Sensei's Morning Forecast: XRP Legal Confirmation, BTC Whale Crash, Jackson Hole Insight

Powell hints at cuts, Nvidia earnings test AI rally, tech slides, Bitcoin whale dumps, XRP ETF hopes rise, and central banks face a global coordination breakdown.

👀 Today’s Key Stories at a Glance

Nvidia Earnings Loom as AI Rally Test: Nvidia’s earnings could confirm AI’s momentum—or trigger a sector-wide sell-off if expectations disappoint.

Jackson Hole Highlights Central Bank Divergence: Global central banks are splitting on policy paths, exposing markets to volatility, missteps, and uncoordinated inflation battles.

Tech Stock Sell-Off Raises Concentration Risk Fears: A Nasdaq pullback and mounting AI skepticism spotlight the fragility of tech’s outsized role in market performance.

Bitcoin Whale Sparks $4K Flash Crash and $310M Liquidations: A massive BTC-to-ETH rotation by a whale triggered cascading liquidations and exposed crypto’s weekend liquidity fragility.

XRP Legal Victory Spurs ETF Filings From Seven Asset Managers: Ripple’s court win unlocked a flood of spot XRP ETF filings, though SEC approval remains the next hurdle.

🧠 One Big Thing

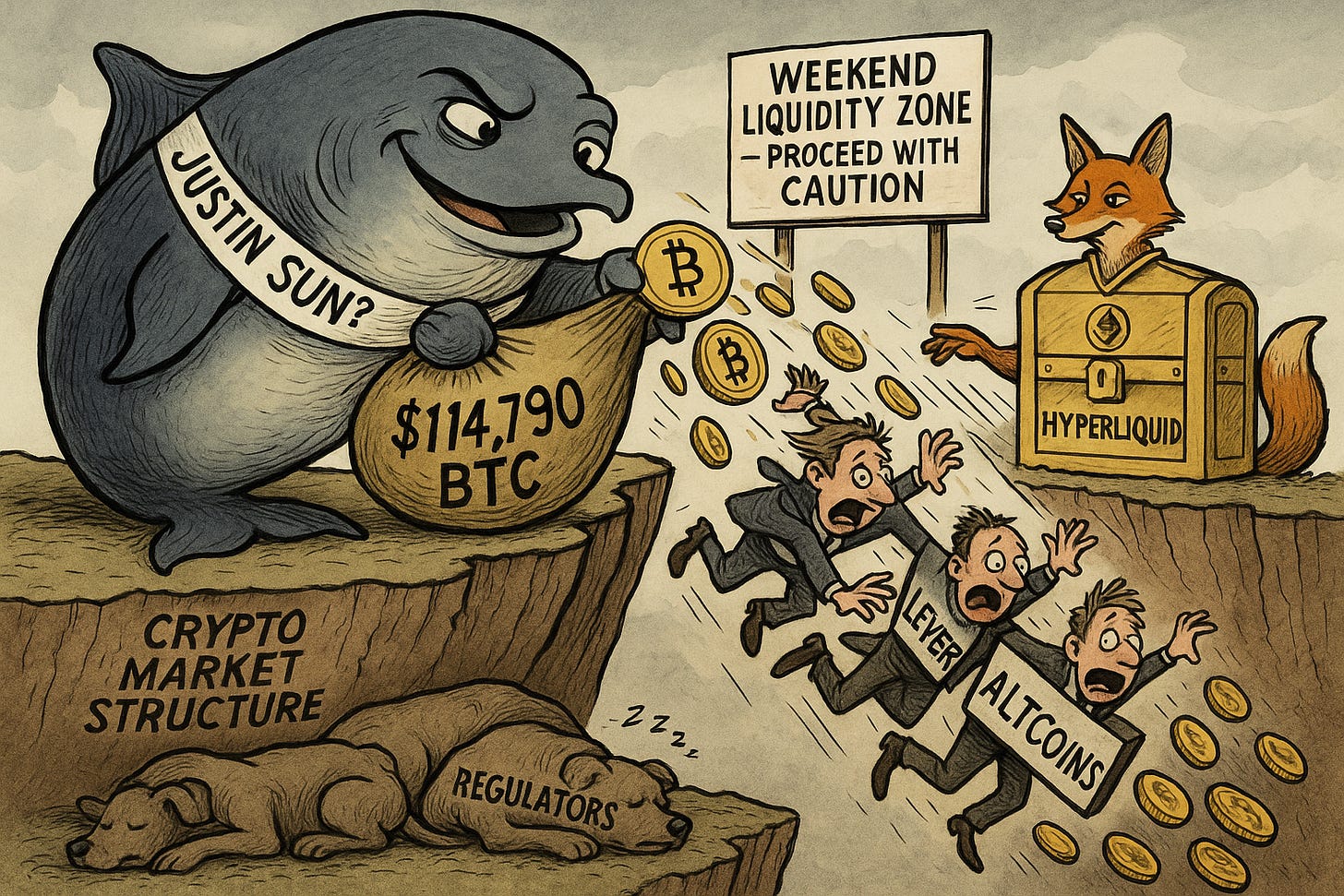

$2.7 Billion: That’s how much a single Bitcoin whale offloaded in minutes on August 24, triggering a $4,000 flash crash and wiping out $310 million in leveraged positions. One wallet moved the entire crypto market.

💰 Money Move of the Day

Watching crypto whales rotate billions between assets is a reminder: price action isn’t always about broad sentiment—it can hinge on one wallet. Know the terrain you’re trading on, especially in thin or leveraged markets.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $111,737 (▼ -1.67%)

Ethereum (ETH): $4,598 (▼ -3.95%)

XRP: $2.94 (▼ -2.70%)

Equity Indices (Futures):

S&P 500 (SPX): 6,362 (▼ -0.26%)

NASDAQ 100: 23,328 (▼ -0.29%)

FTSE 100: 9,183 (▲ +0.27%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.339% (▲ +0.49%)

Oil (WTI): $64.75 (▲ +0.46%)

Gold: $3,392 (▼ -0.10%)

🕒 Data as of UK (BST): 11:18 / US (EST): 06:18 / Asia (Tokyo): 19:18

✅ 5 Things to Know Today

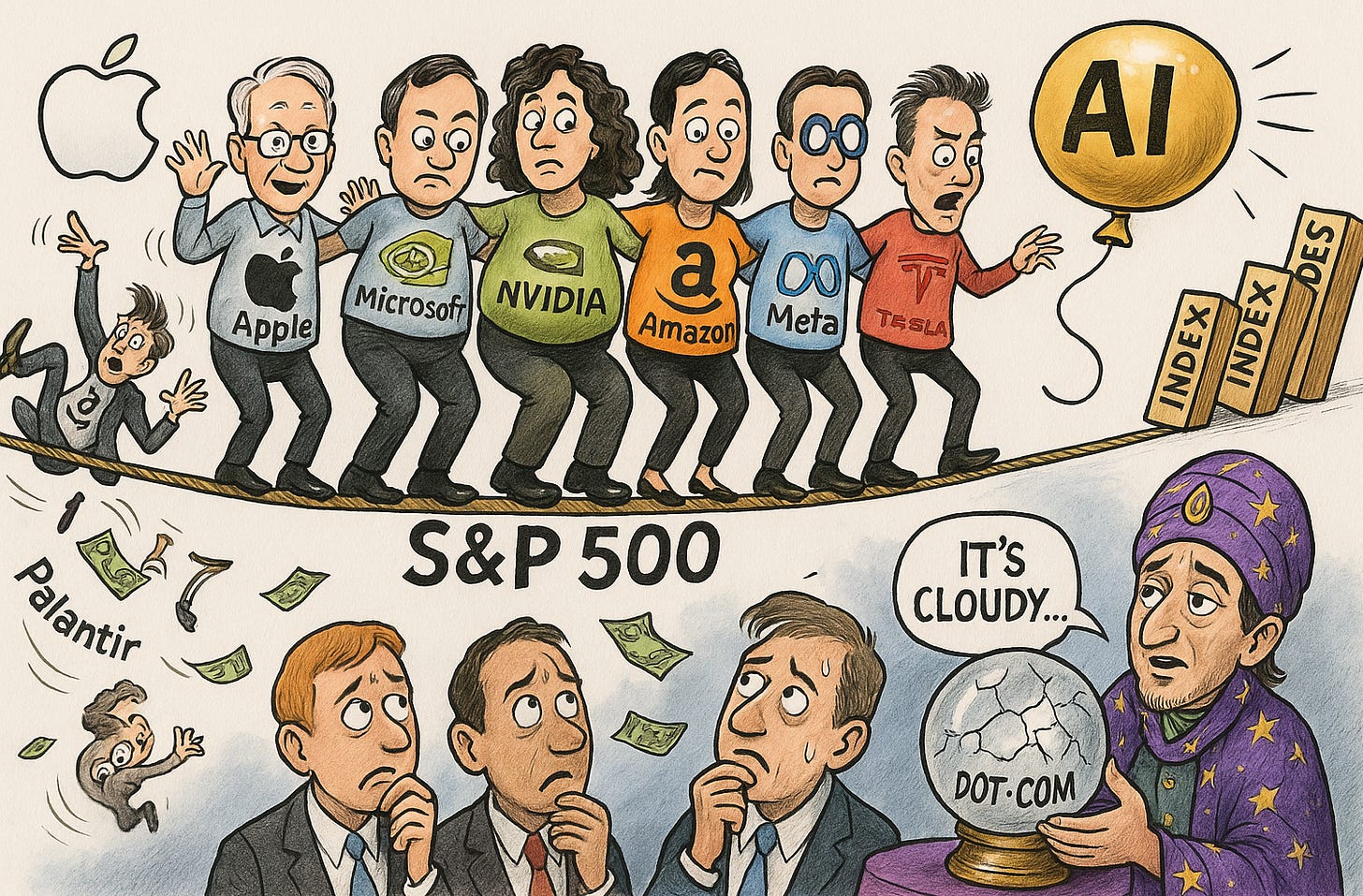

Nvidia Earnings Mark Critical Test as AI Rally Faces Reality Check

Options traders are bracing for a 6% swing in either direction when Nvidia reports Q2 2025 earnings Wednesday after market close, a moment many consider the most pivotal of the season. Analysts are forecasting adjusted EPS of $1.01—up 48.5% year-over-year—on $46 billion in revenue, reflecting a 53% surge. Nvidia’s results carry significant weight due to its 8% share of the S&P 500 and its dominant position in the AI supply chain, with roughly 40% of sales tied to hyperscaler giants Meta, Microsoft, Alphabet, and Amazon (Reuters, Bloomberg). The chipmaker has become the proxy for investor sentiment on AI infrastructure, making this earnings call a market-moving event.

The stakes are high amid intensifying scrutiny of the AI capex boom. Hyperscalers are on pace to spend over $300 billion on infrastructure next year, with GPUs comprising up to 80% of data center costs (Futuriom). Yet some analysts warn that 2026 could see 20–30% capex pullbacks, reintroducing historical investment discipline. Meanwhile, Nvidia faces geopolitical friction, including halted production of its H20 chip for China after Beijing discouraged local firms from adopting it (Morningstar). With the Fed hinting at possible September rate cuts and AI valuations stretched, Nvidia’s outlook will either reinforce bullish momentum—or expose deep fragility in tech’s core assumptions.

Sensei’s Insight: The entire AI rally is tethered to Nvidia’s guidance. If hyperscaler demand shows any cracks or China exposure worsens, the market won’t just wobble—it could unravel.

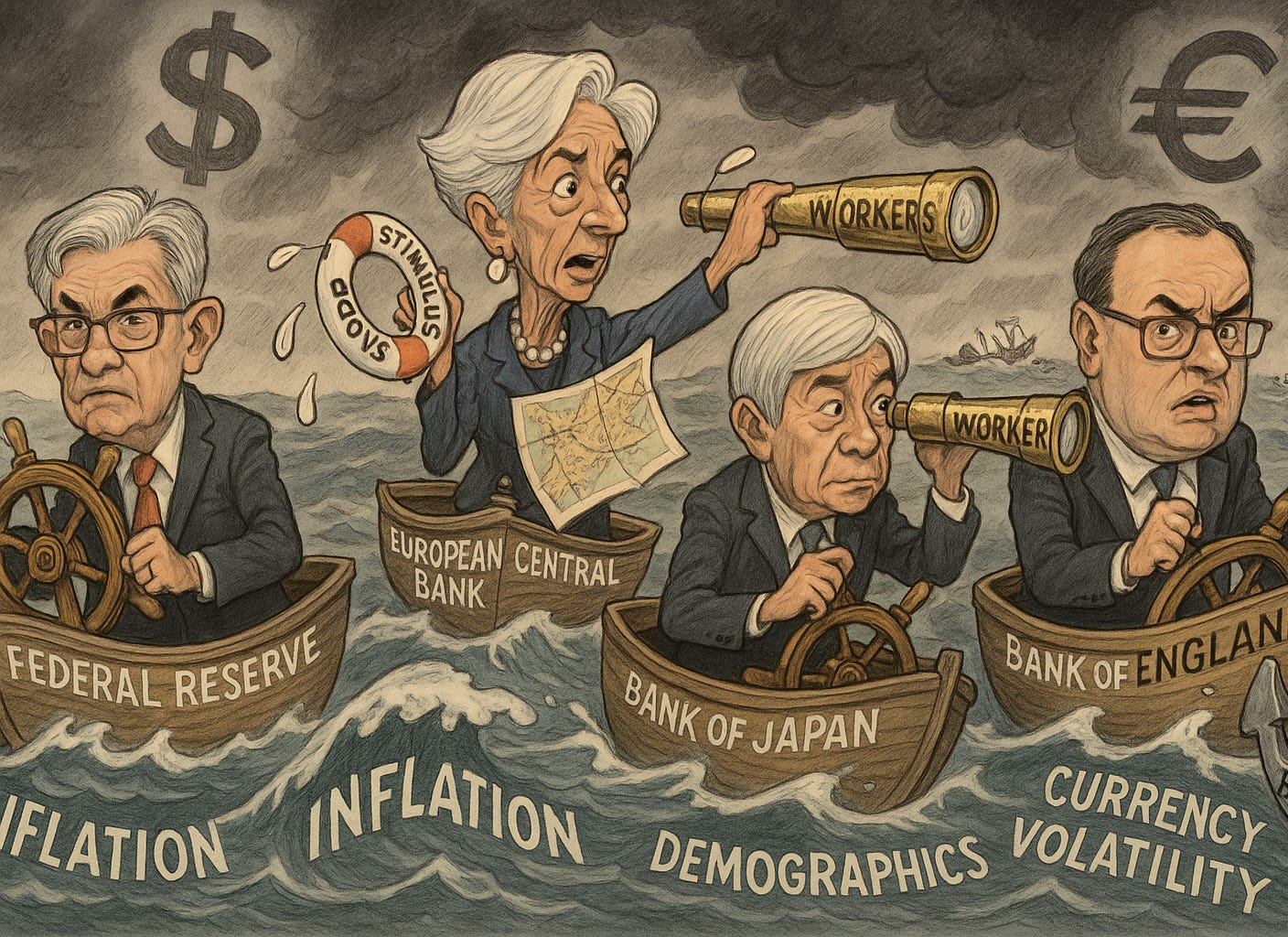

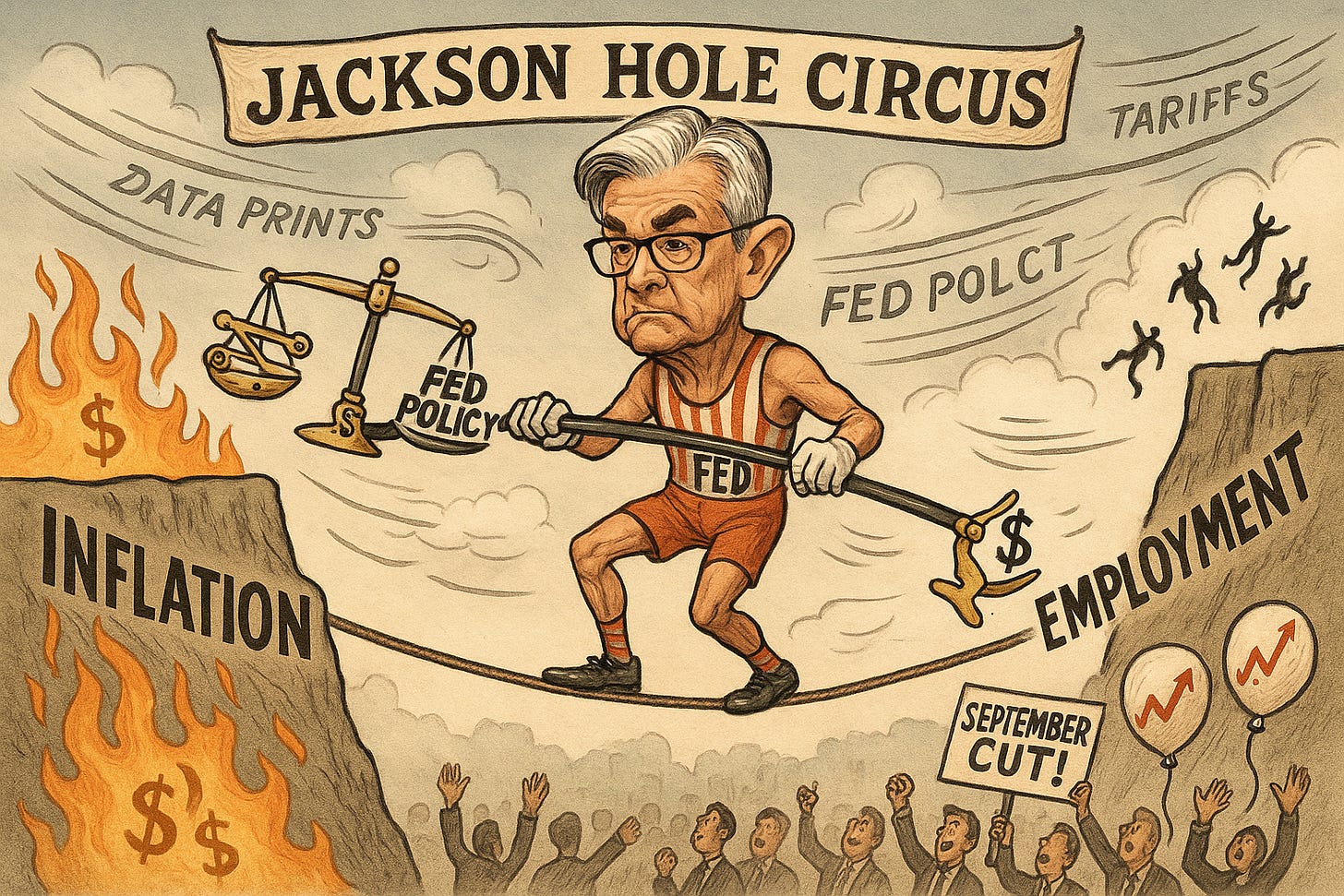

🌍 Fed's Jackson Hole Exposes Global Central Bank Policy Fractures

At the Jackson Hole Economic Symposium (August 22–24), central bankers laid bare a growing fragmentation in global monetary policy. The Federal Reserve paused rate cuts amid tariff-fueled inflation, the European Central Bank pursued further easing despite sticky prices, the Bank of Japan held to ultra-low rates while addressing severe labor shortages, and the Bank of England faced post-Brexit growth stagnation. These sharply diverging paths exposed emerging markets to heightened volatility, with capital flows disrupted as developed economies moved in opposite monetary directions. As detailed by the Atlantic Council and Reuters, the absence of coordination is now a systemic risk.

The event’s theme—“Labor Markets in Transition”—underscored a common structural dilemma: aging populations and persistent labor shortages. Bank of Japan Governor Kazuo Ueda called labor shortfalls Japan’s “most pressing economic issue,” while Bank of England Governor Andrew Bailey warned that 40% of the UK population will be over working age by 2040. European Central Bank President Christine Lagarde noted that foreign workers, who made up just 9% of Europe’s 2022 workforce, were responsible for half of recent economic growth—raising immigration policy tensions. These demographic shifts are distorting policy transmission channels and complicating inflation control, as highlighted in CGTN and ECB research.

Sensei’s Insight: As central banks prioritize domestic mandates over global coordination, expect elevated volatility, erratic currency movements, and rising policy missteps. The post-crisis playbook is obsolete—and the new one hasn’t been written.

Tech Stocks Flash Warning Signal as Sell-Off Challenges Sector's Market Dominance

A mid-August pullback in major tech names has raised fresh concerns over the sector’s market dominance. The Nasdaq fell from 21,607 to 21,172 on August 19–20 before partially rebounding, while Nvidia dropped 3.5% and Palantir plunged over 9% on August 19 alone. Investor sentiment was shaken further by an MIT study showing 95% of enterprise generative AI pilots fail to deliver measurable ROI, with only 5% scaling successfully—most of those through external vendor partnerships. Echoing the caution, OpenAI CEO Sam Altman warned that investors are “overexcited” about AI and likened current conditions to the dot-com bubble, citing inflated valuations and an eventual reckoning for overleveraged players.

The structural risks go deeper than stock price swings. The top 10 stocks now account for approximately 36% of the S&P 500—well above historical averages and even past bubble-era levels (Goldman Sachs). Technology’s sector weight sits near 31.6%, and Nvidia alone holds a 7.8% share—the highest single-stock weighting in four decades. The so-called Magnificent Seven are responsible for 47% of the S&P 500’s 2025 gains, underscoring the market’s heavy reliance on a narrow leadership group (Reuters). While some AI stocks trade at more than 50 times earnings—Palantir’s forward P/E exceeds 245—recent funding rounds show AI startups raised between $20 billion and $35 billion per quarter over the past year, according to market data. Claims of hundreds of unicorns collectively valued over $1 trillion are not substantiated, though several have crossed the $10–100 billion threshold.

Sensei’s Insight: When one sector dominates both performance and valuation, fragility spreads across portfolios—even in diversified funds. Concentration risk isn’t theoretical anymore; it’s the market’s center of gravity.

🐋 Whale Dump Triggers $4K Bitcoin Flash Crash, Sparking $310M Liquidation Cascade

On August 24, 2025, a single Bitcoin whale dumped 24,000 BTC—valued at $2.7 billion—within minutes, triggering a rapid $4,000 plunge in Bitcoin’s price from $114,790 to $110,680. The wallet, still holding 152,874 BTC worth over $17 billion, is believed to be linked to HTX exchange via six-year-old fund trails, and analysts suggest TRON founder and HTX advisor Justin Sun may be the owner, based on historical movement patterns (CoinEdition, Blockchain.News). The sharp sell-off triggered $310 million in liquidations across the crypto market, with longs disproportionately impacted—$502 million compared to $160 million in shorts. Bitcoin alone accounted for $237 million in liquidations, while Ethereum followed closely at $215 million, as automated systems exacerbated the decline.

The whale’s intent wasn’t full exit—it was rotation. On-chain data reveals they converted approximately 22,769 BTC into Ethereum on Hyperliquid exchange over five days, acquiring 472,920 ETH worth $2.22 billion and initiating a $577 million leveraged ETH long. This maneuver not only destabilized prices but also magnified risks inherent in crypto’s current architecture. The flash crash illustrated how whales with legacy holdings—acquired when Bitcoin traded under $10—retain outsized influence in modern markets. With dormant wallets waking amid new highs, thin weekend liquidity, and widespread leverage, similar episodes could become recurring events (CoinGape, Finance Magnates).

Sensei’s Insight: When one wallet moves the entire market, it’s not decentralization—it’s a fragility test in real-time.

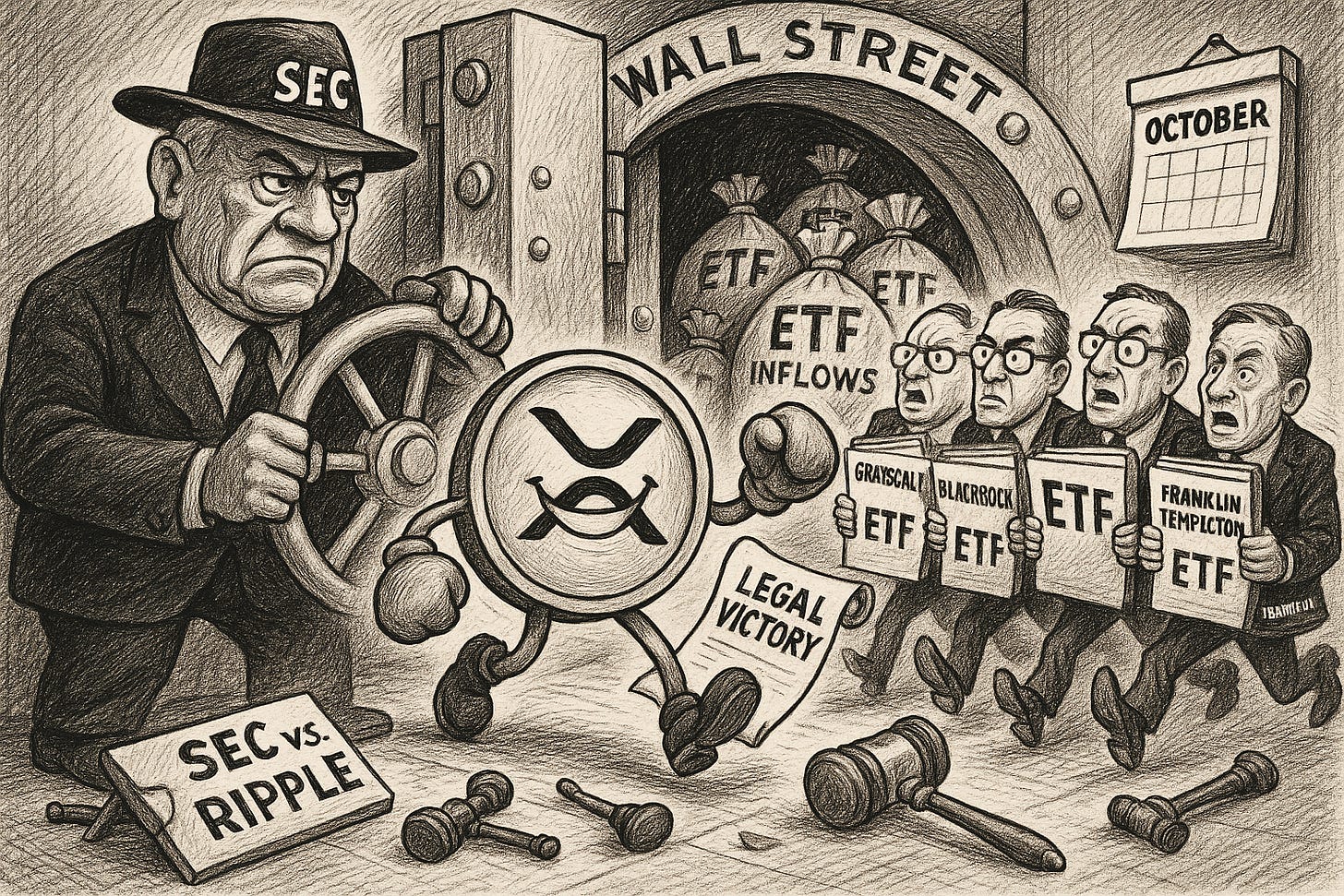

🏛️ XRP Legal Win Triggers ETF Filing Surge

The Ripple-SEC legal battle officially ended on August 22, 2025, as the Second Circuit Court of Appeals dismissed both parties' appeals, concluding the four-year case that began in December 2020. Ripple will pay a $125 million civil penalty, reaffirming prior court decisions. The injunction barring XRP institutional sales without SEC registration remains in place, as Judge Analisa Torres declined to lift it. Her July 2023 ruling—that secondary market sales of XRP are not securities, while institutional sales may qualify as securities offerings—remains the operative precedent (Reuters, CryptoSlate).

Hours after the legal resolution, seven asset managers—Grayscale, Bitwise, Canary Capital, CoinShares, Franklin Templeton, 21Shares, and WisdomTree—amended S-1 registration statements for spot XRP ETFs. The coordinated filings reflect SEC technical feedback and incorporate both cash and in-kind creation/redemption mechanisms, consistent with structures used in approved Bitcoin ETFs. Bloomberg ETF analyst James Seyffart noted a high approval probability (90–95%) by the SEC’s October deadline, though approval is still pending (DLNews, Yahoo Finance). XRP jumped roughly 10% to around $3.10, with trading ranges recorded between $3.05 and $3.37. Analyst projections estimate potential first-year ETF inflows between $4.3 billion and $8.4 billion if approved, drawing comparisons to previous Bitcoin ETF launches. However, these inflow forecasts and expectations of 50%+ rallies remain speculative and market-dependent (OKX Learn, TheCryptoBasic).

Sensei’s Insight: With the court case now closed, XRP's institutional path hinges on regulatory approvals still pending. The October SEC decision could prove catalytic—but until then, all inflow estimates and price trajectories remain watchlist material, not market certainties.

🔗 Connect with Us

Stay plugged in across platforms:

Sensei on X: sensei_crypto_

Martyn Lucas on X: MartynInvestor

Vaz on X: eVTOLHUB

💎 Premium Discord Access: Join the Discord

📺 YouTube Channel (Live & Replays): Martyn Lucas Investor

👕 Limited Merch: Shop Here

🔍 Deeper Dive: Jackson Hole: Inflation, Jobs, and Powell’s Legacy

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.