Sensei’s Morning Will Rachel Reeves Force the Bank of England’s Hand? Reeves’ Gamble Meets Market Reality

FAA cuts flights, Reeves fights inflation, and the BOE hesitates — while Ripple rewires finance, Robinhood beats earnings, and XRP proves crypto’s now core economic infrastructure.

👀 Today’s Stories at a Glance

✈️ FAA orders 10% U.S. flight capacity cut, citing air traffic controller crisis during the record government shutdown.

💷 Reeves scrambles to contain UK inflation, blamed partly on her own tax hikes and wage policies.

🏦 BOE rate decision looms, as markets brace for a tight vote amid falling inflation and upcoming fiscal tightening.

💼 Ripple rules out IPO, focusing instead on private growth, stablecoin expansion, and global payment infrastructure dominance.

💰 Robinhood beats Q3 expectations, but crypto miss and CFO exit temper investor enthusiasm despite strong earnings and growth.

🧠 One Big Thing

The British pound is holding just above $1.30 as the Bank of England faces one of its most divided decisions in years. With inflation softening and unemployment ticking up, markets are pricing a 33% chance of a rate cut today; up from just 10% last month. If the BOE surprises dovish, expect sharp moves in GBP pairs and UK bond yields.

💰 Money Move of the Day

Mind the tax cliffs. With the UK Autumn Budget looming, many expect new capital gains and property tax changes. If you’re sitting on appreciated assets, it may be time to reassess your holding periods or diversification strategy, not to sell, but to prepare. Tax law shifts can hit portfolios harder than market moves.

📊 Market Snapshot

Cryptocurrencies:

Bitcoin (BTC): $103,020.72 (▼ -0.83%)

Ethereum (ETH): $3,395.94 (▼ -0.83%)

XRP: $2.2950 (▼ -2.04%)

Equity Indices (Futures):

S&P 500 (SPX): 6,803.9 (▲ +0.07%)

NASDAQ 100: 25,757.75 (▲ +0.04%)

FTSE 100: 9,756.68 (▼ -0.35%)

Commodities & Bonds:

10-Year US Treasury Yield: 4.136% (▼ -0.60%)

Oil (WTI): $60.24 (▲ +0.72%)

Gold: $4,008.738 (▲ +0.73%)

Silver: $48.626 (▲ +1.36%)

🕒 Data as of UK (BST): 11:19 / US (EST): 06:19 / Asia (Tokyo): 20:19

✅ 5 Things to Know Today

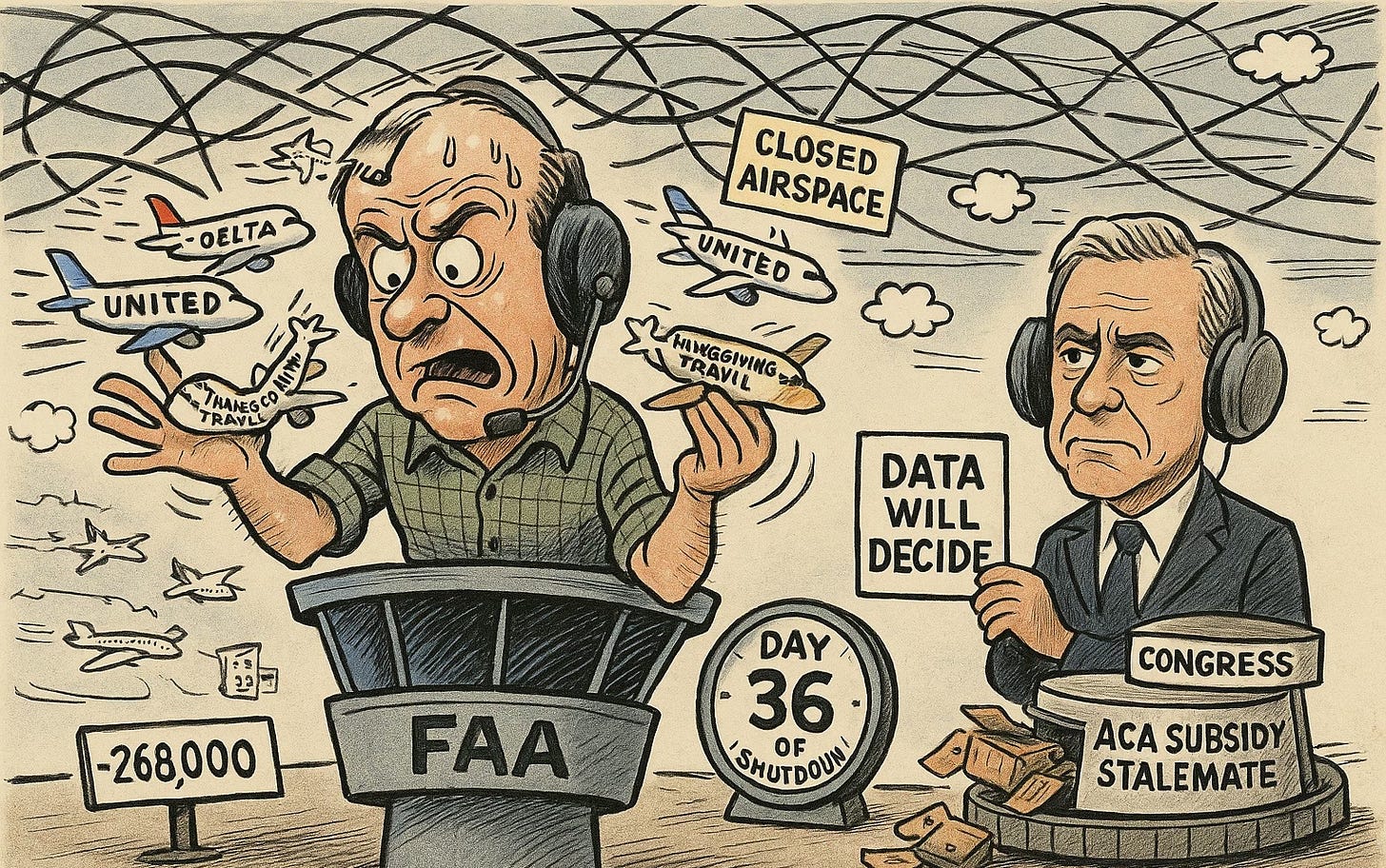

✈️ FAA Orders 10% Flight Capacity Cut Amid Historic Shutdown

The Federal Aviation Administration (FAA) will reduce U.S. flight capacity by 10% at 40 major airports starting Friday, in an unprecedented move to preserve air safety as the government shutdown enters its 36th day; the longest in U.S. history (Reuters; Bloomberg). The phased cuts, 4% Friday, 5% Saturday, and 10% next week, target domestic routes through major hubs such as Atlanta, New York, Chicago, and Dallas–Fort Worth, potentially grounding 1,800 daily flights and removing 268,000 seats from circulation (ABC News). Transportation Secretary Sean Duffysaid “the data will dictate what we do,” hinting that further restrictions could follow if conditions worsen. FAA Administrator Bryan Bedford confirmed this is the first proactive system-wide capacity reduction in the agency’s history, describing the decision as “a controlled slowdown to avoid catastrophe.”

At the core is a worsening air traffic controller crisis, with up to 40% of controllers absent at major facilities and a record 98 “staffing trigger” incidents logged last weekend (CNN; BBC). Controllers, unpaid since October 1, are working 60+ hour weeks under intense fatigue. The shutdown stalemate, driven by disputes over Affordable Care Act subsidies, shows no progress toward resolution, leaving airlines bracing for Thanksgiving chaos. United Airlines is trimming regional routes to protect international operations, while Frontier warned passengers to buy flexible fares. Airline stocks dipped about 1% after hours, with broader markets holding steady, for now. But if controller absences deepen, Duffy warned, “selective airspace closures” could follow, threatening a full-scale disruption (CNBC).

Sensei’s Insight: This is the aviation equivalent of a “soft landing” attempt, measured, not panicked. But if controller fatigue worsens into Thanksgiving week, expect real market turbulence in travel and logistics equities.

💷 Reeves’ Inflation Gamble: Can the Chancellor Contain the Crisis She Helped Create?

UK inflation has accelerated to 3.8%, edging toward 4%, with Chancellor Rachel Reeves now preparing her November 26 Budget to deliver a politically vital reversal. The challenge: her October 2024 fiscal plan, featuring £26 billion in payroll tax hikes and higher minimum wages, has been widely blamed for triggering this renewed price spiral. The Bank of England noted that government policy added 0.6 percentage points to inflation, with energy, water, and vehicle taxes masking earlier disinflation. Food inflation has climbed to 4.3%, projected to hit 5.7% by December, before easing in 2026. Analysts warn that Reeves’ own fiscal levers (taxes and wage policy) may have tightened the cost-of-living squeeze she’s now trying to fix, particularly for lower-income households whose essential costs outpace earnings (Bloomberg; Bank of England).

Reeves is expected to focus on energy and food, which dominate household budgets. Options include removing the 5% VAT on energy bills, at a cost of £2.5 billion annually, or cutting environmental levies that make up 16% of electricityand 6% of gas bills. Treasury models suggest these could trim inflation by up to 0.2 percentage points, though they risk favoring wealthier households. On food, she plans to restructure business rates, shifting costs from physical retailers to online warehouses, to relieve sector pressure and slow price growth. If successful, Panmure Liberum projects up to 100 bps of rate cuts in 2026, reducing government borrowing costs by £10 billion. But with debt at 95.3% of GDP and borrowing topping £20.2 billion in September, the credibility of Reeves’ inflation fight, and her political future, will hinge on December’s inflation print (BBC; Retail Gazette).

Sensei’s Insight: Reeves’ Budget isn’t just an economic test—it’s a referendum on fiscal credibility. Markets will reward genuine disinflation, not accounting tricks. The Bank of England’s November rate decision will be the first verdict.

🏦 BOE Rate Decision & Autumn Budget Collide: Markets Brace for a Tight Call

The Bank of England is expected to hold interest rates at 4% when it announces its decision today at 12:00 GMT, but the vote could be its closest in years. Market consensus leans toward a 6–3 hold, though some analysts see a 5–4 split, reflecting rising pressure for a 25-basis-point cut amid slowing inflation and weaker labor data. Headline inflation eased to 3.8% in September, wage growth is trending below 4%, and unemployment has inched up; data that led Goldman Sachs to forecast a surprise cut this week (Reuters; Yahoo Finance). Markets now assign roughly a one-in-three chance of an immediate cut, up sharply from 10% a few weeks ago (FXStreet).

Policymakers are also constrained by fiscal timing. Chancellor Rachel Reeves’ Autumn Budget, due November 26, is expected to tighten fiscal policy by as much as £30–35 billion, largely through tax rises on capital, property, and savings rather than corporations. That leaves the MPC wary of acting before it sees how new taxes affect demand. Analysts expect a December or February cut if the economy continues to cool. For investors, the twin events could drive sharp market moves: GBP/USD has slipped to 1.30, and gilt yields are volatile as traders brace for both policy and fiscal surprises (CNBC; Charles Stanley).

Sensei’s Insight: Sterling sits at a critical juncture—a dovish surprise could send GBP lower but buoy equities, while a hawkish hold paired with heavy fiscal tightening risks a “double drag” on growth and sentiment.

💼 Ripple Rules Out IPO Amid $40B Valuation and Expansion Push

At the Ripple Swell 2025 conference in New York, President Monica Long confirmed the fintech firm has “no plan, no timeline” for an IPO, distancing itself from a wave of crypto peers rushing to public markets (Bloomberg; Reuters). While exchanges like Bullish, Gemini, and lender Figure Technologies have gone public, Ripple, valued privately at $40 billion, is opting to remain independent. Long cited strong capitalization, saying Ripple can self-fund all “organic and inorganic growth.” That confidence was underscored by a $500 million investment round led by Fortress Investment Group and Citadel Securities, alongside Pantera Capital, Galaxy Digital, and Brevan Howard (Crypto.news).

Ripple’s war chest builds on a $1 billion share buyback and multiple acquisitions, including GTreasury ($1B deal in October), Hidden Road, and Rail, that expand its reach into the corporate payments and stablecoin infrastructure markets (Coinfomania). The firm’s stablecoin RLUSD recently surpassed $1 billion in circulation and is now being integrated into Mastercard, Gemini, and WebBank payment rails (Crypto.news). With its customer base doubling quarter-over-quarter, Ripple is using private funding to scale global partnerships without public-market pressures.

Sensei’s Insight: Ripple’s stance signals confidence and discipline—choosing growth through private capital and adoption over Wall Street optics. Investors should note: Ripple’s focus remains on ecosystem control, not shareholder liquidity.

💰 Robinhood Smashes Q3 Earnings — But Crypto Miss and CFO Exit Temper the Rally

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.