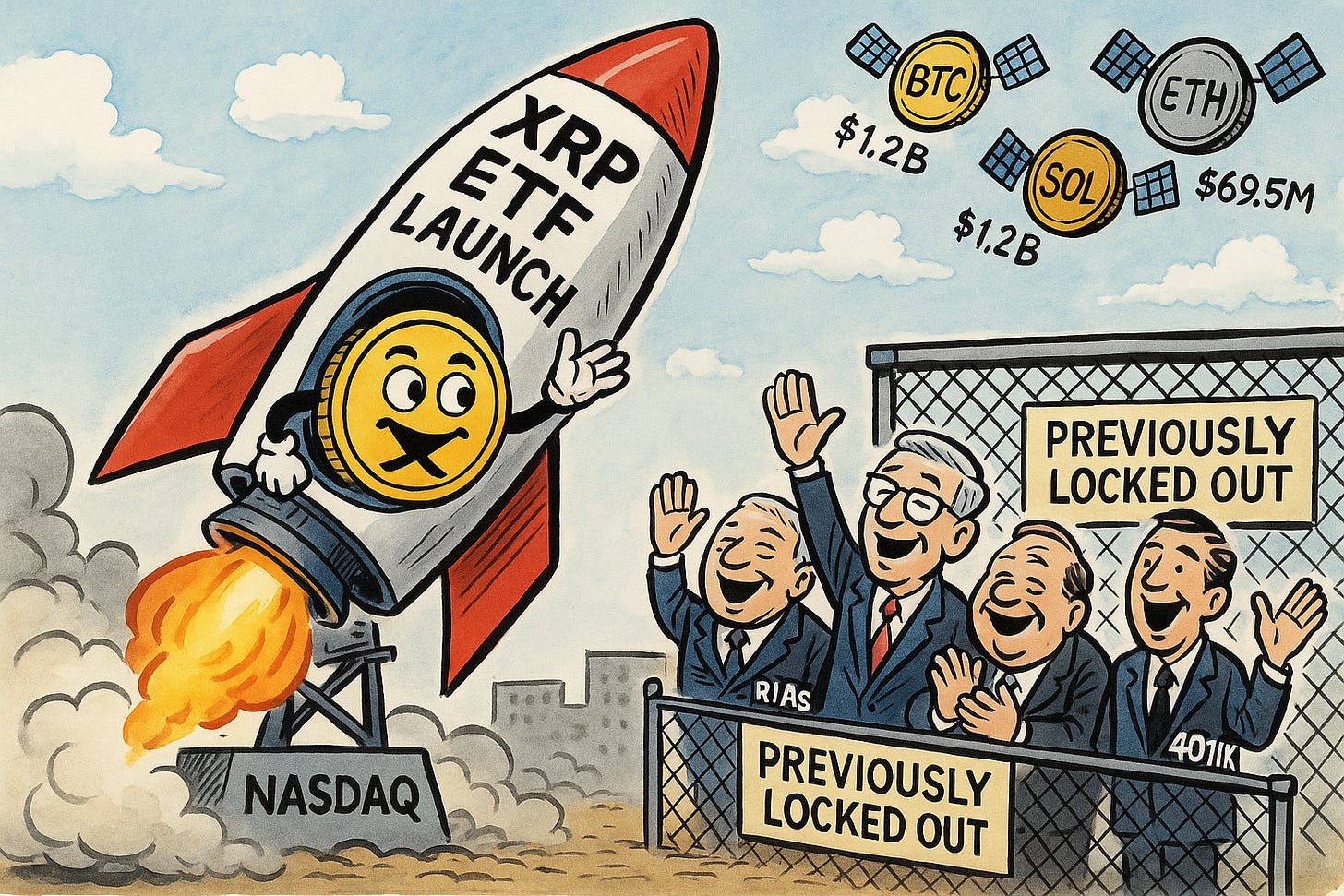

💥 XRP’s First U.S. Spot ETF Launches Today — The Most Important Moment for XRP Since 2017

The first-ever U.S. spot XRP ETF — the Canary XRP ETF (XRPC) — launches this morning on the Nasdaq, officially bringing physical XRP into U.S. regulated markets. The fund is issued by Canary Capital, holds real XRP tokens via Gemini and BitGo custody, and carries a 0.50% fee, higher than peers such as Bitwise’s 0.34% product. XRPC tracks the CCIXber spot reference rate and settles under the 1933 Act — the same structure used by Bitcoin, Ethereum, and Solana ETFs. This places XRP among the short list of U.S.-approved spot crypto products and comes ahead of other expected altcoin filings, including HBAR and Litecoin. For today’s launch, liquidity benchmarks from prior ETF first days provide the comparison set: Bitcoin ETFs hit $4.6B in day-one volume (Reuters), Ethereum $1.2B, Gold’s GLD roughly $1B, Solana’s BSOL $69.5M, HBAR’s HBTC ~$28M, and Litecoin’s LTCW ~$18M. These numbers give us the yardstick for judging XRPC’s opening hour and full-session demand.

The significance of a spot XRP ETF is that it finally opens XRP to the U.S. financial system’s deepest pools of capital. Until today, institutions were structurally locked out — fiduciary rules prevented RIAs, family offices, wealth platforms, pensions, endowments, and retirement accounts from touching exchange-based crypto exposure. Brokerage-only investors, 401(k) custodians, and most advisory platforms had no compliant pathway to XRP. A spot ETF removes all those barriers at once: XRP becomes allocatable in standard brokerage accounts, eligible for retirement wrappers, and accessible to firms that collectively oversee trillions of dollars. Historical ETF launches show what this kind of structural access can do. Bitcoin’s January 2024 approval triggered over $15B of inflows in the first 10 days, Ethereum saw over $3B in the first month, and even smaller assets like Solana and HBAR experienced concentrated bursts of institutional liquidity. If even a fraction of these flows migrate toward XRP, the long-term impact is transformational: persistent buy-side demand, increased market depth, and a shift from speculative trading to systematic allocation.

Sensei’s Insight: Today is the first time XRP True Spot ETF trades inside the U.S. capital market machine. The opening volume, spreads, and NAV premium will tell you instantly whether this is a niche altcoin debut — or the start of a multi-year institutional liquidity cycle.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍Deep Dive: 🚀 Virgin Galactic: High-Risk, High-Reward Ahead of Q3 Earnings

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.