XRP Weekly - Monday, 19 January

From $1,000 to $330,000: The XRP Blueprint Institutions Are Quietly Building + (60% Off Offer)

Daily morning forecasts will resume tomorrow.

Today is a U.S. bank holiday, so markets are closed. Enjoy today’s XRP-focused newsletter.

If you had invested $1,000 into XRP in early 2016, that position would be worth roughly $330,000 today.

A recent Motley Fool calculation cites a peak value of $437,460, but that figure assumes selling at the July 2025 high near $3.65. Since that peak, XRP has corrected close to 48%, bottoming around $1.88 in December before rebounding into the $2 range.

That volatility came around a major turning point. The August 2025 SEC settlement ended a four year legal battle and removed a significant regulatory overhang. The resolution cleared the path for Ripple Labs to pursue more aggressive institutional ambitions, including a potential U.S. national bank charter.

Opportunities like this exist across financial markets, and I have personally captured many over the years.

Tesla ~$15, now up roughly 2,600%

Silver ~$19, now up around 400%

XRP ~$0.30, sold some up around 1000%

Rocket Lab ~$4, now up more than 2,300%

Coinbase ~ $40, sold at a 700% profit

Robinhood ~$8, sold at 1800% profit

These are just a few examples.

This is why I am now opening up my full research process to premium newsletter members and launching a live £5,000 portfolio challenge, documenting real decisions, real risk management, and real outcomes. This launches this week, alongside the chart training course next week, all bundled with all existing premium newsletter features.

To mark the biggest upgrade the newsletter has ever had, there is a limited time, limited capacity offer of 60% off your first year. Click below to access.

Remember I never give financial advice!

This is not about retail hype anymore.

Institutional demand is clearly increasing. In 2025 alone, XRP ETFs absorbed roughly $1.3 billion in just 50 days. On chain data also shows exchange balances down around 57% year over year, suggesting a tightening supply dynamic that could support future price action.

That said, Ripple Labs is valued at around $40 billion and works with more than 300 financial institutions, but many partners use Ripple’s infrastructure without needing to hold XRP directly, which limits purely utility driven demand for now.

For perspective, if you invested $1,000 at today’s price of around $1.98, and XRP reached $100 within the next decade (very possible), that position would grow to roughly $50,500, which represents a 4,950% gain.

That outcome is possible, but it depends on XRP evolving into a dominant global bridge currency, not just continued speculation.

The Consensus

🎁 Claim 60% newsletter discount: Save on premium research and live portfolio challenge with this limited time offer.

📉 Greenland tariffs tank XRP: Trump’s ultimatum sparked massive liquidations, causing an 11% price drop in just hours.

🛑 Coinbase stalls crypto bill: Brian Armstrong withdrew support over concerns regarding stablecoin rewards and restrictive DeFi prohibitions.

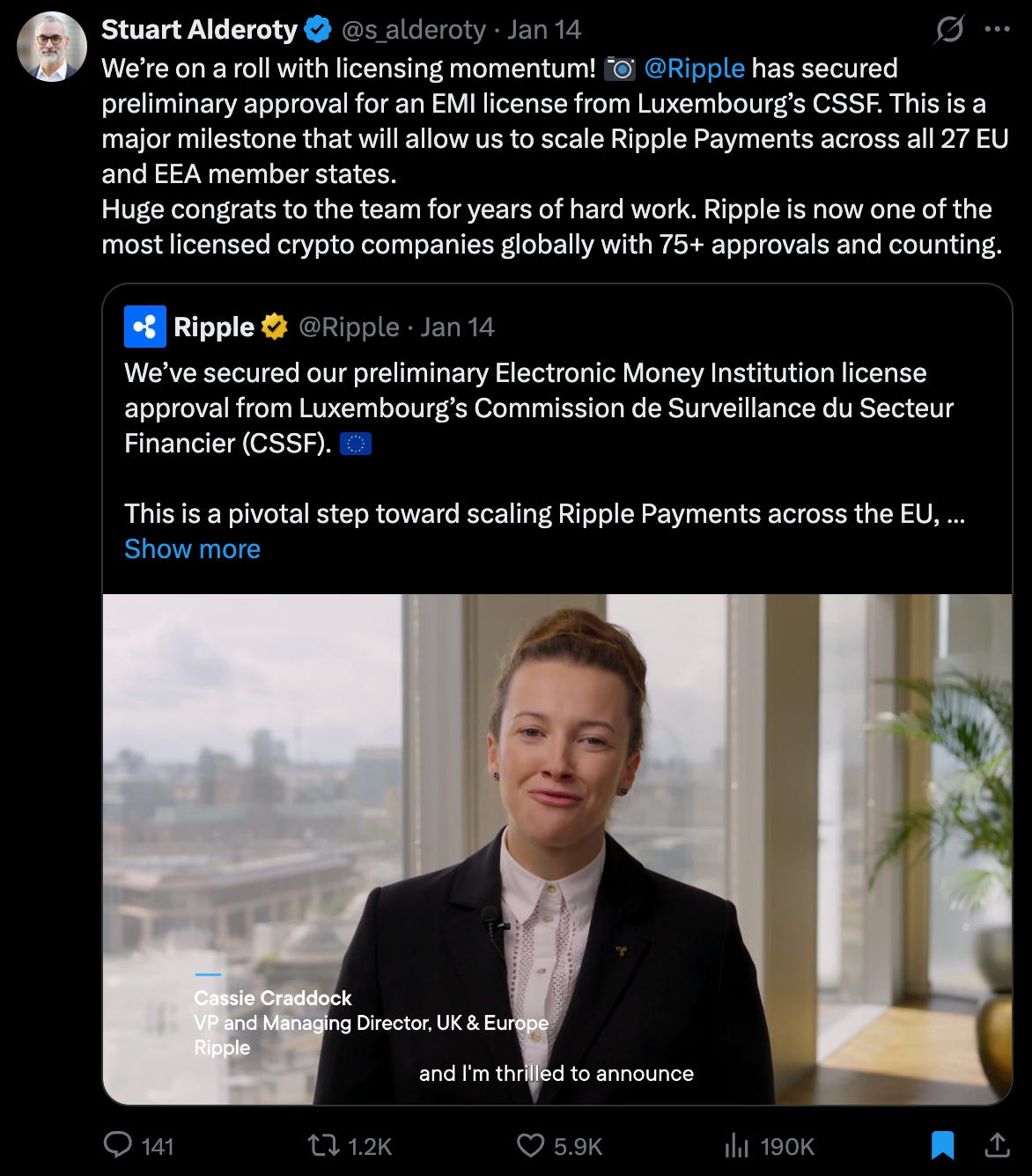

🇪🇺 Ripple wins Europe passport: Luxembourg’s preliminary license allows seamless payment scaling across all 30 EEA nations.

The Chart Watch

Today’s lesson is on limit orders.

I find them especially useful in crypto because we almost always get at least one major liquidation event every month. When they happen, price often wicks aggressively into key technical levels, gets bought almost immediately, and snaps back fast. When those levels are planned in advance, it can offer clean 5–10%+ moves in minutes.

This isn’t financial advice, but liquidation wicks and quick buy-ups are one of the most consistent behaviours in crypto markets.

What happens after the wick depends on structure. Whether price is above or below key support matters. But at strong technical levels, there is usually some form of reaction, which creates opportunity, either to add to spot positions or take short-term trades.

A good example was last night’s/todays move.

XRP flushed below $2 and moved directly into the next key level at $1.85. That level held cleanly, and price bounced roughly 5% in under five minutes.

This is exactly why I use limit orders. I place them in advance at technical levels, not emotionally in the moment. I had orders set at $1.84, with the next downside levels sitting at $1.71. Below that, I’m also watching $1.50 and lower. I’m not saying price will go there, but I always prepare for multiple outcomes rather than guessing one.

Looking slightly further out now, the key question is $2.

If we hold $2, I remain bullish toward $2.30.

If we fail to hold $2, then $1.84 becomes the next major level that needs to defend. As long as that holds, we avoid making a lower high.

A clean break below $1.84 would increase the probability that the broader bearish structure is still in play.

If you want to see more of my downside limit orders and profit targets, I’ve linked a previous XRP Weekly below. Head to the Chart Watch section where all those levels are laid out clearly.

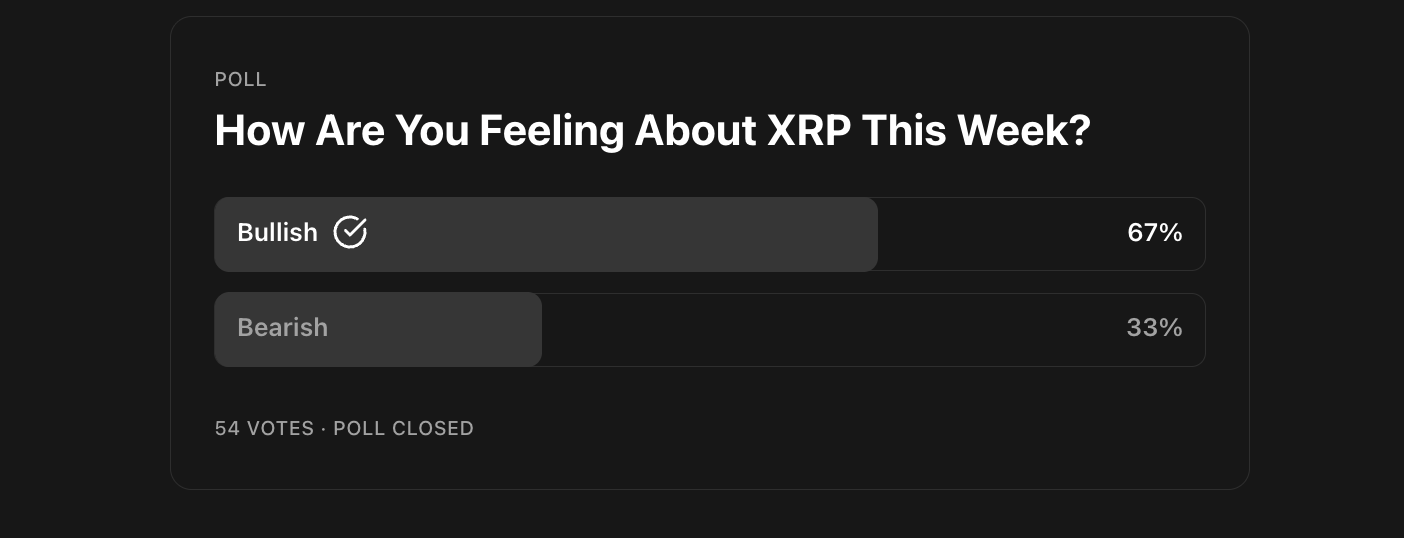

Poll

Last Week’s Results

❌ 67% of you were bullish, however from last Sunday to today XRP is actually down ~7%.

Please do keep voting, it will be interesting to analyze this data in the future and see if we can draw any trends from this.

The Ripple Effect

📉 The $873M Liquidation Massacre: Why XRP Just Crumbled 11%

The crypto market just got a brutal reminder that leverage is a double-edged sword. Today, January 19, a massive $873 million liquidation cascade swept through the space, sparked by President Trump’s tariff ultimatum regarding Greenland. With U.S. markets closed for MLK Day, crypto became the only exit for panicked traders, leading to a “risk-off” flush. While Bitcoin slipped a relatively modest 3.5% to around $92,500, XRP took a much harder hit, plunging 11% from its overnight high to an intraday low of $1.84. This wasn’t just a dip: it was the largest single-day long wipeout for XRP since November 2025, with $39.14 million in long positions vaporized in hours.

This “flash crash” highlights a structural fragility in the current market. XRP’s 11% drop felt more violent than Bitcoin’s because of thinner order books and a high concentration of retail leverage. It’s a classic feedback loop: as the price ticked down, automated margin calls forced selling into a market with few buyers, creating a waterfall effect. Beyond the charts, the macro outlook is shifting. With sticky inflation making Fed rate cuts in March look unlikely and trade tensions with the EU escalating, “smart money” appears to be de-risking. Watch the $1.90 support level closely: if that floor gives way, we may see another test of the $1.80 range as the market continues to digest this geopolitical shock.

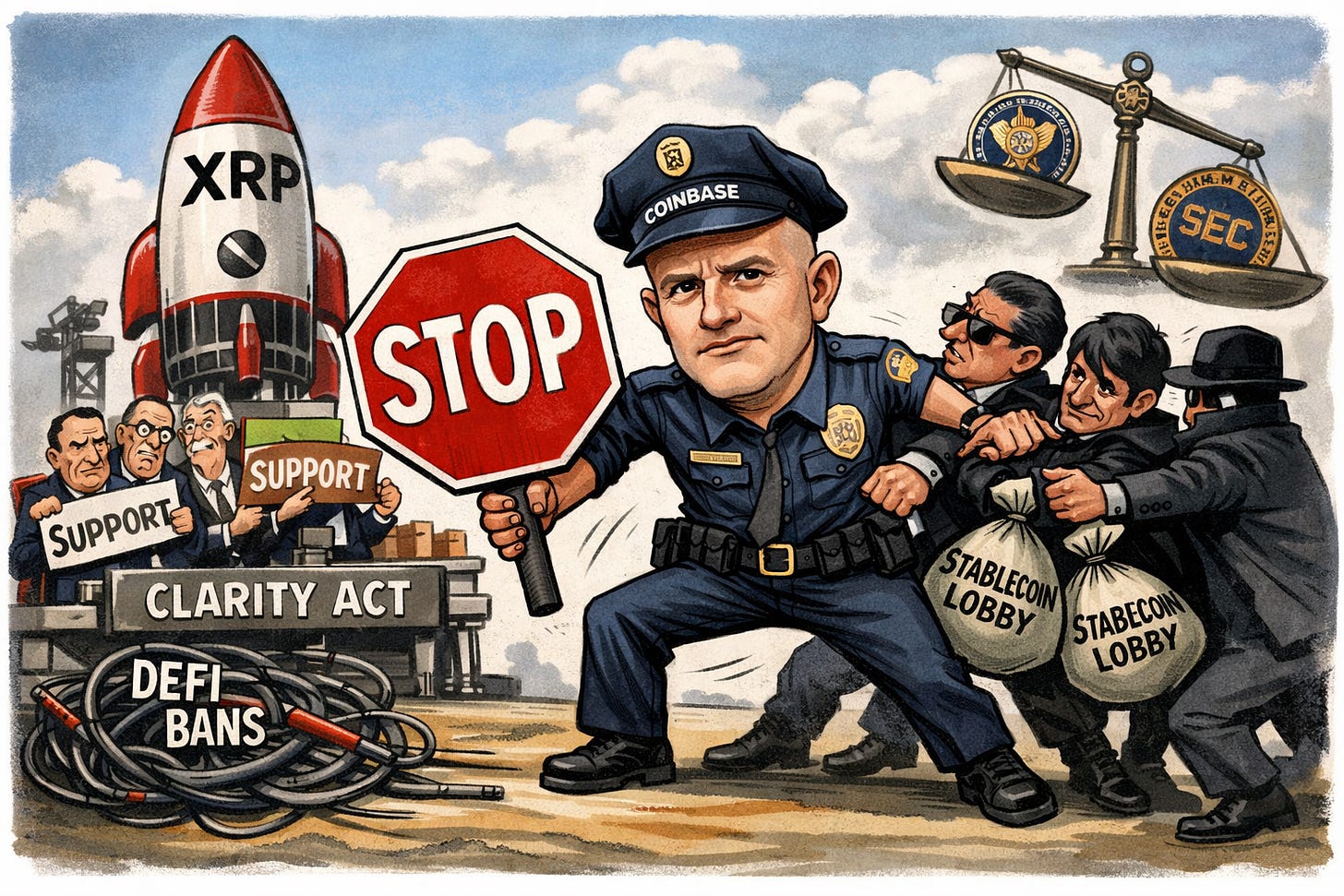

🛑 The Coinbase Roadblock: Why Brian Armstrong Paused XRP’s Progress

The Digital Asset Market Clarity Act draft has hit a major wall, and the name on it is Brian Armstrong. On January 14, the Coinbase CEO abruptly withdrew his support for the 278-page bill, forcing the Senate Banking Committee to postpone its scheduled markup. Armstrong’s “no bill is better than a bad bill” stance is rooted in several critical issues: he alleges the current text creates a de facto ban on tokenized equities, erodes CFTC authority in favor of the SEC, and introduces “catastrophic” DeFi prohibitions. For XRP, which had already satisfied the bill’s January 1 “ETF test” for non-security status, this means its legislative fast-track is officially on ice. (CoinDesk).

The core of the tension is a tug-of-war between crypto exchanges and traditional banks over stablecoin yields. The draft includes restrictions on sharing stablecoin interest with users, a provision heavily pushed by banking lobbyists who fear “deposit flight” from traditional savings accounts to higher-yielding digital assets. While Ripple continues to support the Act, Armstrong argues the amendments are materially worse than the status quo, as they would effectively kill competitive reward mechanisms for platforms like Coinbase. Until a compromise is reached on these stablecoin and DeFi provisions, XRP’s transition to a congressionally codified “network token” remains stuck in the Senate’s waiting room.

🇪🇺 Ripple Just Won the Passport to Europe

Ripple’s regulatory momentum is hitting a fever pitch. In just five days, the company locked down key approvals from the UK’s FCA and a preliminary “Green Light Letter” from Luxembourg’s CSSF. While the UK license establishes a firm footing in London, the Luxembourg win is the real needle-mover. Under the EU’s MiCA framework, this single license grants Ripple “passporting” rights, allowing it to scale its payments infrastructure across all 30 EEA countries without filing individual applications in places like France or Germany. This preliminary approval is conditional: Ripple must still satisfy outstanding requirements to receive final EMI authorization, but it effectively clears the legal path to deploy its USD-pegged stablecoin (RLUSD) to a european market handling roughly 25% of global transaction volume (Whale Alert)

For the smart money, the takeaway here is about infrastructure maturation. Ripple now holds over 75 licenses globally, including a provisional national trust bank charter from the OCC. This regulatory moat is exactly what institutional players like Switzerland’s AMINA Bank require to move beyond pilots into live production. AMINA is already using Ripple’s tech to settle cross-border trades in minutes rather than days. It’s worth noting that while this is a massive win for Ripple’s business, the impact on XRP is nuanced. Since 76% of RLUSD supply exists on Ethereum, XRP is increasingly positioned as a specialist liquidity tool, stepping in only when stablecoin liquidity is thin or for complex emerging market currency pairs. Watch for how quickly other European banks follow AMINA’s lead now that the “red tape” has been replaced with a green light.

Seen on X

Sensei’s Insight: Ripple’s presence on the USA House sponsor list alongside Microsoft, Pfizer, and McKinsey is not a marketing stunt. It is a signal of infrastructure acceptance. The key detail is not the logo, it is the room Ripple is in. This is not a crypto conference. It is where policymakers, central bankers, and global executives are actively discussing how tokenization moves from pilot programs into real-world deployment. Brad Garlinghouse speaking on January 21 at the WEF panel “Is Tokenization the Future?” alongside Coinbase, Standard Chartered, and a European Central Bank governor shows the conversation has shifted from theory to execution. Markets tend to misprice this phase because it lacks immediate price action. Yet this is often where the groundwork for future adoption is laid. That process is unfolding while XRP consolidates near $2, ETF inflows build, and larger holders continue to accumulate. Conferences do not move markets overnight, but they reveal where capital, policy, and infrastructure are aligning next.

Sensei’s Insight: Ripple’s EU passporting approval is not a headline win, it is a structural one. Under MiCA, Ripple can now operate across the entire European Economic Area under a single regulatory framework, collapsing the cost and friction that normally slow institutional adoption. That matters because correspondent banking is already being rebuilt behind the scenes. Banks are moving from pilot programs to live production as cross-border settlement costs, delays, and operational risk become unacceptable at scale. AMINA Bank going live was not experimentation, it was validation. The real takeaway is that stablecoin rails are shifting from optional to essential infrastructure, and Ripple now sits inside the regulatory perimeter needed for that transition. This is how institutional adoption actually unfolds, quietly, methodically, and long before the market prices it in.

Debunked

Posts like this are pure theatre. A random vertical chart, two vague sentences, and a dramatic “Monday will be insane” claim with zero explanation, zero levels, zero accountability. This isn’t insight. It’s a confidence trick dressed up as certainty.

Slapping “IQ 276” in your username doesn’t make a prediction smarter. If anything, it raises the bar. When you loudly signal intelligence, the expectation is logic, evidence, and reasoning. What we got instead was a meme chart and a date-based hype call that collapsed the moment the calendar flipped.

There’s no asset named. No timeframe defined. No conditions outlined. Just an implication that markets must go vertical because a line on a chart once did. When Monday arrived and markets dumped, the claim instantly became meaningless. That’s the tell.

This is how engagement farming works: make an unfalsifiable statement, let followers fill in the blanks, collect likes, and move on when reality disagrees. Intelligence isn’t declaring outcomes. Intelligence is defining assumptions and accepting when you’re wrong.

If this is what “IQ 276” looks like, we are screwed.

The Horizon

Monday, January 19

China GDP, Industrial Production & Retail Sales (02:00 GMT / 21:00 ET Sunday):

Q4 GDP alongside December activity data provides a critical read on China’s growth momentum entering 2026. Weakness would reinforce expectations for further stimulus and pressure commodities and Asian risk assets; resilience would stabilise global risk sentiment amid rising trade tensions.Canada CPI (13:30 GMT / 08:30 ET):

December inflation data sets the tone for early-2026 Bank of Canada policy expectations. A softer print would reinforce easing bias and weigh on CAD, while upside pressure would complicate rate-cut timing.U.S. Markets Closed – Martin Luther King Jr. Day:

Equity and Treasury markets closed, resulting in thinner liquidity and exaggerated moves in FX, commodities, and crypto during the European and Asian sessions.

Tuesday, January 20

UK Labour Market (07:00 GMT / 02:00 ET):

Employment change, claimant counts, and wage growth provide a comprehensive snapshot of UK labour-market conditions. Cooling data would reinforce the BoE’s dovish bias into 2026; resilience would challenge rate-cut expectations and support sterling near-term.PBoC Interest Rate Decision (01:15 GMT / 20:15 ET Monday):

Markets watch for any response to weakening Chinese growth momentum. A cut would signal policy urgency and support risk assets; a hold suggests confidence in existing stimulus measures despite external pressure.

Wednesday, January 21

UK CPI (07:00 GMT / 02:00 ET):

December inflation is a key input for the BoE’s near-term policy stance. Continued disinflation strengthens the case for rate cuts later this year, while any upside surprise would force a more cautious approach and lift UK yields.Trump Keynote Address – World Economic Forum (13:30–14:15 GMT / 08:30–09:15 ET):

Direct commentary on tariffs, geopolitical strategy, and global trade risks. Historically market-moving remarks that could dominate risk sentiment into the U.S. open, particularly for equities, commodities, and FX.WEF Panel – “Is Tokenization the Future?” (09:15–10:00 GMT / 04:15–05:00 ET):

World Economic Forum panel examining the transition of tokenization from pilot programs to full deployment across major asset classes. Participants include Brad Garlinghouse, Brian Armstrong, Bill Winters, François Villeroy de Galhau, and Valérie Urbain. The framing is explicitly institutional and policy-driven rather than speculative, making this a key signal on how regulators and global banks view tokenization as operational financial infrastructure.

Thursday, January 22

ECB Monetary Policy Minutes (12:30 GMT / 07:30 ET):

Details from the December meeting reveal internal dissent and shape expectations ahead of the February 5 ECB decision. Key for eurozone rates and EUR direction.Bank of Japan Rate Decision & Press Conference (03:00–06:30 GMT / 22:00–01:30 ET Wednesday):

The BoJ is expected to hold at 0.75%, but markets are focused on forward guidance and outlook revisions. Any hawkish signal amid persistent yen weakness could trigger sharp JPY moves and ripple across global risk markets.U.S. GDP (Q3 Final) & Initial Jobless Claims (13:30 GMT / 08:30 ET):

Final GDP revisions are largely priced in, but claims data remains a key high-frequency labour signal. A sustained rise would reinforce the narrative of emerging economic slack.U.S. PCE Inflation & Personal Income/Spending (15:00 GMT / 10:00 ET):

The Fed’s preferred inflation gauge and a crucial input ahead of the January FOMC meeting. Softer core PCE would ease policy pressure; resilience in spending complicates the disinflation narrative.

Friday, January 23

BoJ Quarterly Outlook Report (03:00 GMT / 22:00 ET Thursday):

Updated growth and inflation forecasts often drive larger moves than the rate decision itself. Upward revisions would increase speculation of further tightening later in 2026.UK Retail Sales (07:00 GMT / 02:00 ET):

December data offers a clean read on holiday-season consumer health. Weakness would confirm pressure on UK growth and support a dovish BoE stance.U.S. S&P Global PMI (Preliminary) (14:45 GMT / 09:45 ET):

Early January activity indicators provide the first signal of Q1 momentum. Any slip toward contraction would reignite recession concerns and pressure risk assets.

It is the best newsletter out there thanks sensei