Rate Cut Today: The Real Battle Is in Powell’s Words as He Takes the Stage

Markets have priced in the move—but not the message. Will the Fed fuel a risk rally or shut it down?

The Federal Reserve announces its latest policy decision today, and markets are holding their breath. Inflation has cooled but hasn’t fully normalised, the job market is wobbling, and financial conditions have eased sharply. While a 0.25 percentage point rate cut is almost guaranteed, what Fed Chair Jerome Powell says about the path ahead will shape risk sentiment across stocks, crypto, and bonds.

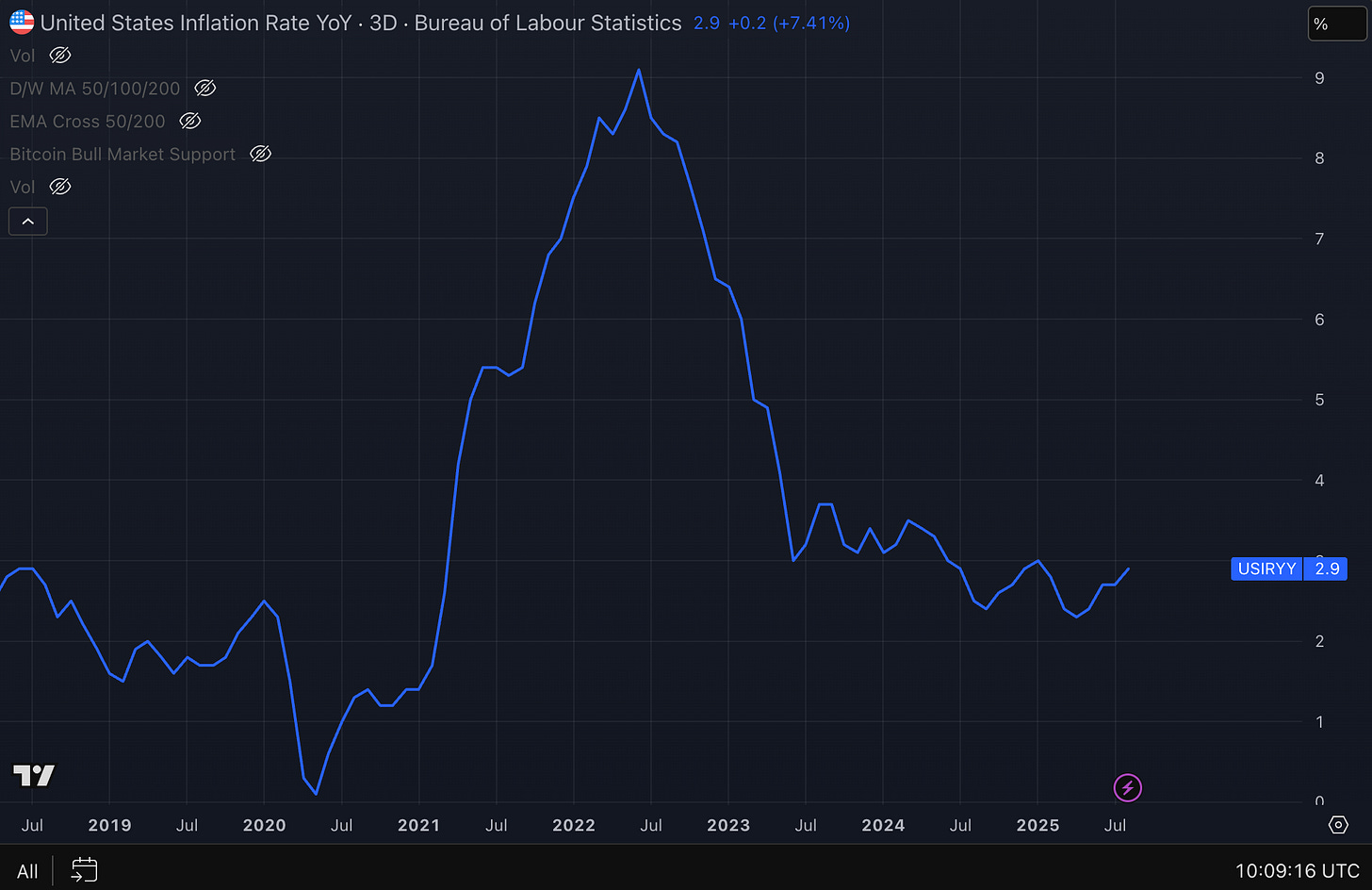

🔥 Inflation: Cooling… But Not Cold

Inflation is trending in the right direction—but the Fed’s fight isn’t over.

In August, the Consumer Price Index (CPI) rose 2.9% YoY, with core inflation (excluding food and energy) at 3.1%. Shelter was the biggest driver, rising 0.4% on the month.

At the producer level, the PPI fell 0.1% MoM, with a 2.6% YoY gain—showing softer pipeline pressures.

The Fed’s favorite gauge, PCE inflation, came in at 2.6% headline and 2.9% core in July—its closest flirtation with target so far this cycle.

💬 “Inflation is easing, but it’s not mission accomplished yet,” said Michael Feroli, chief U.S. economist at JPMorgan. “The Fed will want to keep its options open—even as it cuts.”

This cut won’t be celebratory. It’ll be cautious. The Fed will likely frame it as a vote of confidence in the trend, not a victory lap.

👷 Jobs: Cracks in the Foundation

The labor market is bending—not breaking.

The August jobs report showed just 22,000 new payrolls. Unemployment ticked up to 4.3% and wage growth slowed to 3.7% YoY (BLS).

Revisions to past data show the labor market has been weaker than thought—911,000 jobs were wiped off the books over the past year (Reuters).

Gains are concentrated in health care. Other sectors—like energy, government, and manufacturing—are flashing red.

💬 “This is the soft landing the Fed prayed for—cooler wages, fewer hires, but no cliff edge,” said Diane Swonk of KPMG.

Bottom line: With inflation ebbing and jobs softening, the Fed has cover to ease.

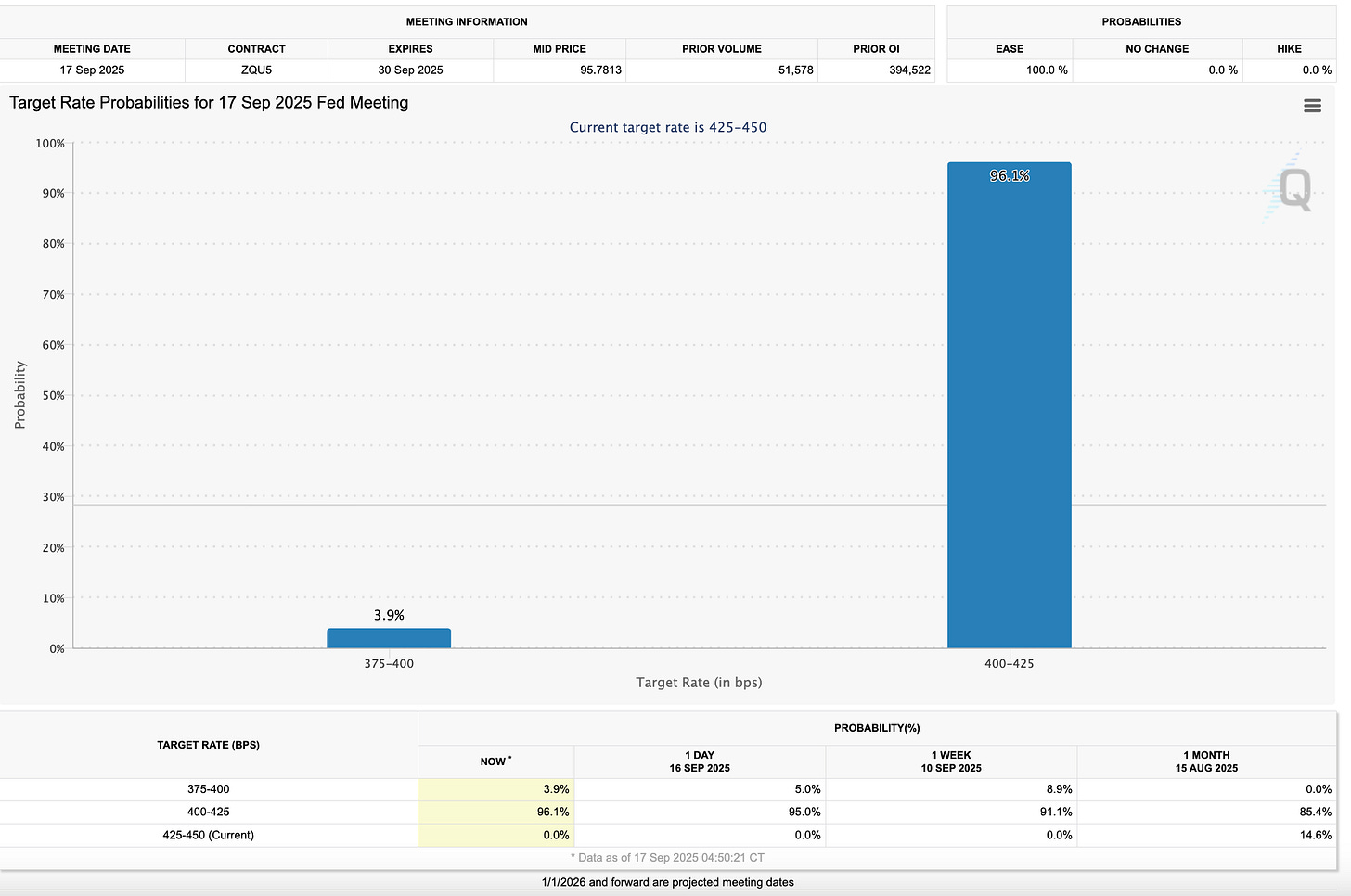

🎯 What the Fed Will Likely Do Today

The Fed last cut on Dec 18, 2024, trimming the federal funds rate to 4.25–4.50% (Fed statement). Since then? Nothing—but pressure has built.

Today, markets see a near-certainty of another 25 basis point cut, per the CME FedWatch Tool (the chart above). A 50bp surprise is possible, but unlikely—the Fed will want to preserve credibility and not appear panicked.

🎙️ Powell’s Words Matter More Than the Cut

Markets aren’t just listening for the decision—they’re decoding Powell’s tone.

Market-friendly signals:

Fed acknowledges risks are shifting toward growth.

Confirms inflation is moving sustainably lower.

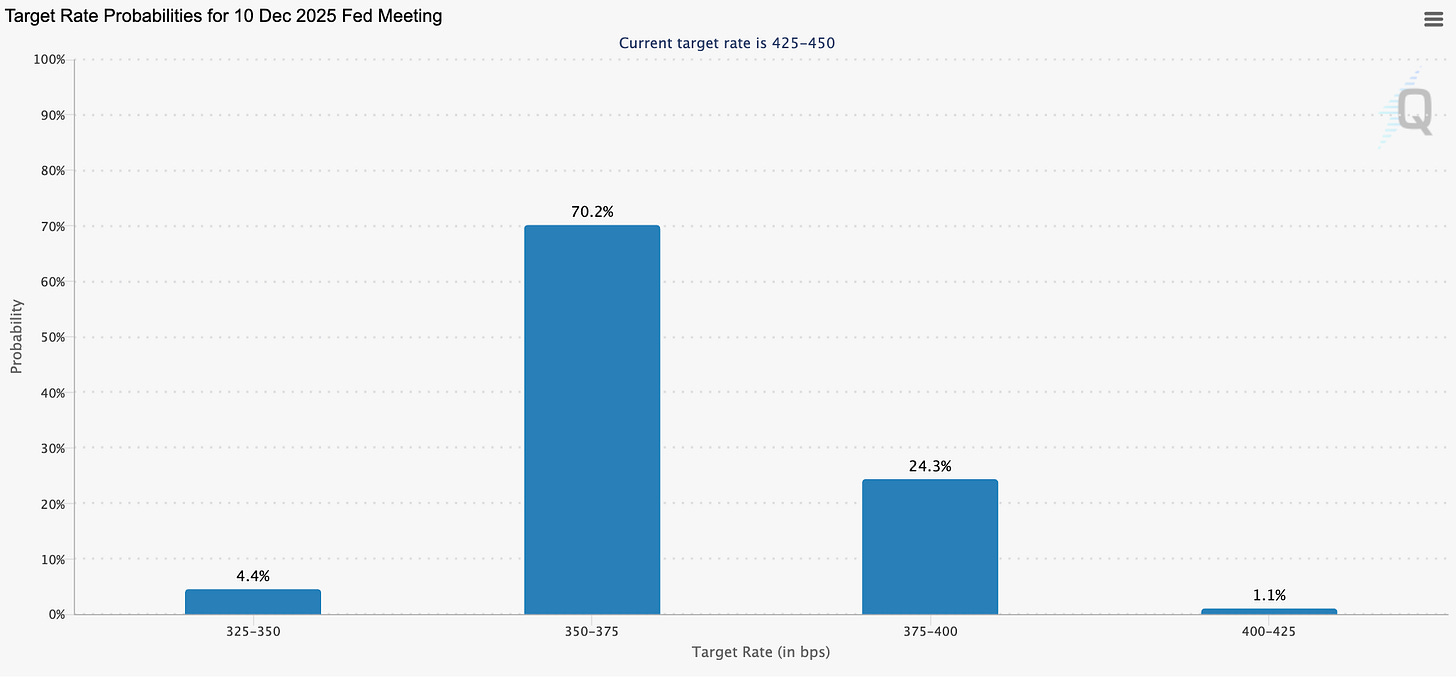

💡 Hints at 2–3 more cuts in 2025. The chart below shows markets pricing the federal funds rate at 3.50–3.70% by the December FOMC meeting. That implies a cut at nearly every meeting through year-end—including today’s.

Hawkish tones to watch for:

Warnings about sticky services inflation.

Talk of a higher neutral rate (suggesting less room to cut).

Pushback on investor expectations for aggressive easing.

Result: Expect a rally if Powell gives the green light. A pullback if he pours cold water on hopes.

🕊️ Quick Note from Sensei:

I’m away on my honeymoon this week, so while the daily newsletter won’t be running as usual, I didn’t want you to miss this key FOMC moment.

If you're enjoying these insights, give it a like, repost, or share—and if you want more in-depth coverage, consider becoming a premium member to support the work and unlock exclusive insights, deeper research, and 1-on-1 contact.

See you back in your inbox soon.

— Sensei 🥷📉

Enjoy the rest of the newsletter.

📊 Quick Poll for Readers

📈 Market Impact: Stocks, Crypto, Bonds

Keep reading with a 7-day free trial

Subscribe to Sensei.news to keep reading this post and get 7 days of free access to the full post archives.